Be part of Our Telegram channel to remain updated on breaking information protection

Insidebitcoins gives buyers with a curated checklist of the best digital tokens to discover. With these tokens, buyers can capitalize in the marketplace’s upward pattern.

The latest information replace exhibits that the worldwide cryptocurrency market capitalization is $1.16 trillion. Thus reflecting a 2.67% enhance over the previous 24 hours. Throughout the identical interval, the full buying and selling quantity within the crypto market amounted to $35.88 billion, marking a 14.15% lower.

Notably, the decentralized finance (DeFi) sector contributed $4.01 billion to this buying and selling quantity, comprising 11.17% of the full crypto market 24-hour quantity. Stablecoins additionally performed a big position, with a mixed buying and selling quantity of $32.26 billion, representing 89.91% of the full crypto market 24-hour quantity.

7 Finest Altcoins to Put money into Proper Now

Bitcoin’s market dominance presently stands at 51.47%, reflecting a modest enhance of 0.12% over the day. These figures present a snapshot of the latest developments within the cryptocurrency market, indicating each general development and the particular contributions of DeFi and stablecoins to the buying and selling panorama.

1. Maker (MKR)

The Maker Protocol has lately reported a big milestone, attaining an annualized income of $203 million. This success will be attributed to the affect of rising U.S. treasury yields all year long.

Moreover, Maker’s stablecoin, DAI, has witnessed a surge in its provide, reaching a yearly excessive of $5.6 billion. One other contributing issue to this accomplishment is the rising deposits of real-world property (RWA), which have reached a considerable $Three billion.

Furthermore, yield alternatives have performed a vital position in driving the expansion of Maker’s stablecoin, DAI. This development is especially because of the DAI Financial savings Charge (DSR) mechanism, operated by the Spark Protocol. Therefore providing DAI holders an annual yield fee of 5%.

⚡️ @sparkdotfi has launched its brand-new web site.

Discover Spark’s objective and options as a community-built DeFi infrastructure, sustained by the Spark SubDAO.

Test it out → https://t.co/yzR9qjm823 pic.twitter.com/p6fcJNIsvE

— Maker (@MakerDAO) October 18, 2023

This mechanism has considerably elevated the demand for DAI, leading to a fivefold growth of the sDAI provide since August. As such, SDAI now constitutes 31.3% of DAI’s complete provide, equal to $1.7 billion.

2. Avalanche (AVAX)

Avalanche’s value efficiency has breached the $10.15 resistance degree, propelled by a constant accumulation of patrons. AVAX has undergone a considerably turbulent value journey, in the end falling under $10.15. Nonetheless, the sustained inflow of patrons throughout buying and selling helped breach the resistance degree. As well as, elevated shopping for was important in AVAX experiencing this upward trajectory.

In latest information, Avalanche’s value was $10.30, registering a 2.93% enhance in its market capitalization throughout the intraday buying and selling session. Buying and selling quantity additionally surged inside the identical session, indicating lively purchaser participation. Likewise, the volume-to-market cap ratio is 3.11%, reflecting the cryptocurrency’s liquidity.

Based on the AVAX value prediction, the utmost anticipated value for AVAX by the tip of 2023 is roughly $21.83. This projection assumes a situation with out main bearish market occasions and anticipates a mean value of round $17.64 for AVAX in 2023.

SK Planet subsidiary and Korean leisure large Dreamus is launching a ticketing platform powered by Avalanche and SK Planet’s UPTN Subnet.

Let’s check out why it is a massive win for blockchain ticketing and actual world use instances 🎟️🔺 pic.twitter.com/f9JVKsxoaT

— Avalanche 🔺 (@avax) September 21, 2023

Moreover, if the cryptocurrency market witnesses a downtrend, the minimal value for Avalanche Coin in 2023 may decline to $15.49. Nonetheless, the evaluation suggests a possible for a bullish rally within the crypto market, resulting in a considerable value enhance.

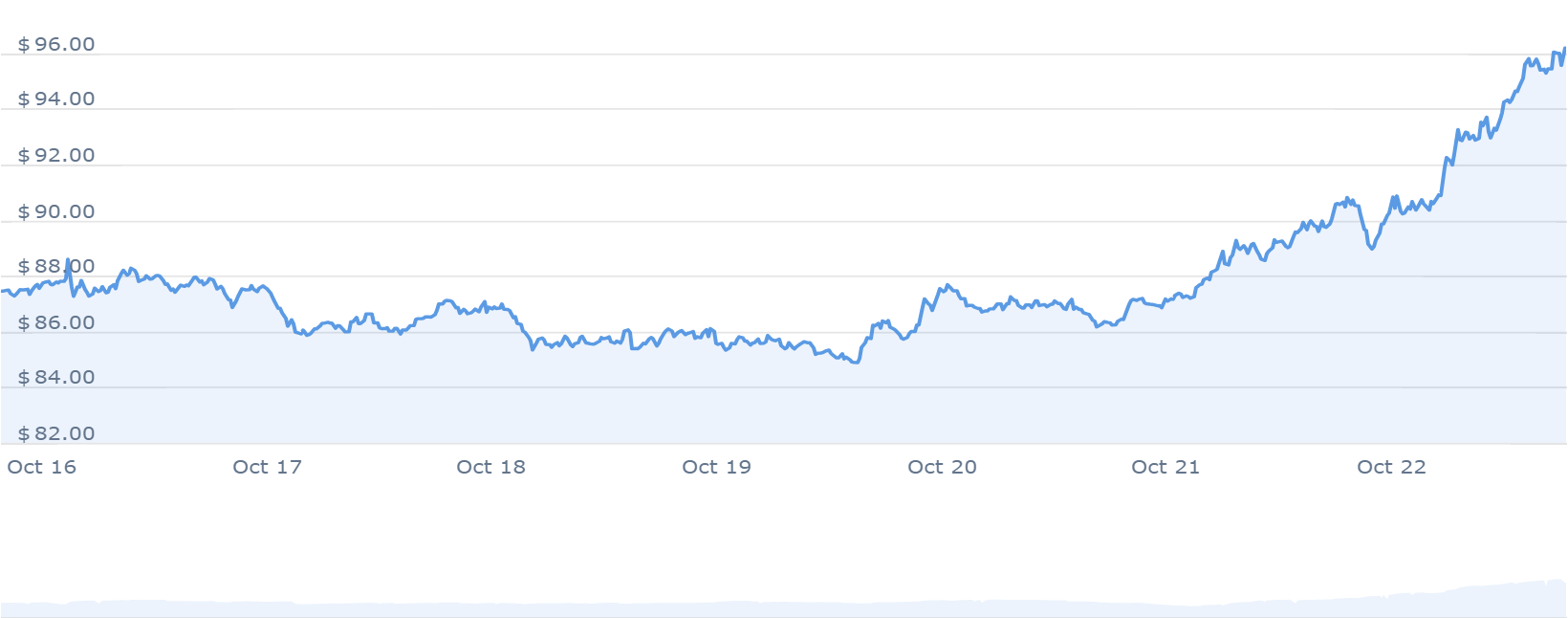

3. Quant (QNT)

Quant goals to boost interoperability between numerous blockchain networks and purposes via the Overledger working system. Overledger acts as a bridge, overcoming the long-standing problem of seamless integration between varied blockchain initiatives. Thus enabling blockchain-based initiatives to work together effectively.

Furthermore, Overledger is a gateway to facilitate connectivity between blockchain-based initiatives and purposes. It fosters intra-blockchain ecosystem connectivity and interconnectivity with completely different blockchain networks. This connectivity encompasses well-established blockchain networks like Ethereum.

Moreover, Quant’s strategy is structured round creating distinct layers, every catering to completely different ranges of interplay. These layers embrace transactions, messaging, filtering, and ordering.

Wishing all of the delegates at @money2020‘s #Money2020USA an awesome few days forward.

The way forward for cash, and notably #payments, is a subject we have given a number of thought to.

Right here is our founder and CEO @gverdian on central financial institution digital currencies:https://t.co/upjccb38O6

— Quant (@quant_network) October 22, 2023

Likewise, it encompasses an software for sharing and referencing equivalent messages related to different purposes. This layered framework is designed to offer a complete resolution for blockchain interoperability.

Based on the evaluation, the utmost value projection for Quant is roughly $213.91. Moreover, a extra conservative estimate locations the typical value of QNT at round $188.74 by 2023.

4. Fantom (FTM)

Fantom is a blockchain platform that operates on a Directed Acyclic Graph (DAG) construction and makes use of its proprietary consensus mechanism, Lachesis. Its major mission is to offer builders with decentralized finance (DeFi) companies.

FTM, the platform’s native PoS token, is the spine for transactions, permitting for charge assortment, staking actions, and person rewards. Moreover, it allows swift and cost-effective transactions. As such, customers also can have interaction in on-chain governance by using FTM tokens for voting.

One function of Fantom is its declare to considerably improve transaction velocity, decreasing it to lower than two seconds. This aligns with its purpose of being a quick, safe, and cost-efficient fee platform for varied purposes, together with DeFi.

Fantom goals to draw builders interested by deploying decentralized options, positioning itself as a competitor to Ethereum. The mission’s mission is to realize compatibility between all world transaction programs.

> Go to @FantomFDN X

> Click on the bell icon

> Notifications ON

> Do not miss information

> 10.24.23

> Easy!— Fantom Basis (@FantomFDN) October 20, 2023

Concerning value predictions, it’s anticipated that the utmost value for Fantom will stay close to $1.12 because the broader crypto market regains its worth. Nonetheless, within the occasion of a big bearish pattern within the crypto market, the minimal value may drop to $0.84 by 2023.

5. Launchpad XYZ (LPX)

Launchpad XYZ, a blockchain startup, has set its sights on a pivotal position within the Internet 3.Zero funding panorama. Their core goal is to empower crypto buyers, newcomers, and skilled merchants with invaluable info to facilitate well-informed selections.

Achieve an edge within the #Crypto markets with #LaunchpadQuotient! 🔥

Our #LPQ leverages over 400 information factors so you may make smarter selections 🔥#LPQInsights #Trading #Web3 pic.twitter.com/zx3v7JkFyp

— Launchpad.xyz (@launchpadlpx) October 22, 2023

Launchpad XYZ permits buyers to leverage alternatives in a bullish market with an attractive provide of a 12% bonus on LPX tokens. Nonetheless, the continued bonus is proscribed to 2 days earlier than it ends. Moreover, LPX tokens will be acquired utilizing USDT throughout this presale, with every funding yielding LPX tokens in return.

The presale has efficiently raised a considerable quantity, totaling $1,928,302.29. Additionally, the present change fee values 1 LPX token at 0.0445 USDT, offering buyers with a transparent monetary overview.

Along with the funding alternative, Launchpad XYZ provides a spread of investor advantages. These embrace entry to the Launchpad XYZ platform and unique privileges reminiscent of precedence entry to buying and selling indicators, guides, newsletters, and many others.

6. Gnosis (GNO)

In latest developments inside the decentralized finance (DeFi) sector, the Gnosis chain Whole Worth Locked (TVL) has skilled a rise. Based on information from DeFiLlama, the TVL on the Gnosis chain has grown by 92% over the previous month, surpassing the $150 million milestone. This surge will be attributed to the latest launch of sDAI, attracting roughly $50 million in property.

As well as, the introduction of sDAI on the Gnosis chain has garnered consideration inside the DeFi group. Thus permitting customers to generate curiosity and actively have interaction within the DeFi ecosystem.

Furthermore, the elevated Gnosis chain TVL signifies a rising confidence in DeFi as a viable monetary ecosystem. Information from DeFiLlama underscores the speedy adoption and heightened curiosity in sDAI. This implies that extra customers are diversifying their portfolios and exploring the DeFi panorama for brand new alternatives.

— GnosisDAO (@GnosisDAO) October 12, 2023

Within the evolving DeFi panorama, Gnosis’s sDAI is well-positioned to be on the forefront of this transformation. Its aggressive rates of interest and sturdy integration with MakerDAO make it an choice for these trying to enter the DeFi house or develop their portfolios.

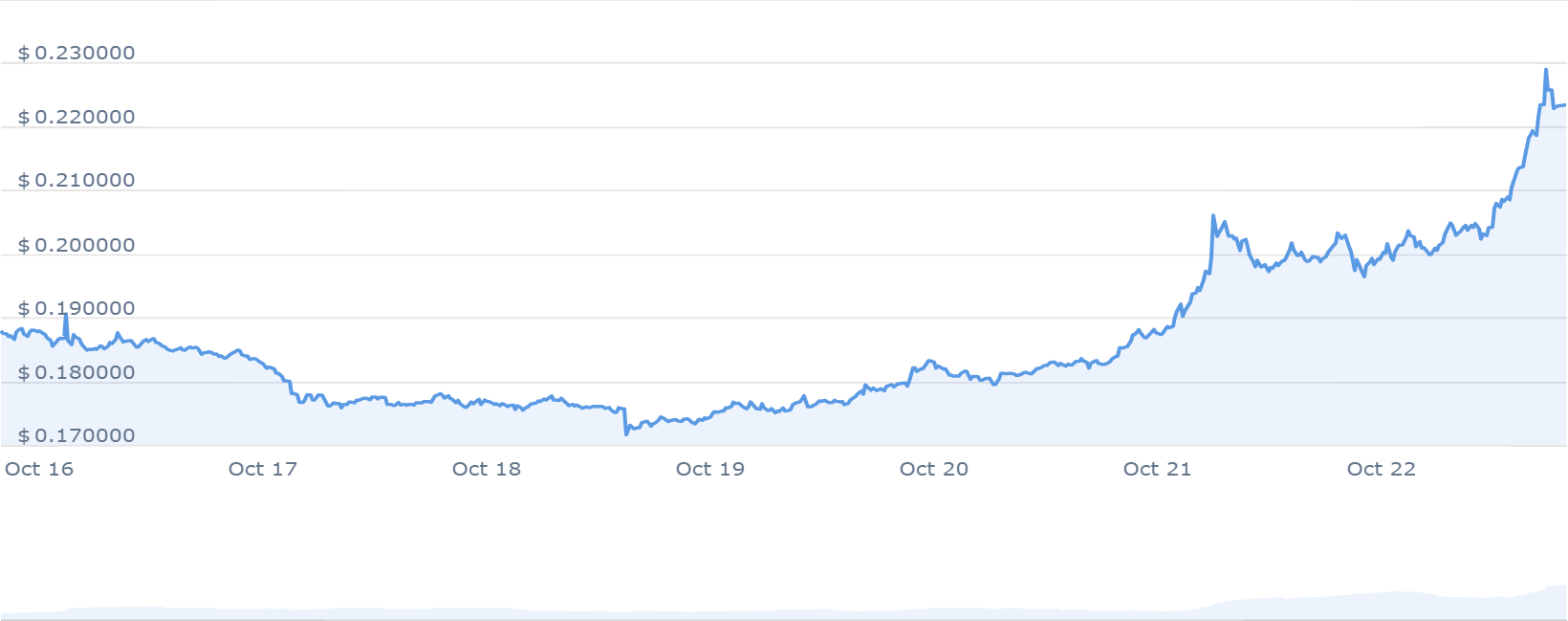

7. Solana (SOL)

Based on information from DeFiLlama, Solana’s DeFi sector has registered a 12.2% enhance, reaching $20 million inside the final 24 hours. This improvement has positioned Solana because the ecosystem with the best Whole Worth Locked (TVL) enhance among the many high 10 ecosystems. Thus surpassing rivals like Binance Good Chain (BSC), Ethereum, and Polygon.

Notably, this surge in TVL displays Solana’s substantial development, amounting to over 40% since its recorded worth of $210 million on January 1. Additionally, the uptick in TVL will be attributed to buyers’ rising curiosity within the DeFi ecosystem facilitated by Solana.

Moreover, strategic partnerships orchestrated by the Solana workforce have performed a pivotal position in attracting investor consideration. The workforce cast notable collaborations with distinguished entities reminiscent of Visa and Shopify throughout the present yr.

Blockchains ought to be accessible, quick, and frictionless.

Hear from the co-founders of @orca_so, @rawfalafel & @oritheorca, about how Solana’s low latency and excessive throughput allows them to give attention to constructing their product 🐋#OnlyPossibleOnSolana pic.twitter.com/3OL5pQJ1hW

— Solana (@solana) October 20, 2023

Solana’s efficiency has remained persistently optimistic, aligning with the final tendencies within the cryptocurrency market. Over the previous seven days, SOL has witnessed a big enhance of 33.9%, surpassing the $30 threshold. The token presently trades at $30.40, reflecting an intraday acquire of 4.01%. This constant development underscores the growing investor curiosity in Solana and its DeFi ecosystem.

Learn Extra:

New Crypto Mining Platform – Bitcoin Minetrix

- Audited By Coinsult

- Decentralized, Safe Cloud Mining

- Earn Free Bitcoin Every day

- Native Token On Presale Now – BTCMTX

- Staking Rewards – Over 1,000% APY

Be part of Our Telegram channel to remain updated on breaking information protection

More NFT News

Hashrate Development Aligns With Rising Search Curiosity

SOL Worth Hits Report, Persevering with Turnaround From Crypto Winter Crash

Bitcoin Nears $100,000 As Trump Council Anticipated To Implement BTC Reserve