The difficulties migrating digital property similar to bonds or NFTs with residual funds between completely different L1 or L2 chains

Authors: Andreas Freund, L2 WG Co-Chair, on behalf of the EEA Neighborhood Tasks L2 Working Group

Everyone knows that Web3 will rule the world, regardless of shoppers hooked on the web2 manner of immediate gratification furiously hitting (again) buttons and yelling at screens when their Ethereum transactions aren’t full after 2 seconds. L2s will give these shoppers their Pace for the Web3 world of tomorrow, at the moment.

L2s may give Fortnite nerds their favourite, uncommon in-game skins or weapons as NFTs that may be traded in or outdoors of the sport, producing eye-watering earnings. They will additionally present full privateness in asset buying and selling with esoteric zk-zk-rollups. Full privateness is a dream for all conventional finance asset managers and is frowned upon by world tax authorities.

So what’s to not love or hate or love and hate about L2s?

As our asset managers are excitedly creating L2 buying and selling accounts, they’re shortly confronted with the comparatively meager collection of monetary property that may be traded on L2s. Wish to transfer any of your debt devices from Ethereum’s Maker, Aaave, Compound, or Centrifuge? Nope! Annuities? Nope! Dividend-paying shares? Nope! How about transferring them to different Blockchains or transferring them from different Blockchains? Nope!

Nicely, you are able to do easy NFTs or tokens, or you’ll be able to create and commerce your debt devices instantly on an L2, however they are going to be caught there. At that time, our asset supervisor sighs, closes their laptop computer, and walks away. Since our asset supervisor represents about 40 Trillions USD of trades per quarter globally, and since extra advanced property comprise 95%+ of these trades, L2s can have a tough time taking up conventional finance, and thus proceed to develop exponentially for a protracted time frame, except they’ll deal with the market of digital property paying residuals.

The query is then why are these sorts of advanced digital property out there on Ethereum markets similar to Aave however can’t be moved to L2s?

Let’s take a step again and have a look at the present scenario. At the moment, the strategy of bridging digital property similar to ERC20 tokens or NFTs between networks – for instance, Ethereum <> L2, Ethereum <> Zksync, Ethereum <> Polygon – immobilizes the property on the origin community after which instantiates them on the goal community.

This method works nicely if the digital asset has no related enterprise guidelines that infer rights or obligations to asset homeowners similar to secure cash or easy NFTs. Examples of vital digital property that infer rights to the digital asset proprietor are residual funds/asset grants similar to dividend-paying equities, bonds, annuities, asset-backed securities, digital property with royalties, and many others.

Sadly, such digital property at the moment can’t be transferred between networks as a result of a switch would break the connection between the asset and the rights or obligations related to it.

Given the significance of digital property with residuals in conventional finance, the rising proliferation of DeFi property that mimic conventional property similar to bonds or asset-backed securities, and increasingly worth locked in bridges and L2s, there’s a important hazard that L2s will hit a development plateau as a result of they can not provide what a lot of the world needs to commerce.

So, what may very well be doable resolution approaches to this conundrum?

The reply is, not many … at the least but!

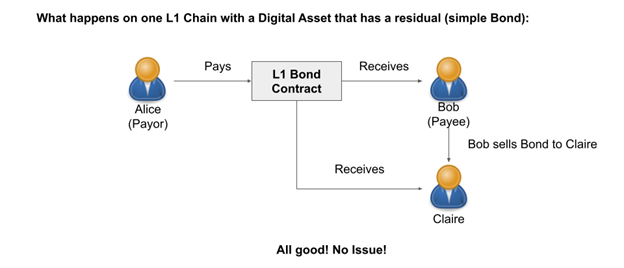

Determine 1: A easy bond on an L1 blockchain

Utilizing the straightforward instance of a Bond on Ethereum paying on a schedule in DAI (see Determine 1 above), we define among the challenges (in Determine 2 under):

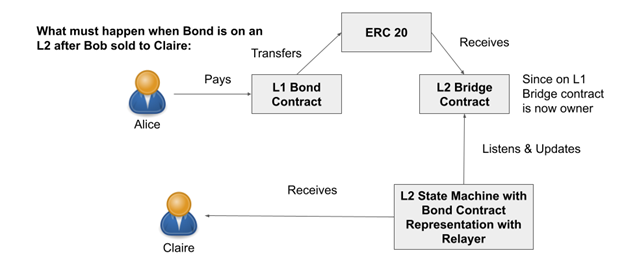

- Since Alice, the payer of the scheduled bond funds, is mostly unaware that Bob, the payee, moved a bond from Ethereum (L1) to L2, Alice would ship funds to the L1 Bond sensible contract with Bob’s Ethereum deal with. Since Bob is not the proprietor of the bond, however moderately the bridge contract is, the fee would fail.

- If the bond contract have been nonetheless conscious that Bob was the payee, then it might nonetheless settle for a bond fee, however the fee can be owned by the bridge contract.

- Subsequently, when the bond is locked within the bridge, the anticipated DAI bond funds have to be instantiated on the L2 aspect within the Bond contract, now with Bob’s L2 deal with being the proprietor of each the Bond token and the wrapped DAI

- Which means that when a fee is acquired into the Ethereum bond contract, the bridge community have to be notified in regards to the fee by way of an occasion and mint the fee quantity as wrapped DAI on the DAI bridge contract on the L2 aspect, for Bob. That’s problematic as a result of there is no such thing as a corresponding DAI within the bridge on the Ethereum aspect. In any case, it’s related to the Ethereum (L1) bond contract. Which means that Bob’s WDAI on L2 can be nugatory. Subsequently, the fee quantity in DAI can solely be minted as an Ethereum IOU within the L2 Bond contract, because the DAI can’t be taken out of the L2 bridge contract. Ergo, the DAI funds the bondholder receives are ineffective on the L2 aspect. That’s naturally not fascinating.

- If the bond is traded to Claire on L2, Claire is now eligible to obtain bond funds and Bob not is. That implies that after Claire bought the Bond, the bridge community should notify the L1 bond contract of the brand new proprietor for Claire’s fee to be acquired on the Ethereum aspect. That additionally implies that Alice must know that she must ship her bond funds listed to Claire and never Bob. And as soon as Claire receives a fee, the bridge community must create the identical Ethereum DAI IOU on the L2 aspect. And so forth for each possession change.

These open questions are for the straightforward case of a bond. Royalties for instance, the place the funds are principally unbiased of token possession and sometimes a couple of get together receives a portion of the fee, are much more advanced as a result of not all funds must be bridged. Nonetheless, the (internet current) worth of the digital asset relies on general fee flows.

Usually talking, it’s unclear easy methods to port advanced digital property between networks when the worth of the asset is dependent upon funds on the origin community however the asset is traded on the goal community.

A promising first try has been made to deal with this advanced problem with the GPACT protocol and Crosschain Protocol Stack, which is at the moment being developed throughout the EEA Crosschain Interoperability Working Group.

The newly formed EEA Community Projects L2 Working Group, with participation from the EEA, Matter Labs, Polygon, Offchain Labs, Accenture, VMWare, ConsenSys, Perun, Connext, Present, and the Ethereum Basis, has additionally taken up the problem and revealed an Eth Magicians and Eth Research submit on the topic, calling on the Ethereum neighborhood to solicit feedback and deal with this problem, and is collaborating with the EEA Crosschain Interoperability Working Group to see if the GPACT protocol could be efficiently utilized in a PoC to switch advanced digital property between L2 networks.

We’re inviting all events to affix us and deal with this vital problem for the complete public, enterprise, and Blockchain ecosystem collectively!

Discover out extra in regards to the EEA Community Projects right here. Be taught extra about changing into an EEA Member and you should definitely comply with us on Twitter, LinkedIn and Facebook for all the most recent.

More NFT News

EEA Trade Day at Devcon 2024 – Enterprise Ethereum Alliance

The State of L2 Bridges – 2024 replace – Enterprise Ethereum Alliance

Thanks Anaïs Ofranc and QualitaX – Enterprise Ethereum Alliance