This text was written by Andjela Radmillac and the interview was performed by Anastasia Chernikova, Editor-In-Chief of The Vivid Minds.

Vignesh Sundaresan won’t be a family identify simply but. Nonetheless, the serial entrepreneur has made its mark within the crypto trade with a pseudonym that may actually ring a bell—MetaKovan.

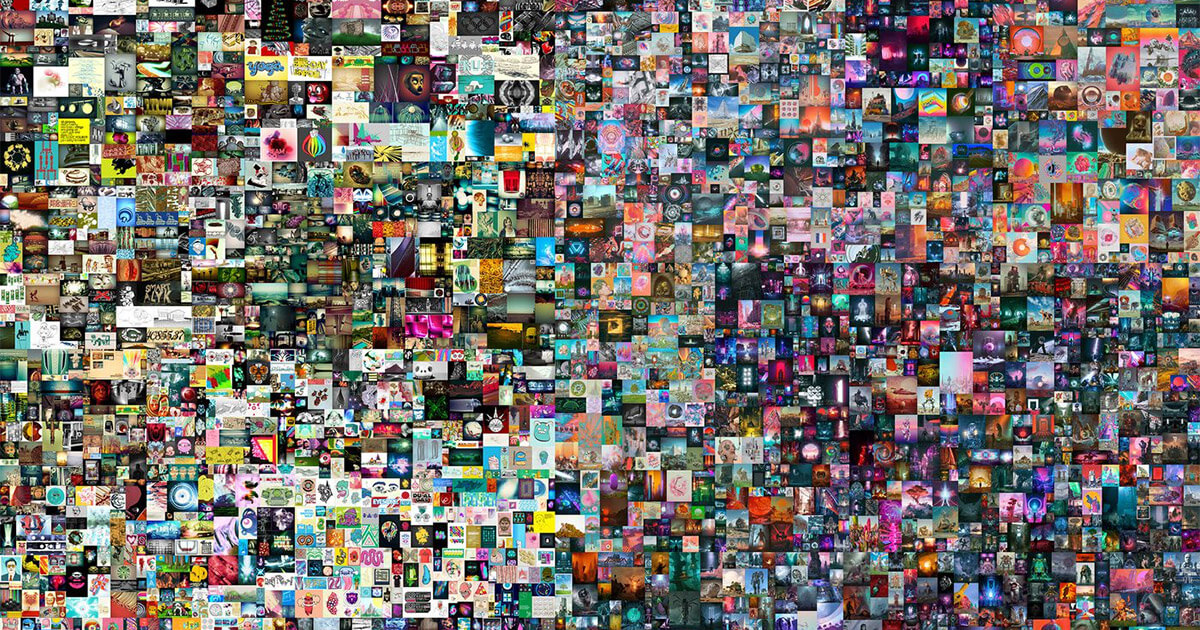

Nearly precisely a yr in the past, Sundaresan bought the world’s costliest NFT and the third costliest piece offered by a dwelling artist. His $69.three million buy of Beeple’s historic “Everydays: The First 500 Days” shocked the trade and was, at the least partly, accountable for propelling NFTs into the mainstream.

The street to Beeple actually is paved with good intentions

For months, the general public tried to wrap its head across the buy and determine the id of the individual that now owned the world’s costliest non-fungible token.

And whereas the id of MetaKovan, the pseudonym behind the acquisition, was rapidly revealed, the motivation behind the acquisition remained largely unknown. Within the days after the historic buy, Sundaresan defined that a part of his motivation to accumulate Beeple’s work was to indicate Indians and other people of shade that they might grow to be artwork patrons.

“Think about an investor, a financier, a patron of the humanities. Ten occasions out of 9, your palette is monochrome. By profitable the Christie’s public sale of Beeple’s Everydays: The First 5000 Days, we added a touch of mahogany to that shade scheme,” he said on the time.

Nevertheless, different elements have been additionally at play.

In an interview with CryptoSlate, Sundaresan stated he considered the acquisition as an funding in himself as he felt that he was making historical past.

“I’m pleased to be a part of the rationale why NFTs are recognized worldwide. And to present again to the system that offered a lot to me,” he instructed Anastasia Chernikova.

The wealth Sundaresan acquired within the crypto trade stays largely unknown. He notes that he solely invests in initiatives he believes in and is just within the undertaking’s success. The cash, he believes, got here as an afterthought.

He first acquired concerned with the crypto trade all the best way again in 2013, when he was searching for other ways to ship cash. Bitcoin, then a comparatively obscure new sort of forex, offered itself as an ideal answer to getting cash programmable.

After reaping success by providing escrow providers for Bitcoin funds, Sundaresan based Cash-e. The timing was excellent—the 2013 bull run introduced in 14,000 customers to the change in six months. By subsequent summer time, he offered the change for $160,000, which he rapidly poured into one other undertaking. He co-founded BitAccess, a Y-Combinator-backed undertaking that went on to put in a whole bunch of Bitcoin ATMs around the globe.

His quest for promising initiatives led him to Ethereum in 2016, when he invested a big sum of money in its ICO.

“I used to be extra serious about creating and impacting the world, and I used to be loyal to the know-how. At that time, retaining the cash was about not waving my thoughts, however clearly, it looks like a smart move now.”

“I by no means thought it could attain $100, a lot much less $1,000. I wished to be a part of the group. I keep in mind celebrating when ether was $15 as a result of we thought that Ethereum had made it, not as a result of we grew to become wealthy. That’s the sensation that I nonetheless carry,” he stated.

That very same feeling will most definitely stop him from ever promoting Beeple’s work, he later famous.

There’s additionally the issue of sentimental worth—Sundaresan defined that the story behind Beeple’s work was what attracted him and led him to outbid Tron’s Justin Solar within the Christie’s public sale.

“It was the labor of the work that attracted me greater than the ability or expertise or inventive potential,” he stated of Beeple’s work, which accommodates 5,000 illustrations that have been 13 years within the making. “It spoke to me as a result of precisely 13 years in the past I didn’t have any cash. I began coding so I felt prefer it was just like my journey – beginning with nothing and ending up with one thing stunning due to onerous work. I appreciated it for that greater than its inventive depth or anything.”

The way forward for NFTs is shiny and thrilling

Other than immense wealth, the rise of NFTs has additionally created a schism between its traders. First inhabited by a close-knit group from the artwork world, the NFT area now hosts all kinds of traders, most of whom see them as a bottomless pit of cash.

This has created a wholly new class of NFT initiatives—hype initiatives—which noticed particular person NFTs offered for tens of hundreds of thousands of {dollars} and billions in buying and selling quantity. A lot of these NFT initiatives are normally those that discover their method into mainstream media, as information about pixelized Twitter profile pictures offered for $23 million tends to draw probably the most consideration.

That spotlight, Sundaresan says, doesn’t profit the broader NFT ecosystem. As an alternative, they paint an image of exclusivity and make the area appear like it’s solely reserved for the richest, going towards every little thing the trade stands for.

“I’m not a fan of Cryptopunks, the Yacht Membership, and different PFP (photo-for-profile) initiatives. I don’t wish to be a part of unique golf equipment anymore. As an alternative, I wish to be a part of inclusive golf equipment and produce extra folks in and create a system the place they get collectively and admire one thing. So I personally have stayed away from them.”

That doesn’t imply that there isn’t a phase of the market PFP initiatives have been designed to satisfy. Nevertheless, the initiatives themselves most definitely received’t final by way of one other crypto winter.

“There can be developments, and they’re going to go, and different developments will come up. I believe initiatives with unfair distribution will not be everlasting, and nobody can cease the brand new and higher initiatives, which is able to grow to be extra frequent. I’m within the various to PFP initiatives.“

Regardless of his quest for fulfilling and promising initiatives, Sundaresan claims that even he’s not proof against FOMO.

“You can not keep away from FOMO even when you have every little thing on this planet. FOMO is a frame of mind.”

Any fears of lacking out are rapidly remedied, although. He notes that anytime he feels envious of the cash being made in a hype undertaking, he tries to see the place the undertaking can be in a number of years.

“And if I don’t imagine in it, I’ll sit it out,” he defined. “For instance, I’ve by no means touched Cardano or Solano, as a result of I don’t agree with their token distribution. And I’d really feel ‘oh, man, if I purchased in, I might have made that cash,’ however then I might have forgotten my rules.”

His rules state that not every little thing within the crypto trade must be seen as an funding—particularly not NFTs. The development of shopping for NFTs to generate income off of them will change quickly, he stated, because the trade begins including extra utility to them. Individuals will expertise the artwork of their NFTs in lots of new methods because the asset class strikes away from wallets and will get extra intertwined with the true world.

Turning into a bigger a part of the true world will result in an entire new set of issues, the most important one being regulation. Nevertheless, Sundaresan believes that any efforts to control the digital NFT world can be futile, to say the least. The quick growth tempo we’ve all been accustomed to within the crypto trade signifies that it is going to be unattainable for governments and regulators to catch up.

“It is going to take three years for regulators to place a legislation into power, and by then, the crypto group will already be doing one thing else. You may regulate the off-ramps and the on-ramps, which is okay. However banning one thing that you just don’t perceive is mistaken. When politicians determine find out how to regulate NFTs, one thing else will come up. And I do not know what’s going to be subsequent. Regulation has at all times lagged behind innovation, and I believe that’s a part of the design.”

This interview was performed by Anastasia Chernikova, Editor-In-Chief of The Vivid Minds, a media devoted to tales about how leaders overcome challenges and transfer ahead.

More NFT News

Marathon and Hut Eight scoop up $1.6 billion price of Bitcoin throughout market dip

Osprey Funds Launches First US Publicly Quoted BNB Belief

Will Binance's BNB Attain $1000? Worth Prediction Amid Authorized Challenges in Australia