Introduction

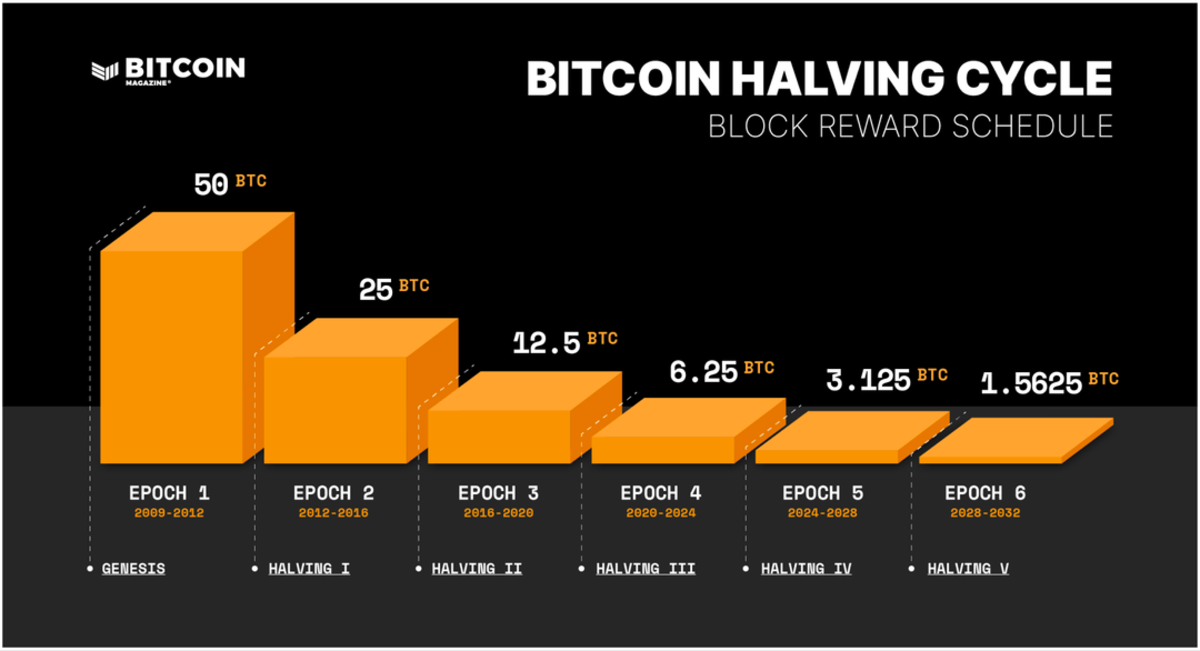

As we strategy the conclusion of the third epoch, the countdown to the next Bitcoin halving is firmly underway. The halving (also called the “Halvening”) is without doubt one of the most essential and revolutionary options of Bitcoin. Each 10 minutes, the Bitcoin community points new bitcoin and roughly each 4 years (each 210,000 blocks, to be exact) the quantity issued (the “block subsidy”) is minimize in half. The block subsidy is the reward miners obtain for validating and recording new transactions on the blockchain.

The halving of the block subsidy is a important consider bitcoin’s eventual capped provide of 21 million bitcoin. As well as, miners additionally acquire transaction charges that customers connect to their transactions to encourage miners to incorporate them within the subsequent block. Subsequently miners usually earn extra bitcoin for mining a block than simply the subsidy. .

WHEN IS THE NEXT BITCOIN HALVING?

The subsequent Bitcoin halving is anticipated to happen on or round April 20, 2024 EST, lowering the block reward from 6.25 to three.125 BTC. This halving interval — or epoch — will improve the provision by 164,250 bitcoin (from 19,687,500 to 20,671,875), a mere 328,124 bitcoin from the utmost provide restrict of 21 million.

TO CALCULATE THE NEXT HALVING DATE

- Decide the block interval: Whereas it’s true that Bitcoin’s block time (the time between every block) is roughly 10 minutes, the time can range barely attributable to hash price and community changes.

- Discover the present block peak: You’ll want to know the present block peak, which yow will discover on numerous blockchain explorer web sites or straight out of your Bitcoin node when you’re operating one.

- Calculate the blocks remaining till the subsequent halving: Bitcoin’s halving happens each 210,000 blocks. Subtract the present block peak from the subsequent halving block peak.

- Calculate the estimated time remaining: Multiply the variety of blocks remaining by the approximate block interval (in seconds) to estimate the time remaining till the subsequent halving.

- Convert the time right into a date: Convert the estimated time remaining right into a date format to seek out out when the subsequent halving is anticipated.

Present block peak: might be discovered here.

Block time: might be discovered here.

Present date: xx/xx/xxxx

Blocks per epoch: 210,000

Subsequent halving block peak: 210,000 instances subsequent halving quantity

Calculation:

(((Subsequent Halving Block Peak – Present Block Peak)*10)/60)/24 = Days remaining

Hash price and issue adjustment are two variables which consistently form the velocity at which blocks are processed and subsequently the intervals between blocks. The date of the subsequent halving can range because of this, so it’s essential to maintain operating the calculation.

HISTORY OF BITCOIN HALVINGS

As of March 2024, there have been three Bitcoin halvings:

- On November 28, 2012, Bitcoin’s block subsidy decreased from 50 BTC per block to 25 BTC per block.

- On July 9, 2016, the second Bitcoin halving decreased the block subsidy from 25 BTC per block to 12.5 BTC per block.

- On Might 20, 2020, the third Bitcoin halving lowered the block subsidy from 12.5 BTC per block to six.25 BTC per block.

BITCOIN HALVING 2012

The 2012 halving was Bitcoin’s first halving.

Halving:

Date: November 28, 2012

Halving quantity: 01

Block peak: 210,000

Block reward: 25

Mined provide: 10,500,000 (quantity of bitcoin already issued when the halving occurred)

Epoch:

Subsidy: 5,250,000

Proportion of mined provide: 25%

BITCOIN HALVING 2016

The 2016 halving was Bitcoin’s second halving.

Halving:

Date: July 9, 2016

Halving quantity: 01

Block peak: 420,000

Block reward: 12.5

Mined provide: 15,750,000 (quantity of bitcoin already issued when the halving occurred)

Epoch:

Subsidy: 2,625,000

Proportion of mined provide: 12.5%

BITCOIN HALVING 2020

The 2020 halving was Bitcoin’s third halving.

Halving:

Date: Might 20, 2020

Halving quantity: 03

Block peak: 630,000

Block reward: 6.25

Mined provide: 18,375,000 (quantity of bitcoin already issued when the halving occurred)

Epoch:

Subsidy: 1,312,500

Proportion of mined provide: 6.25%

BITCOIN HALVING 2024

The 2024 halving can be Bitcoin’s third halving.

Halving:

Date: April 20, 2024 (estimated)

Halving quantity: 04

Block peak: 840,000

Block reward: 3.125

Mined provide: 19,687,500 (quantity of bitcoin issued when the halving occurred)

Epoch:

Subsidy: 656,250

Proportion of mined provide: 3.125%

FUTURE BITCOIN HALVINGS

The blocktime variable will introduce some variance in estimated halving dates, however it’s attainable to undertaking approximate dates till the conclusion of block subsidies in 2140. Under, we offer a succinct overview of anticipated halving dates from 2024 to 2060, providing useful insights into these upcoming milestones.

| Epoch Quantity | Block peak | Halving Yr | Estimated Halving Date |

|---|---|---|---|

|

04 (of 32) |

840,000 |

2024 |

April 20, 2024 |

|

05 (of 32) |

1,050,000 |

2028 |

2028 |

|

06 (of 32) |

1,260,000 |

2032 |

2032 |

|

07 (of 32) |

1,470,000 |

2036 |

2036 |

|

08 (of 32) |

1,680,000 |

2040 |

2040 |

|

09 (of 32) |

1,890,000 |

2044 |

2044 |

|

10 (of 32) |

2,100,000 |

2048 |

2048 |

|

11 (of 32) |

2,310,000 |

2052 |

2052 |

|

12 (of 32) |

2,520,000 |

2056 |

2056 |

|

(cont…) |

HISTORICAL IMPLICATIONS OF THE BITCOIN HALVING

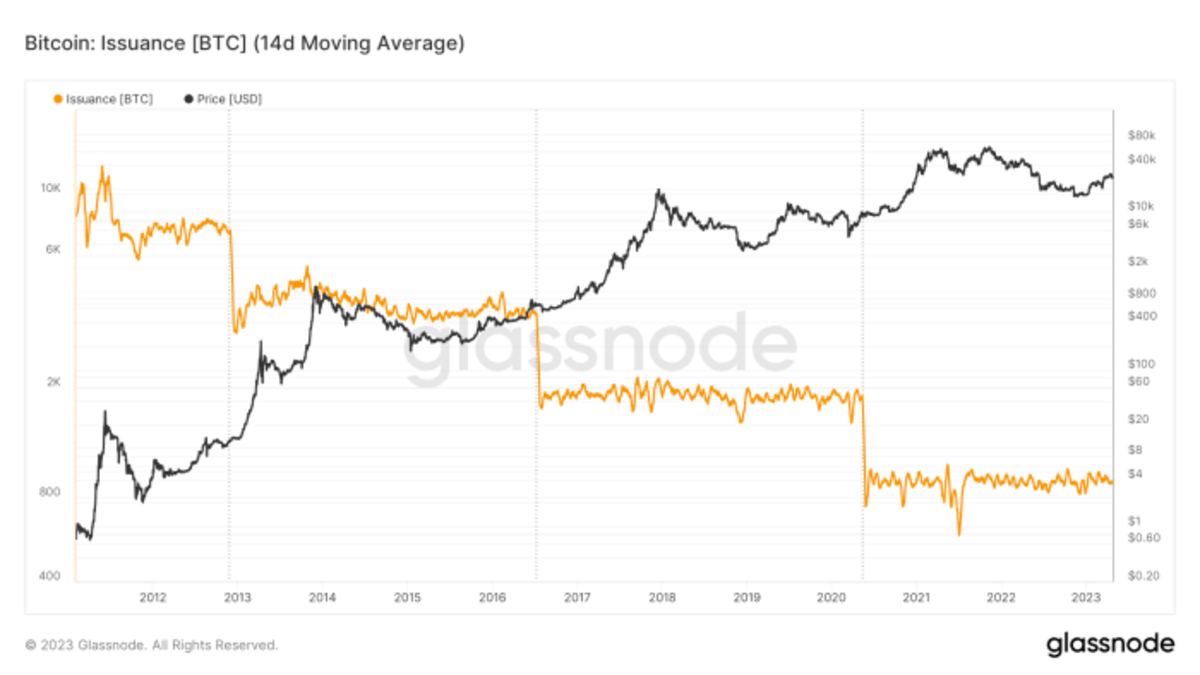

Halving occasions have constantly preceded important will increase in bitcoin’s value, making them a focus for market analysts.

Value Appreciation

Traditionally, bitcoin’s value has skilled important upswings following halving occasions because of the mixture of lowered provide and elevated demand. These occasions considerably affect the general provide of bitcoin, thereby affecting its value. However, it’s important to acknowledge that the value dynamics are influenced by many components past halving occasions.

- After the 2012 halving, the bitcoin value rose roughly 9,000% to $1,162.

- After the 2016 halving, the bitcoin value rose roughly 4,200% to $19,800.

- After the 2020 halving, the bitcoin value rose roughly 683% to $69,000.

Bitcoin issuance price will get lowered in half roughly each 4 years.

Challenges for Miners

Halving occasions can pose challenges for miners, as their revenue decreases when block rewards are minimize in half. To stay aggressive, miners should function effectively, doubtlessly driving the event and adoption of extra energy-efficient mining expertise. It’s fairly frequent for miners to go bankrupt, which regularly impacts the community’s hash price, the provision of accessible for-sale bitcoin, and in the end bitcoin’s value. Via the upheaval, the issue adjustment finally restores equilibrium and the Bitcoin community and ecosystem continues to march ahead.

FAQs:

Will Bitcoin go up on the halving?

Bitcoin’s historic efficiency after a halving occasion has proven a outstanding upward trajectory. The discount within the price of recent provide is Bitcoin’s path to absolute shortage. This occasion usually sparks elevated curiosity and demand. Nonetheless, it’s very important to train warning and never view the halvings as assured paths to fast earnings. The prudent strategy is to grasp the long-term potential of bitcoin and contemplate it as a retailer of worth somewhat than trying to time the market with shopping for and promoting.

Is Bitcoin halving bullish?

The Bitcoin halving is definitely a bullish occasion, because it shifts the provision dynamics in favor of value appreciation. Whereas the halving is mostly seen as a bullish occasion, it’s sensible to do not forget that bitcoin’s value is influenced by a number of components. Warning is suggested.

What number of days after Bitcoin halving does it hit its peak?

A take a look at the previous three halving occasions reveals {that a} important value rise normally begins inside a number of months of the halving occasion. Additionally, earlier than a halving occasion, the value of bitcoin tends to rise as traders anticipate a value rally post-halving. After the halving, the value normally takes over 12 months to succeed in its peak.

Do you have to purchase bitcoin earlier than the halving?

As a substitute of making an attempt to grasp when to purchase and promote bitcoin, it’s advisable to grasp the worth of the asset. That mentioned, a sample has performed out prior to now the place shopping for 6-12 months earlier than the halving and promoting 12-18 months after the halving tends to return a large revenue. Previous efficiency and conduct will not be a assure of future efficiency. Our greatest recommendation to those that aren’t skilled merchants could be to purchase and maintain for a lot of cycles.

More NFT News

Hashrate Development Aligns With Rising Search Curiosity

SOL Worth Hits Report, Persevering with Turnaround From Crypto Winter Crash

Bitcoin Nears $100,000 As Trump Council Anticipated To Implement BTC Reserve