That is an opinion editorial by Kudzai Kutukwa, a passionate monetary inclusion advocate who was acknowledged by Quick Firm journal as certainly one of South Africa’s top-20 younger entrepreneurs below 30.

(Supply: Photo by John Webb on Unsplash)

Privateness is a necessary human right that’s now being taken without any consideration. It’s not about having one thing to cover, however about exercising the facility to selectively reveal yourself to the world and thus securing autonomy over your personal life. Doorways, locks, home windows, safes and drapes are among the gadgets we use within the bodily realm to protect our privateness. Sadly we now dwell in a society during which privateness has been overcome by the compulsion for sharing and transparency. The web in its present type is poor in consumer privateness and was not developed with sturdy privateness protections from the onset. Our private information is the “new oil” and is ripe for exploitation by the state, Large Tech and hackers. Sharing has grow to be the default because of the provision of digital instruments that permit one to share all the things from valuable moments to precise places.

Whereas social media platforms have made communication over lengthy distances a lot simpler, the digital footprints being generated on-line, on daily basis by billions of individuals compromise their privateness — and by extension their private safety — in quite a few methods. Knowledge hacks, on-line stalking, cyberbullying and phishing assaults are all however just a few examples. Nonetheless, because of the aforementioned sharing tradition, the need to keep up privacy is frowned upon and deemed suspicious. In spite of everything, why would you want privateness when you have nothing to cover? With out privateness we proceed to dwell below the false phantasm of freedom, whereas our decision-making is remotely managed by these gathering our information. Privateness is neither unlawful neither is it a luxurious. Privateness is a crucial prerequisite for freedom.

Till just lately monetary privateness was the default because of the intensive use of commodity cash reminiscent of gold and afterward after that, money. You might freely transact with out revealing any private data to retailers or exposing any of your purchases to the financial institution. In recent times, nevertheless, using money has been gradually declining (and monetary privateness together with it) because of the rise of different digital cost channels and in some instances as a result of legal restrictions. The concept behind these restrictions being that they’re a instrument for combating tax evasion, cash laundering and arranged crime. Even if digital cost channels are much less non-public than money, there are legal guidelines and limitations on who can entry your monetary data, and there are authorized processes that should be adopted earlier than any disclosure of your monetary data to a 3rd get together by a monetary establishment. Whereas not foolproof, they did ship primary monetary privateness safety. As a pseudonymous foreign money, Bitcoin transactions are public by default and might be seen by anybody and everybody. In case your id might be tied to a selected Bitcoin “pockets handle” your monetary life (insofar as that bitcoin pockets is anxious) is now completely within the public area, with no authorized processes required to entry that data. That is the foremost cause why purposes and providers that defend the privateness of cryptocurrency transactions are being focused by governments globally.

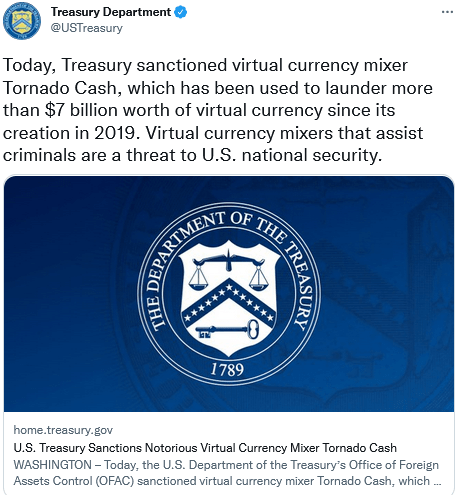

On eight August 2022, the US Treasury’s Workplace For Belongings Management (OFAC) sanctioned Twister Money (TC), an Ethereum smart contract mixer, that enables individuals to guard their monetary privateness on-line, and added it to the Specifically Designated Nationals (SDN) Record. This successfully signifies that Americans, residents and entities are banned from interacting with TC in any method. Privateness-enabling instruments like TC permit individuals to transact with out exposing their total monetary exercise. In different phrases they’re helpful for the preservation of economic privateness the place transactions on-chain are involved. In accordance with OFAC, TC was allegedly used to launder cryptocurrency value $455 million that was hacked from Axie Infinity’s Ronin Bridge protocol by the North Korean government-backed hacker group the Lazarus group. OFAC had beforehand sanctioned the Lazarus group in 2019 and additional factors out that TC additionally obtained funds that had been hacked from the Concord bridge in June in addition to the Nomad bridge.

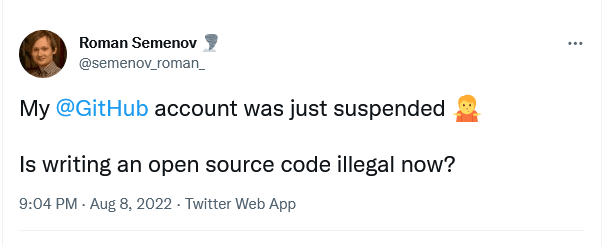

Historically, people or entities had been the goal of OFAC sanctions, nevertheless what’s odd about this explicit state of affairs is that TC is neither a pure particular person or a juristic particular person, it’s open-source code. Code is speech (Bernstein v. DOJ) and is thus protected by the First Modification. In the identical method {that a} written musical rating is helpful for communication amongst musicians, code can be “an expressive means for the change of data and concepts,” amongst pc programmers (Junger v. Daley). Subsequently, the creation and sharing of open-source code is protected by the First Modification, similar to the creation and sharing of music, books and movies.

Open-source code is free to be used by anybody and since no business achieve accrues to its publishers, it’s due to this fact a public good. The banking system, web and roads are all public items which might be utilized by law-abiding residents and criminals alike, however unhealthy actors are those which might be focused, not the infrastructure. Even SWIFT acknowledges this truth in line with a press release on their website’s FAQ part. In response to the questions, “What’s the position of SWIFT in relation to monetary sanctions which might be imposed by regulators?” and “Does SWIFT adjust to all sanctions legal guidelines?” they state the next:

“SWIFT doesn’t monitor or management the messages that customers ship via its system. All choices on the legitimacy of economic transactions below relevant rules, reminiscent of sanctions rules, relaxation with the monetary establishments dealing with them, and their competent worldwide and nationwide authorities. So far as monetary sanctions are involved, the main target of SWIFT is to assist its customers in assembly their obligations to adjust to nationwide and worldwide rules. SWIFT is just a messaging service supplier and has no involvement in or management over the underlying monetary transactions which might be talked about by its monetary institutional clients of their messages.”

In different phrases they’re suggesting that as a impartial communications community they don’t seem to be topic on to the likes of OFAC and due to this fact the duty for the enforcement of sanctions lies straight with the monetary establishments processing them. So far as I can inform the identical reasoning might be utilized to impartial, privateness enhancing open-source protocols like TC that may be utilized by legislation abiding residents and criminals alike. It’s towards this background that any rational particular person observing the absurdity in all this could be forgiven for considering that maybe the intent of this motion is extra about sending a message to not solely discourage using mixers however to additionally curtail their improvement. OFAC’s sanction by default implicitly pre-supposes guilt on the a part of anybody in search of monetary privateness and by default compels full disclosure of a consumer’s data (i.e., their total on-chain monetary historical past). This isn’t only a sanction on TC alone however a gradual creep in direction of outlawing all privateness enhancing open-source software program, or any software program deemed unlawful by The State.

In accordance with a current article within the Financial Times, a senior unnamed Treasury official commenting on the sanction of TC stated:

“‘We do imagine that this motion will ship a extremely vital message to the non-public sector in regards to the dangers related to mixers writ massive,’ including that it was ‘designed to inhibit Twister Money or any kind of reconstituted variations of it to proceed to function. Right now’s motion is the second motion by Treasury towards a mixer, nevertheless it is not going to be our final.’”

If that isn’t an open declaration of battle towards monetary privateness then I do not know what’s. This motion by OFAC of sanctioning an open-source protocol units a precedent for not directly criminalizing the act of in search of monetary privateness. Moreover, it additionally creates uncertainty inside the open-source group, as builders could also be held answerable for writing code which may be utilized by criminals afterward. Even if open-source code creators have zero management over how their code can be used, certainly one of TC’s contributing builders, Alex Pertsev was arrested by Dutch authorities and he’s being accused of cash laundering. Other than being a contributor to TC’s code no proof has been disclosed that ties Alex to the laundered funds nor have any official expenses towards him been made and he’s nonetheless in police custody, as of time of writing this text. That is the slippery slope that we discover ourselves in. This is the reason censorship resistance and decentralization are crucial.

Following the sanction of TC, “fragility contagion” ensued, which noticed Github deleting all the software program repository of TC. Ethereum’s two largest node infrastructure suppliers Infura and Alchemy restricted access to information on Twister Money good contracts, Defi Protocols’ like Aave, DYDX and Uniswap blocking access to TC and stablecoin issuers like Circle instantly freezing assets related to TC. All of those firms went above and past the necessities of the sanctions legislation. They did not simply obey an unjust order, they went out of their method to inflict additional harm with out even placing up a struggle — a lot for being “on this collectively.” With out censorship resistance and decentralization as your first line of protection, you don’t have anything. Something that’s “decentralized in identify solely” (DINO) is the low hanging fruit that state assaults can be directed at first, and as we have now already seen with the TC fallout, it doesn’t take a lot to rattle the cage. Over time I count on all these DINO initiatives to both be sanctioned out of existence like TC or be co-opted into centralized finance.

The million greenback query of the day is how does this have an effect on Bitcoin? Provided that Bitcoin is totally decentralized and censorship resistant, why ought to Bitcoiners take note of any of this? Firstly, Bitcoin isn’t non-public by default, and as such each transaction is recorded on the blockchain in perpetuity. That is additional compounded by the truth that a lot of the Bitcoin buying and selling quantity is attributable to a couple centralized exchanges like Binance, FTX and Coinbase; consequently, the vast majority of new entrants find yourself shopping for their bitcoin from these exchanges. The issue with that’s that one has to supply private data to those exchanges so as to fulfill know your buyer (KYC) necessities. Thus, any Bitcoin bought via these exchanges turns into tied to your actual id. This creates three main issues, particularly:

- Your private data sitting on an change’s centralized database is susceptible to hacks and information leakages. This data might be shared with the federal government on request and make you a possible goal for an “EO 6102 attack.”

- Exchanges can grow to be a choke level for the enforcement of regulatory actions like OFAC’s sanctions and they’re obliged to conform.

- The lack of monetary privateness as your transactions might be tracked advert infinitum by the change, even within the occasion of a withdrawal of the bitcoin from the change.

These are among the dangers posed by using centralized exchanges and they won’t hesitate to do The State’s bidding when referred to as upon. One of the simplest ways to start to bypass these vulnerabilities is to start out with getting your bitcoin off exchanges and self-custodying your bitcoin in a {hardware} pockets. Self-custody must be the norm because it’s probably that over time, third-party custodial providers can be one other regulatory choke level. The subsequent step is to purchase bitcoin from non-KYC peer-to-peer exchanges like Bisq and Hodl-Hodl. Along with this, common CoinJoining for transactions is one other step that may be taken to enhance privateness.

A CoinJoin is when two or extra events batch their transactions into one transaction, with the intention of obfuscating who owns which coin after the transaction. The CoinJoin is forward-looking privateness in that it severs the historic hyperlinks connected to your bitcoin from any future transactions, thus stopping blockchain information watchers from tracing the origin of the bitcoin. It’s extremely advisable particularly for bitcoin that was purchased from centralized exchanges so as to keep primary transactional privateness. Not like mixers like TC, CoinJoin coordinators by no means at any level take custody of your bitcoin — they don’t seem to be cash transmitters and are solely message transmitters like SWIFT. You will need to notice nevertheless, that some centralized exchanges reject and flag deposits containing “combined cash” thus representing one other choke level that can be utilized to clamp down on Bitcoin privateness.

Working your own node coupled with CoinJoins and shopping for non-KYC bitcoin provides an extra layer of privateness to your Bitcoin transactions. As a gateway to the Bitcoin ecosystem your node is accountable for broadcasting transactions, verifying the legitimacy of the bitcoin you obtain and thus defending your privateness. With out your personal node you need to depend on a random public Bitcoin node to let you know your stability and to broadcast/obtain transactions in your behalf. The hazard with that is that you simply reveal data that can be utilized to establish you reminiscent of your IP handle, pockets stability in addition to all of your present and future addresses. Worse nonetheless, surveillance firms additionally run a few of these nodes, and the very last thing you need is that this data of their arms. Working your personal node ensures that you’re insulated towards these network-level privateness leaks. Mining can be an possibility that may be utilized to entry non-KYC bitcoin whereas additionally leading to a much more decentralized hash charge for the community. All issues thought-about, the perfect resolution could be incomes bitcoin versus shopping for it and spending bitcoin versus promoting it. A bitcoin round financial system removes the necessity altogether to make use of fiat on/off ramps thus steadily obsoleting the position of centralized exchanges and over time dampening the volumes of bitcoin flowing via them.

Whereas Bitcoin is undoubtedly censorship resistant on the protocol stage, it nonetheless stays susceptible on the particular person stage as a result of lack of sturdy privateness ensures. The steps outlined above are measures that may be taken within the short-term to reinforce monetary privateness and by extension insulate towards coordinated state assaults. Whereas these could appear inconvenient and tedious, the additional effort is value all of it issues thought-about. Within the long-term, extra user-friendly privateness instruments should be constructed on the software layer so as to make utilizing bitcoin privately the rule, not the exception. Monetary freedom is among the most vital pillars for securing particular person freedom. Outlawing monetary privateness, straight or not directly, severely undermines that freedom by erecting a digital panopticon that powers the surveillance state. In a society the place the fixed menace of financial censorship is a gift actuality, it could be harmful to have a system the place each transaction you make is analyzed, monitored and managed by The State (assume CBDC’s).

Because the battle on monetary privateness heats up it’s clever to recollect the phrases of cypherpunk Phil Zimmermann in his essay, “Why I Wrote PGP”:

“If we do nothing, new applied sciences will give the federal government new computerized surveillance capabilities that Stalin may by no means have dreamed of. The one method to maintain the road on privateness within the data age is robust cryptography.”

Bitcoin not solely gave us a head begin in sustaining monetary privateness however within the eventual separation of cash and state. It’s incumbent upon us to defend our monetary privateness, as a result of with out it we are going to in all probability be doomed to central banking imposed serfdom.

It is a visitor submit by Kudzai Kutukwa. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc. or Bitcoin Journal.

More NFT News

Machine Studying in Focus as Chainalysis Acquires Hexagate

Extra Than Half of Crypto Tokens, Memecoins Launched in 2024 Have been Malicious: Blockaid

Hedera Value Prediction for Right now, December 18 – InsideBitcoins