Fast Take

As Bitcoin (BTC) charts a modest improve, pushing towards the $43,000 mark—an roughly 1% rise over the past 24 hours, exchange-traded funds (ETFs) are experiencing a slightly contrasting development.

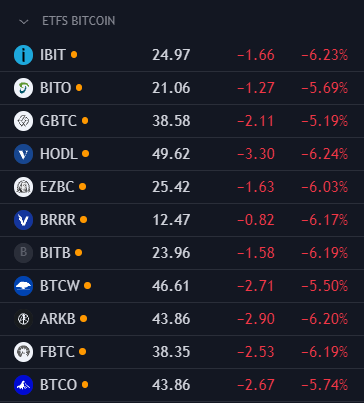

With the pre-market buying and selling exhibiting unfavourable indicators, notable ETFs such because the IBIT BlackRock ETF and HODL Van Eck ETF have registered vital losses, down by -1.66% and -3.30%, respectively. These figures additional intensify the general downward trajectory since their launch, with each ETFs recording a drop of over 6%.

The opposed development isn’t confined to those ETFs alone. Information signifies that almost all of crypto-equities have succumbed to an analogous destiny, with MSTR down -0.27%, roughly 30% down from the Jan. 2 excessive at $706.

Notably, the value used to calculate the Web Asset Worth (NAV) for Bitcoin ETFs is currently $42957.16 and can subsequent be up to date at 9 pm GMT on Jan. 16.

Because the buying and selling day culminates, CryptoSlate will proceed monitoring to supply readers with the newest and complete evaluation.

The submit Bitcoin inches up while leading ETFs slide further down in pre-market trading appeared first on CryptoSlate.

More NFT News

Funds Diverted to Crypto Trades, Luxurious Splurges

Crypto markets can be pressured by commerce wars till April: analyst

KuCoin and Others Face Scrutiny