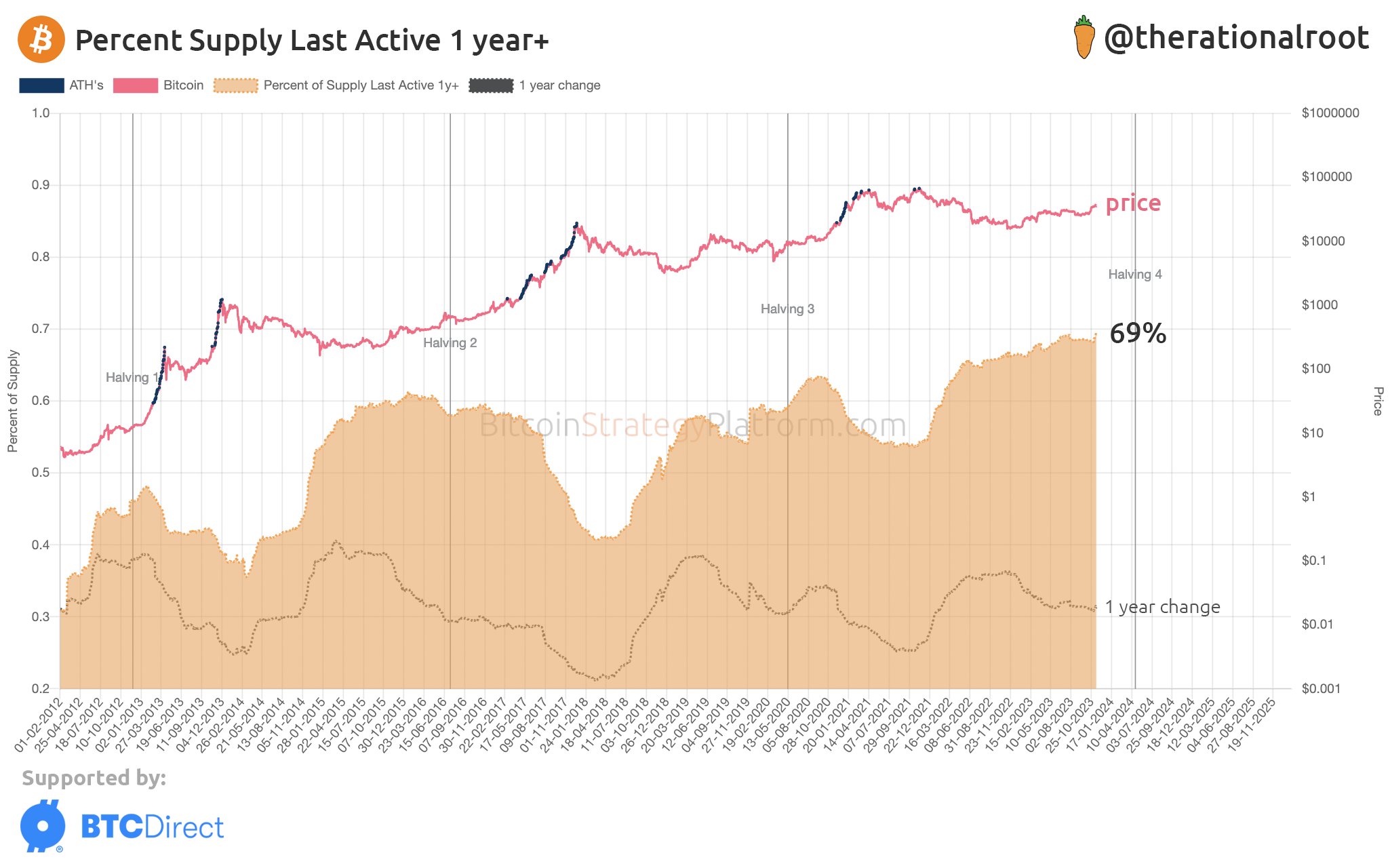

On-chain knowledge reveals that the share of the Bitcoin provide inactive since at the very least one 12 months in the past has hit the 69% mark.

Bitcoin HODLing Grows As Provide Continues To Develop into Dormant

As identified by analyst Root in a brand new post on X, an all-time excessive (ATH) quantity of the BTC provide hasn’t moved in over a 12 months. The 1-year+ provide that’s of curiosity right here is only a section of a bigger group known as the “long-term holders” (LTHs).

The LTHs comprise one of many two major divisions of the Bitcoin investor base, with the opposite group being the “short-term holders” (STHs). Relying on the analytics platform, the cutoff between these cohorts is outlined in a different way, however typically, 5 to 6 months is chosen because the boundary.

The buyers carrying cash youthful than this quantity are put contained in the STHs, whereas these holding for longer than the interval are known as the LTHs.

Statistically, the longer a holder retains their cash dormant, the much less seemingly they grow to be to maneuver them at any level. One other method to put this might be that the extra the availability ages, the much less possible it turns into to be bought.

Due to this cause, the LTHs are the extra dedicated a part of the market, as they don’t have a tendency to simply promote even whereas the cryptocurrency goes by way of a rally or a crash.

Those that have crossed the 1-year threshold would naturally be stalwart diamonds even among the many LTHs. Presently, a lot of the asset’s provide falls below this class, and it has solely continued to develop not too long ago, because the chart under shows.

The worth of the metric appears to have been going up not too long ago | Supply: @therationalroot on X

As proven within the graph, the share of the whole Bitcoin provide in circulation that’s been dormant since greater than a 12 months in the past has not too long ago seen some contemporary rise and has now reached the 69% mark, a brand new ATH.

One 12 months in the past, BTC was nonetheless buying and selling across the lows it had attained after the collapse of the FTX exchange. Thus, the availability that had only in the near past matured into the vary would have been purchased within the first week after this crash.

Since these lows, Bitcoin has greater than doubled in worth, so it’s outstanding that these buyers are nonetheless not giving into the attract of profit-taking and are somewhat selecting to HODL the asset additional. Maybe these buyers have even increased hopes for the asset, so they’re holding out till additional value uplift.

With cash being successfully locked out of the promoting provide to an ATH diploma, it might be fascinating to see how the continuing Bitcoin rally performs out from right here.

BTC Worth

On the time of writing, Bitcoin is buying and selling at round $36,800, down 2% prior to now week.

Seems to be just like the asset has gone by way of a little bit of a rollercoaster in the previous few days | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, BitcoinStrategyPlatform.com

More NFT News

Hashrate Development Aligns With Rising Search Curiosity

SOL Worth Hits Report, Persevering with Turnaround From Crypto Winter Crash

Bitcoin Nears $100,000 As Trump Council Anticipated To Implement BTC Reserve