Around the Block sheds mild on key tendencies in crypto. Written by Connor Dempsey, sourced from the work and insights from all the workforce at Coinbase Ventures & Corp Dev

TLDR:

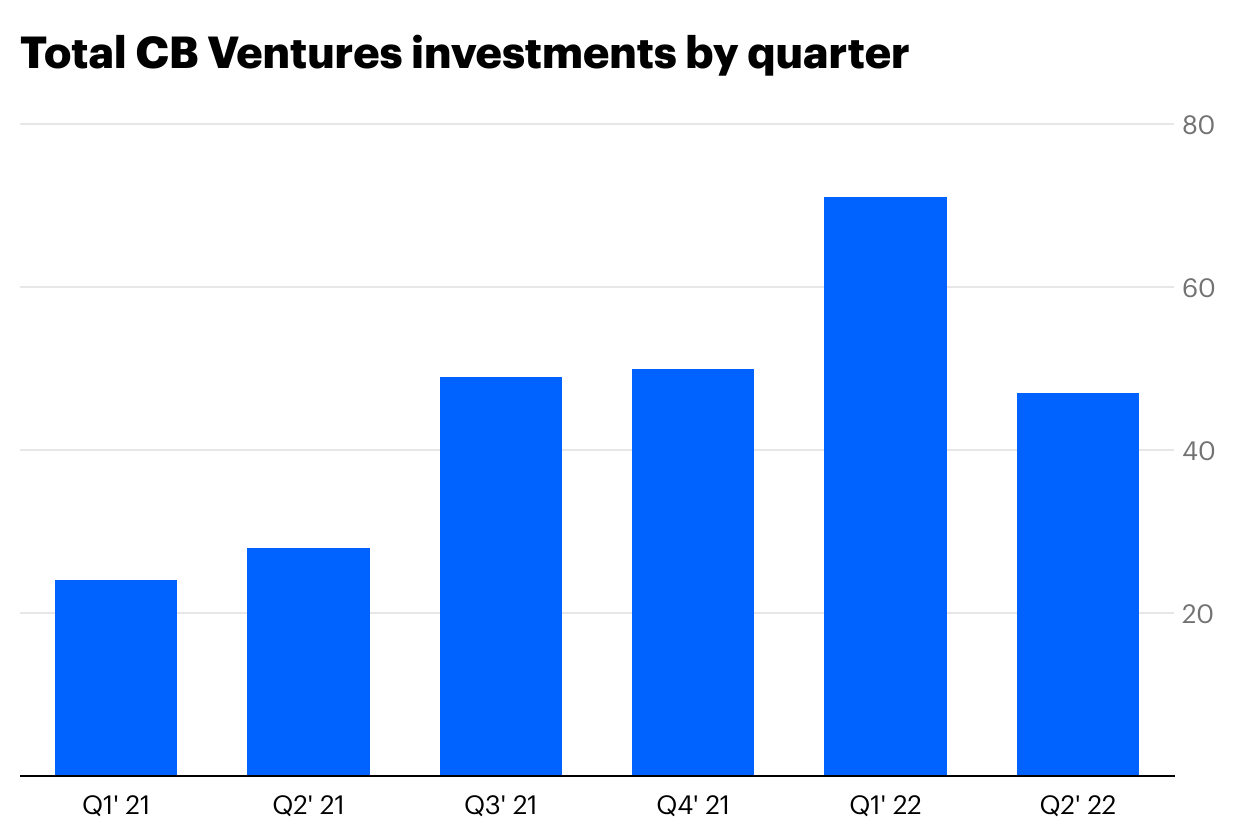

- Coinbase Ventures deal exercise mirrored the general tempo of the enterprise panorama, down 34% QoQ. Exercise remained up 68% YoY, reflecting the regular progress of our enterprise apply over the previous 12 months

- Among the many key tendencies noticed, we imagine that Web3 gaming will onboard the following large wave of crypto customers, with skilled founders from Web2 gaming persevering with to pour into the area

- We’re enthusiastic about Web3 person purposes working to upend the captive fashions of Web2 and provides customers management over their audiences and communities

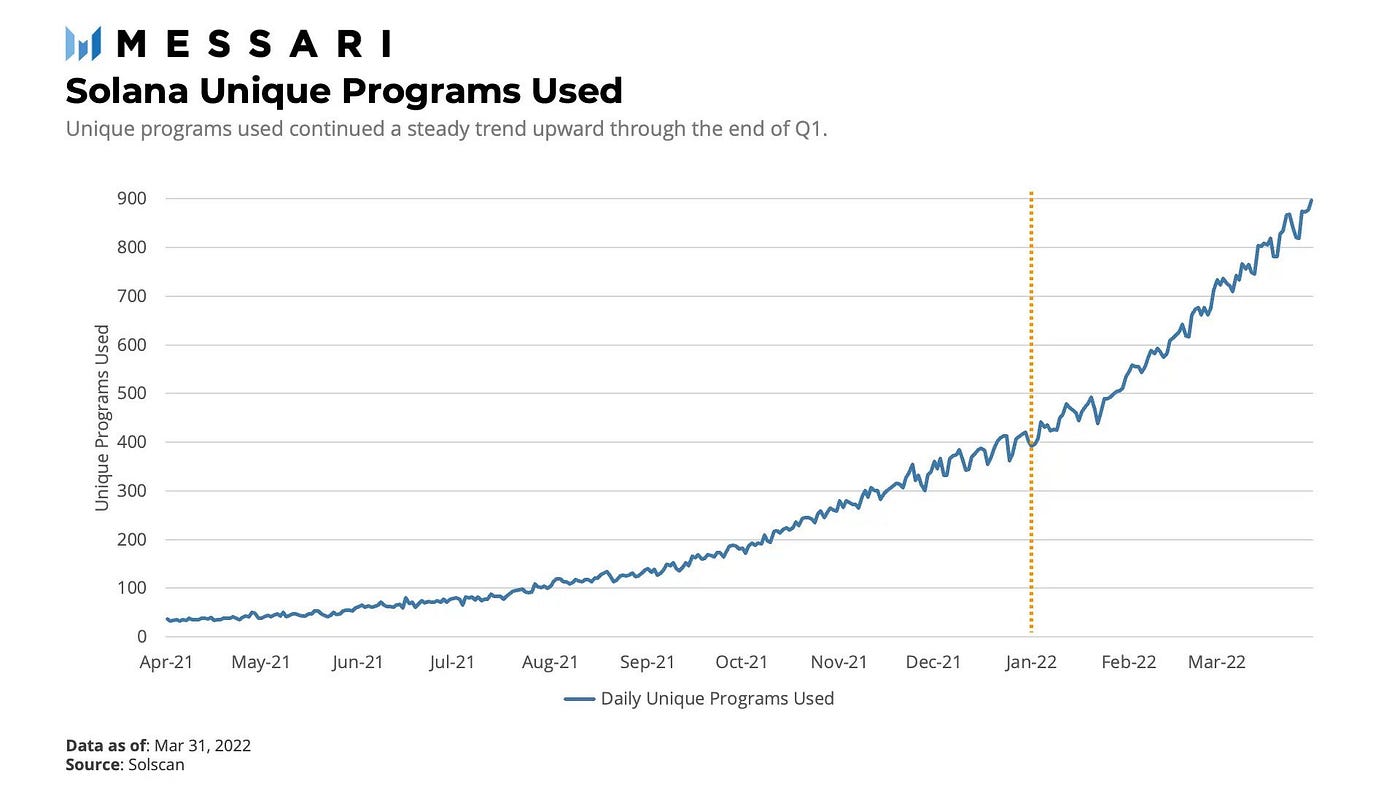

- The Solana ecosystem continues to point out spectacular momentum and developer traction

- Huge UX enhancements are coming to crypto that may obfuscate away complexity and ship experiences on par with Web2

- The USA continues to be dwelling to the majority of corporations in our portfolio, with Singapore, UK, Germany, and India all establishing spectacular innovation hubs

- The place CeFi lenders faltered this 12 months, DeFi lending platforms have been resilient

- Present value motion apart, we stay satisfied that the chance inside crypto and Web3 are far better than most notice.

The primary half of 2022 was turbulent for all markets. The Dow and S&P had their worst first halves since 1962 and 1970. The NASDAQ had its worst quarter since 2008. Bitcoin had its worst quarter since 2011, DeFi TVL ended down 70% from its excessive, and June NFT gross sales slumped to ranges not seen in a 12 months.

A core a part of the crypto market chaos stemmed from the collapse of the $60B Terra ecosystem in Might. This contributed to the implosion of a $10B crypto fund (Three Arrows Capital) that had leveraged publicity to Terra together with a number of different trades that moved towards them (GBTC, stETH). Subsequent, it was revealed that Three Arrows Capital had borrowed closely from a few of the largest centralized lenders in crypto. Unable to recoup these loans, a number of of those lenders have been pressured out of business.

The macro market downturn seeped into the enterprise panorama as effectively.

Enterprise panorama

The broader enterprise market started to point out indicators of cooling in Q1, with whole funding dropping for the primary time since Q2 2019. That pattern continued in Q2, with whole enterprise funding dropping 23%, marking the biggest dip in a decade. The quarter additionally noticed later stage corporations like Klarna raising down rounds; an extra signal of the instances.

Crypto enterprise funding nonetheless noticed a report Q1, however as we wrote in our last letter, we’d already begun seeing indicators of a slowdown that we anticipated to floor in Q2. Certain sufficient, data from John Dantoni at The Block confirmed that crypto enterprise funding {dollars} decreased 22%: the primary down quarter in two years.

In Q2, Coinbase Ventures continued to rank among the many most active investors in crypto, but additionally noticed deal place sluggish, with the entire depend reducing 34% QoQ, from 71 to 47. Regardless of the slowdown in comparison with the fervent tempo of late 21 and Q1 22, our Q2 exercise nonetheless elevated 68% YoY; indicative of the general progress of our enterprise apply.

The decline largely mirrored the general market circumstances — with volatility within the markets, we noticed many founders rethink or put their rounds on pause, significantly on the later levels. We’re seeing that many corporations are foregoing a fundraise until completely needed, and even then, provided that they really feel assured that they’ll present the expansion wanted to justify a brand new spherical.

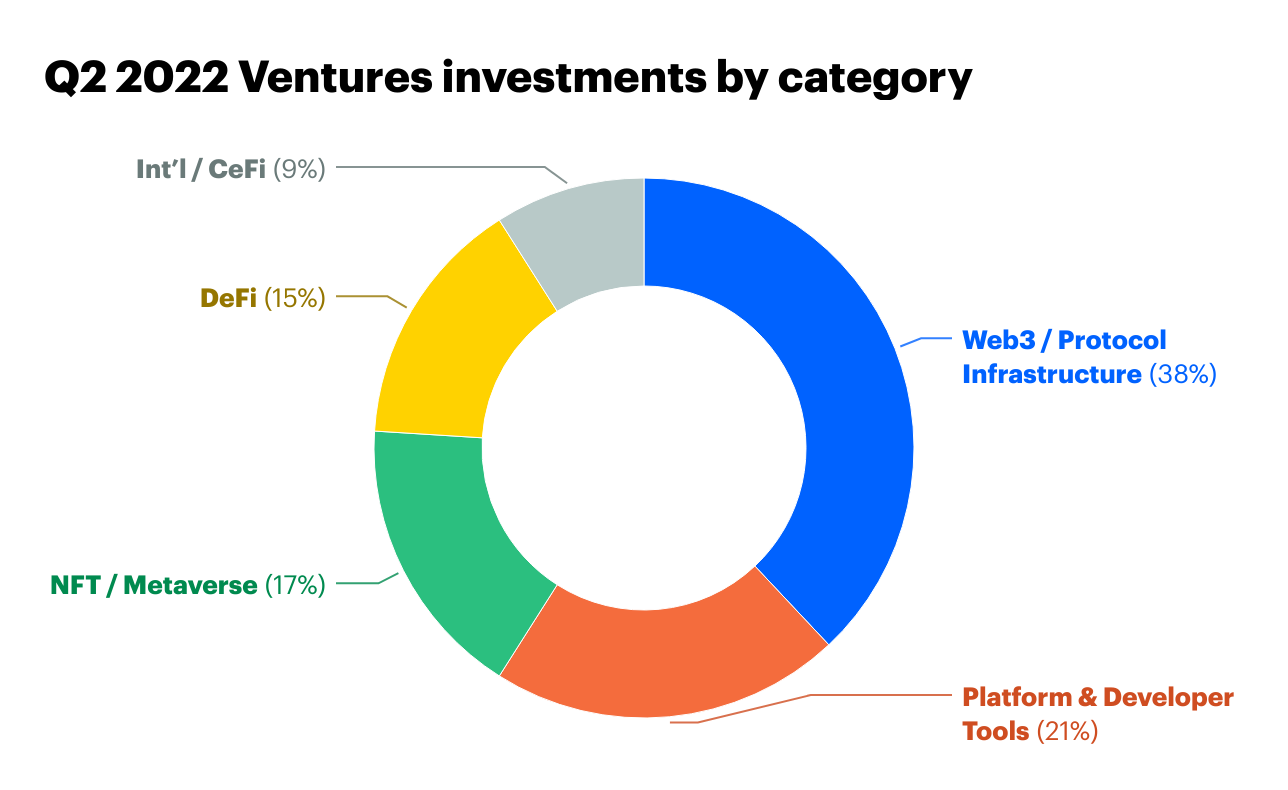

Gloomy macro atmosphere apart, there are nonetheless loads of top quality founders elevating on the seed stage, the place we’re most lively. Wanting past the worth motion on the areas that we invested in exhibits the vary of actual utility that’s persevering with to be constructed and paints a promising image of the longer term: one with a vibrant array of Web3 person purposes, improved UX, strong DeFi markets, scalable L1/L2 ecosystems, and the entire instruments builders must construct the following killer app.

Right here’s how our exercise broke down over Q2.

Now, let’s take a look at some themes that stood out. (* denotes Coinbase Ventures portfolio firm)

The approaching period of blockchain gaming

With the meteoric rise and subsequent fall of Axie Infinity exercise, many pundits have been gleefully fast to dismiss blockchain gaming as a passing fad. As we wrote in September, Axie was experiencing a constructive suggestions loop that would flip unfavorable ought to the fervor driving the sport die down, which is finally what occurred. Regardless, Axie posted almost $1B in gross sales in a single month and attracted 2M DAUs with basically zero advertising price range. This put all the gaming world on discover to the facility of this new vertical.

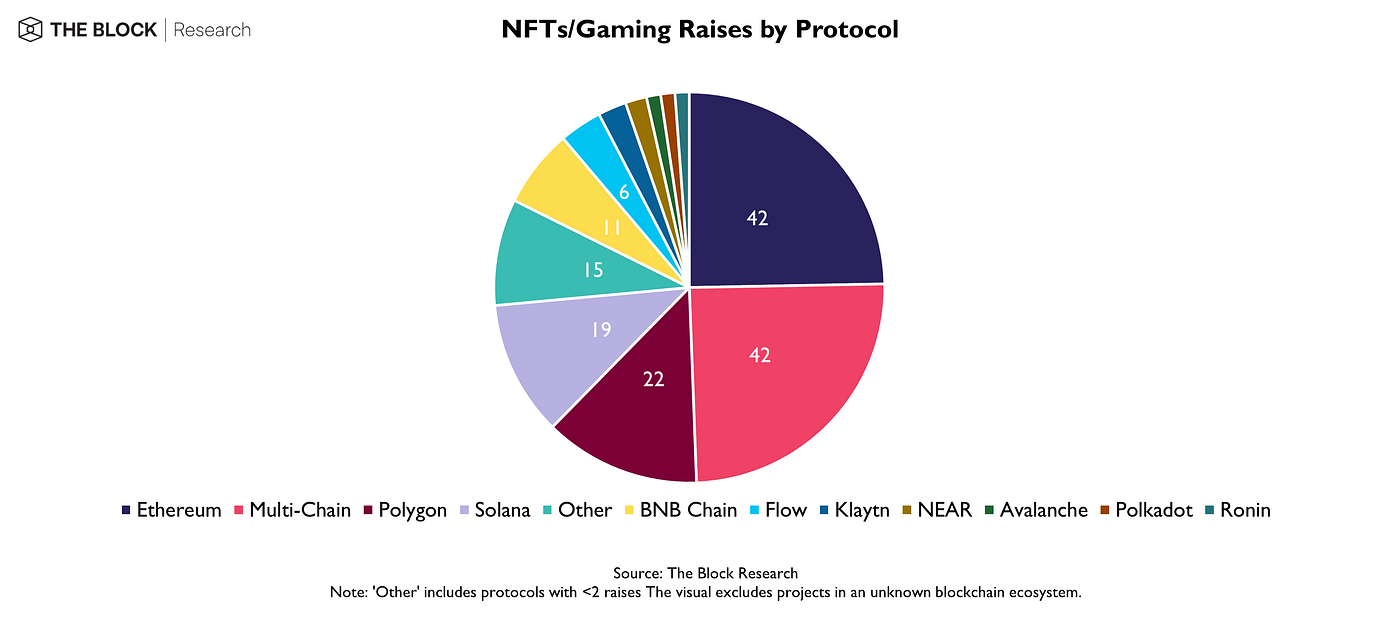

With an estimated 3.2B+ gamers on this planet, we strongly imagine that Web3 gaming will onboard the following large wave of crypto customers. Web3 gaming remained a sector of heavy funding in Q2, with The Block estimating that $2.6B+ was raised. Our exercise over the previous couple of quarters solely strengthens our conviction.

As we noticed in Q1, founders with sturdy observe data in Web2 gaming proceed to embrace this class. For instance, Azra games*, was based by the creators of the $1.4B+ cellular blockbuster Star Wars Galaxy Heroes. Their aim is to construct a fight RPG recreation with a strong in-game economic system that may nonetheless garner mainstream enchantment. The area has additionally attracted Justin Kan, co-founder of the sport streaming platform Twitch, which was sold to Amazon for $1B. Kan’s new firm, Fractal*, is constructing a market for NFT gaming property.

Firms like Venly* will add gas to the hearth with a collection of instruments that permit Web2 recreation builders seamlessly make the leap into Web3. Established gaming powerhouses are even beginning to come round, with Fortnite creator Epic Video games now permitting NFT based games into its recreation retailer.

It is going to take a while for this sector to mature, but it surely’s rising more and more clear that blockchain gaming might be a large class sooner or later. Anticipate an elevated deal with sustainable economics and gameplay that infuses NFTs with extra acquainted Web2 gaming experiences.

Rewiring Web2

Past gaming, the following era of Web3 person purposes are working to upend the captive fashions of Web2 and to provide customers management over their audiences and communities. One firm we’re significantly enthusiastic about is Farcaster*: a sufficiently decentralized social community based by Coinbase alumns Dan Romero and Varun Srinivasan. Their early product resembles Twitter, however with the important thing distinction of letting customers personal the connection with their audiences.

Farcaster is an open protocol, much like e-mail (SMTP). Whereas Farcaster has constructed the primary social app on the protocol, different builders can construct competing purchasers, identical to we now have Gmail and Apple iCloud. When you can’t take your Twitter followers with you to TikTok, somebody may construct a TikTok equal on the Farcaster protocol, and Farcaster customers can take their followers with them to a brand new, differentiated platform. Not solely can customers preserve higher possession of their viewers, but it surely additionally opens the door for extra aligned monetization. The place most promoting spend goes on to Twitter, Instagram, and so on, Farcaster customers with massive followings can monetize their audiences immediately throughout platforms.

One other funding we’re enthusiastic about is Highlight.xyz*, which sits on the burgeoning intersection of Web3 and music. Spotlight will let musicians create their very own web3-enabled fanclubs / communities (no coding needed), full with token gating, entry to NFT airdrops, merchandise and extra. Spotlight joins different CBV portcos like Audius*, Sound.xyz*, Mint Songs*, and Royal*, all providing musicians new avenues for connecting with and monetizing their fanbases.

All advised, we stay enthusiastic about Web3’s potential to reimagine entrenched Web2 fashions for social media, music, and extra, and finally return energy to creators.

Solana dawn

Noticeable in our Q2 exercise was the continued momentum behind the Solana ecosystem. Whereas Ethereum and the EVM stay king so far as developer traction and appropriate apps, we’re noting a transparent pattern in early groups putting significance on Solana. All in, we did 10 offers constructing on Solana in Q2.

On condition that Solana sensible contracts are coded in Rust versus the EVM’s Solidity, founding groups typically select between constructing in a single or the opposite. More and more, we’re seeing groups choose to help each the EVM and Solana from the onset — like current additions in Coherent and Moralis. We’ve seen others begin on EVM and choose to completely transition to Solana whereas the above talked about Fractal opted to construct on Solana from the onset.

Add in the truth that a number of massive funds have publicly expressed help for the ecosystem, and it means that Solana’s endurance is actual. Chain liveliness nonetheless (the power for Solana to stay on-line) stays a problem that’s paramount for the Solana workforce to resolve.

The UX of All the things

An general clunky and disjointed crypto person expertise has lengthy been a hurdle for adoption. Consider what a person has to do to execute a typical transaction: convert fiat to crypto, switch crypto to a pockets, bridge crypto to their community of selection, after which lastly execute a transaction.

In Q2, we’ve invested in a number of groups (not but introduced) engaged on streamlining and verticalizing all the retail transaction journey. Quickly builders constructing in crypto and Web3 will be capable to deploy all the transaction stack with a number of easy strains of code and commonplace set of APIs.

The top outcome might be a future the place, for instance, a person can execute a DEX transaction in a single click on. Within the background, fiat might be transformed into crypto, moved to a pockets, bridged to an L1/L2, earlier than executing the swap and custodying the asset of their pockets of selection. The entire complexity might be obfuscated away and we’ll have person experiences on par with Web2 — a large unlock.

The place are the buidlers?

This quarter we took a take a look at the place the founding groups we’ve invested in are primarily based. Whereas crypto is a world trade, considerably unsurprisingly, the biggest focus of our founding groups hail from the US — dwelling to 64% of our 356 portfolio corporations; all of the extra purpose for regulators to foster quite than inhibit this quick rising sector.

Singapore has established itself as the bottom of most of the groups constructing in Asia. In the meantime, the UK and Germany are dwelling to rising hubs, with coverage makers proactively working in direction of regulatory clarity. We proceed to be impressed by founding groups in India, who we anticipate to play a significant position in the way forward for crypto adoption (CBV portfolio firm Frontier, with 30 engineers in India has constructed a beautiful mobile-first DeFi aggregator supporting 20+ chains and 45+ protocols).

This quarter, we have been additionally excited to again 5 groups based by former Coinbase staff, together with the aforementioned Coherent and Farcaster, in addition to three others not but introduced. We’re proud to proceed to help staff who obtain a world class crypto schooling at Coinbase and go on to discovered world class corporations and initiatives.

Wrapping up

Whereas there’s loads to be enthusiastic about sooner or later, there are additionally loads of classes to be discovered within the current. The present crypto crises is much like these we’ve seen play out in conventional finance. The opaqueness that centralized lenders and Three Arrows Capital operated beneath resulted in an incapacity for lenders to correctly consider the chance of their counterparties. Lenders didn’t understand how a lot the others had lent to 3AC, nor did they understand how a lot leverage and threat 3AC was taking over. Traders didn’t understand how a lot threat they have been uncovered to altogether. When the market moved towards each the lenders and 3AC, lenders have been left with large holes of their steadiness sheets, and buyers have been left holding the bag.

Nevertheless in distinction to the centralized lenders dealing with insolvency, it’s necessary to notice that blue chip DeFi lenders Aave, Compound, and MakerDAO operated and not using a hitch. Each mortgage and its phrases remained transparently on-chain for all to see. When collateralization ranges fell beneath thresholds, collateral was offered through autonomous code and lenders have been paid again. This similar code additionally dictated that Celsius was pressured to pay back $400M in loans to Aave, Compound, and MakerDAO — no courtroom order wanted (although overcollaterization performed a task). All advised, it served as a strong proving level for decentralized finance.

That’s simply to say that it could be straightforward to get discouraged by the present value motion whereas forgetting simply how far we’ve are available a brief interval. When the final bear market hit, the preferred person utility was Crypto Kitties. Lately, there are extra profound, impactful improvements than we will depend. DeFi, NFTs, a wealthy DAO ecosystem, all happened within the final two years, and even got here collectively to make a real impact on the world stage. In the meantime, layer2 scaling solutions are lastly right here, and might take us from the dial-up to broadband part, able to supporting a wealthy array of person purposes with easy UX as well.

As in earlier downturns, detractors are as soon as once more confidently saying crypto dead. Nevertheless, from our seat within the trade, we’re invigorated by the sensible founders we see working tirelessly to maneuver this expertise ahead. As all the monetary system and world digitizes itself, we stay satisfied that the chance inside crypto and Web3 are far better than most notice.

More NFT News

EEA Trade Day at Devcon 2024 – Enterprise Ethereum Alliance

The State of L2 Bridges – 2024 replace – Enterprise Ethereum Alliance

Thanks Anaïs Ofranc and QualitaX – Enterprise Ethereum Alliance