If historic information is something to go, Bitcoin’s (BTC) value would possibly dip additional this September, which has been the worst-performing month on report for the crypto asset since 2013.

Accessible information reveals that the flagship digital asset has solely seen its worth rise in two September between 2013 and 2021, which had been in 2015 and 2016. Outdoors of these two, BTC has recorded a mean 6% decline within the month.

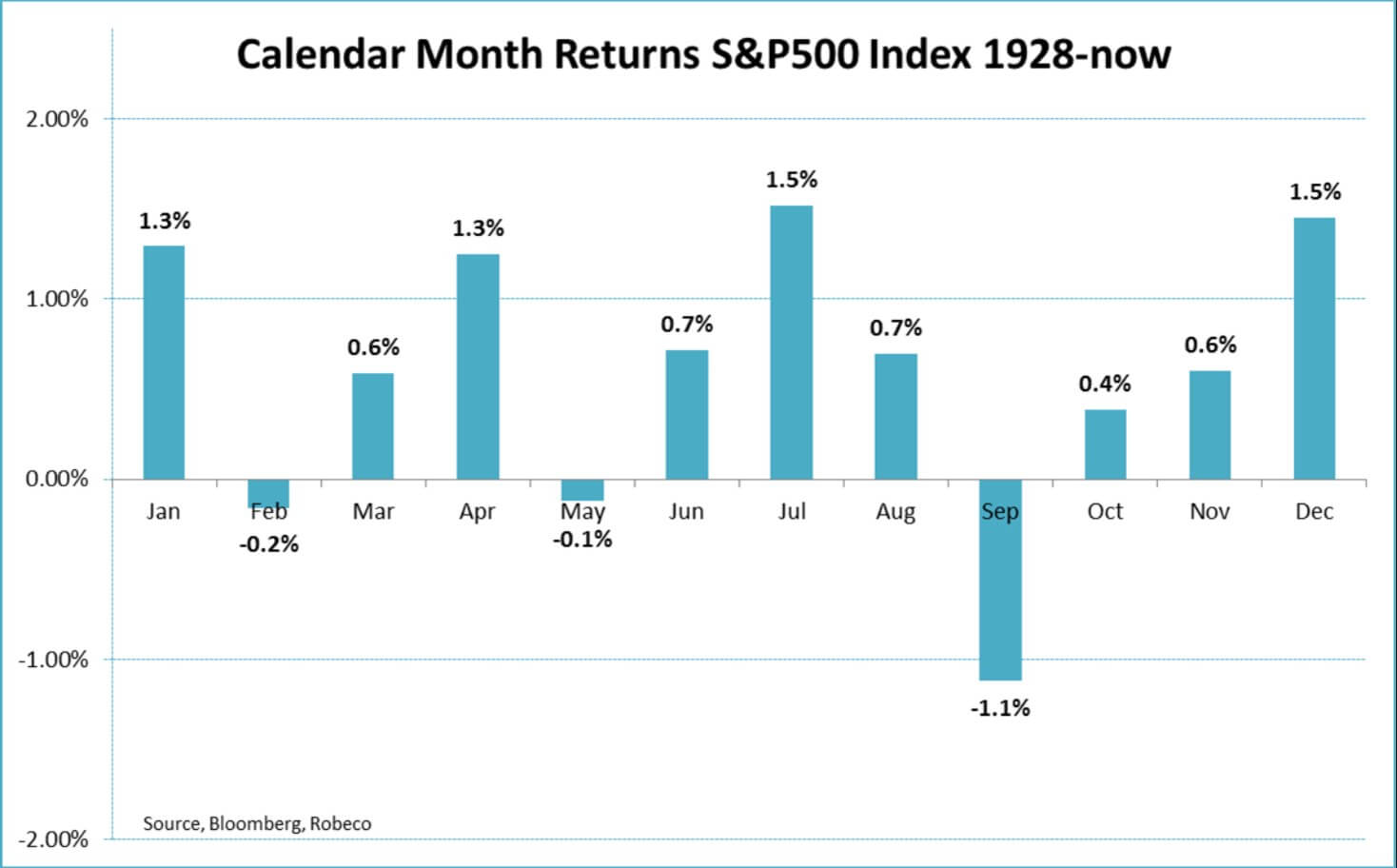

In the meantime, the September impact will not be peculiar to BTC alone. The S&P 500 has additionally had downturns in most of September since 1928.

Between 1928 and now, the S&P 500 averaged a 1.1% decline in September. Consultants argue that the final market decline in September is because of traders’ conduct.

In accordance with Elena Dure, most traders usually exit their market positions in September to lock of their positive aspects and even tax losses because the 12 months attracts to an in depth.

There’s additionally a better charge of asset liquidation as faculties resume in September and the necessity for money to pay faculty prices arises.

Given how BTC value has principally mirrored that of S&P efficiency because the pandemic, it is not going to be totally shocking if there’s a additional decline in BTC value this month.

Will this September buck the development?

Whereas many traders will need Bitcoin’s value to return to earlier highs, the potential for a crimson September is already manifesting after the asset misplaced all its positive aspects over the previous few months within the remaining days of August.

After weeks of buying and selling across the $20,000 vary and plenty of analysts suggesting that the value may need bottomed, BTC’s worth has dropped under $20,000. Within the final 24 hours, the cryptocurrency’s worth declined 1.4% and by 2.2% on the seven days metrics.

On this 12 months alone, Bitcoin’s value has been down by round 59%.

The probabilities of September 2022 being an outlier month like 2015 and 2016 can be minimal, provided that the circumstances chargeable for declining asset worth persist.

Federal Reserve Chairman Jerome Powell warned that the USA financial system would face extra “ache” because the authorities wrestle to regulate the rising inflation.

The assertion has led to a number of consultants predicting that the FOMC might additional hike the rate of interest in September.

Other than that, the US Labor Division revealed that unemployment rose to three.7% – the best since February –one other indication of the struggles of the US financial system.

More NFT News

Marathon and Hut Eight scoop up $1.6 billion price of Bitcoin throughout market dip

Osprey Funds Launches First US Publicly Quoted BNB Belief

Will Binance's BNB Attain $1000? Worth Prediction Amid Authorized Challenges in Australia