The XRP Ledger (XRPL), a decentralized public blockchain developed by David Schwartz, CTO of Ripple Labs, has continued to evolve and present development within the third quarter (Q3) of 2023, as highlighted in a latest report by Messari.

The XRPL, facilitating cross-currency and cross-border funds for over a decade, has witnessed vital milestones, together with a surge in market capitalization and developments in community options.

XRP Ledger Reveals Robust Improvement In Q3

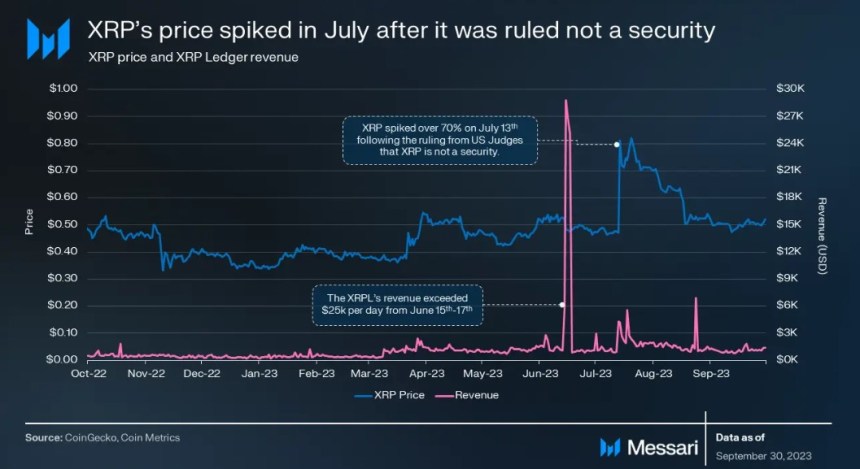

As of Q3 2023, XRP, the native token of the XRPL, has secured its place because the fifth-largest cryptocurrency by market capitalization at a formidable $27.eight billion.

Notably, the token’s market cap skilled exceptional development, rising by 59.9% year-to-date (YTD) and recording an 11.9% quarter-over-quarter (QoQ) surge.

In accordance with Messari, one distinctive side of the XRPL is the deflationary pressure utilized to its total supply of 100 billion XRP. Transaction charges on the community are burned, decreasing the provision over time.

For the reason that inception of the XRP Ledger, roughly 10 million XRP have been burned. Nonetheless, to counterbalance the burn charge, 1 billion XRP vests to Ripple every month.

Unspent or undistributed XRP returns to escrow. This course of will proceed till the remaining ~48 billion XRP turns into liquid, making burned charges the only issue influencing provide.

In contrast to many different cryptocurrency networks, the XRPL doesn’t present rewards or transaction charges to its validators. As a substitute, validators are incentivized by supporting community decentralization, just like full nodes on Ethereum (ETH) or Bitcoin (BTC).

The Proof-Of-Authority (PoA) consensus algorithm depends on belief between nodes, organized by way of distinctive node lists (UNLs). This strategy contributed to the community’s resilience and safety by way of 2023.

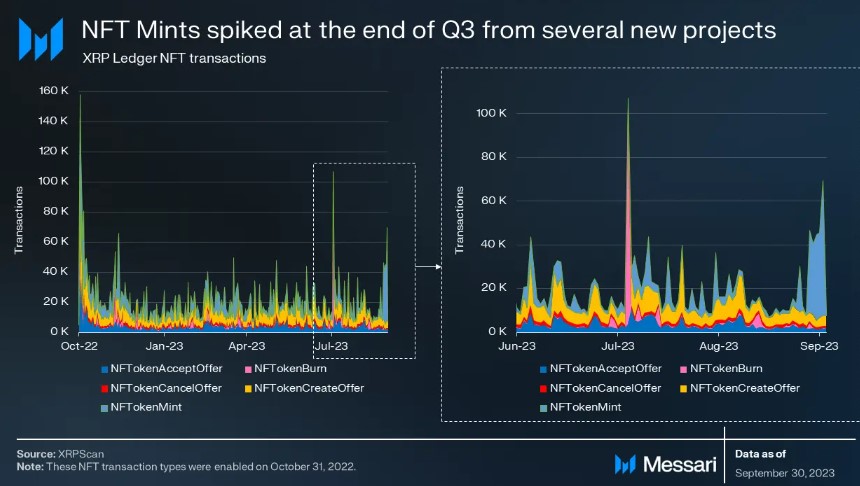

NFTs Thrive On XRPL With Notable Progress In Q3

In Q2 2023, XRPL skilled declining community exercise metrics, together with average daily transactions and lively addresses. Nonetheless, Q3 witnessed a resurgence, with common day by day transactions reaching 1.06 million and lively addresses totaling 44,000.

Particularly, NFT transactions confirmed vital development, with common day by day NFT transactions rising 7.3% QoQ to 16,700.

NFTs are constructed into the core protocol and don’t require good contracts for creation or transfers. Standardization of NFTs by way of XLS-20 2in October 2022 introduced advantages akin to royalties and anti-spam options. The XRPL ecosystem has grown steadily, with Three million NFTs minted utilizing the XLS-20 commonplace.

General, the XRP Ledger has demonstrated vital development and growth all through Q3 2023, pushed by market capitalization positive factors, regulatory victories, and developments in community options.

With a robust concentrate on deflationary dynamics, distinctive consensus algorithms, and the rise of NFT transactions, the XRPL continues to place itself as a outstanding participant on the planet of cross-currency and cross-border funds, in response to Messari.

Conversely, XRP has demonstrated consistent gains throughout numerous time frames. Presently, the token is buying and selling at $0.6073, which has not been reached since August 2023, leading to a modest 0.4% revenue throughout the 24 hours.

Notably, XRP has maintained an upward pattern, delivering substantial returns of 10%, 24%, and 16% up to now seven, fourteen, and thirty-day time frames, respectively. Notably noteworthy is the distinctive efficiency throughout the one-year timeframe, the place XRP has surged by 32%.

Featured picture from Shutterstock, chart from TradingView.com

More NFT News

Hashrate Development Aligns With Rising Search Curiosity

SOL Worth Hits Report, Persevering with Turnaround From Crypto Winter Crash

Bitcoin Nears $100,000 As Trump Council Anticipated To Implement BTC Reserve