That is an opinion editorial by Kane McGukin, who has 13 years of wealth administration expertise spanning brokerage and institutional fairness gross sales. He’s an impartial registered funding advisor.

“This gamble got here undone because of the dumping of hundreds of thousands of {dollars} in copper into the market to cease a hostile takeover in an unrelated group.”

The historical past of cash and excessive finance is lengthy and storied. It’s a world of financial methods and firms constructed to frothy heights solely to return crashing down at somewhat apparent however “sudden” moments.

In case you dig in, should you comply with the cash path over tons of of years and throughout varied related however completely different financial schemes and financial methods, you will see that that cash results in greed, greed results in leverage, and leverage results in an eventual liquidity crisis. These are the occasions that convey monetary methods crashing down.

You could be shocked at first. However, after a deeper overview, you’ll start to note a sample. Whereas dates change, names change, and asset bubbles change, liquidity crises are at all times a lot the identical.

There’s nothing new underneath the solar.

The opening quote is concerning the Knickerbocker Belief Firm, which was the match that ignited the hearth inflicting the Panic Of 1907.

The Downside With Man Is Cash And The Downside With Cash Is Man

In mild of the collapse of Voyager, Celsius, Three Arrows Capital, BlockFi and now their savior FTX, the opening quote says all of it. Over the previous couple of days, as collateral has unwound, no asset, agency or protocol has been left unscathed. Not even Bitcoin.

It is because a liquidity disaster is a liquidity disaster and so they all rhyme, all of them march to the same beat. If we alter only a phrase right here or there, the tune is sort of clear. For example, within the opening quote, if we alter “copper” to “FTT tokens” we transfer from 1907 to 2022.

This gamble got here undone because of the dumping of hundreds of thousands of {dollars} of FTT tokens into the market to cease a hostile takeover in an unrelated group.

“Simply ten years earlier than the disaster, the financial institution grew from $10 million in deposits to $61 million. The failure of such a prestigious monetary establishment inevitably induced the jitters to unfold all through the banking system.”

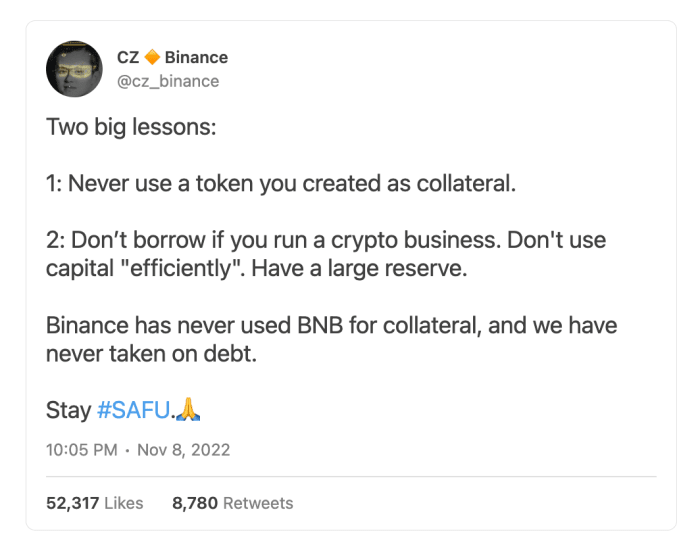

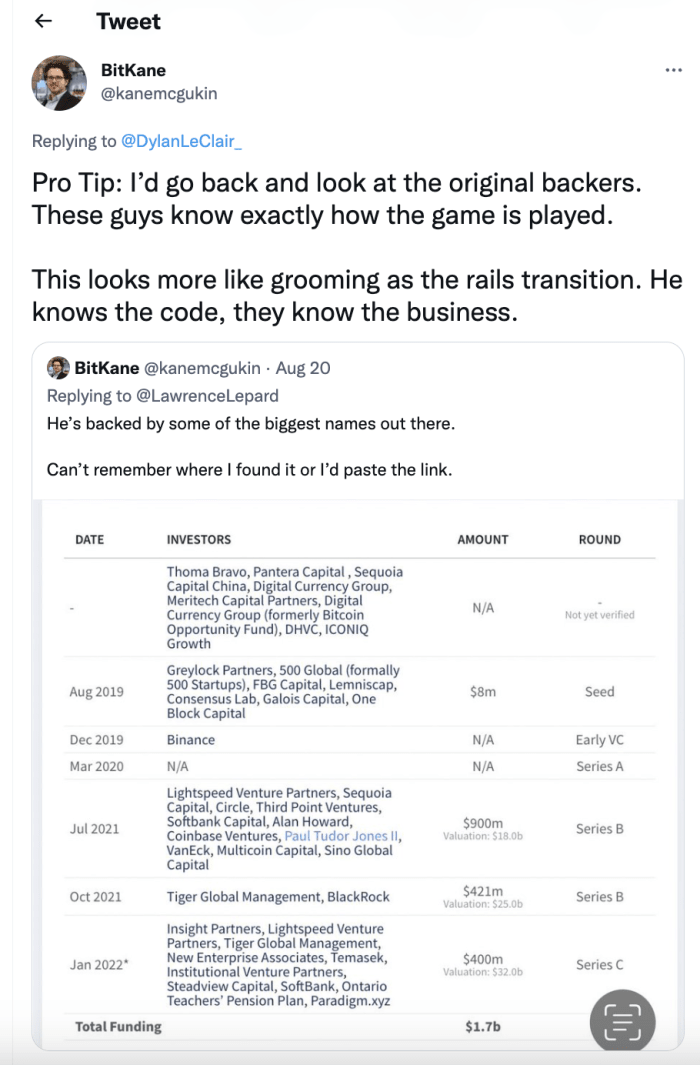

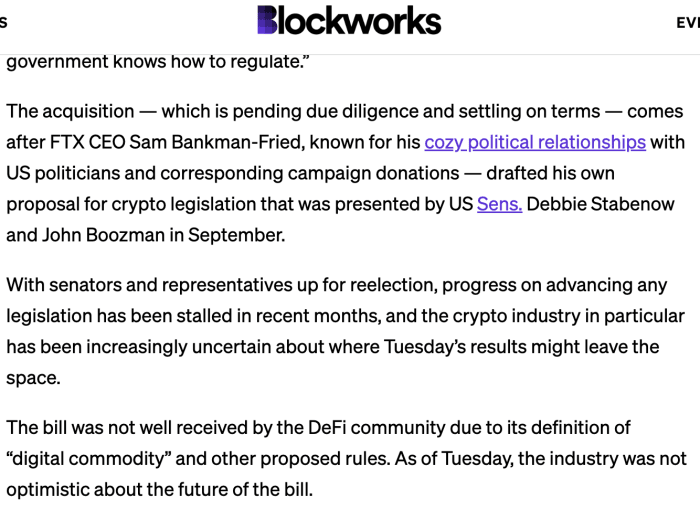

In a nutshell, that is the battle we’ve seen between Sam Bankman-Fried of FTX and Changpeng Zhao of Binance, a battle that introduced down the home and despatched worry all through the crypto market and introduced doubtless giant losses to a lot of conventional finance backers.

In disaster moments liquidity seizes till the mud settles and new gamers step in. It’s disaster moments that normally reset the principles. They redefine the gamers, transfer the stacks and begin the sport board anew. That’s why the traits of a liquidity crunch are repetitive in nature. In a roundabout manner, when you’ve seen one, you’ve seen all of them.

Monetary calamity is nothing new. At many various factors in historical past, man has developed new financial applied sciences that drive society ahead, with one caveat: we’ve been unable to take action with out avoiding greed, liquidity crunches and panics.

Whether or not it’s Alexander Hamilton’s development of the U.S. financial system following the Revolutionary Conflict, wildcat banking, The Panic Of 1907, The Nice Melancholy, the financial savings and mortgage disaster, the asian forex disaster, the 2000 crash or The Nice Recession in 2008, all of those panics and crises look a lot the identical.

You may change the names of the folks and the instances of the occasions, however the playbook for orchestration is properly documented.

It begins with an space that’s evenly regulated to fully unregulated. The market will get cornered by educated gamers who pump development in an exponential method. The grifters make good-looking earnings, an attraction that brings extra. Greed will get uncontrolled simply as collateral dries up and patrons are margined past a degree of no return. As soon as the final purchaser buys, the music stops and a collapse begins to feed on itself.

It’s a narrative informed many instances over the previous couple of hundred years in monetary markets, one which has performed out once more with the collapse of FTX and others in crypto in 2022.

New Rails, New Guidelines. Mockery Turns To Battle.

There’s euphoria within the air. A brand new monetary system means creating a brand new set of monetary rails, bringing on a brand new set of elites who will problem the previous political guard. As a brand new financial medium flows via the system, we see a girth of recent curiosity and bubbles start to kind. There’s an encouragement of leverage, a craving for greed that in the end results in difficult the previous guard and its guidelines. Bitcoin and the cryptocurrency ecosystem aren’t any completely different as we’ve seen these traits rear their ugly head during the last couple of years.

What begins as a mockery shortly turns into a battle. The unlikely turns into a formidable challenger as incubation occurs in unregulated markets. Typically, this new upstart musters a problem by offering for many who have been left to the wayside by staunch, unhelpful insurance policies which might be antiquated of their potential to fill the wants of the folks of the brand new day and age.

Shades Of Panic

“The failure of the Knickerbocker Belief Firm was however the starting, not the top, of a panic that might engulf a turbulent and quickly rising nation because it entered the 20 th century.”

“Given the elemental elements in place that ought to help the demand for housing, we consider the impact of the troubles within the subprime sector on the broader housing market will doubtless be restricted.”

“When the tape falls behind for ten minutes or half an hour the change and its doings drop, because it have been, behind a cloud. In consequence the common-or-garden ticker — which everybody has taken with no consideration thus far — has out of the blue grow to be the large downside of the inventory market.”

These panics, whereas financial in nature, have been artificial and handcrafted beneath the floor, as specified by “Tragedy And Hope” and an enormous array of different historic books and officially-documented accounts.

Expertise is all you want. To grow to be properly versed in a single, in a roundabout manner, makes you properly versed in all.

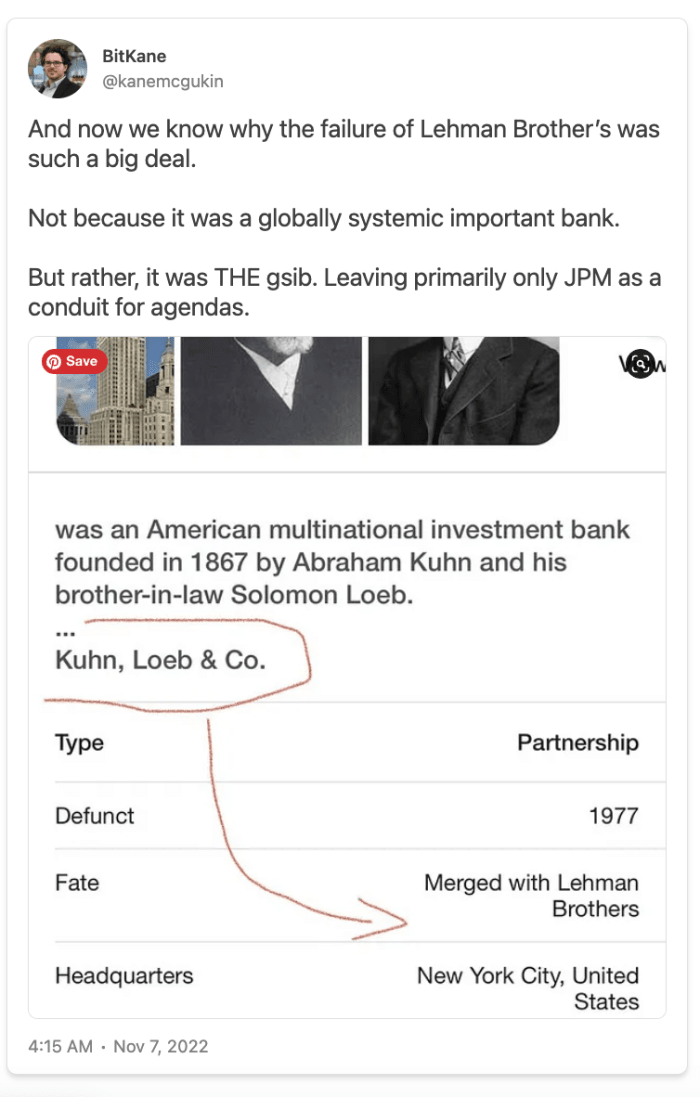

Whether or not it’s the behind-closed-doors meetings of 2008 to resolve the winners (JPMorgan) and losers (Bear Sterns and Lehman Brothers) to be able to reshape Wall Avenue, or it’s the iron-fisted and locked-door conferences of 1907 held by John Pierpont Morgan himself, they’re not too dissimilar to an SBF/CZ Twitter agreement of 2022.

In every disaster, the targets are clear and the identical. Shuffle the deck. Preserve energy. Restart the music. However, depart the management within the palms of an internal circle.

“Brokerage companies, which dealt with inventory market transactions, have been additionally at risk of failing. They have been paying skyrocketing rates of interest on loans to fulfill their obligations. Morgan put collectively a $25 million ‘cash pool’ for making decrease curiosity loans to them, avoiding an nearly sure inventory market crash. However the largest brokerage agency on Wall Avenue, Moore & Schley, was $25 million in debt. The chapter of this key agency might nonetheless set off a inventory market crash. Morgan referred to as a gathering on the Morgan Library. He assembled the town’s industrial and belief firm bankers, put them in separate rooms, locked the entrance door, and stored the important thing in his pocket till he might negotiate a deal. The assembly went properly into the night time. Belief firm bankers resisted pooling their reserves to cease the panic, however negotiations wore on. At 4:30 a.m., Morgan lastly bullied them into signing an settlement. It referred to as for the belief firm bankers to bail out their brother bankers who have been fighting runs on their deposits. For his half, Morgan promised to avoid wasting the Moore & Schley brokerage.”

Panics do occur due to frothy and lax monetary curiosity.

Nonetheless, should you go down the rabbit gap, you’ll discover they’re much less concerning the banks and extra intentional snares to push or keep energy and management. As within the case of 1907, a panic was created as a method to justify a federal reserve financial institution (1913) that in any other case wouldn’t be accepted by the folks.

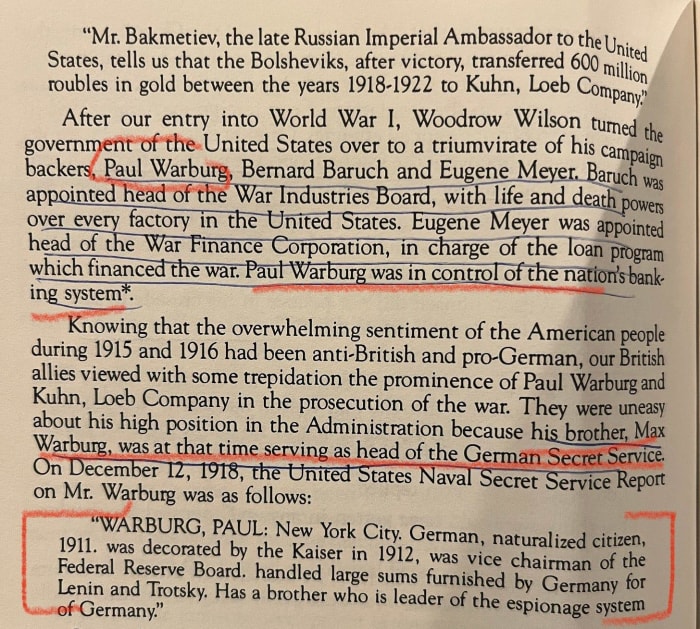

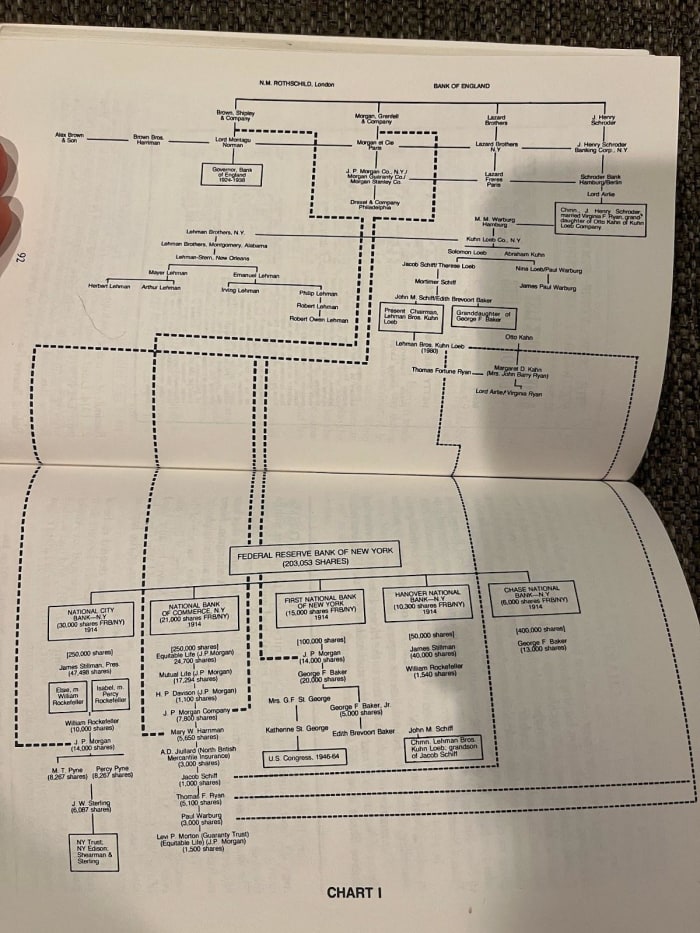

Whereas the U.S. was arrange as a free nation, Alexander Hamilton adopted the banking practices of England and over the primary hundred or so years, we gave again the facility via an interconnected net of J.P. Morgan, Paul Warburg’s federal reserve, Kuhn, Loeb & Co. (Lehman Brothers) and the constructing out of an industrial society and media conglomerates who served propaganda for many who have been close to however managed from afar. In that regard, we broke free however maintained a direct tie to the hand of the Rothschild’s who’ve been mentioned to manage a worldwide banking cartel for the reason that mid-to-late 1700s.

Panic Is The Approach Of Sustaining Energy

At present, on the time chain of historical past, we discover ourselves sitting on a dot rife with chaos and battle, whether or not it’s damaged cash, crises, political bickering or geopolitical financial and cyber battles. We discover ourselves in a world of eroding values and certainly one of damaged cash.

The propaganda blares from each side and hops from one nation to the following, distorting the main target of not one, however all. This isn’t by chance. It’s the traditional story of fine versus evil, a narrative that began with Adam and Eve and morphed into the Rothschildian formulation for banking success. Articulate methods, not by chance however by design. Created to muster chaos… on all sides, in order that these within the center stand able to revenue whatever the consequence.

The Rothschild formulation is nothing greater than market making, making markets on a worldwide scale. Markets that create battle, markets that create chaos, markets devoid of peace. As a result of one takes no allegiance, it funds each side to create demand that drives a liquidity crunch such that capital centralizes itself again into their palms, into the palms of the cartel.

After a lot gathering, it’s my opinion that on the prime sits the Rothschild formulation, pushed out to the world by insurance policies and practices set by the Financial institution For Worldwide Settlements (BIS).

Coverage is then carried out by the IMF, World Financial institution and World Financial Discussion board. These orders are handed to the Federal Reserve whose New York desk executes the orders into the markets, inflicting all different world central banks to react, both in unison or in opposition to the grain. All of it depends upon their particular person tolerance for his or her peoples’ ache.

That is what we’ve seen all through man’s financial historical past. The previous couple of years aren’t any completely different. Geopolitical clashes have shaped and are spilling over into monetary markets similtaneously a brand new monetary system and rails are being constructed. The battle is on many fronts, each political and monetary. New guidelines are being set.

Guidelines that convey success and provides energy as a result of that’s what liquidity crises do. They shuffle the deckchairs, consolidate energy and centralized management into the palms of some.

Management the cash, management the folks. Break the cash, break the folks.

Repair the cash… repair the world.

It is a visitor submit by Kane McGukin. Opinions expressed are totally their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

More NFT News

Machine Studying in Focus as Chainalysis Acquires Hexagate

Bitcoin Traders Are Now Up $67,000 On Common – And This Is Simply The Begin

Extra Than Half of Crypto Tokens, Memecoins Launched in 2024 Have been Malicious: Blockaid