A provide shock could also be brewing in Bitcoin as on-chain information reveals 57% of all BTC hasn’t seen any motion since at the very least two years in the past.

Bitcoin Provide Dormant Since 2+ Years Has Been Setting New All-Time Highs

As identified by Capriole Investments founder Charles Edwards in a post on X, the BTC provide, dormant since at the very least two years in the past, has been hitting consecutive new all-time highs (ATHs) lately.

The Bitcoin buyers holding provide this previous make-up for a section of the broader “long-term holder” (LTH) group. The LTHs confer with the buyers who’ve been holding their cash since at the very least 155 days in the past.

A statistical reality is that the longer holders hold their cash nonetheless on the blockchain, the much less possible they turn out to be to maneuver them at any level. Due to this cause, the LTHs are thought-about the extra cussed aspect of the BTC market.

The two+ years section would then embrace the buyers who could be probably the most stalwart of diamond palms even amongst these HODLers, as their holding time is considerably larger than simply 155 days.

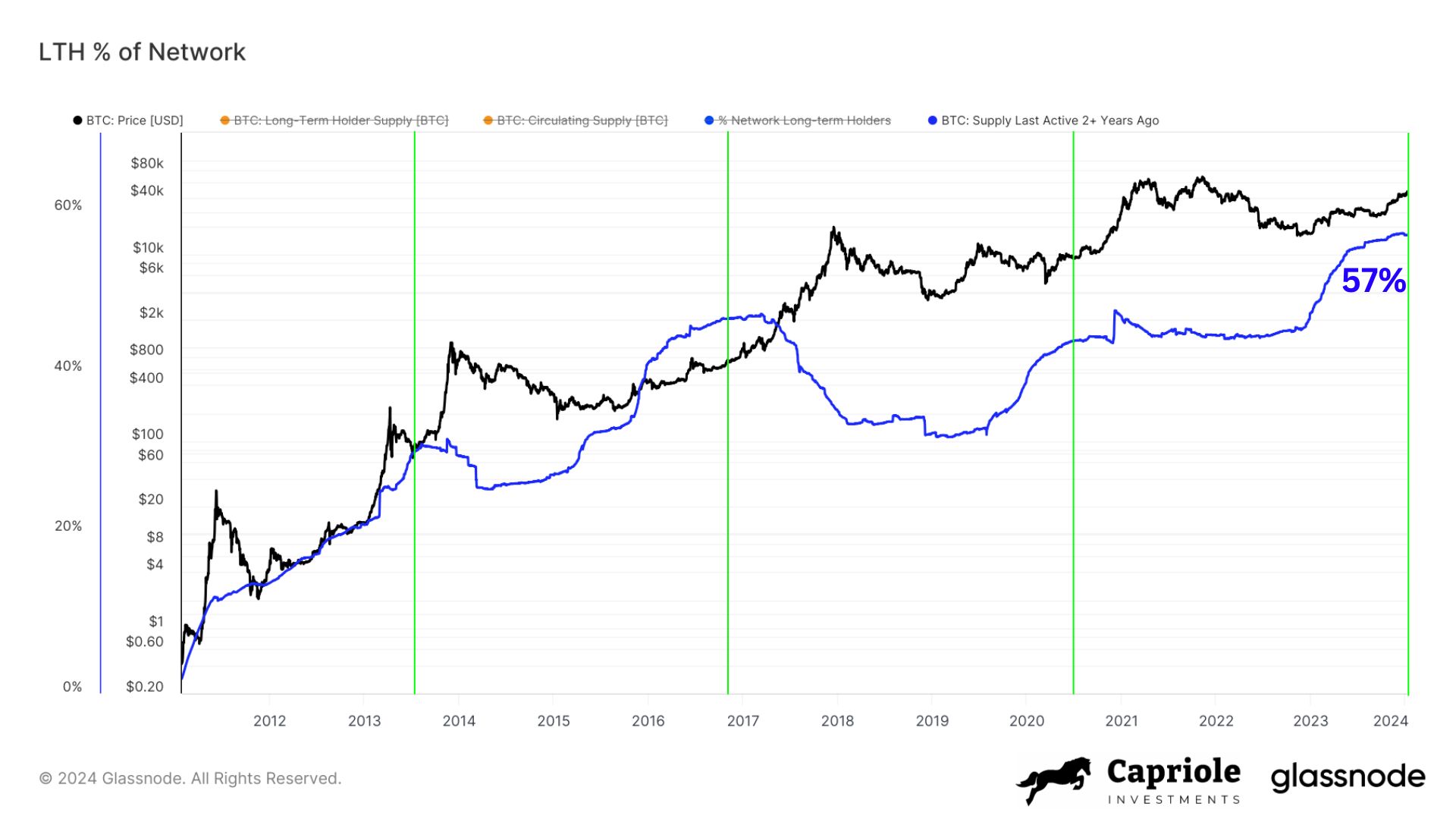

Now, here’s a chart that reveals the pattern within the share of the whole circulating Bitcoin provide held by this section of the LTHs over the historical past of the cryptocurrency:

The worth of the metric appears to have been going up in latest days | Supply: @caprioleio on X

As displayed within the above graph, the provision held by these LTHs has been following an upward trajectory for the reason that FTX collapse and has been repeatedly setting new ATHs.

Just lately, the expansion within the metric has slowed a bit, however it has nonetheless been going up. At current, round 57% of the Bitcoin provide is locked within the palms of those HODLers.

Edwards notes that that is creating an enormous provide squeeze for the cryptocurrency. The quant has additionally identified {that a} related pattern has been seen within the leadup to all previous bull runs (marked with the inexperienced traces within the chart).

Earlier at this time, the US SEC finally approved the Bitcoin spot ETFs. Edwards has defined that this might lead towards the provision shock solely rising deeper since “the ETFs had been solely authorised for CASH subscriptions (not in-kind). So each buy takes extra Bitcoin off the market.”

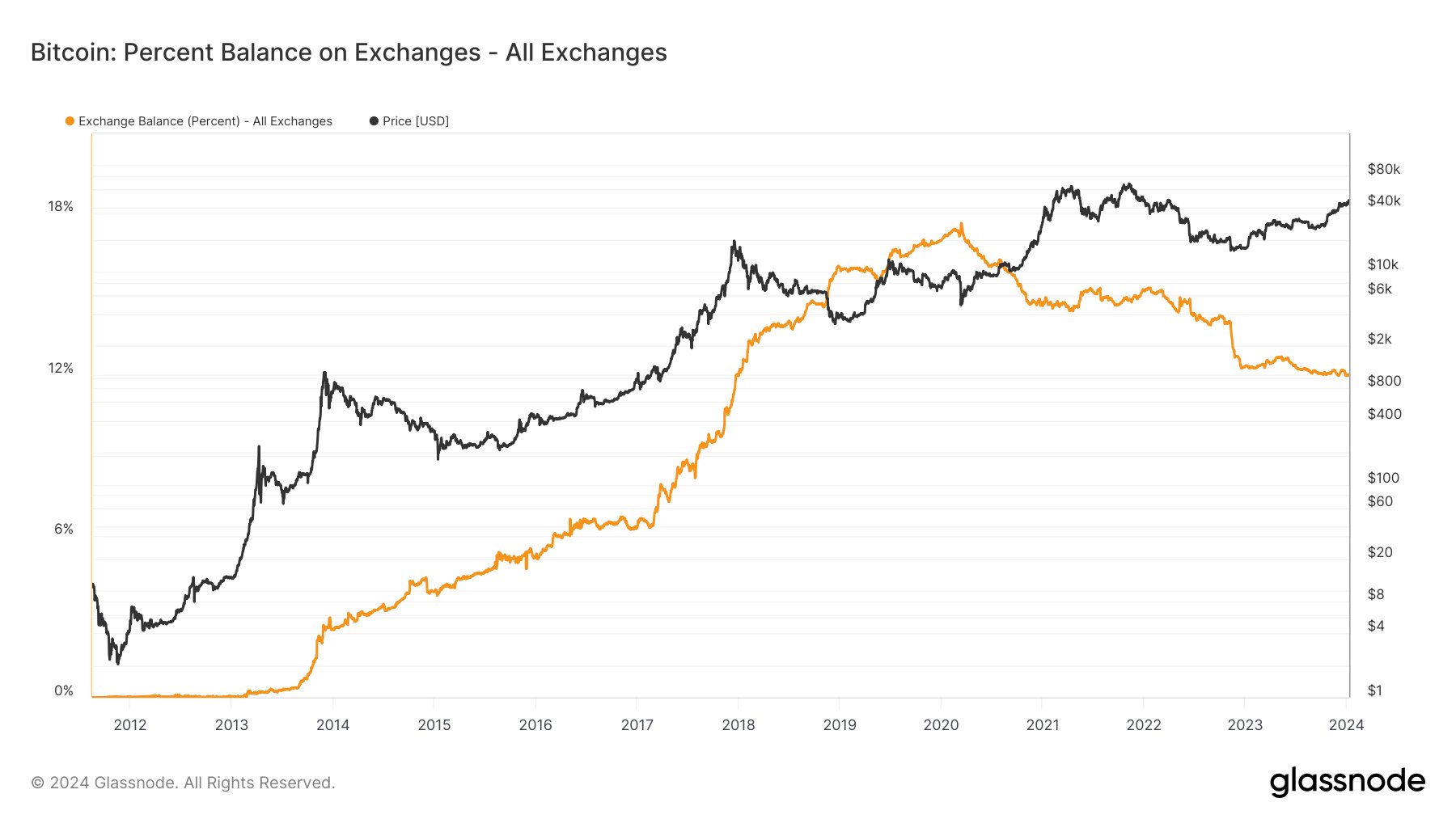

A chart analyst, James V. Straten, shared that would additionally present one other angle at a provide shock brewing within the asset.

Appears to be like just like the metric's worth has been taking place since some time now | Supply: @jimmyvs24 on X

The above graph reveals the info for the share of the Bitcoin provide sitting within the centralized exchanges’ wallets. This metric has been taking place over the previous couple of days, and now, simply 12% of all BTC is being saved on these platforms.

The trade provide is considerably extra prone to be concerned in shopping for and promoting actions (since that’s what these platforms are for, naturally), so taking place means the efficient buying and selling provide of the asset can be lowering.

BTC Worth

On the time of writing, Bitcoin is buying and selling at round $45,900, up greater than 4% during the last week.

The worth of the coin has gone via a rollercoaster prior to now day | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

More NFT News

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin

Canine Memecoins Rebound as Bitcoin Reaches $98,000