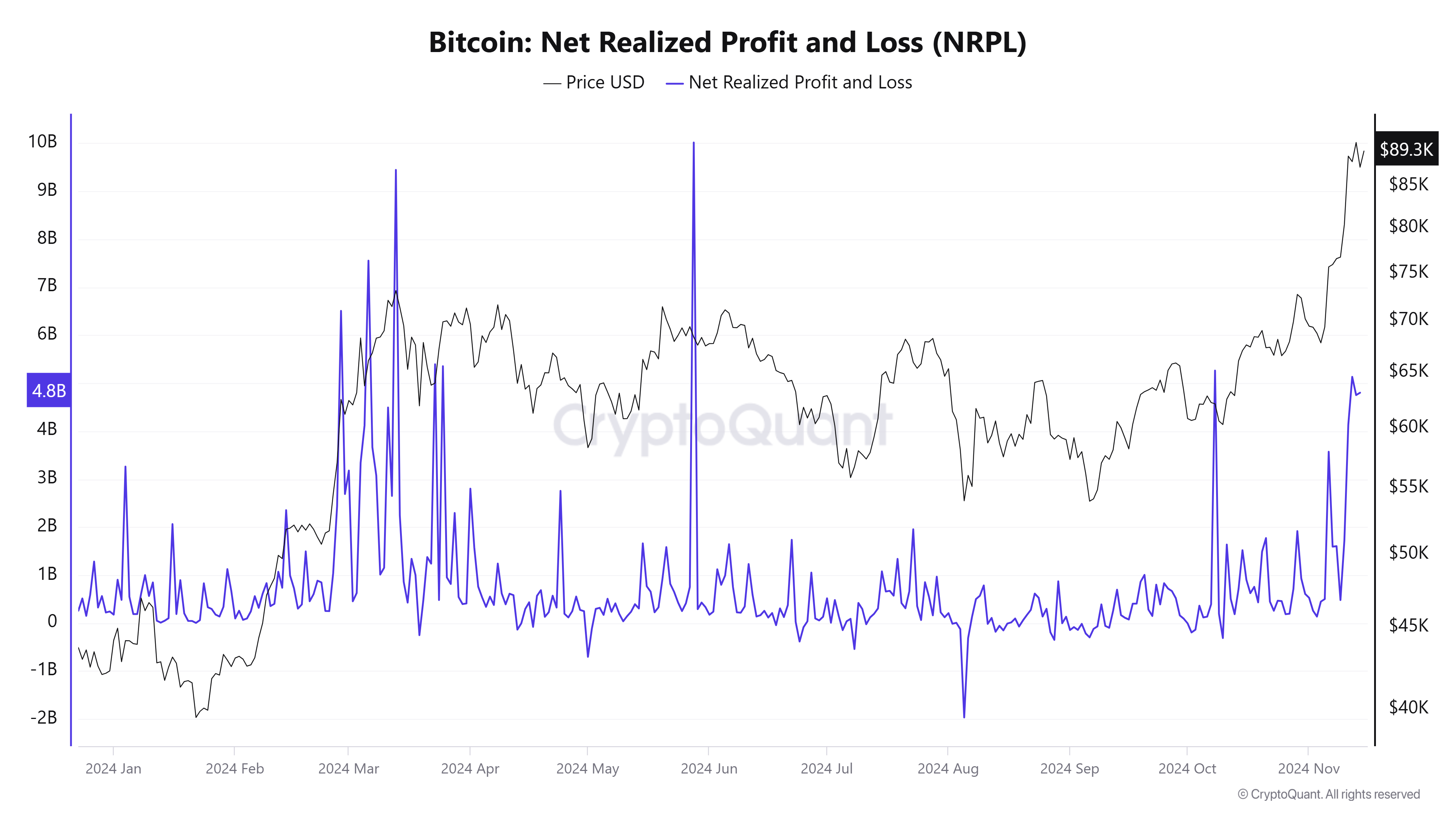

Since Nov. 12, the Bitcoin market has entered a part of serious profit-taking, with day by day realized earnings averaging round $5 billion — marking the best revenue ranges in over a month, based on CryptoQuant data.

On Nov. 12, Bitcoin traders recorded $5.1 billion in earnings because the asset traded close to $88,000. By Nov. 13, earnings declined barely to $4.75 billion however rose once more to $4.eight billion on Nov. 14, with Bitcoin’s value reaching a brand new all-time excessive above $93,000.

The exercise comes after Bitcoin’s current rally above $90,000, which was fueled by market optimism following President Donald Trump’s election win on Nov. 5. Many traders appear to be locking in positive factors after some of the spectacular runs in Bitcoin’s historical past.

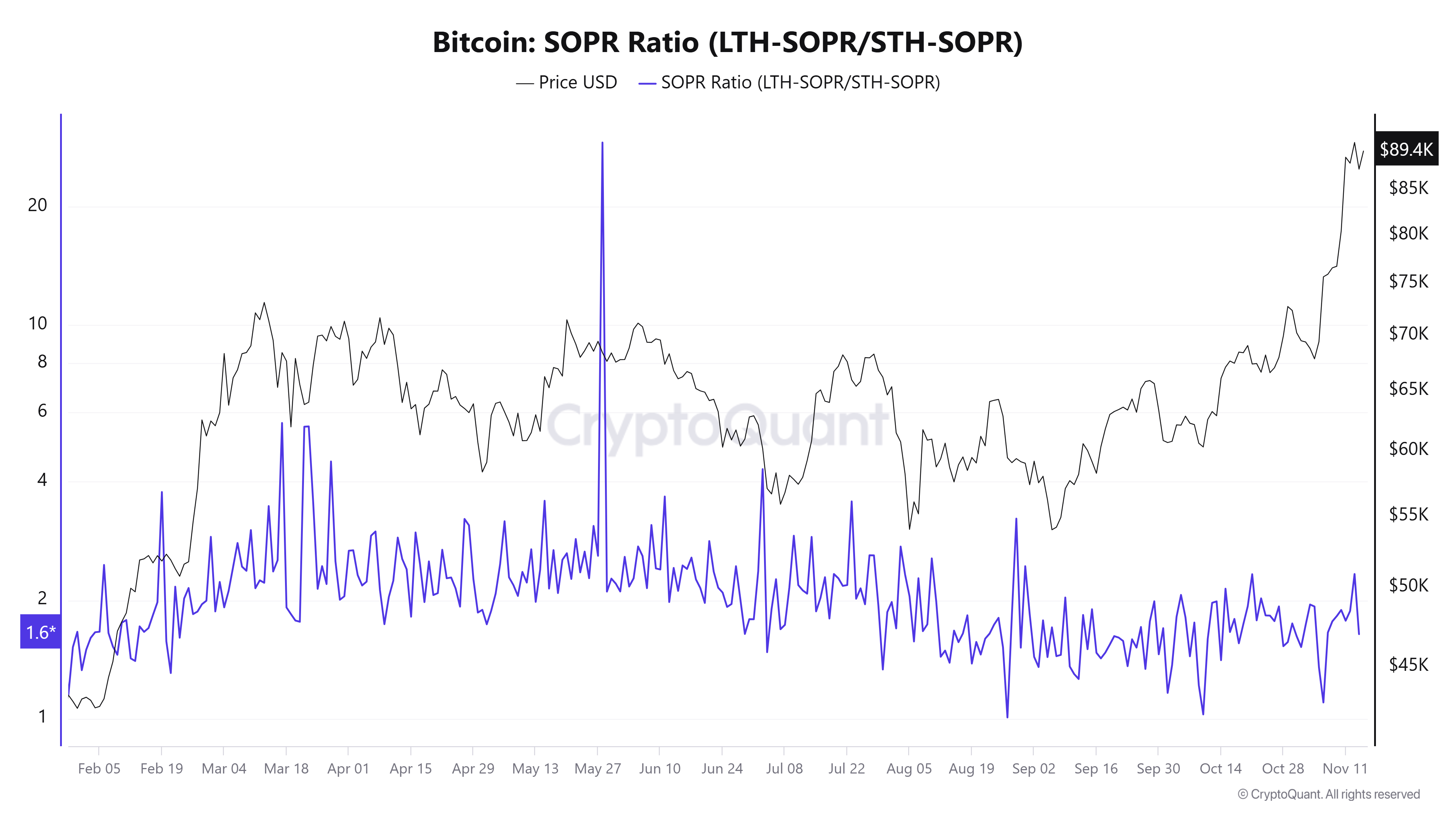

CryptoQuant’s spent output revenue ratio (SOPR) data suggests long-term holders are main the profit-taking. The SOPR metric, which measures realized earnings amongst completely different investor teams, spiked sharply on Nov. 13, reaching its highest level since August.

Traditionally, such traits typically point out a possible value peak or the beginning of a consolidation part.

More NFT News

Bitcoin Memecoins Emerge as Market Anticipates $100Ok Milestone

Past schedules and time zones: Can TradFi sustain with the 24/7 crypto revolution?

Poland presidential candidate desires to permit nation to carry Bitcoin with strategic reserve