Be a part of Our Telegram channel to remain updated on breaking information protection

Earlier than it failed this month, FTX distinguished itself from quite a lot of opponents within the extremely unregulated crypto enterprise by claiming to be the “most regulated” trade on the planet and welcoming elevated authorities scrutiny.

The technique and techniques behind founder Sam Bankman-regulatory Fried’s agenda are actually revealed in firm paperwork, together with the beforehand unreported phrases of a deal introduced earlier this 12 months with IEX Group, the American inventory buying and selling platform talked about in Michael Lewis’s e-book “Flash Boys” about fast, computerized buying and selling.

A doc dated June 7 states that as a part of the settlement, Bankman-Fried acquired a 10% share in IEX with the choice to accumulate your entire firm within the subsequent 2.5 years. The 30-year-old CEO had the possibility to advocate for crypto regulation earlier than the U.S. Securities and Change Fee because of the connection.

One among FTX’s bigger goals was to swiftly create a pleasant regulatory framework for itself by buying stakes in companies that already had licenses from authorities, skipping the continuously drawn-out approval course of. This deal and others talked about within the paperwork, which embrace enterprise updates, assembly minutes, and technique papers, make clear this purpose.

In response to FTX information from a gathering on September 19, the corporate spent about $2 billion on “acquisitions for regulatory functions.” For example, it acquired LedgerX LLC, a futures trade, final 12 months, granting it three Commodity Futures Buying and selling Fee licenses concurrently. As a licensed trade, FTX now had entry to the U.S. commodities derivatives markets. Securities generally known as derivatives get their worth from one other asset.

The paperwork reveal that FTX additionally thought of its regulatory standing as a method of securing contemporary funding from vital traders. It touted its licenses as an important benefit over opponents within the paperwork defending its request for tons of of thousands and thousands of {dollars} in funding. It claimed that the “regulatory moats” it had constructed would preserve opponents at bay and grant it entry to profitable new alliances and markets that had been out of attain for unregulated organizations.

In a doc distributed to traders in June, the trade boasted, “FTX has the cleanest model in crypto.”

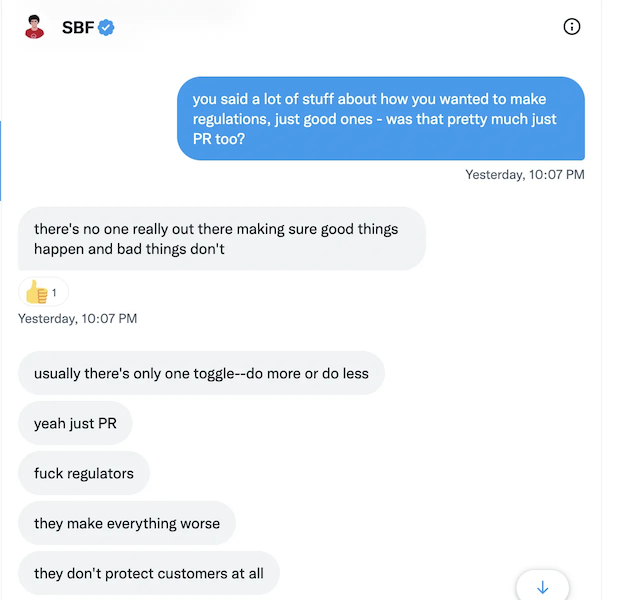

In a text conversation with Vox this week, Bankman-Fried modified his thoughts concerning regulatory points. He responded in a collection of messages when requested if his earlier admiration of rules was “simply PR,” saying, “sure, simply PR… fuck regulators… they make issues worse… they don’t defend prospects in any respect.”

A consultant for IEX declined to make clear specifics of the cope with FTX, aside from to emphasize that FTX can’t promote its “small minority place” in IEX to a 3rd celebration with out its permission. The spokeswoman said, “We’re at the moment assessing our authorized alternate options with regard to the previous transaction.

Regulation Fail

Following a fruitless try by Bankman-Fried to gather emergency money, FTX failed final week. By way of the handfuls of licenses it acquired by way of its quite a few acquisitions, it had been topic to some regulatory scrutiny. Nevertheless, that didn’t protect its purchasers and traders, who now stand to lose billions of {dollars}. FTX had been secretly playing with buyer funds utilizing $10 billion in deposits to assist a buying and selling firm owned by Bankman-Fried.

In response to 4 attorneys, the truth that Bankman-Fried was pursuing authorities whereas secretly taking huge dangers with prospects’ cash signifies a large regulatory hole within the bitcoin sector. Aitan Goelman, a lawyer with Zuckerman Spaeder and a former prosecutor and director of CFTC enforcement, stated, “It’s a patchwork of worldwide regulators — and even domestically there are massive gaps.” That’s the fault of a regulatory construction that was sluggish to adapt to the emergence of cryptocurrency.

In response to a supply conversant in the SEC’s views on cryptocurrency regulation, the company believes that cryptocurrency companies are working unlawfully outdoors of U.S. securities legal guidelines and relying as a substitute on different licenses that provide solely bare-bones shopper safety. The individual added, “These representations, whereas nominally truthful, don’t cowl their actions.”

First Step: Licenses

Bankman-Fried had lofty targets for FTX, which from scratch in 2019 had by this 12 months grown to greater than $1 billion in revenues and represented 10% of all trades within the worldwide cryptocurrency market. In a doc named “FTX Roadmap 2022,” which is undated, he said that he hoped to create a monetary app the place customers may commerce shares and tokens, ship cash, and financial institution.

The “Roadmap” doc stated that “getting as a lot licensing as moderately attainable” is “Step 1” in attaining that goal.

The assertion within the doc learn, “Partially that is to make sure that we’re regulated and compliant; partially that is to have the ability to develop our product providing.”

That’s the reason FTX went on an acquisition binge, per the filings. Bankman-Fried selected to buy licenses moderately than apply for every one, which could take years and contain awkward questions.

However the methodology has its limitations, too: The paperwork reveal that sometimes the businesses it acquired lacked the actual permits it required.

The information state that certainly one of FTX’s goals was to permit its home purchasers entry to the American derivatives markets. It predicted that the market would improve commerce quantity by $50 billion per day, bringing in thousands and thousands of {dollars} in income. It needed to persuade the CFTC to switch certainly one of LedgerX, FTX’s lately bought futures trade licenses, to be able to try this.

Months had been spent on the appliance process, and as regular, FTX was required to supply $250 million for a default insurance coverage reserve. In response to the minutes of a gathering of its advisory board held in March, FTX believed the CFTC may ask it to lift the fund to $1 billion.

FTX filed for chapter and has withdrew its software because it was unable to obtain approval.

Paperwork present extra advantages to purchasing companies in trade for licenses: It’d grant Bankman-Fried the entry to regulators he sought.

The IEX settlement, which was declared in April, is an effective instance. Brad Katsuyama, CEO of IEX, and Bankman-Fried said their need to “create regulation that in the end protects traders” in a joint interview with CNBC. A very powerful factor on this state of affairs, in response to Bankman-Fried, is “transparency and safety in opposition to fraud.”

In March, Katsuyama, Bankman-Fried, and SEC Chairman Gary Gensler had been all known as to a gathering.

In response to a supply near IEX, the assembly’s goals had been to discover the concept of IEX opening a buying and selling venue for digital property like bitcoin and to tell the SEC prematurely about its association with FTX, which had not but been made public. The insider claimed that FTX’s accountability was to supply the infrastructure for crypto buying and selling.

Their preliminary proposal was bluntly rejected by SEC officers as a result of it could have included the institution of a much less strictly regulated non-exchange buying and selling venue, which the company opposes for cryptocurrencies, in response to the person conversant in the SEC’s considering.

In later interactions with the SEC, the quantity of Bankman-role Fried’s was not clear. In response to the supply acquainted with the SEC’s reasoning, Bankman-Fried was solely tagging alongside when SEC officers determined to satisfy with Katsuyama in March. Katsuyama was within the “driver’s seat” in the course of the assembly, in response to the insider, and he remained comparatively mute.

No matter his engagement, FTX bragged to its traders about its discussions. At a gathering of its advisory board in September, FTX declared that discussions with the SEC had been “very fruitful.”

In response to the minutes of the assembly, it said that “We’re most likely going to have pole place there.”

The SEC would dispute that FTX was within the “pole place,” in response to the person with information of their considering. Every part the SEC tried to manage cryptocurrency buying and selling can be public information, the insider claimed.

In response to the individual near IEX, there have been by no means any operational agreements between the trade and FTX.

An inventory of FTX’s interactions with varied regulators is accessible in a paper from Could. The paper, which has not beforehand been made public, demonstrates how FTX was usually in a position to deal with the issues that got here up.

For example, South African authorities despatched a warning to shoppers in February stating that FTX and different cryptocurrency exchanges weren’t permitted to run their companies there. In consequence, FTX and a neighborhood trade got here right into a enterprise settlement in order that the companies may proceed. In response to its current operations in South Africa, FTX is at the moment completely authorized.

Moreover, the Could doc reveals that FTX had a run-in with the SEC. The SEC checked out how cryptocurrency corporations had been processing shopper deposits earlier this 12 months. Some companies provided curiosity on deposits, which the SEC claimed could remodel them into securities and require registration in accordance with its rules. FTX reported that the investigation was wanting into whether or not the property had been being “loaned out or in any other case used for operational causes” within the checklist of its regulatory interactions.

It was subsequently revealed final month that FTX had actually carried out that, transferring billions of {dollars} in consumer money to Bankman-Fried’s buying and selling firm, Alameda Analysis.

The SEC’s examination crew, which seems to be at market actions that might put traders at hazard, was anxious a few totally different concern, in response to FTX’s Could doc, and that was a rewards program the corporate provided to shoppers that paid curiosity on cryptocurrency deposits.

The letter claims that FTX knowledgeable the regulator that its items didn’t have the identical issues as these of different suppliers whose merchandise the company had regarded into.

FTX said that they “confirmed these had been solely rewards primarily based and don’t contain lending (or different use) of the deposited crypto”. In response, the SEC said that it had completed its “casual inquiry” and didn’t need any extra data “presently.”

On the investigation, the SEC declined to remark. “FTX’s response there was correct; FTX US’s rewards program didn’t entail leasing out any property,” Bankman-Fried responded.

Associated

Sprint 2 Commerce – Excessive Potential Presale

- Energetic Presale Dwell Now – dash2trade.com

- Native Token of Crypto Indicators Ecosystem

- KYC Verified & Audited

Be a part of Our Telegram channel to remain updated on breaking information protection

More NFT News

Machine Studying in Focus as Chainalysis Acquires Hexagate

Extra Than Half of Crypto Tokens, Memecoins Launched in 2024 Have been Malicious: Blockaid

Hedera Value Prediction for Right now, December 18 – InsideBitcoins