Knowledge exhibits the cryptocurrency by-product market has noticed mass liquidations following the crash of Bitcoin and different belongings.

Bitcoin Has Seen Bears Profitable As Worth Has Plunged 6% Over The Previous Day

Lately, Bitcoin has been caught in consolidation within the $60,000 to $70,000 value vary, unable to mount any sustained transfer in both route. Through the previous day, nonetheless, the coin has seen a big transfer away from this vary, and it’s not within the route the bulls would have needed.

The beneath chart exhibits what the worth motion of the cryptocurrency has regarded like just lately.

The worth of the coin has noticed a plunge over the previous couple of days | Supply: BTCUSD on TradingView

Throughout this newest plunge, BTC briefly slipped to a low below $57,000 earlier than seeing a small rebound to the present $57,500 mark. That is the bottom that the asset has been since late February.

As is often the case, the remainder of the sector has additionally burned alongside the unique cryptocurrency, however Bitcoin’s 6% drop within the final 24 hours is deeper than that of many altcoins.

With the emergence of this new sharp value motion available in the market, it’s not stunning that the by-product market merchants have been caught off-guard by the breakout of the vary.

Crypto Spinoff Market Has Seen Liquidations Of Over $424 Million

In accordance with information from CoinGlass, the market volatility has triggered a excessive quantity of liquidations within the by-product aspect of the sector. The “liquidation” of a contract happens when it amasses losses of a sure diploma and receives forceful closure from the platform with which it’s open.

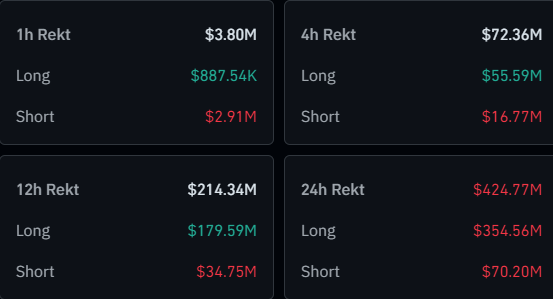

Right here is the info relating to the cryptocurrency-related liquidations which have occurred in the course of the previous day:

Appears like an enormous quantity of liquidations have occurred over the past 24 hours | Supply: CoinGlass

The desk exhibits that the cryptocurrency market as a complete has suffered virtually $425 million in liquidations throughout this era. On condition that the worth motion throughout the sector has been in direction of the draw back, it’s unsurprising to see longs making up for many of this flush.

Extra particularly, $354 million of those liquidations got here from the lengthy contract holders, making up for greater than 83% of the full. A mass liquidation occasion like in the present day’s is popularly often known as a “squeeze,” since this newest one concerned an awesome majority of the longs, it could be known as a protracted squeeze.

Throughout a squeeze, a pointy swing within the value causes numerous liquidations, which feed again into the transfer, amplifying it and leading to much more liquidations.

Given its place because the coin with probably the most market cap, Bitcoin has naturally occupied the biggest a part of the person contributions to this squeeze.

BTC seems to have seen $164 million in liquidations in the course of the previous day | Supply: CoinGlass

Traditionally, large-scale liquidations like this newest one haven’t been uncommon within the cryptocurrency market. It is because the varied cash may be fairly risky, so it may be arduous to wager on anyone route.

Associated Studying: First In History: Bitcoin Miners Now Need More Than 1 EH/s Of Power To Mine 1 BTC

Leverage use can also be widespread within the sector, with many platforms providing simply accessible excessive multipliers. With all of the dangerous hypothesis, it’s unsurprising that the market shakes when value motion like in the present day’s happens.

Featured picture from Shutterstock.com, CoinGlass.com, chart from TradingView.com

More NFT News

Machine Studying in Focus as Chainalysis Acquires Hexagate

Extra Than Half of Crypto Tokens, Memecoins Launched in 2024 Have been Malicious: Blockaid

Hedera Value Prediction for Right now, December 18 – InsideBitcoins