Santa Clara-based healthcare tech firm Semler Scientific (SMLR) just lately disclosed that it bought an extra 47 Bitcoin (BTC), bringing its whole holdings to 1,058 BTC.

Semler Scientific Continues To Improve Its BTC Holdings

Semler Scientific, a Nasdaq-listed healthcare producer, introduced that it purchased an extra 47 BTC for $three million. This acquisition comes as Bitcoin stays about 7% beneath its all-time excessive (ATH) worth.

The agency gathered 141 BTC between July and September for $8.Four million. The newest buy of 47 BTC was made between the top of September and November 4, in line with the agency’s Q3 2024 report.

The acquisition, valued at $three million, has elevated Semler Scientific’s whole holdings to 1,058 BTC. The corporate indicated it plans to proceed buying BTC.

Commenting on the event, Doug Murphy-Chutorian, chief government officer of Semler Scientific, stated:

We stay laser-focused on buying and holding bitcoin, whereas supporting innovation and progress in our healthcare enterprise.

Semler Scientific launched into its BTC acquisition journey in Could 2024, when it bought 581 BTC for $40 million. Later in September, the agency added 83 BTC to its reserves – bought for $5 million.

The corporate appears to observe a technique much like MicroStrategy’s (MSTR) method. Eric Semler, chairman of Semler Scientific, instructed that the corporate is exploring further financing alternatives to amass extra BTC, mirroring MicroStrategy’s method.

Regardless of this, Semler Scientific’s inventory efficiency doesn’t align with MSTR’s trajectory. SMLR closed at $29.97 on November 5, down 2.31% for the day. Though the inventory has risen by 8.31% during the last six months, it stays down 32.16% year-to-date (YTD).

In distinction, MSTR is up a outstanding 225.44% on a YTD foundation. Prior to now six months, the inventory worth has risen by 75.75%, though the inventory has taken a beating previously month, sliding by 15.47%.

Semler’s Q3 2024 report exhibits that its web revenue elevated to $5.6 million, up from $5.5 million in Q3 2023.

Firm Bitcoin Reserves Changing into A Widespread Pattern

Moreover Semler Scientific, MicroStrategy, and Tesla, an growing variety of corporations are progressively warming as much as the thought of getting a BTC reserve.

Most just lately, Japanese agency Metaplanet announced that it had bagged one other 108 BTC, getting the agency nearer to its formidable goal of holding 1,000 BTC.

This pattern of including BTC to company steadiness sheets is unsurprising, as a number of seasoned analysts have expressed optimism about BTC’s long-term prospects.

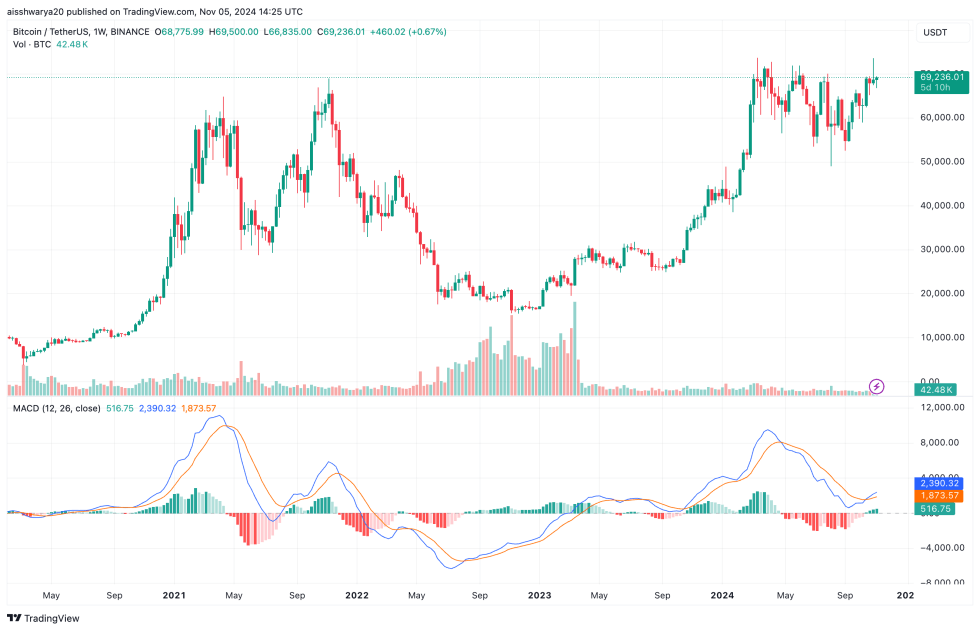

As an illustration, analysts at analysis agency Bernstein just lately predicted that BTC reaching $200,000 by the top of 2025 is a ‘conservative’ estimate. BTC trades at $69,236 at press time, up 0.9% previously 24 hours.

Featured Picture from Unsplash.com, Charts from Google Finance and TradingView.com

More NFT News

Hashrate Development Aligns With Rising Search Curiosity

How you can Speak About Crypto With Your Household This Thanksgiving

XRP, Cardano (ADA), Solana (SOL) Outperform Bitcoin (BTC) Worth as SEC Chair Gary Gensler Units Exit Date