Lower than a day earlier than the polls closed in america, crypto analysts continued to supply their two cents on the way forward for Bitcoin and cryptocurrencies.

For instance, many Wall Road analysts say wild BTC market costs will proceed after the elections. Different analysts and observers have shared their worth predictions based mostly on who will win this Tuesday.

Associated Studying

Gautam Chhugani of the Berstein Group initiatives that Bitcoin can improve to $80,000 and even $90,000 if the Republican Donald Trump wins the election. If Kamala Harris wins the polls, Chhugani expects the BTC worth to dip to $50,000.

However Bernstein didn’t cease making Bitcoin predictions instantly after the election; the group stays bullish on Bitcoin within the brief time period and expects the digital asset to hit $200,000 by 2025.

In keeping with Bernstein analysts, the opposite key components driving Bitcoin’s worth are the growing demand for spot BTC ETFs and rising US money owed.

Bernstein Adjusts BTC Worth Predictions: $50Okay Underneath Harris, $80-90Okay With Trump

Bernstein analysts have adjusted their Bitcoin worth estimates based mostly on the potential outcomes of the upcoming U.S. election. If Harris wins, they foresee Bitcoin dropping to round $50,000, whereas a… pic.twitter.com/Z1zJ21aJ48

— The Wolf Of All Streets (@scottmelker) November 4, 2024

Bernstein’s Bullish Outlook For Bitcoin Subsequent Yr

Analysts at Bernstein are betting on Bitcoin and anticipate its worth to succeed in $200,000 by the tip of subsequent 12 months, whatever the election outcomes. Gautam Chhugani made this daring prediction days earlier than the People visited the polls and added that the outcomes wouldn’t affect the long-term outlook for the asset.

The analyst’s bullish mission on Bitcoin is anchored on a number of components. He even likened the asset to a “genie out of the bottle” and mentioned stopping its worth trajectory is troublesome.

Chhugani recognized a number of components that may drive the asset’s worth, together with elevated curiosity on the BTC ETFs and better authorities’s nationwide debt. Final month, Bernstein’s prime analyst focused $100okay for Bitcoin however quickly revised his projection to mirror adjustments in market tendencies.

BTC’s Erratic Worth Motion Forward Of Elections

This 12 months’s election battle between Trump and Harris is among the many most extremely debated and anticipated. Along with conventional polling, information from betting markets like Polymarket turned well-known, too.

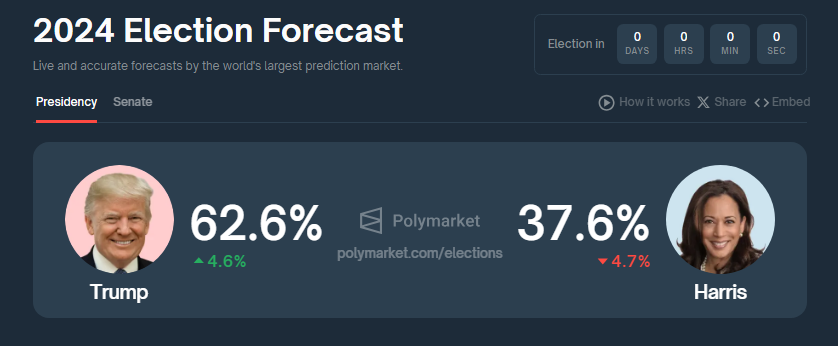

For instance, at Polymarket, Trump remains the favorite, cornering 63% of all wagers, with Harris getting 38%. Bernstein analysts say that whatever the outcomes, the asset may have short-term worth actions.

Nonetheless, they anticipate BTC to profit extra from a Trump win. In the identical Bernstein evaluation, Bitcoin might improve to $90,000 if the Republican wins.

At present, Bitcoin’s worth has dropped to $69okay to $68okay because of profit-taking. Additionally, analysts famous the weak inflows this week to ETFs. Most analysts agree that Bitcoin continues to be poised for an end-of-the-year rally.

Associated Studying

US Election Outcomes Can Affect Different Digital Belongings

The US elections have an effect on different digital belongings in addition to Bitcoin. For instance, in a Harris presidency, Ether might achieve because of heightened laws that may restrict the efficiency of its competitors, like Solana.

Nonetheless, Chhuhani gives a differing view, saying if the SEC adopts average insurance policies, these can propel Bitcoin and different belongings.

This 12 months’s election cycle places crypto and the blockchain on the middle of debates. Each candidates have shared their ideas on crypto, with Trump providing extra crypto-friendly options.

Initially, Democrat Harris was reluctant to supply coverage proposals, however she shifted her tone because the marketing campaign moved ahead.

Featured picture from Invezz, chart from TradingView

More NFT News

DOGE Worth Soars 19% As Buyers Flock To Its Rival PEPU

Ethereum Holders Endure Unrealized Losses – Is ETH Undervalued?

Russia Bans Crypto Mining In Russia-Occupied Ukraine Territories, Cites Power Scarcity