In a month marked by heightened volatility, Apecoin (APE) has been a battleground for bulls striving to forestall a dip under the essential $1 mark.

This tug-of-war between bulls and potential downward strain underscores the extreme market dynamics surrounding Apecoin, leaving traders on the sting as they monitor the crypto’s value actions on this unstable November panorama.

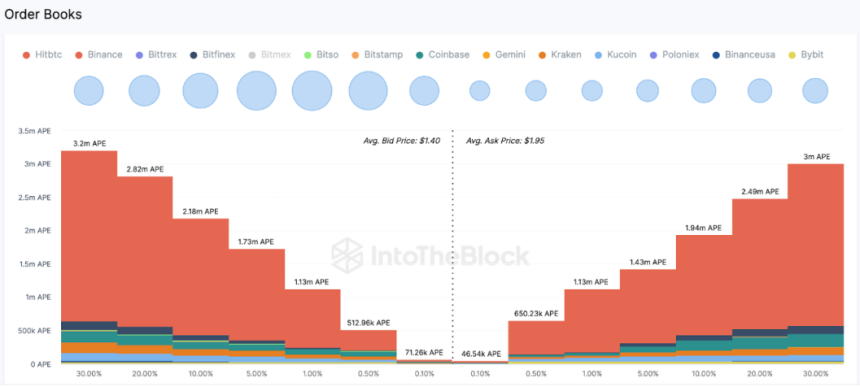

The newest information from the spot market reveals a resolute stance from bullish merchants, as orders for greater than 11 million APE tokens have beern strategically positioned across the present value.

APE has increased by 30% to surpass $1.70 following a decline to a weekly low of $1.30 on November 21. On-chain information tasks long-term Apecoin traders’ resilience would possibly reenergize APE value prospects.

APE Complete Order Books. Supply: IntoTheBlock

Apecoin Value Rebounds From All-Time Low

On October 9, the worth of Apecoin plunged to an all-time low and narrowly averted breaking under the $1 help stage. Nevertheless, the APE token has now elevated by 40%, and as of November 24, the meme coin was buying and selling at about $1.45.

The market state of affairs that APE is now working in is troublesome. The latest value will increase of the token are in danger as a result of bearish on-chain indicators.

Over the previous couple of months, the quantity of APE cash obtainable on exchanges has nearly doubled to a little bit over 50 million, which can sign a rise in purchaser demand.

The mix of a lower in energetic addresses and a rise in provide on exchanges signifies a pessimistic deviation, which can point out an impending decline within the value of the meme foreign money.

Two notable corrections have occurred in APE throughout its present surge. The 61.8% Fibonacci stage marked the primary retracement, and 50% marked the second corrective.

Complete crypto market cap is presently at $1.four trillion. Chart: TradingView.com

These retracements are getting thinner, which is a bullish indication of accelerating momentum and extra purchaser conviction.

Taking this into consideration, traders could use the 38.2% and 50% Fibonacci ranges as a useful information when putting stop-loss orders, performing as a buffer in opposition to any market volatility.

Apecoin’s price is now bouncing between $1.063 and $1.506, indicating that it’s in a unstable market. There are some indications of stability from the 10-Days Transferring Common at $1.410 and the 100-Days Transferring Common at $1.303.

Nonetheless, it’s vital to keep watch over the resistance ranges at $1.695 and $2.139 and the help ranges at $0.365 and $0.808. These ranges can be essential in influencing the short-term value actions of APE.

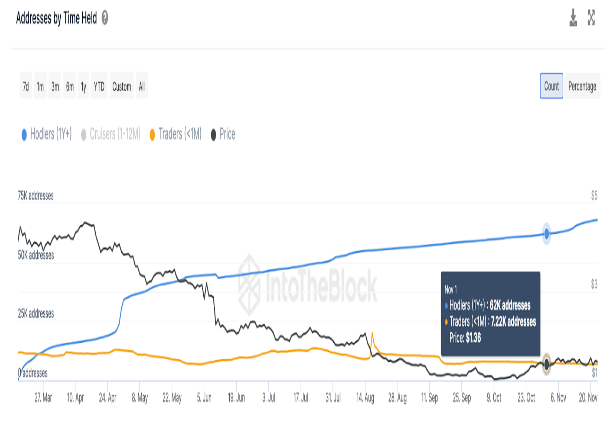

APE addresses by time held. Supply: IntoTheBlock

Shift In Deal with Dynamics

In the meantime, as reported by IntoTheBlock, a optimistic development divergence is clear between the long-term and short-term holder addresses for APE. Illustrated within the Addresses by Time Held chart, the rely of long-term addresses has surged by 6,060 wallets for the reason that starting of November.

Concurrently, the Apecoin community has skilled a lower of three,800 within the variety of dealer/short-term wallets over the identical interval, highlighting a noteworthy shift in tackle dynamics.

The forthcoming week holds important significance for traders in APE, as it is going to function a vital evaluation of the sturdiness of this meme coin and its prospects for extra upward actions.

(This web site’s content material shouldn’t be construed as funding recommendation. Investing entails threat. Once you make investments, your capital is topic to threat).

Featured picture from Pexels

More NFT News

SOL Worth Hits Report, Persevering with Turnaround From Crypto Winter Crash

Bitcoin Nears $100,000 As Trump Council Anticipated To Implement BTC Reserve

DOGE Worth Soars 19% As Buyers Flock To Its Rival PEPU