Bitcoin’s value actions dominate headlines, however the true story of BTC lies beneath the floor. Past technical evaluation and value hypothesis, on-chain knowledge affords an unparalleled view of provide, demand, and investor conduct in actual time. By leveraging these insights, merchants and traders can anticipate market tendencies, observe institutional actions, and make data-driven selections.

For a extra in-depth look into this subject, take a look at a latest YouTube video right here: Mastering Bitcoin On-Chain Data

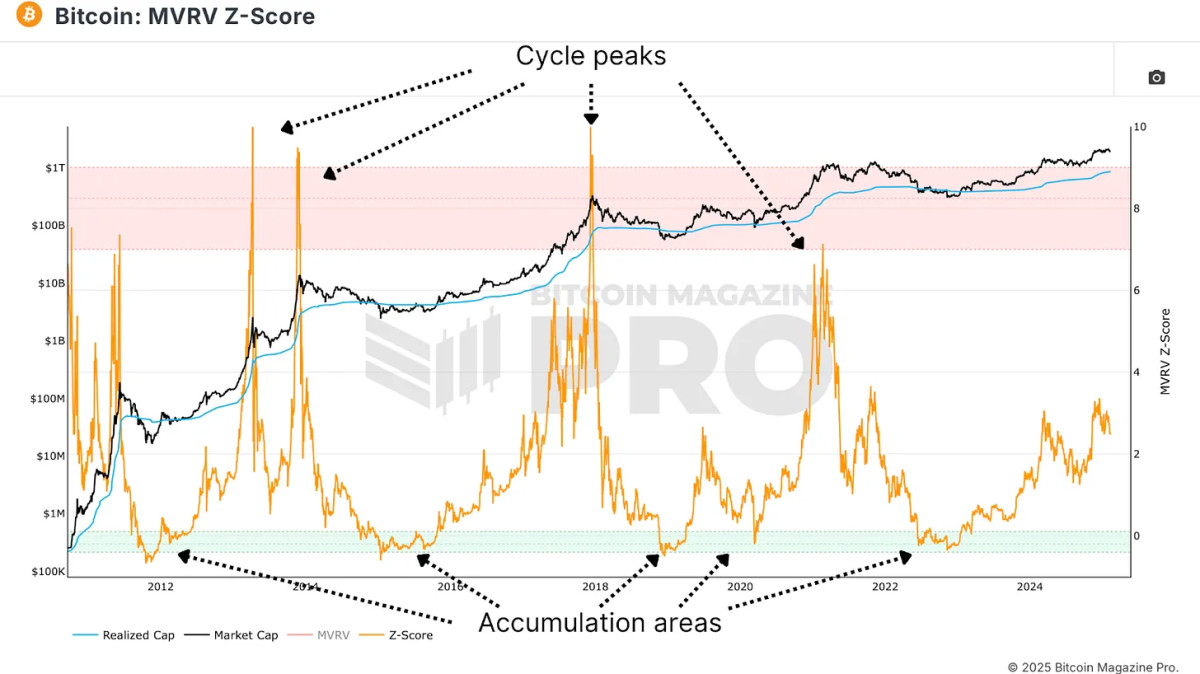

Realized Worth & MVRV Z-Rating

On-chain knowledge refers back to the publicly obtainable transaction information on Bitcoin’s blockchain. In contrast to conventional markets, the place investor actions are obscured, Bitcoin’s transparency permits for real-time evaluation of each transaction, pockets motion, and community exercise. This data helps traders establish main tendencies, accumulation zones, and potential value inflection factors.

One of the vital essential on-chain metrics is Realized Price, which displays the typical value foundation of all BTC in circulation. In contrast to conventional belongings, the place investor value bases are tough to find out, Bitcoin gives real-time visibility into when nearly all of holders are in revenue or loss.

To reinforce the utility of Realized Worth, analysts make use of the MVRV Z-Score, which measures the deviation between market worth and realized worth, standardized for Bitcoin’s volatility. This indicator has traditionally recognized optimum shopping for zones when it enters the decrease vary and potential overvaluation when it enters the pink zone.

Monitoring Lengthy-Time period Holders

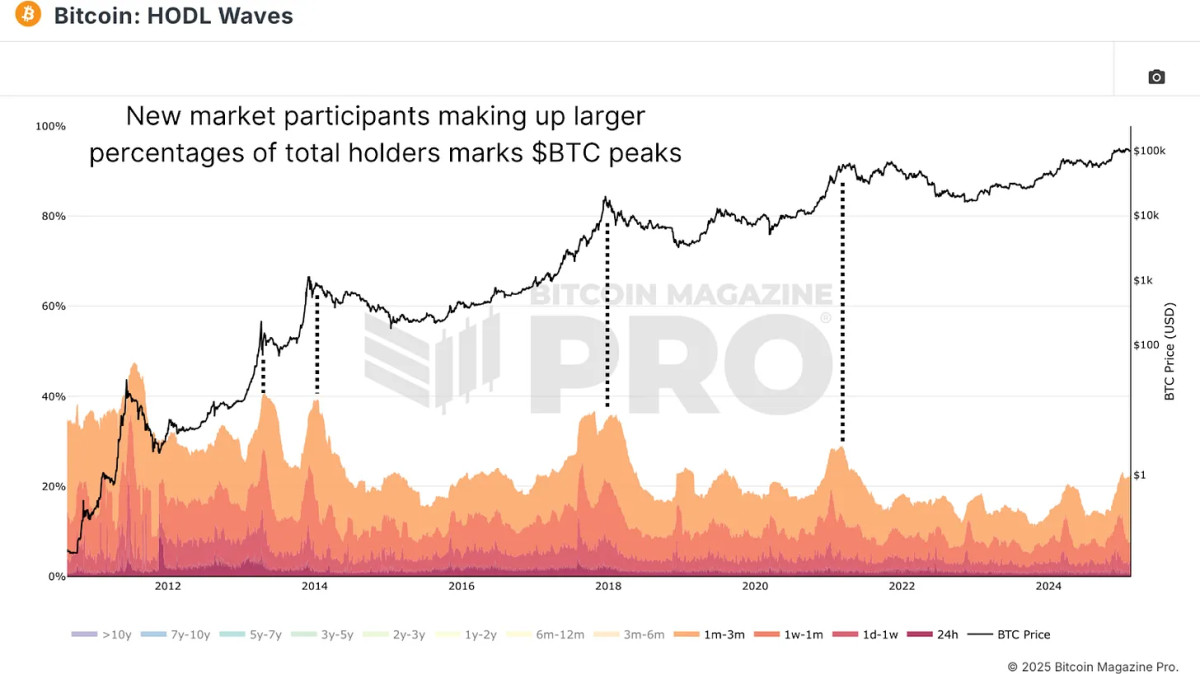

One other key metric is the 1+ Year HODL Wave, which tracks Bitcoin addresses that haven’t moved funds for not less than a yr. A rising HODL wave signifies that traders are selecting to carry, decreasing circulating provide and creating upward value stress. Conversely, when this metric begins declining, it suggests profit-taking and potential distribution.

HODL Waves visualizes the complete distribution of Bitcoin possession by age bands. Filtering to new market members of three months or much less reveals typical retail participation ranges. Peaks in short-term holders usually sign market tops, whereas low ranges point out ultimate accumulation zones.

Recognizing Whale Actions

Supply Adjusted Coin Days Destroyed quantifies the overall BTC moved, weighted by how lengthy it was held, and standardizes that knowledge by the circulating provide at the moment. For instance:

- 1 BTC held for 100 days → 100 Coin Days Destroyed

- 0.1 BTC held for 1,000 days → 100 Coin Days Destroyed

This metric is invaluable for detecting whale exercise and institutional profit-taking. When long-dormant cash all of a sudden transfer, it usually indicators giant holders exiting positions. Historic knowledge confirms that spikes on this knowledge level align with main market tops and bottoms, reinforcing its worth in cycle evaluation.

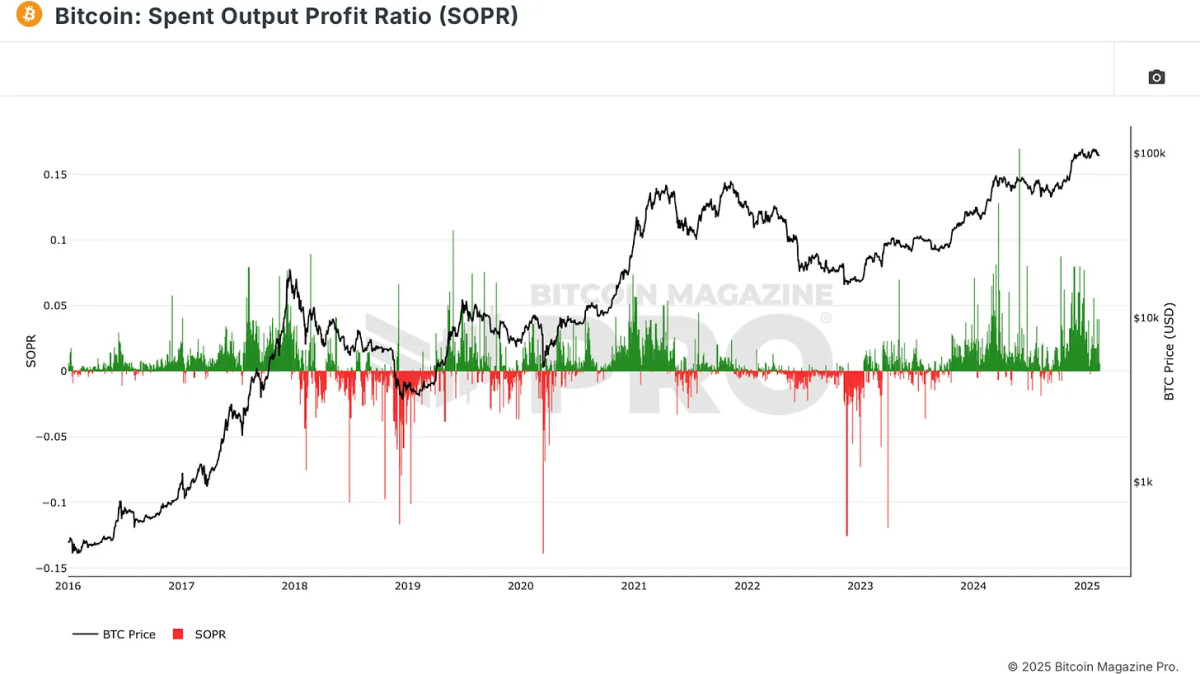

Realized Beneficial properties & Losses

The Spent Output Profit Ratio (SOPR) reveals the profitability of BTC transactions. A SOPR worth above Zero signifies that the typical Bitcoin being moved is in revenue, whereas a worth under Zero means the typical sale is at a loss. By observing SOPR spikes, merchants can establish euphoric profit-taking, whereas SOPR declines usually accompany bear market capitulations.

Counting on a single metric will be deceptive. To extend the likelihood of correct indicators, traders ought to search confluence between a number of on-chain indicators.

For instance, when:

- MVRV Z-score is within the inexperienced zone (undervalued)

- SOPR signifies excessive realized losses (capitulation)

- HODL waves present a decline in short-term holders (promoting exhaustion)

This alignment traditionally marks optimum accumulation zones. You must also search for confluence for any deliberate profit-taking in your BTC holdings, in search of the above metrics all signaling the other to stipulate overheated market circumstances.

Conclusion

Bitcoin’s on-chain knowledge gives a clear, real-time view of market dynamics, providing traders an edge in decision-making. By monitoring provide tendencies, investor psychology, and accumulation/distribution cycles, Bitcoiners can higher place themselves for long-term success.

Discover dwell knowledge, charts, indicators, and in-depth analysis to remain forward of Bitcoin’s value motion at Bitcoin Magazine Pro.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. All the time do your individual analysis earlier than making any funding selections.

More NFT News

21Shares to Liquidate Energetic Bitcoin and Ether Futures ETFs Amid Market Downturn

Sweet Digital Units To Launch A New NFT Assortment Subsequent Week

Dogecoin Sees 47% Spike In Lively Addresses, Why Worth May Comply with Swimsuit