JPMorgan Chase, the biggest financial institution in America, has revealed publicity to identify Bitcoin Alternate-Traded Funds (ETFs) in a newly filed doc with the Securities and Alternate Fee (SEC) at present.

The SEC submitting by JPMorgan Chase gives particular insights into the financial institution’s publicity to identify Bitcoin ETFs. The financial institution at present has publicity to identify Bitcoin ETFs issued by a number of the largest asset managers on the planet: BlackRock, Constancy, Grayscale, and extra.

Although, the amount of cash allotted to every ETF appears a bit underwhelming, taking into account how a lot cash different establishments are allocating to buying Bitcoin. That is as a result of:

“JPM, Susquehanna (which additionally owns these ETFs and was throughout this web site final week) and others are simply market makers and/or AP’s. Their possession is not essentially indicative of something aside from that is what number of shares they’d on 3/31/24,” commented Bloomberg ETF Analyst James Seyffart. “Should you’re making markets in these items, the variety of shares held may swing closely everyday. The 13F knowledge is solely a snapshot of *LONG* positions held on 3/31 13F’s do not present shorts OR derivatives. So we do not actually have a full take a look at their true publicity on 3/31.”

Bloomberg Senior ETF Analyst Eric Balchunas additionally commented on the information, stating we’ll “prob[ably] see lots of the large banks report some holdings of their position as market makers/APs. That’s dif[ferent from] them shopping for for the publicity (and thus much less hypocritical in JPM’s case).. props for catching this tho we nonetheless engaged on getting the file on bbg it simply got here out.”

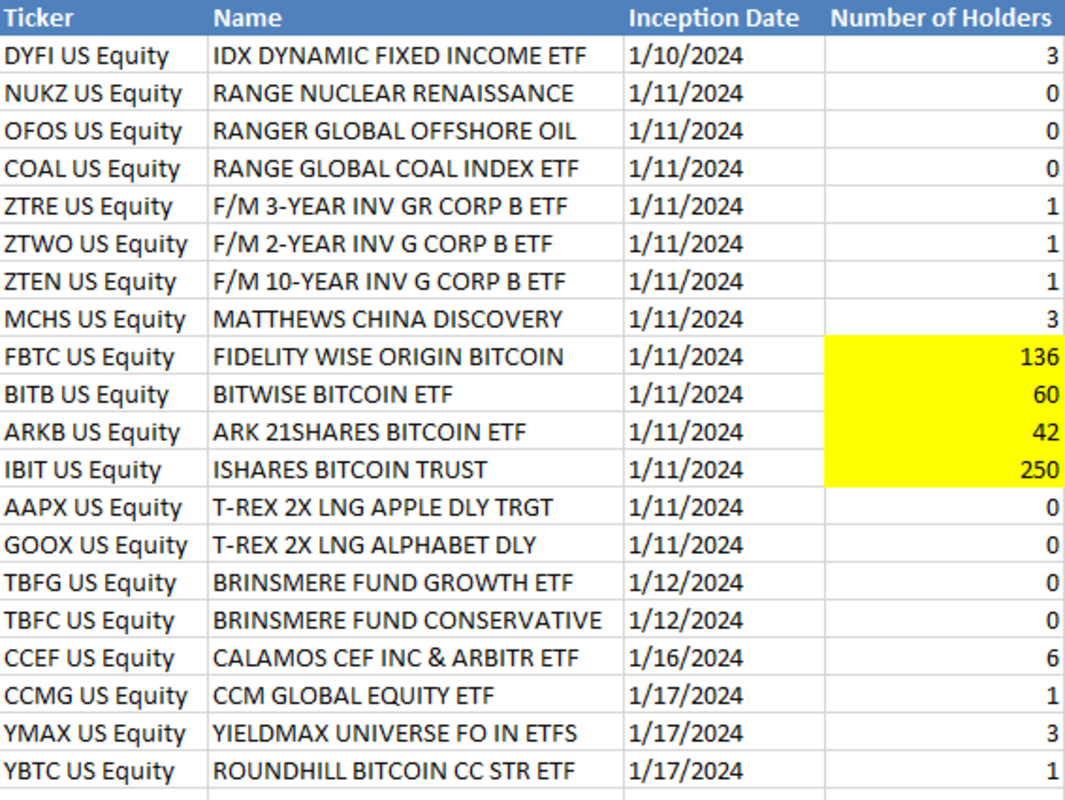

“What’s notable IMO is the sheer variety of holders that every has thus far. $IBIT is as much as 250. That is bonkers for first quarter on market,” Balchunas continued. “Here is comparability of the opposite ETFs launched identical week-ish as btc ones. And we nonetheless have like per week of 13Fs to roll in but.”

JPMorgan’s disclosure comes simply hours after Wells Fargo, America’s third largest financial institution, additionally made an identical revelation about its spot Bitcoin ETF publicity.

More NFT News

SOL Worth Hits Report, Persevering with Turnaround From Crypto Winter Crash

Bitcoin Nears $100,000 As Trump Council Anticipated To Implement BTC Reserve

DOGE Worth Soars 19% As Buyers Flock To Its Rival PEPU