OpenSea sees their buying and selling quantity decline 13% to $303 million, its lowest stage since June 2021, as different NFT marketplaces take a slice of its income.

The secondary NFT marketplace is experiencing low volumes regardless of onboarding collections from Ethereum layer-two answer Arbitrum in Sep. 2022.

OpenSea and main NFT collections undergo

OpenSea’s buying and selling quantity is down 94% since hitting an all-time excessive of $4.86 billion in Jan. 2022. Data from Dune Analytics additionally exhibits a decline of about 86% within the ETH buying and selling quantity for the reason that starting of the 12 months. OpenSea helps NFTs from a number of blockchains, together with Ethereum, Solana, Avalanche, and Klatyn. Layer-two answer Arbitrum recently announced that its NFTs can be listed on OpenSea.

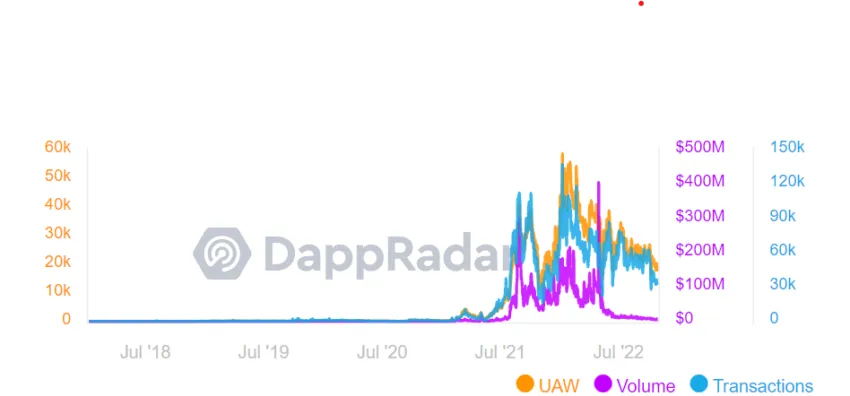

Transaction data from DappRadar additionally exhibits a pointy decline in NFT transactions on the secondary market from over $406 million in Might 2022 to $7.63 million at press time, a drop of 98%.

The price floor for the Bored Ape Yacht Club NFT assortment, the NFT assortment with the very best gross sales quantity of all time, has dropped from a peak of 144.9 ETH on Might 1, 2022, to 64.7739 ETH at press time. CryptoPunks, one other standard NFT assortment, has seen its value flooring drop from round 122 ETH on Aug. 30, 2021, to 100 ETH.

Bear market responsible?

This downtrend is consistent with a new Activate Technologies report that suggests the hype section for NFTs is over. The variety of adults 18 or older shopping for NFTs declined from 76% in 2021 to 51% in 2022. This knowledge is backed up by a current report by Binance Analysis, suggesting {that a} decline in OpenSea customers is a symptom of the broader decline in cryptocurrency markets, which prompted buyers to get rid of riskier and extra speculative asset courses.

NFT analyst NFTkek stated that the variety of NFTs minted had decreased within the final month, suggesting that NFT artists are creating fewer collections.

OpenSea additionally faces a rising risk from multichain marketplaces like Magic Eden. Magic Eden started as a market for NFTs minted on Solana. It has since expanded its product providing. Its vary contains Ethereum NFT collections like ArtBlocks, Otherdeed for Otherside, the Bored Ape Yacht Membership, and CryptoPunks. Common social media web site Reddit has additionally seen an explosion of curiosity in its NFT assortment, with users creating 3 million wallets.

Whereas difficult for marketplaces like OpenSea, multichain listings profit the tip consumer. It’s because there’s a risk of trading NFTs throughout completely different blockchains, enhancing the liquidity of the NFTs and doubtlessly growing their worth. Customers might flip to different blockchains on a market providing decrease charges than the Ethereum community.

At press time, CryptoPunks had the highest Ethereum NFT trading volume of 881,800 ETH on Magic Eden.

For Be[In]Crypto’s newest Bitcoin (BTC) evaluation, click here

Disclaimer

All the data contained on our web site is printed in good religion and for normal info functions solely. Any motion the reader takes upon the data discovered on our web site is strictly at their very own threat.

More NFT News

Marathon and Hut Eight scoop up $1.6 billion price of Bitcoin throughout market dip

Osprey Funds Launches First US Publicly Quoted BNB Belief

Will Binance's BNB Attain $1000? Worth Prediction Amid Authorized Challenges in Australia