Be part of Our Telegram channel to remain updated on breaking information protection

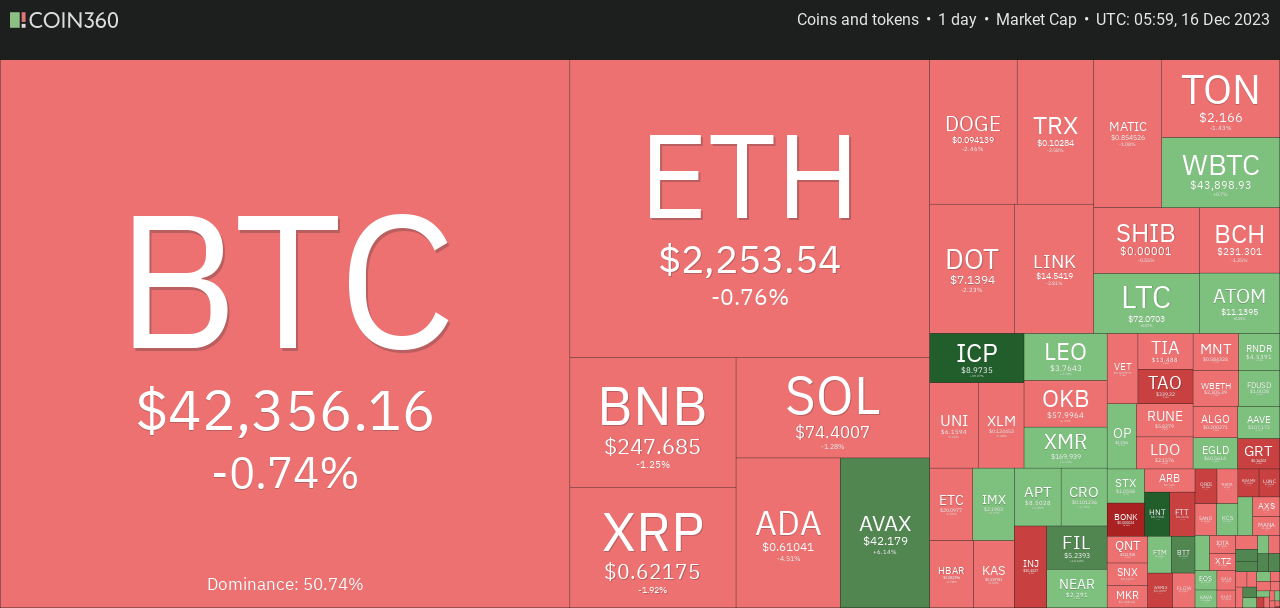

The worldwide cryptocurrency market cap has exhibited stability regardless of a slight dip, at present at $1.6 trillion, marking a marginal 0.80% lower over the previous day. Concurrently, the entire buying and selling quantity inside the crypto sphere over the last 24 hours has reached $60.46 billion, demonstrating a 10.80% discount.

Inside this panorama, decentralized finance (DeFi) continues to solidify its presence, accounting for $Eight billion in quantity, representing 13.24% of the entire crypto market’s 24-hour buying and selling quantity. Remarkably, stablecoins contribute considerably, totaling $54.11 billion, comprising 89.50% of the general crypto market’s day by day buying and selling quantity.

Bitcoin, the flagship cryptocurrency, at present holds dominance at 51.74%, experiencing a minor 0.13% decline inside the day, indicating a shift in market dynamics.

SEC Commissioner Hester Peirce has echoed sentiments expressed by bullish cryptocurrency buyers, acknowledging that the approval of a spot Bitcoin Trade-Traded Fund (ETF) ought to have occurred years in the past. Peirce believes regulatory limitations have impeded progress, emphasizing the necessity to tackle these hurdles.

Subsequent Cryptocurrency To Explode

Whereas expressing assist for a spot Bitcoin ETF, Peirce kept away from speculating on its approval, notably as anticipation mounts forward of the looming Jan. 10 deadline for the choice on the ARK/21Shares’ spot Bitcoin ETF utility. The anticipation surrounding this determination has notably contributed to the surge in Bitcoin’s worth, which has greater than doubled this yr, reflecting buyers’ optimism and anticipation of the forthcoming vote.

1. XDC Community (XDC)

XDC is at present surging after a hiatus within the crypto market and is able to be the following cryptocurrency to blow up. The present degree marks a major milestone in its latest worth efficiency.

The token soared to $0.517 on Saturday earlier than experiencing a slight retracement to $0.513. At the moment, XDC is buying and selling at $0.0513, boasting a 2.9% surge in 24-hour buying and selling quantity, which quantities to $17.94 million.

Notably, XDC’s good points in opposition to main cryptocurrencies BTC and ETH have been exceptional, initially surpassing 30% earlier than stabilizing round 8%. Over the previous week, XDC has misplaced 3.87% and three.73% up to now month.

The yr has been a testomony to XDC’s resilience and progress, beginning under $0.025 and practically doubling in worth by mid-April. Nonetheless, subsequent fluctuations noticed a 33.3% drop till mid-July, when a breakout occurred round $0.032, sparking a rally of roughly 160%.

Whereas the token has surged by 180% over the previous yr and greater than 111% in 2023, it stays down by roughly 78% from its peak of $0.192, reached in August 2021.

XDC serves because the native token of the XDC blockchain, with roughly 35% of the entire provide of 37.85 billion tokens—valued at 13.85 billion—circulating available in the market. The mission, initiated in 2017 by Atul Khekade, has secured a complete funding of $50 million, per Crunchbase information.

As a utility token, XDC facilitates world and home commerce, offering liquidity to the monetary trade and enhancing enterprise effectivity via tokenized and non-tokenized providers. The XDC01 protocol hosts utility tokens like EURS, GBEX, CGO, LBT, SRX, and WXDC inside the XDC ecosystem.

2023: A Transformative Yr for #XDCNetwork! 🌟

This yr introduced key milestones in commerce finance, regulation & ecosystem progress. 📈

Discover a yr of innovation & world affect ⬇️https://t.co/p59jTHQ7Ww

Because of the #XDC group for all of your assist!

— XDC Basis (@XDCFoundation) December 14, 2023

The XDC Community, beforehand often known as XinFin, operates on a delegated proof of stake consensus community (XDPoS), facilitating hybrid relay bridges, immediate block finality, and interoperability with ISO 20022 monetary messaging requirements.

The community’s hybrid structure combines options of each private and non-private blockchains, enabling cross-chain sensible contracts that assist institutional purposes in commerce finance and tokenization. With interoperable sensible contracts, speedy commerce settlement, and Ethereum Digital Machine (EVM) compatibility, the XDC Community provides a scalable infrastructure for enterprises and particular person contributors.

2. Bitcoin ETF Token (BTCETF)

The presale part of the Bitcoin ETF Token, a pivotal Ethereum-based coin tailor-made to capitalize on the anticipated approval of a spot Bitcoin ETF, has reached its climactic 10th and remaining stage. With just a few days remaining, buyers have a restricted window to purchase the following cryptocurrency to blow up at its lowest accessible worth of $0.0068.

Amidst the mounting worry of lacking out (FOMO) surrounding the upcoming approval of a spot Bitcoin ETF, merchants have injected $4.2 million into the BTCETF preliminary coin providing. The presale inches nearer to its difficult cap objective of $4,956,000, with lower than $800,000 remaining to be raised.

The long-awaited arrival of a #Bitcoin #ETF from @BlackRock may revolutionize the #Crypto scene, attracting institutional consideration and igniting a brand new period. 🚀

The Ultimate Stage of #BitcoinETF is now effectively underway!

Keep tuned for extra updates on these #Crypto developments! 📈 pic.twitter.com/AuF6wt9T4H

— BTCETF_Token (@BTCETF_Token) December 15, 2023

Enthusiasm amongst contributors is pushed by the potential for astronomical returns, with projections suggesting a staggering 100x acquire, underscoring the palpable anticipation surrounding the transformative affect of a spot Bitcoin ETF on the crypto funding panorama.

The Bitcoin ETF Token is a strategic avenue for optimizing funding portfolios in anticipation of the anticipated approval, poised to doubtlessly materialize as early as January.

Uniquely designed with burn mechanisms tied to ETF approval, launch milestones, buying and selling volumes, and belongings underneath administration, the BTCETF token guarantees direct advantages for holders at every important part of the journey from approval to market adoption.

The seismic affect of a spot Bitcoin ETF approval has prompted notable shifts, together with Google revising its promoting rules on crypto to allow fund managers issuing such merchandise to advertise them.

Investing in BTCETF immediately signifies greater than a mere guess on the SEC’s approval of a spot product; it positions buyers for a extra profound, longer-term strategic transfer within the face of an impending financial shift. This strategic positioning turns into more and more related as economies worldwide bear a profound, secular transformation catalyzed by Bitcoin’s central position.

Bitcoin spinoff cash just like the Bitcoin ETF Token are poised to reap the rewards of this profound financial and monetary evolution, with the potential for extra international locations to embrace this world transformation because the world navigates important shifts in financial paradigms.

Go to Bitcoin ETF Token.

3. Neo (NEO)

The NEO cryptocurrency maintained its upward trajectory for near every week, constructing upon a 2.62% acquire within the final 24 hours. This pattern alerts a sturdy rebound from its quick assist zone and extends its rally.

The NEO worth at present stands at $13.23, inching nearer to a problem in opposition to its close by resistance space. This sustained upward momentum paints a doubtlessly bullish state of affairs for NEO because it strives to breach the anticipated ceiling.

Technical indicators supply insights into NEO’s momentum, with the 20-day Exponential Shifting Common (EMA) at $11.94, the 50-day EMA at $11.05, and the 100-day EMA at $10.08. The ascending alignment of those EMAs presents a bullish backdrop, indicating NEO’s sturdy place above these ranges, signifying a gentle uptrend.

The Relative Power Index (RSI) for NEO has surged to 59.64, a notable rise from yesterday’s 55.02, reflecting escalating shopping for strain. Whereas not but overbought, the uptick implies present purchaser dominance. Notably, with the RSI under the standard overbought threshold of 70, there exists room for additional upward motion earlier than NEO turns into overextended.

Neo’s October highlights within the Neo World Improvement (NGD) Normal Month-to-month Report:

🏆 #NeoAPACHackathon Finale in Hong Kong

🔗 Neo’s MEV-resistant sidechain

🤝 Partnerships and group engagement

🚀 Progress on Neo and group initiatives https://t.co/8JxrYyRAGY— Neo Good Financial system (@Neo_Blockchain) December 13, 2023

An important growth in NEO’s technical evaluation is the Shifting Common Convergence Divergence (MACD) histogram, registering at 0.04, up from the day past’s 0.02. This constructive MACD momentum averts a bearish crossover, which is essential in avoiding a possible reversal of NEO’s worth pattern.

Market gamers intently monitor NEO’s worth because it nears the horizontal resistance zone between $13.36 and $14.20, coinciding with the Fib 0.236 degree at $13.37, including significance to the resistance.

A definitive breach above this space may verify the continuation of the bullish pattern, doubtlessly ushering in additional good points. Its standing as the following cryptocurrency to blow up can be cemented.

4. Multibit (MUBI)

Lastly, MultiBit has additionally emerged as a groundbreaking participant within the crypto house. It’s a dual-sided bridge, introducing a paradigm shift in seamless cross-network transfers between BRC20 and ERC20 tokens, marking a major milestone in blockchain interoperability.

This pioneering bridge facilitates the easy motion of cryptocurrency tokens throughout Ethereum Digital Machine (EVM) networks reminiscent of Ethereum and BNB blockchains and the Bitcoin blockchain. This innovation heralds a brand new period of cross-chain interoperability, fostering smoother interactions between various blockchain networks.

Accompanying this growth, the native token of MultiBit, MUBI, has skilled a unprecedented surge in worth, hovering by over 35% and setting its sights on a brand new all-time excessive, at present positioned at $0.2.

Spotonchain reviews spotlight a staggering 76% surge within the worth of MUBI over the previous 24 hours, positioning it prominently inside the BRC20 pattern.

🔸new itemizing on MultiBit $FOOX

🔸 @foox_brc20 is a BRC20 memecoin primarily based on Fox

🔸🦊 CA: 0x20fCefA41045080764C48C2b9429e44C644e5deA pic.twitter.com/mqeplM8LzW

— MultiBit (@Multibit_Bridge) December 15, 2023

Delving deeper into MUBI’s ecosystem, evaluation of the highest 11 holders of the token, excluding exchanges, reveals substantial unrealized earnings reaching $9.Three million. This strategic group strategically amassed 44.Eight million MUBI tokens, valued at $10.1 million, throughout 12 addresses, together with holdings in varied staking applications.

These important developments underscore MultiBit’s rising affect within the cryptocurrency area. Because it continues to redefine cross-chain interactions and accumulate substantial buying and selling volumes, MultiBit is positioned on a trajectory that might reshape the panorama of token transfers and interoperability between various blockchain networks. The platform’s innovation in bridging disparate blockchain ecosystems signifies a pivotal step towards a extra interconnected and streamlined decentralized future.

Learn Extra

New Crypto Mining Platform – Bitcoin Minetrix

- Audited By Coinsult

- Decentralized, Safe Cloud Mining

- Earn Free Bitcoin Each day

- Native Token On Presale Now – BTCMTX

- Staking Rewards – Over 100% APY

Be part of Our Telegram channel to remain updated on breaking information protection

More NFT News

SOL Worth Hits Report, Persevering with Turnaround From Crypto Winter Crash

Bitcoin Nears $100,000 As Trump Council Anticipated To Implement BTC Reserve

DOGE Worth Soars 19% As Buyers Flock To Its Rival PEPU