Crypto trade and custodian Gemini has confidentially filed for an preliminary public providing (IPO), Bloomberg reported, citing individuals conversant in the matter.

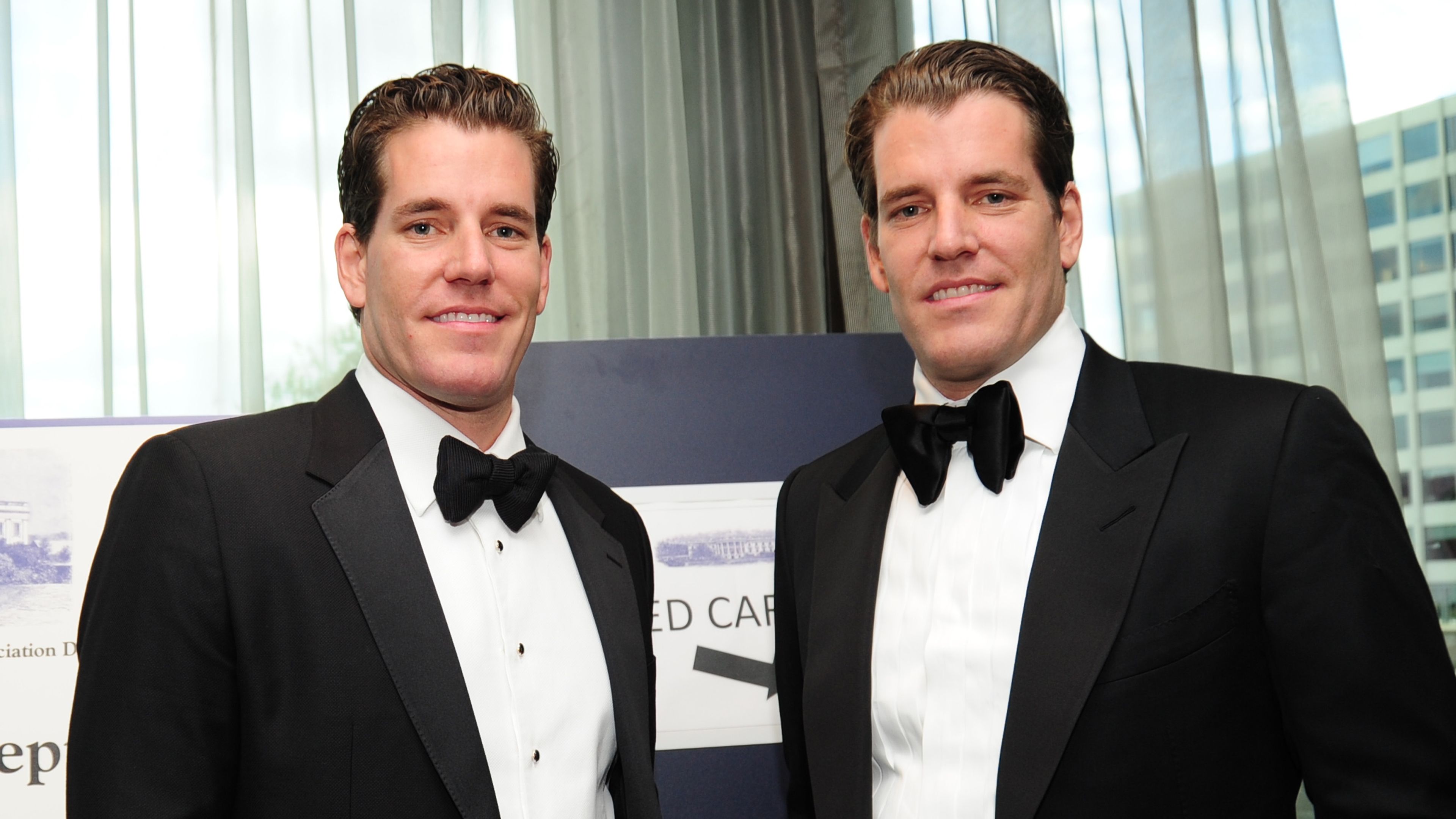

The agency, based by billionaire Cameron and Tyler Winklevoss, is working with Goldman Sachs and Citigroup, the report mentioned, noting that no closing resolution has been made on the itemizing.

The potential IPO comes after the U.S. Securities and Change Fee (SEC) ended its investigation into Gemini with out taking motion, according to a February post by Cameron Winklevoss. The corporate additionally settled a separate Commodity Futures Trading Commission lawsuit in January for $5 million.

Gemini is amongst a number of crypto companies lining as much as checklist their firms within the U.S. public market after the SEC has been in a full-scale litigation retreat within the first months of the Trump administration.

Simply right this moment, Bloomberg reported that Crypto trade Kraken is contemplating an IPO by the primary quarter of 2026, including to the studies that companies comparable to Circle, Bullish (mum or dad firm of CoinDesk) and Blockchain.com are additionally queueing up for a U.S. itemizing.

More NFT News

Africa Crypto Week in Evaluate: Kenyan Youth Urged to Be a part of Binance Academy, Cameroonian Digital Lending Platform Explores Stablecoins as Memecoin Group Hacks South African Parliament

Bitcoin Golden Cross Might Sign Bull Run Continuation – Analyst

Fundraising Through NFTs May Be Exempted From SEC Legal guidelines