Searching for the very best crypto platforms in Australia? With the rising reputation of digital currencies, selecting the best platform is essential. The very best crypto exchanges in Australia provide numerous options, from aggressive charges to sturdy safety measures and a variety of supported cash.

On this information, we are going to overview the very best Australian crypto exchanges primarily based on their buying and selling charges, supported cryptocurrencies, AUSTRAC licensing, and AUD cost strategies.

Key Takeaways:

- The very best crypto exchanges in Australia are Swyftx, CoinSpot, OKX, Coinbase, Kraken, CoinJar, Bybit, eToro Australia, Impartial Reserve, and Crypto.com as a result of their excessive safety, AUSTRAC registration, and aggressive charges.

- The most well-liked Australian cryptocurrency exchanges assist many AUD cost strategies like financial institution transfers, PayID, and credit score/debit playing cards for handy deposits and withdrawals.

Checklist of High Australian Crypto Exchanges and Platforms

We’ve got reviewed 30+ top crypto trading platforms in Australia primarily based on options equivalent to charges, safety, laws, supported cash, ease of use, and AUD deposit strategies. Right here is the checklist of the 14 greatest crypto exchanges in Australia:

- Swyftx: Total greatest crypto change Australia

- CoinSpot: Greatest as a result of AUSTRAC registration

- OKX: Best for advanced crypto trading tools

- Coinbase: Greatest for high-security requirements

- Kraken: Greatest for crypto and NFT buying and selling

- CoinJar: Greatest for long-standing popularity

- Bybit: Best for leveraged trading in Australia

- eToro Australia: Greatest for social buying and selling options

- Impartial Reserve: Greatest for buying and selling with superior crypto tax reporting

- Crypto.com: Greatest crypto staking platform in Australia

- BTC Markets: Greatest for environment friendly AUD transactions

- Digital Surge: Greatest for aggressive buying and selling charges

- Uniswap: Greatest Australian decentralized change

- MEXC: Best for zero trading fees

Greatest Bitcoin and Crypto Exchanges in Australia Reviewed

Here’s a detailed overview of high Australian cryptocurrency buying and selling platforms:

Swyftx

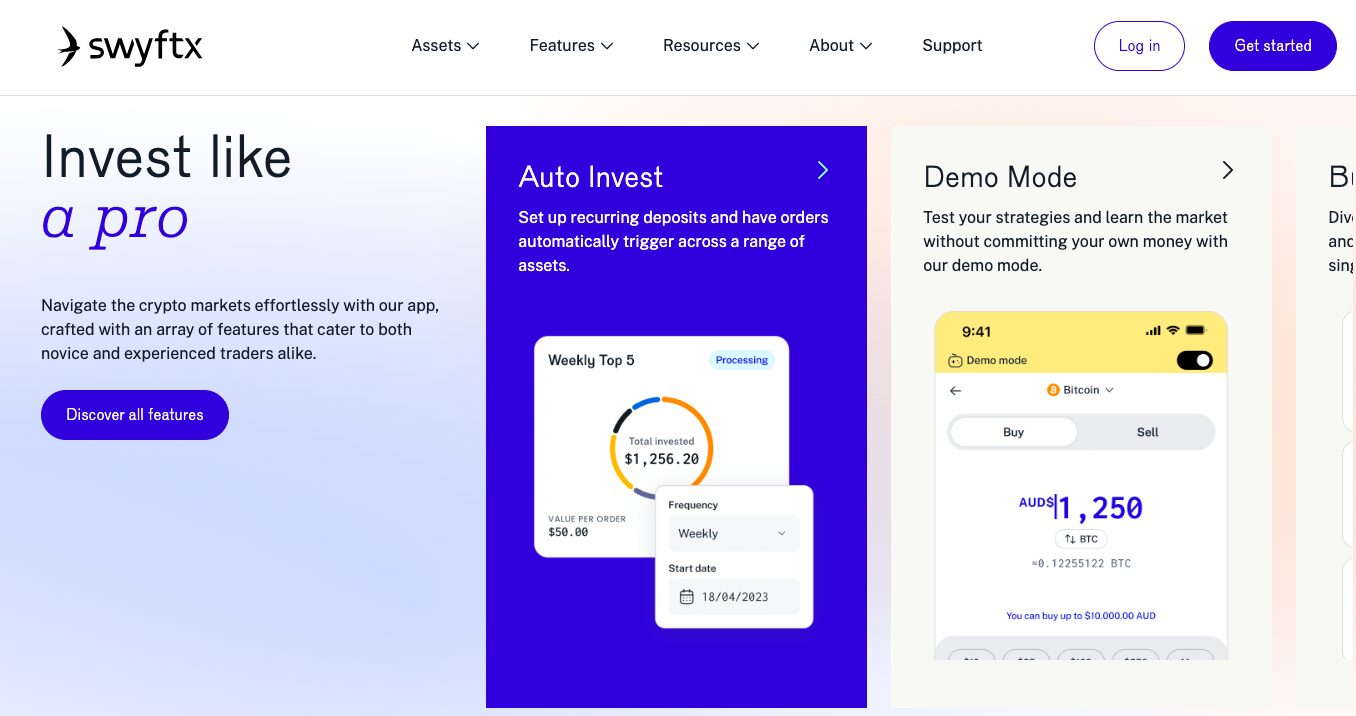

Swyftx has emerged as a number one cryptocurrency change in Australia since its launch in 2018. The platform now serves over 700,000 customers throughout Australia and New Zealand. Swyftx gives buying and selling for 400+ cryptocurrencies, together with standard cash like Bitcoin, Ethereum, and Dogecoin, in addition to a variety of altcoins.

The change boasts aggressive charges, with a flat 0.6% buying and selling price that decreases for high-volume merchants. Deposits by way of AUD financial institution transfers are free, whereas third-party cost processing incurs a small price. Swyftx’s user-friendly interface caters to each inexperienced persons and skilled merchants, that includes a demo mode for apply buying and selling with digital funds.

Swyftx prioritizes safety, implementing measures like two-factor authentication and biometric login. The platform shops 90% of consumer funds in offline chilly storage for added safety. Swyftx is registered with AUSTRAC and complies with Australian laws, offering customers with a way of legitimacy and belief.

The change gives further options like recurring buys for dollar-cost averaging and a cellular app for on-the-go buying and selling. Swyftx’s buyer assist is accessible 24/7 by way of reside chat, with a mean response time of beneath 5 minutes.

Professionals

- Huge collection of 400+ cryptocurrencies

- Superior options together with recurring buys, bundles, and SMSF accounts

- Consumer-friendly interface with demo mode

- Registered with AUSTRAC, enhancing belief

- 24/7 buyer assist and cellular app for Android and iOS

Cons

- No leverage buying and selling or futures contracts for superior merchants

- Excessive withdrawal charges apply for some cryptocurrencies

CoinSpot

CoinSpot, based in 2013 and headquartered in Melbourne, is one in all Australia’s largest and most trusted cryptocurrency exchanges. With over 2.5 million customers, it helps greater than 490 cryptocurrencies, providing the widest number of digital property amongst Australian exchanges.

It’s licensed by Blockchain Australia and has achieved ISO 27001 certification for data safety, guaranteeing a excessive stage of security for customers’ funds and information.

The change prices a flat 1% buying and selling price, which is comparatively excessive in comparison with some worldwide opponents like Binance however aggressive throughout the Australian market. It gives a number of deposit strategies, together with POLi, PayID, and financial institution transfers, all freed from cost. Nonetheless, card and money deposits incur charges of 1.88% and a couple of.5%, respectively.

CoinSpot additionally supplies distinctive options like crypto staking with versatile choices, permitting customers to earn returns with out locking their property for prolonged intervals. It gives 23 staking choices, with some property yielding as excessive as 78% APY. Plus, CoinSpot has an NFT market that helps direct purchases of standard NFTs equivalent to Bored Ape Yacht Membership and Cool Cats.

Professionals

- Over 490 cryptocurrencies obtainable for buying and selling

- Sturdy safety with ISO 27001 certification and options like 2FA and anti-phishing measures

- Straightforward for inexperienced persons with numerous deposit strategies

- 24/7 Australian-based buyer assist

- Numerous staking choices and an built-in NFT market

Cons

- A flat 1% price on trades, which is increased than opponents

- It lacks superior buying and selling instruments like futures and margin buying and selling

OKX

OKX is a widely known Australian cryptocurrency change that was launched in 2017. It operates globally and gives a broad vary of buying and selling choices, together with spot buying and selling, futures, and decentralized finance (DeFi) merchandise.

OKX helps over 350 cryptocurrencies, which makes it a flexible platform for merchants. The change is acknowledged for its aggressive price construction, with buying and selling charges beginning as little as 0.08% for makers and 0.1% for takers. These charges will be additional lowered by way of excessive buying and selling volumes or holding OKB, the platform’s native token.

The platform makes use of a number of layers of safety, together with multi-factor authentication and chilly storage for property, which helps safeguard consumer funds. OKX additionally publishes common Proof of Reserves stories to keep up transparency. Nonetheless, it’s essential to notice that OKX is not obtainable within the U.S. and Canada as a result of regulatory restrictions, which restrict its accessibility in these areas.

OKX supplies a wide range of passive revenue alternatives, together with staking, financial savings accounts, and extra sophisticated merchandise like Shark Fin and Twin Funding. These merchandise allow you to earn curiosity in your investments all through a wide range of intervals, whether or not versatile or fastened.

The platform additionally contains superior buying and selling instruments like copy buying and selling, which permits newbies to emulate the strategies of skilled merchants, and buying and selling bots, which automate transactions primarily based on established methods.

Professionals

- Low and aggressive buying and selling charges

- No deposit and crypto-to-crypto forex conversion charges

- Wide selection of supported cryptocurrencies

- Gives superior instruments like copy buying and selling, and buying and selling bots

- Sturdy safety measures and clear operations

Cons

- Not obtainable within the U.S. and Canada

- Previous controversies associated to false buying and selling volumes

Coinbase Australia

Coinbase is likely one of the greatest crypto buying and selling platforms in Australia, providing a platform for getting, promoting, and storing digital property. It was based in 2012 and have become the primary main cryptocurrency change to go public on NASDAQ in 2021 beneath the ticker COIN.

Coinbase is accessible in over 100 nations, together with Australia, and serves over 103 million verified customers with $250+ billion in property on the platform.

In Australia, Coinbase helps over 240 cryptocurrencies, together with standard property like BTC, ETH, MATIC, and ADA. Coinbase supplies options like a user-friendly interface, a cellular app, and academic instruments by way of Coinbase Earn, the place customers can earn crypto by studying about numerous digital property.

Coinbase’s charges are increased in comparison with different Australian exchanges, with transaction prices starting from 0.4% to 4.5% relying on the tactic and quantity of commerce. The platform helps AUD deposits by way of PayID, and you can also make direct purchases utilizing credit score or debit playing cards with charges of round 3.99% per transaction.

Professionals

- Excessive-security requirements, together with 98% of property saved in offline chilly storage

- Excessive liquidity and buying and selling quantity

- Make quick AUD deposits and withdrawals utilizing PayID

- $20 price of BTC welcome bonus

- Coinbase Pockets for DeFi customers

Cons

- Larger transaction and deposit charges in comparison with different Australian exchanges

- Customers can’t withdraw AUD on to the checking account

Kraken

Kraken is one other international cryptocurrency change for Australians that has been in enterprise since 2011. It supplies companies to over 10 million prospects in additional than 190 nations. It gives spot buying and selling, margin buying and selling with leverage as much as 5x, buying and selling futures with greater than 100 contracts, and staking companies. Greater than 200 cash are supported on the location.

Kraken operates in Australia as a registered Digital Forex Change Supplier with AUSTRAC and holds ISO 27001 certification, demonstrating its dedication to high-security requirements and regulatory compliance. As a frontrunner in transparency, Kraken additionally pioneered the Proof of Reserves Audit.

You’ll be able to benefit from the comfort of free and on the spot AUD deposits and withdrawals by way of dependable strategies like PayID and Osko financial institution transfers, making it straightforward to maneuver funds out and in of the platform.

Kraken gives deep liquidity and aggressive spreads throughout a wide range of AUD buying and selling pairs, together with standard ones like BTC/AUD, USDT/AUD, and ADA/AUD. In case you’re in search of extra buying and selling choices, it’s also possible to convert your AUD to USD, providing you with entry to a wider collection of international crypto markets.

With Kraken Professional, you begin with a low price of 0.25%, and by growing your 30-day buying and selling quantity, you may even cut back your charges to zero. This low-cost construction is good in the event you’re a frequent dealer. For superior buying and selling, Kraken Professional supplies a customizable interface that permits you to interact in spot buying and selling, handle AUD funding, and extra—all inside one highly effective platform.

If you’re desirous about extra personal and customized buying and selling experiences, Kraken’s Over-The-Counter (OTC) commerce desk gives tailor-made companies for high-value and institutional transactions. You’ll be able to commerce straight with the desk in AUD by way of chat or by way of the OTC portal.

Professionals

- Superior safety measures, together with 2FA, AUSTRAC registration, and chilly storage for many funds

- NFT market for artists and artwork collectors

- Gives margin, futures, and staking, appropriate for extra skilled merchants

- Excessive buying and selling quantity helps massive transactions with minimal value influence

- Helps AUD deposits with on the spot funding choices like PayID

Cons

- Some options, like leverage buying and selling, might not be obtainable in all areas as a result of regulatory necessities

- Doesn’t assist new or low-cap altcoins for buying and selling

CoinJar

CoinJar is Australia’s longest-running cryptocurrency change, based in 2013. The platform helps over 60 cryptocurrencies. It permits customers to begin buying and selling with as little as $10 and gives easy-to-use cellular and internet interfaces. It additionally helps a number of currencies, together with AUD, EUR, and GBP, for deposits and buying and selling, with funds shortly accessible by way of financial institution transfers, PayID, or credit score and debit playing cards.

CoinJar is understood for its sturdy safety measures, storing over 90% of its digital property offline in safe areas and utilizing personal key-enabled, multi-sig wallets. Plus, it gives the CoinJar Card, a pay as you go Mastercard that permits customers to spend their cryptocurrencies like money, both on-line or in-store, with out month-to-month charges. The cardboard integrates with Apple Pay and Google Pay.

The change additionally options CoinJar Bundles, which let you put money into themed baskets of cryptocurrencies, facilitating portfolio diversification and automatic investing by way of greenback price averaging.

Regardless of its many benefits, CoinJar prices a 2% price on bank card buys. CoinJar’s sturdy buyer assist and its recognition as Blockchain Australia’s 2023 Digital Forex Change of the 12 months additional improve its popularity as a dependable and accessible possibility for cryptocurrency buying and selling in Australia.

Professionals

- Quick transactions with PayID and financial institution transfers

- CoinJar Card gives crypto spending with no month-to-month charges

- Absolutely registered and compliant with AUSTRAC and the Monetary Conduct Authority UK

- Purchase Bitcoin and different cryptocurrencies along with your SMSF account

- OTC marketplace for high-volume merchants

Cons

- Excessive buying and selling charges, 1% for getting/promoting crypto

- No superior buying and selling instruments and markets

- A restricted collection of cash

Bybit

Bybit is Australia’s high derivatives change, identified for its complete buying and selling capabilities and easy-to-use design. Bybit was based in 2018 and has developed considerably, with over 40 million registered customers worldwide.

The platform supplies a wide range of buying and selling options, together with spot buying and selling, derivatives, and futures. Bybit gives over 1200 cash, giving a various vary of buying and selling pairings.

Certainly one of Bybit’s key strengths is its superior buying and selling instruments. The change gives leveraged buying and selling as much as 100x on numerous contracts, permitting merchants to maximise their potential earnings, albeit with increased dangers. Bybit’s buying and selling engine is designed to deal with as much as 100,000 transactions per second, guaranteeing a clean buying and selling expertise even throughout excessive volatility intervals. The platform can also be identified for its 99.99% system performance uptime.

Moreover, Bybit has launched distinctive options such because the Unified Buying and selling Account, which streamlines buying and selling by merging many asset courses right into a single account. The platform additionally has a copy buying and selling software, which permits inexperienced merchants to duplicate the strategies of top-performing merchants.

Professionals

- As much as 100x leverage on derivatives buying and selling

- Multi-signature chilly pockets storage and a devoted insurance coverage fund

- Handles 100,000 transactions per second, guaranteeing clean trades

- Consumer-friendly cellular app for inexperienced persons

- Crypto buying and selling bots with DCA and grid methods

Cons

- Leveraged buying and selling could also be restricted for Australians as a result of laws

- Restricted choices for direct AUD fiat forex deposits

eToro Australia

eToro is the very best cryptocurrency dealer in Australia, famous for its intensive asset class choices and user-friendly structure. Based in 2007, eToro has grown right into a worldwide community that helps greater than 30 cryptocurrencies, together with Bitcoin, Ethereum, and XRP.

It’s a multi-asset platform that enables customers to commerce equities, ETFs, commodities, in addition to cryptocurrency. The platform has constructed a robust popularity for its novel CopyTrader operate, which permits customers to imitate profitable traders’ transactions, making it an excellent various for newbies.

There’s a minimal $10 minimal funding required for cryptocurrency buying and selling, even smaller traders can take part. Plus, inventory buying and selling on the location is charged a hard and fast value of $2.

eToro’s social buying and selling community, which permits customers to work together with others, change concepts, and observe market actions, is one in all its most notable options. The app helps novice customers apply their buying and selling strategies risk-free by offering a $100,000 digital fund trial account.

Relating to prices, eToro prices a 1% price on cryptocurrency transactions but supplies aggressive spreads for cryptocurrency buying and selling.

Professionals

- Low $10 minimal deposit for crypto trades

- CopyTrader function for replicating profitable trades

- Regulated by ASIC, offering a safe setting

- Consumer-friendly interface with a cellular app

- Demo account with $100,000 digital funds for apply

Cons

- Restricted numbers of digital property are supported

- Buyer assist will be gradual at occasions

- Larger spreads on some cryptocurrency pairs

Impartial Reserve

Independent Reserve is one in all Australia’s most trusted cryptocurrency exchanges, established in 2013 and primarily based in Sydney. It has over 300,000 customers throughout Australia, New Zealand, and Southeast Asia, and helps 30 of the preferred cryptocurrencies. The change permits buying and selling with 4 fiat currencies: Australian Greenback (AUD), New Zealand Greenback (NZD), U.S. Greenback (USD), and Singapore Greenback (SGD).

The platform gives insurance coverage towards large-scale hacks, making it one of many most secure choices for Australian crypto merchants. The change is regulated by AUSTRAC, guaranteeing compliance with Australian monetary legal guidelines.

Impartial Reserve is particularly standard amongst high-net-worth traders and self-managed tremendous fund (SMSF) customers. This is because of its over-the-counter (OTC) desk and superior tax reporting options. These instruments assist customers handle their portfolios and simplify tax obligations.

Nonetheless, the change has a number of drawbacks. Its collection of cryptocurrencies is smaller in comparison with different Australian exchanges like Swyftx, which can not enchantment to these looking for to commerce lesser-known cash. Moreover, whereas the platform gives superior buying and selling instruments, its interface might really feel much less intuitive for inexperienced persons.

Professionals

- Safe with 2FA, chilly storage, and non-compulsory insurance coverage

- Low charges, beginning at 0.5%, dropping to 0.02% for big merchants

- Wonderful SMSF assist and superior tax reporting instruments

- Prompt deposits by way of Osko/PayID

Cons

- Restricted cryptocurrency choices (solely 30+ obtainable)

- The buying and selling interface could also be advanced for inexperienced persons

Crypto.com

Crypto.com is likely one of the most secure Australian crypto exchanges. Established in 2016, it gives a sturdy platform for buying and selling over 350 cryptocurrencies. It gives options like staking, lending, and incomes curiosity on crypto property. Customers may purchase and promote NFTs by way of its market.

Australian customers can simply deposit and withdraw Australian {dollars} (AUD) by way of financial institution switch, bank cards, and PayID, amongst different strategies. The platform supplies a aggressive edge for customers who maintain Crypto.com’s native CRO token, providing price reductions and better returns on staking—as much as 14.5% yearly on sure cryptocurrencies.

Crypto.com’s Visa debit card is a key function that permits you to spend crypto on on a regular basis purchases. Relying on the quantity of CRO staked, cardholders can earn as much as 5% cashback. Moreover, the app is accessible on desktop and cellular, offering seamless entry to handle property.

Professionals

- Switch AUD by way of NPP and Apple/Google Pay

- Registered with AUSTRAC and licensed by ASIC

- Trusted by over 100 million customers worldwide

- Recurring buys with every day, weekly, or month-to-month trades

- Take pleasure in as much as 5% again on all spending with a Crypto.com Visa card

Cons

- Sluggish buyer assist occasions

- Larger buying and selling charges for non-CRO holders

- Lack of superior buying and selling instruments

BTC Markets

BTC Markets is one other of Australia’s Bitcoin exchanges, based in 2013. Primarily based in Melbourne, it serves over 325,000 customers and has processed greater than AUD 24 billion in trades. It’s a platform tailor-made to each retail and institutional traders, providing a variety of companies from easy crypto purchases to superior buying and selling choices.

The platform helps 36 totally different cryptocurrencies, together with Bitcoin, Ethereum, XRP, and stablecoins like USDT. For fiat-to-crypto transactions, BTC Markets facilitates Australian Greenback (AUD) deposits and withdrawals by way of PayID and Osko, guaranteeing fast and fee-free transactions. It additionally helps recurring buys, making it straightforward for long-term traders to automate purchases over time.

It has obtained ISO 27001 certification and is registered with AUSTRAC. Moreover, a sturdy 99.99% uptime on the platform ensures reliable commerce execution. The platform additionally caters to massive trades by way of an Over-the-Counter (OTC) desk for institutional shoppers. Nonetheless, its companies might really feel restricted as a result of an absence of superior instruments and a comparatively smaller collection of cryptocurrencies in comparison with worldwide exchanges.

Professionals

- Sturdy safety (ISO 27001 licensed)

- Helps AUD transactions and quick deposits

- Entry superior order varieties together with restrict, market, cease restrict, and greenback price averaging

- Monitor your complete asset holdings, values, and fairness over time

- Credit score your pockets with AUD in seconds utilizing Osko PayID, direct deposit, or card

Cons

- Restricted cryptocurrency choice (solely 36 property)

- No reside chat buyer assist

Digital Surge

Digital Surge is a well-liked Australian crypto change providing entry to over 310 cryptocurrencies. The platform is understood for its aggressive charges, charging a flat price of 0.5% on trades. There aren’t any charges for AUD deposits made by way of PayID or financial institution transfers, which is a big cost-saving function.

Excessive-volume merchants can cut back charges additional. Digital Surge gives quick and free AUD withdrawals, making it environment friendly for transferring funds out and in of the change. To enhance security, the platform additionally employs sturdy identification verification procedures, is registered with AUSTRAC, and adheres to stringent regulatory compliance.

Its invoice cost service, which permits prospects to pay Australian payments with Bitcoin, is one in all its distinctive options. Furthermore, Digital Surge facilitates clean interplay with tax reporting software program, which helps prospects deal with tax liabilities related to Bitcoin holdings.

Though the platform is nice for novices, skilled merchants might discover it much less interesting as a result of it doesn’t have subtle options like margin buying and selling. Moreover, it’s much less useful for customers from different nations as a result of it solely accepts AUD for forex transactions.

Professionals

- Over 310 cryptocurrencies can be found

- Safe with 2FA and chilly storage

- Bitcoin invoice cost possibility

- Easy interface, superb for inexperienced persons

- Safe & on the spot 24/7 deposits by way of PayID

Cons

- Lacks superior buying and selling options

- Solely helps AUD for fiat transactions

- No bank card deposit possibility

Uniswap

Uniswap is a decentralized change (DEX) in Australia. It runs on the Ethereum blockchain. Utilizing an Automated Market Maker (AMM) system, customers can commerce ERC-20 tokens with out the necessity for middlemen. This platform performs transactions straight between friends by way of liquidity swimming pools, eradicating the requirement for an order e-book or a government.

For Australians, Uniswap supplies a decentralized, self-custody various to centralized exchanges. You’ll be able to retain management over your crypto property quite than third-party accounts. Nonetheless, one notable drawback is Ethereum’s excessive fuel costs, which may make smaller trades expensive, notably throughout occasions of community congestion.

All good contracts and transaction information on Uniswap are verifiable and publicly accessible as a result of its transparency and open-source nature. However, You need to have digital forex to begin buying and selling as a result of it doesn’t assist fiat cash.

Professionals

- Helps 1000’s of ERC-20 tokens on the Ethereum blockchain

- No account or identification verification is required

- Customers retain full management of their funds

- Liquidity suppliers earn 0.3% from trades

- No central authority, enhancing safety and privateness

Cons

- Ethereum transaction prices will be excessive

- Solely crypto-to-crypto trades are allowed

- Smaller swimming pools can result in value slippage throughout buying and selling

MEXC

MEXC is the most cost effective cryptocurrency change in Australia. Certainly one of its standout options is the no-KYC crypto trading, permitting customers to withdraw as much as 10 BTC every day with out finishing identification verification. This makes it an interesting selection for privacy-conscious merchants. Moreover, MEXC can also be a zero-fee crypto exchange. It prices zero charges for maker trades on its spot market, which helps customers save on buying and selling prices.

The platform helps greater than 2,800 cryptocurrencies, together with lesser-known tokens not obtainable on most exchanges. Its complete choice caters to customers trying to diversify their portfolios with area of interest property. MEXC additionally gives a wide range of superior buying and selling instruments, equivalent to copy buying and selling and futures buying and selling, with leverage choices as much as 200x for futures.

With its customizable TradingView charts, easy-to-use consumer interface, and tutorial options like demo buying and selling, the platform caters to merchants of all ability ranges. It supplies further options like trailing cease orders and API integration for skilled merchants.

Professionals

- Withdraw as much as 10 BTC every day with out verification

- Zero maker charges on spot buying and selling

- Huge collection of cash, over 2,800 cryptocurrencies

- Excessive leverage with as much as 200x on futures

- Sturdy safety like Multi-factor authentication and chilly storage

Cons

- Doesn’t assist AUD deposits and withdrawals

- It’s a extremely unregulated crypto buying and selling platform

Select the Greatest Crypto Change for Australian Buyers?

When deciding on the best cryptocurrency change in Australia, quite a few standards should be examined. Every element has a direct influence on the expertise of buying and selling digital property, from simplicity of use to safety and value.

Right here’s a full breakdown of the main facets to contemplate when selecting an Australian cryptocurrency change.

1. Safety and Regulatory Compliance

High Australian platforms implement multi-layered safety protocols, together with superior encryption strategies, common penetration testing, and chilly storage options that preserve as much as 95% of consumer property offline. Two-factor authentication (2FA) is now normal, with some exchanges providing biometric verification for added safety.

AUSTRAC registration is essential, guaranteeing exchanges adhere to Australia’s strict anti-money laundering (AML) and counter-terrorism financing (CTF) laws.

Main exchanges additionally conduct common third-party audits, offering transparency about their safety measures and monetary well being. Some have even established bug bounty applications, providing rewards of as much as $100,000 for figuring out crucial vulnerabilities.

2. Buying and selling Charges

The following consideration is charges. All crypto exchanges cost charges for buying and selling, depositing, and withdrawing funds. The price construction varies from one change to a different. In some circumstances, there are flat charges for every transaction, whereas others might use a percentage-based system.

On common, buying and selling charges in Australia vary between 0.1% and 1%. As an illustration, in the event you commerce $1,000 price of Bitcoin, a 0.5% price would price $5. Whereas these charges could seem small, they’ll accumulate over time, particularly for frequent merchants.

Nonetheless, it’s essential to look past simply buying and selling charges. Deposit charges for financial institution transfers are sometimes free, however bank card deposits can incur prices of 2-4%. Withdrawal charges differ by cryptocurrency, with Bitcoin withdrawals usually costing round 0.0005 BTC.

Some Australian exchanges have launched fee-free buying and selling intervals for brand spanking new customers or throughout promotional occasions. Moreover, concentrate on unfold charges on on the spot purchase/promote options, which will be as excessive as 5% on some platforms.

3. Liquidity and Buying and selling Quantity

Liquidity is the lifeblood of environment friendly buying and selling, straight impacting the pace and value of transactions. Australian buying and selling exchanges have seen important progress in buying and selling volumes, with high platforms dealing with anyplace from $500 million to over $5 billion in every day trades.

Larger liquidity usually interprets to tighter bid-ask spreads, lowering slippage and guaranteeing higher value execution. Some exchanges present liquidity information for every buying and selling pair, permitting merchants to evaluate market depth.

Throughout peak buying and selling occasions, often between 10 AM and a couple of PM AEST, liquidity tends to be at its highest. Exchanges with international operations usually present higher liquidity as a result of their bigger consumer base, however guarantee they nonetheless cater particularly to the Australian market with AUD buying and selling pairs.

4. Supported Cryptocurrencies

Whereas Bitcoin and Ethereum proceed to dominate commerce quantity on most exchanges, demand for altcoins is growing. High exchanges presently checklist cryptocurrencies starting from 50 to over 400, together with growing DeFi tokens, NFT-related cash, and blockchain gaming property.

Some platforms have included “launchpad” capabilities, which allow you to take part in preliminary coin choices (ICOs) and token gross sales for brand spanking new initiatives. The choice to stake a wide range of proof-of-stake cash straight on the change is rising extra standard, with some giving yearly APR of as much as 20% on particular property.

5. Consumer Expertise and Interface

Main Australian exchanges have invested closely in intuitive designs, with options like customizable dashboards, real-time charting instruments, and one-click buying and selling.

Cellular apps have turn out to be more and more subtle, with some boasting over 500,000 downloads and scores above 4.5 stars on app shops. These apps usually embody options like value alerts, portfolio monitoring, and even biometric login for enhanced safety.

Some exchanges have launched “lite” variations of their platforms, catering to inexperienced persons with simplified interfaces whereas nonetheless providing superior buying and selling views for skilled customers. The flexibility to customise the buying and selling interface, together with darkish mode choices and widget preparations, is turning into a regular function on high Australian platforms.

6. AUD Fee Strategies

Whereas financial institution transfers stay probably the most cost-effective methodology, with processing occasions usually between 1-Three enterprise days, on the spot choices are gaining reputation.

PayID and NPP (New Funds Platform) transfers provide near-instant AUD deposits at most main exchanges. Credit score and debit card funds, whereas handy, usually incur charges of 2-4%.

Some exchanges have partnered with particular Australian banks to supply lowered charges or on the spot transfers. POLi funds are supported by a number of Australian platforms, offering a fast deposit possibility with out bank card charges.

A couple of forward-thinking exchanges have even begun exploring integration with rising cost applied sciences like Open Banking, doubtlessly providing extra seamless and safe fund transfers sooner or later.

7. Buyer Assist

Dependable customer support might make or break the consumer expertise. High Australian crypto exchanges now present 24/7 service by way of a number of channels. Some have deployed AI-powered chatbots able to answering frequent questions promptly.

Response occasions differ, however high exchanges try to reply easy questions in minutes and deal with most difficulties inside 24 hours. Some platforms now present VIP service for high-volume merchants, together with specialised account managers and precedence decision.

Neighborhood-driven assist by way of boards and data bases can also be turning into extra widespread, with some exchanges that includes libraries of over 500 articles and video programs.

Buying and selling Options and Instruments

Many Australian exchanges now settle for superior order varieties like OCO (One-Cancels-the-Different) and trailing stops, along with the traditional market, restrict, and stop-loss orders.

Most main platforms present normal API entry for algorithmic buying and selling, and a few even embody easy instruments for constructing bots to automate buying and selling processes. You may also test options equivalent to staking, leverage buying and selling, choices buying and selling, and the NFT market.

8. Status

Lastly, it’s crucial to evaluate the change’s normal reputation. This may be achieved by trying by way of scores, studying consumer opinions, and discovering out if the platform has ever been part of any hacks or scandals.

It’s extra possible {that a} respected change with glorious suggestions from different Australian shoppers would provide a secure and reliable service. For instance, Swyftx and CoinSpot have a strong popularity as dependable platforms. Search out exchanges which have a observe report of success, since it is a dependable signal.

Evaluating the Greatest Cryptocurrency Exchanges in Australia

| Change | Buying and selling Charges | Supported Cash | AUSTRAC Licensed | Fee Strategies |

| Swyftx | Flat 0.6% (decreases for top quantity) | 400+ | Sure | Financial institution, PayID, Credit score/Debit Playing cards |

| CoinSpot | Flat 1% | 490+ | Sure | POLi, PayID, Financial institution Transfers, Credit score/Debit Playing cards |

| OKX | From 0.08% (makers) to 0.1% (takers) | 350+ | Sure | Financial institution, PayID, Credit score/Debit Playing cards |

| Coinbase | 0.4% – 4.5% | 240+ | Sure | PayID, Credit score/Debit Playing cards |

| Kraken | From 0.4% (takers) to 0.25% (makers) | 200+ | Sure | PayID, Osko, Financial institution Transfers |

| CoinJar | 1% for trades, 2% for bank card purchases | 60+ | Sure | Financial institution Transfers, PayID, Credit score/Debit Playing cards |

| Bybit | 0.1% maker/taker | 1200+ | No | Third-party funds solely |

| eToro Australia | 1% | 30+ | Sure | Financial institution Account, Credit score/Debit Playing cards |

| Impartial Reserve | From 0.5% to 0.02% (excessive quantity) | 30+ | Sure | Osko, PayID, Financial institution Transfers |

| Crypto.com | 0.15% maker and 0.3% taker | 350+ | Sure | Financial institution, PayID, Credit score/Debit Playing cards |

| BTC Markets | Flat 0.1% | 36 | Sure | PayID, Osko, Financial institution Transfers |

| Digital Surge | Flat 0.5% | 310+ | Sure | PayID, Financial institution Transfers |

| Uniswap | Fuel charges (variable) | 1000’s (ERC-20) | No | – |

| MEXC | 0% | 2800+ | No | Not supported |

What’s a Crypto Change?

A cryptocurrency change is a web-based market the place crypto tokens and merchandise will be bought, offered, and traded. By serving as middlemen between patrons and sellers, these platforms let customers convert fiat cash, equivalent to Australian {dollars} (AUD), into digital property, equivalent to BTC, ETH, and numerous different cryptocurrencies.

Roughly 17.7% of the inhabitants in Australia, or over 4.6 people, possess cryptocurrencies, with Bitcoin being probably the most broadly used. Cryptocurrency exchanges are important to those transactions as a result of they offer Australians an easy-to-use interface to dive into the realm of digital property.

Forms of Crypto Change in Australia

- Centralized Exchanges (CEX): These are the most typical sort of crypto change. They’re run by corporations that handle the transactions and maintain customers’ property. CEXs are standard due to their ease of use, security measures, and liquidity. Examples embody OKX Australia, CoinSpot, and Swyftx.

- Decentralized Exchanges (DEX): DEXs permit peer-to-peer buying and selling with out the necessity for a government. Transactions are performed straight between customers, and the platform doesn’t management funds. The sort of change gives extra privateness however much less buyer assist. Well-liked DEXs embody Uniswap and PancakeSwap.

- Brokerage Exchanges: These platforms permit customers to purchase cryptocurrencies straight from the change at a hard and fast value. Brokerages are perfect for inexperienced persons as a result of their simplicity, although they usually cost increased charges. Examples embody eToro Australia.

- Peer-to-peer (P2P) Cryptocurrency Exchanges: P2P exchanges in Australia let customers transact with one another straight and with out the necessity for middlemen. In contrast to conventional exchanges, these platforms – like Paxful and LocalBitcoins – permit patrons and sellers to discount over pricing and cost choices. To ensure secure transfers, P2P exchanges often use escrow companies, which retailer bitcoin till each events fulfill their finish of the discount. They’re well-liked as a result of they supply anonymity and a variety of cost choices, like as money and financial institution transfers, for buying and selling.

Purchase Cryptocurrency in Australia: Step-by-Step Information

Shopping for cryptocurrency in Australia is an easy course of. Right here’s a step-by-step information:

- Select a Crypto Change: Choose an Australian change that fits your wants. For inexperienced persons, platforms like CoinSpot and Swyftx are standard as a result of their user-friendly interfaces. In case you choose superior buying and selling options, OKX Australia is a good selection.

- Create an Account: To register on the change, enter your e mail deal with, password, and identification. In Australia, the vast majority of exchanges must Know Your Buyer (KYC) verification, which entails submitting identity-verifying papers equivalent to a passport or driver’s license.

- Deposit Cash: Put cash into your change pockets as quickly as your account has been validated. The vast majority of Australian exchanges let customers deposit AUD by PayID, bank card, or financial institution switch. Some additionally take POLi and PayPal funds.

- Decide a Cryptocurrency: Look over the checklist of cryptocurrencies which are obtainable and resolve which one you want to purchase. Notable choices embody Ripple, Ethereum, and Bitcoin.

- Purchase Crypto: To buy cryptocurrencies, enter the specified quantity and full the transaction. You’ve gotten the choice to buy a specific amount of cryptocurrencies or a predetermined quantity of AUD. After the commerce is accomplished, your cryptocurrency will present up in your change pockets.

- Switch to a Safe Pockets (Non-compulsory): To extend safety, take into account transferring your BTC to a private {hardware} pockets. This reduces the hazard of shedding digital property if the change is hacked. You need to use wallets like Ledger and Trezor.

Are Crypto Exchanges Authorized in Australia?

Sure, crypto exchanges are authorized in Australia. The federal government has adopted a progressive method to cryptocurrency regulation, trying to strike a stability between innovation and client security. Since 2018, cryptocurrency exchanges in Australia have been required to register with AUSTRAC (Australian Transaction Studies and Evaluation Centre) and observe AML/CTF laws.

Exchanges that present sure cryptocurrency-related monetary merchandise, equivalent to crypto derivatives, are required by the Australian Securities and Investments Fee (ASIC) to own an Australian Monetary Providers (AFS) license. To enhance client security, the Australian authorities mentioned in 2022 that it might be implementing a regulatory construction for cryptocurrency exchanges within the upcoming years.

Whereas crypto exchanges are authorized, it’s essential to notice that not all cryptocurrencies or crypto-related actions are permitted. For instance, preliminary coin choices (ICOs) are topic to strict laws, and a few privateness cash have been delisted from Australian exchanges as a result of regulatory considerations.

How is Cryptocurrency Taxed in Australia?

The Australian Taxation Office (ATO) views cryptocurrency as an asset that’s liable to capital positive factors tax (CGT). This means that any revenue or loss will likely be topic to capital positive factors or losses taxation.

That is the way it operates:

Shopping for and Holding: While you purchase a cryptocurrency and maintain it as an funding, you don’t must pay taxes till you promote or commerce it.

Promoting or Buying and selling: While you promote or commerce cryptocurrency for fiat forex (like AUD) or one other cryptocurrency, you might be required to calculate your capital acquire or loss. In case you maintain the asset for greater than 12 months earlier than promoting, chances are you’ll be eligible for a 50% CGT discount.

Let’s say, in the event you purchased 1 Bitcoin for $30,000 and offered it for $50,000, your capital acquire is $20,000. In case you held it for greater than 12 months, you solely must report $10,000 (50% of the acquire) in your taxable revenue.

Utilizing Cryptocurrency for Purchases: In accordance with the ATO, utilizing cryptocurrency to pay for services or products is equal to promoting the asset.

Airdrops and Staking Rewards: Any cryptocurrency that you simply get by way of staking rewards or airdrops is handled as common revenue and is to be reported on the present honest market worth. Your tax burden will likely be decided by your revenue tax price.

Cryptocurrency as a Enterprise: In case you commerce cryptocurrencies as a enterprise (e.g., day buying and selling), any earnings will likely be taxed as enterprise revenue quite than capital positive factors. On this case, it’s also possible to declare deductions for any bills associated to your buying and selling actions.

File-Holding: You need to preserve thorough data of each transaction that you simply make, in line with the ATO. This accommodates particulars on the date of the transaction, the type of cryptocurrency, the quantity, the worth in Australian {dollars}, and the transaction’s meant use. Penalties might outcome from inaccurately reporting your earnings.

You’ll be able to observe and compute your Bitcoin taxes with using applications like Koinly and ClearTax.

Conclusion

When exploring the very best crypto exchanges Australia, platforms like Swyftx, CoinSpot, OKX, and others stand out for his or her strong safety measures, Australian monetary companies license, and aggressive price constructions.

These exchanges cater to a wide range of buying and selling wants, from informal to superior, with assist for various AUD cost strategies and complete buying and selling instruments. Choosing the proper change depends upon your particular necessities, however specializing in these with excessive safety and regulatory compliance is essential for a secure and environment friendly buying and selling expertise.

FAQs

Is Binance obtainable in Australia?

Binance is accessible in Australia, however its companies are considerably restricted. Whereas Australian customers can entry primary spot buying and selling for cryptocurrencies, different options like futures, choices, and leveraged tokens have been discontinued. This follows elevated scrutiny by Australian regulators, resulting in the cancellation of Binance Australia’s derivatives license.

In consequence, solely institutional or wholesale traders might have entry to extra superior buying and selling merchandise, however most retail customers are barred from derivatives buying and selling.

Are Australian Bitcoin exchanges secure?

Bitcoin exchanges in Australia function beneath strict authorities scrutiny, which reinforces their security. Regulatory our bodies mandate that these platforms register with AUSTRAC and observe stringent anti-money laundering protocols.

Many exchanges make use of strong safety measures, equivalent to offline storage and multi-factor authentication. When deciding on an change, it’s sensible to contemplate these with a longtime presence in Australia and a confirmed observe report.

Though exchanges try to safeguard customers’ funds, it’s typically advisable to switch substantial cryptocurrency holdings to a private chilly pockets for prolonged storage.

What are the very best crypto apps in Australia?

Swyftx and OKX are certainly among the many high crypto apps in Australia, every providing distinctive options. Swyftx is understood for its user-friendly interface, aggressive charges, and big selection of supported cryptocurrencies. It additionally supplies a demo mode for inexperienced persons to apply buying and selling with out threat.

OKX, alternatively, gives a extra superior buying and selling platform with options like futures and margin buying and selling. Each apps present strong safety measures and are compliant with Australian laws.

Swyftx may be extra appropriate for inexperienced persons and people targeted on the Australian market, whereas OKX may enchantment to extra skilled merchants in search of superior options.

What’s the greatest crypto change for inexperienced persons in Australia?

For inexperienced persons in Australia, each Swyftx and CoinSpot are glorious crypto exchanges. Swyftx gives a user-friendly interface, aggressive charges, and a demo mode for apply buying and selling. It additionally supplies instructional sources. CoinSpot is understood for its simplicity and big selection of supported cryptocurrencies. It gives on the spot purchase/promote options and a simple price construction.

Swyftx would possibly edge out these in search of decrease charges and extra superior options as they develop, whereas CoinSpot could possibly be preferable for these prioritizing simplicity and a wider collection of cryptocurrencies.

Can I commerce AUD straight on Australian exchanges?

Sure, you possibly can commerce Australian {Dollars} (AUD) straight on Australian cryptocurrency exchanges. Most respected Australian exchanges provide BTC/AUD, ETH/AUD, and extra buying and selling pairs.

Exchanges like Swyftx, CoinSpot, and others present numerous strategies to deposit AUD, together with financial institution transfers, POLi funds, and generally credit score/debit playing cards. Buying and selling with AUD additionally simplifies tax reporting, as there’s no must calculate positive factors or losses from forex change.

What are the AUSTRAC-licensed crypto exchanges?

All digital forex change corporations working in Australia are required by AUSTRAC (Australian Transaction Studies and Evaluation Centre) to register and adjust to AML/CTF laws.

Most main Australian exchanges, together with Swyftx, CoinSpot, and Impartial Reserve, are AUSTRAC-registered. You’ll be able to study the standing of an change’s licensing on the AUSTRAC website.

How do I deposit AUD right into a crypto change?

The strategies for depositing AUD right into a crypto change can differ between platforms, however frequent choices embody:

- Financial institution Switch: Usually probably the most cost-effective methodology, although it might take 1-2 enterprise days.

- PayID: Gives near-instant transfers for supported banks.

- BPAY: Out there on some exchanges, often takes 1-Three enterprise days.

- Credit score/Debit Card: Gives on the spot deposits however usually comes with increased charges.

- Money Deposits: Some exchanges permit money deposits at particular areas.

Verify your chosen change’s deposit choices and related charges earlier than making a transaction.

What are the charges for buying and selling cryptocurrency in Australia?

The charges for buying and selling cryptocurrencies in Australia differ in line with the change and the type of transaction. Typically, you pay deposit, buying and selling, and withdrawal charges.

Financial institution transfers usually have little or no deposit charges, nevertheless, bank card deposits might have increased prices. Buying and selling prices typically differ between 0.1% and 1% per transaction. There’s additionally a withdrawal price and spreads.

Is cryptocurrency buying and selling authorized in Australia?

Sure, cryptocurrency buying and selling is authorized in Australia. The federal government has taken a progressive method to regulating the crypto business, aiming to foster innovation whereas defending shoppers and sustaining monetary system integrity.

Nonetheless, crypto exchanges and sure crypto-related companies should adjust to regulatory necessities, together with registration with AUSTRAC and adherence to AML/CTF laws.

Are there any Australian crypto platforms with no charges?

MEXC is the very best no-fee crypto change in Australia. It prices 0% maker charges for spot buying and selling. It additionally has very low (0.01%-0.1%) taker charges. The change is very dependable with no-KYC buying and selling and a number of superior crypto buying and selling options.

More NFT News

L’Oreal Professionnel AirLight Professional Assessment: Quicker, Lighter, and Repairable

A Full Information to the OpenSea NFT Market

High 7 Binance Alternate options for 2024: Charges and Options Reviewed