The most important information within the cryptoverse for Nov. 10 contains SBF planning to boost funds to bailout FTX and make customers complete, SEC chairman Gary Gensler advocating for extra investor safety following FTX collapse, and Sequoia Capital writing off its over $200M funding in FTX as nugatory.

CryptoSlate High Tales

Leaked slack messages show SBF plan to raise funds for FTX bailout

In line with leaked slack messages reportedly despatched to FTX workers, Sam Bankman-Fried plans to boost extra funds to repay clients and traders affected by the collapse.

SBF added that FTX worldwide could merge with FTX US to extend its liquidity and fund operations.

Sequoia writes-off over $200M FTX investment as ‘worthless’

VC agency Sequoia had earlier invested about $63.5 million into FTX and FTX US earlier than the crypto trade began struggling.

In gentle of the FTX collapse, Sequoia knowledgeable its traders that it was writing off over $200 million as unhealthy debt to FTX.

SBF seeks to raise liquidity for FTX International; funds to go “straight to users”

FTX’s CEO Sam Bankman-Fried (SBF) in a Nov. 10 tweet apologized for exceeding customers’ deposit margin which brought on the FTX collapse. Consequently, FTX had the next worth of belongings than person deposits.

SBF stated he was exploring all doable choices to boost funds and liquidate present collateral in order to refund customers affected by the collapse.

Crypto markets rocked as stablecoin reserves deplete, Curve 3pool concentrated by USDT, 60k BTC leaves Binance, Alameda shorts USDT

Following stories that Binance pulled away from saving FTX because of an $Eight billion gap in FTX’s stability sheet, Binance revealed its Proof of Assets, which revealed that Binance held roughly $18.three billion value of belongings in its reserve

Nonetheless, the FTX collapse is posing some liquidity points for stablecoins. The Curve 3pool grew to become unbalanced, because the USDT, DAI, and USDC balances adjusted to 84%, 8%, and eight% respectively. Rumors additionally emerged that FTX’s Alameda was seeking to dump about $550,000 value of USDT.

With the rising worry, uncertainty, and doubt rocking the crypto market, some Bitcoin holders moved to withdraw about 60,000 BTC from exchanges, indicating a sentiment to dump their belongings to keep away from additional contagion.

SEC’s Gensler says more investor protection is needed after FTX fiasco

The securities and trade fee (SEC) Chairman Gary Gensler informed CNBC that he had warned crypto exchanges together with Sam Bankman’s FTX that non-compliance with regulatory legal guidelines would undermine investor safety.

Gensler reiterated that one of the simplest ways forward can be for crypto exchanges to be duly registered with the regulators, in order to guard traders and stop market crises attributable to huge gamers, who “co-mingle” to commerce towards their clients.

Solana postpones token unlock amid double-dip fears, developers unaffected

By design, Solana was purported to unlock about 18 million SOL tokens between Nov. 9 and Nov. 10. Nonetheless, as a result of FTX ecosystem collapse, Solana has postponed the unlock date until Nov. 12, in order to scale back the sale strain on Solana’s struggling token (SOL).

Counterintuitively, the staking unlocks for Solana builders have been accomplished immediately, which noticed about 353,687 SOL tokens launched into the market.

Bitcoin spikes to $17,800 on better than expected CPI data

The FTX collapse of Nov. 9, noticed Bitcoin fall to a 103-week low of about $15,600. Lower than 24 hours later, Bitcoin spiked by 7.5% to commerce at $17,800 in response to the discharge of October’s Shopper Value Index (CPI) knowledge.

The market had anticipated a report of a few 7.9% rise in inflation, nevertheless, the October CPI knowledge revealed that inflation sits at 7.7% year-on-year.

Kraken’s Jesse Powell says crypto community should ‘raise standards’ to put end to bad actors

Kraken‘s founder Jessee Powell in response to the FTX collapse stated that the crypto neighborhood although open-minded and trusting ought to undertake strict requirements in verifying crypto initiatives earlier than selling them.

Powell known as on enterprise capital corporations to be strict with their due diligence course of earlier than backing any mission and endorsing them to the general public.

The Kraken chair added that the U.S. regulators want to supply a transparent regulatory framework for crypto companies to function and provide their providers in a supervised method.

Analysis Spotlight

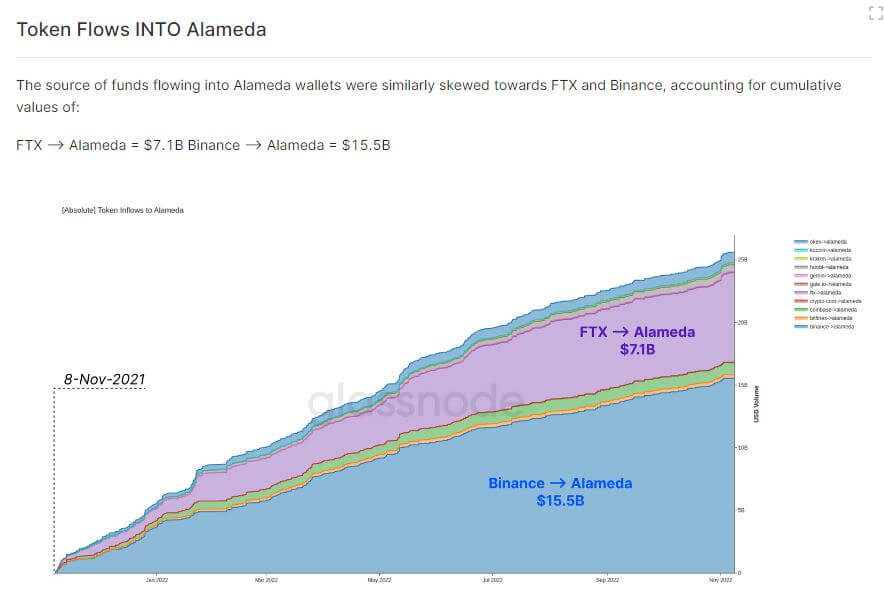

FTX, Alameda used Binance as intermediary for their parasitic relationship

On-chain knowledge analyzed by CryptoSlate revealed that between November 2021 and November 2022, Sam Bankman-Fried’s Alameda Analysis transferred about $49 billion value of tokens to FTX, with over $4.2 billion reportedly despatched in September 2022.

From the chart, Alameda reportedly obtained about $25 billion value of stablecoins and altcoins, with $7.1 billion coming from FTX and over $15.5 billion being despatched from Binance wallets.

Consistent with the on-chain knowledge, Binance performed the intermediary to facilitate fund transfers between Alameda and FTX, which brought on the 9/11 crypto market collapse.

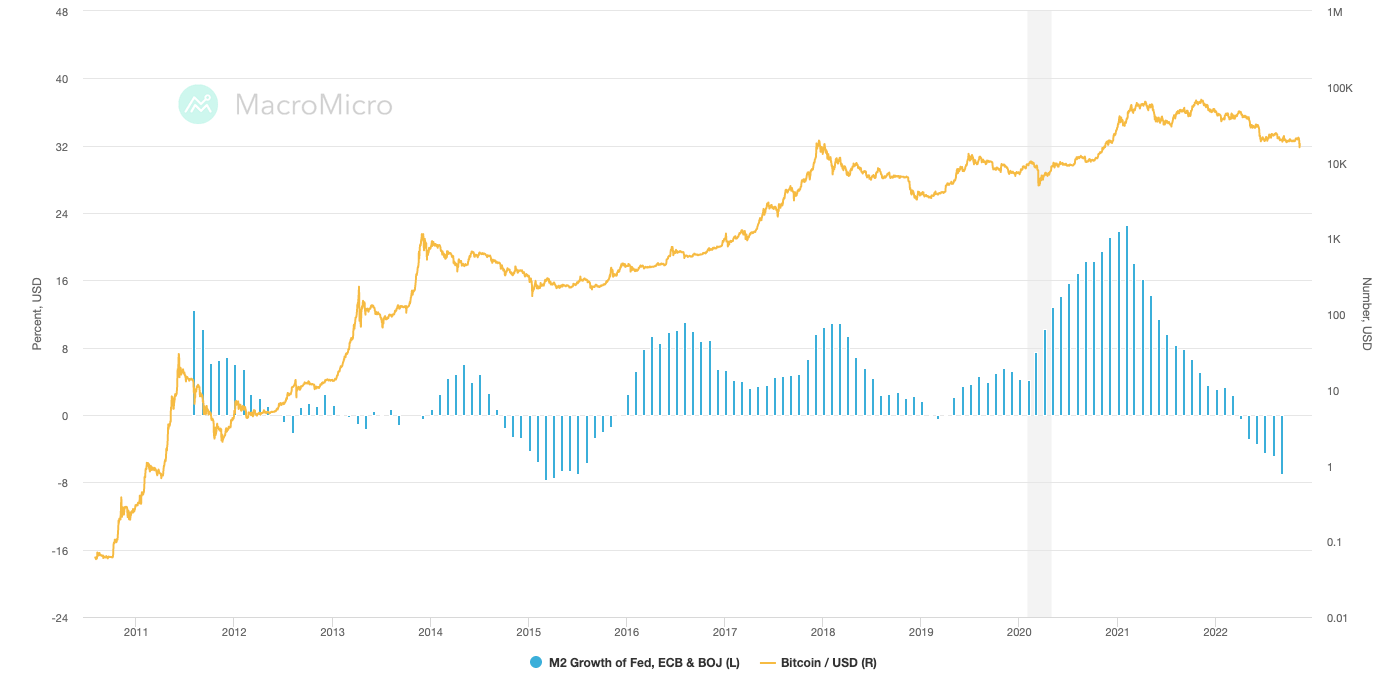

M2 money supply could be a better measure of inflation than CPI

Many Economists think about the M2 cash provide (which incorporates money and checking deposits, financial savings deposits, and cash market securities) as a greater measure of inflation than M1 which is used to trace the Shopper Value Index (CPI).

In line with the October CPI knowledge, inflation sits at 8%, whereas the M2 determine stands above 25%. Many customers consider that inflation could also be nearing the 25% mark set by M2.

As well as, the M2 determine is seeing a rising curiosity from Crypto Analysts because it tracks Bitcoin value efficiency.

From the chart, through the durations of 2015, 2019, and 2022, the M2 determine noticed a decline, which coincided with a fall in Bitcoin value. Consequently, the worldwide M2 is turning into a metric that performs a key function in figuring out Bitcoin’s value motion.

Information from the Cryptoverse

Tron to help FTX

FTX has introduced that it’s working with Tron to permit TRX, BTT, JST, SUN, and HT token holders to swap their belongings 1:1 to exterior wallets.

For the primary installment, about $13,000,000 value of belongings can be obtainable for withdrawal with plans to deploy extra belongings within the coming weeks.

Iranian corporations commerce about $Eight billion through Binance

Reuters reported that main crypto trade Binance allegedly facilitated transitions value $7.Eight billion from Iranian corporations that have been sanctioned by the U.S. authorities.

The funds flowed between Binance and Iran’s largest crypto trade, Nobitex, utilizing Tron cryptocurrency to cancel their on-chain id.

Crypto Market

Within the final 24 hours, Bitcoin (BTC) elevated by over 4% to commerce at $17,476, whereas Ethereum (ETH) surged by 9% to commerce at $1,297.

More NFT News

Marathon and Hut Eight scoop up $1.6 billion price of Bitcoin throughout market dip

Osprey Funds Launches First US Publicly Quoted BNB Belief

Will Binance's BNB Attain $1000? Worth Prediction Amid Authorized Challenges in Australia