Binance skilled a historic day and stress take a look at yesterday after a number of rumors and FUD surfaced. As Bitcoinist reported yesterday, most of it was certainly FUD whereas the Proof of Reserves is elevating some query marks.

However how does it look a day later? Did the FUD depart any harm in its wake? In an inside memo to his workers, Binance CEO Changpeng Zhao reportedly warned of “powerful months forward,” as Bloomberg reports.

In reference to the sharp enhance in withdrawals from the change, CZ mentioned that the corporate will overcome the present challenges and that Binance is in a robust monetary place and can “survive.”

What Was Going On With USDC Withdrawals On Binance Yesterday?

One of the critically considered actions by Binance yesterday was the truth that it had quickly stopped withdrawals of the stablecoin USDC. Crypto Twitter noticed parallels with FTX.

Nevertheless, as Austin Campbells, head of portfolio administration at Paxos, defined, that is an comprehensible transfer. Campbells wrote in a weblog submit:

Would you consider me if I instructed you the issue is definitely conventional banks and the interactions between stablecoins? It’s.

The issue based on the Paxos govt is that exchanges and stablecoins maintain solely a portion of their reserves in quickly obtainable belongings, and one other portion is in treasury payments which are processed solely throughout financial institution hours and with delays.

Which means that stablecoin issuers can solely devour a sure proportion of their funds outdoors of enterprise hours. “If a $1B redemption is available in at 3am Saturday NY time, you must wait till NY banking hours to satisfy the rest of it”, he mentioned.

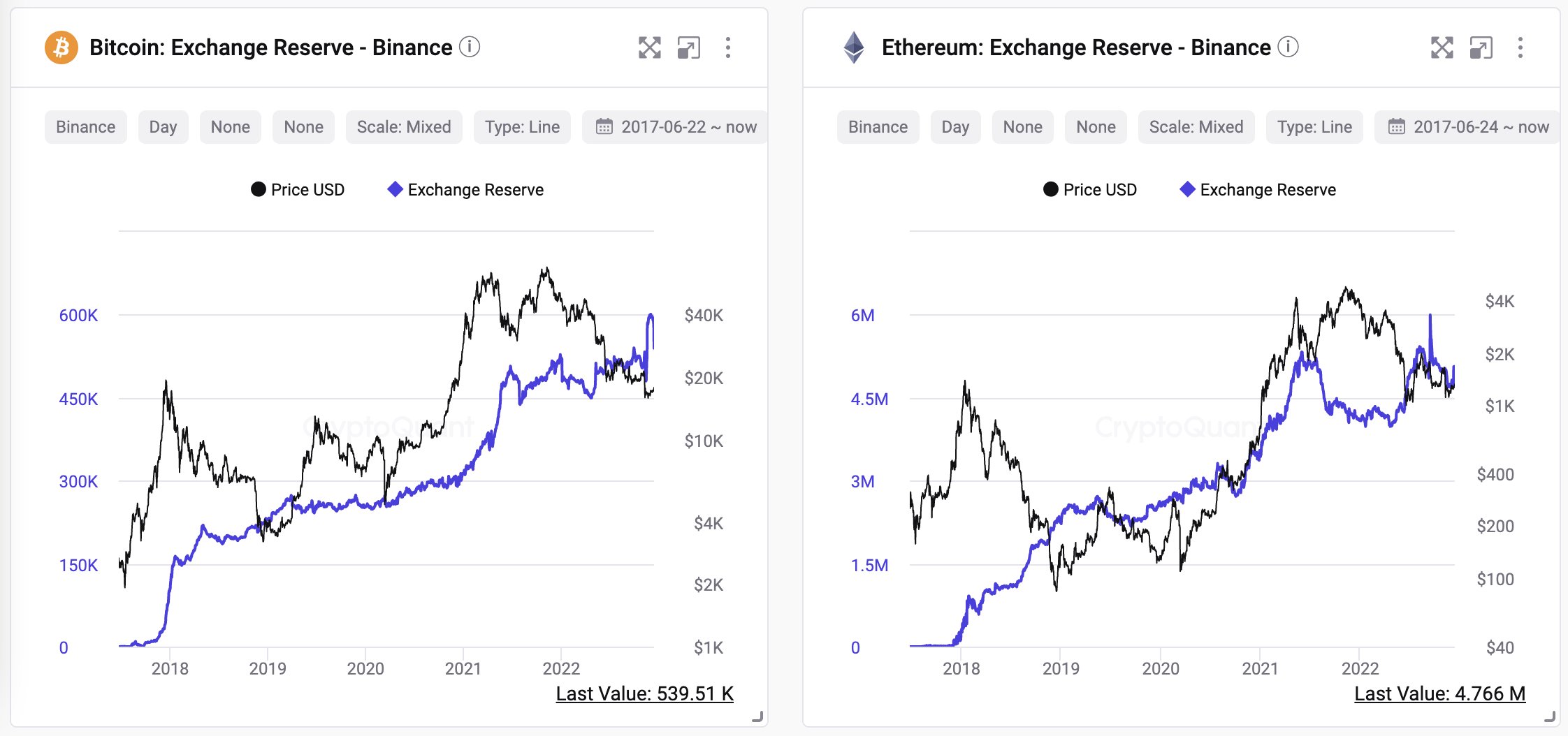

Ki Younger Ju, Co-Founder and CEO of CryptoQuant, additionally pointed to on-chain information to dispel the Binance FUD. Ju famous that Binance’s BTC reserves have dropped -8% within the final two days, however elevated +24% throughout the FTX financial institution run final month.

“There could be issues to be clarified for regulation, however I don’t see any shady on-chain actions for now,” Ju mentioned and confirmed the next charts with a wholesome state of BTC and ETH reserves.

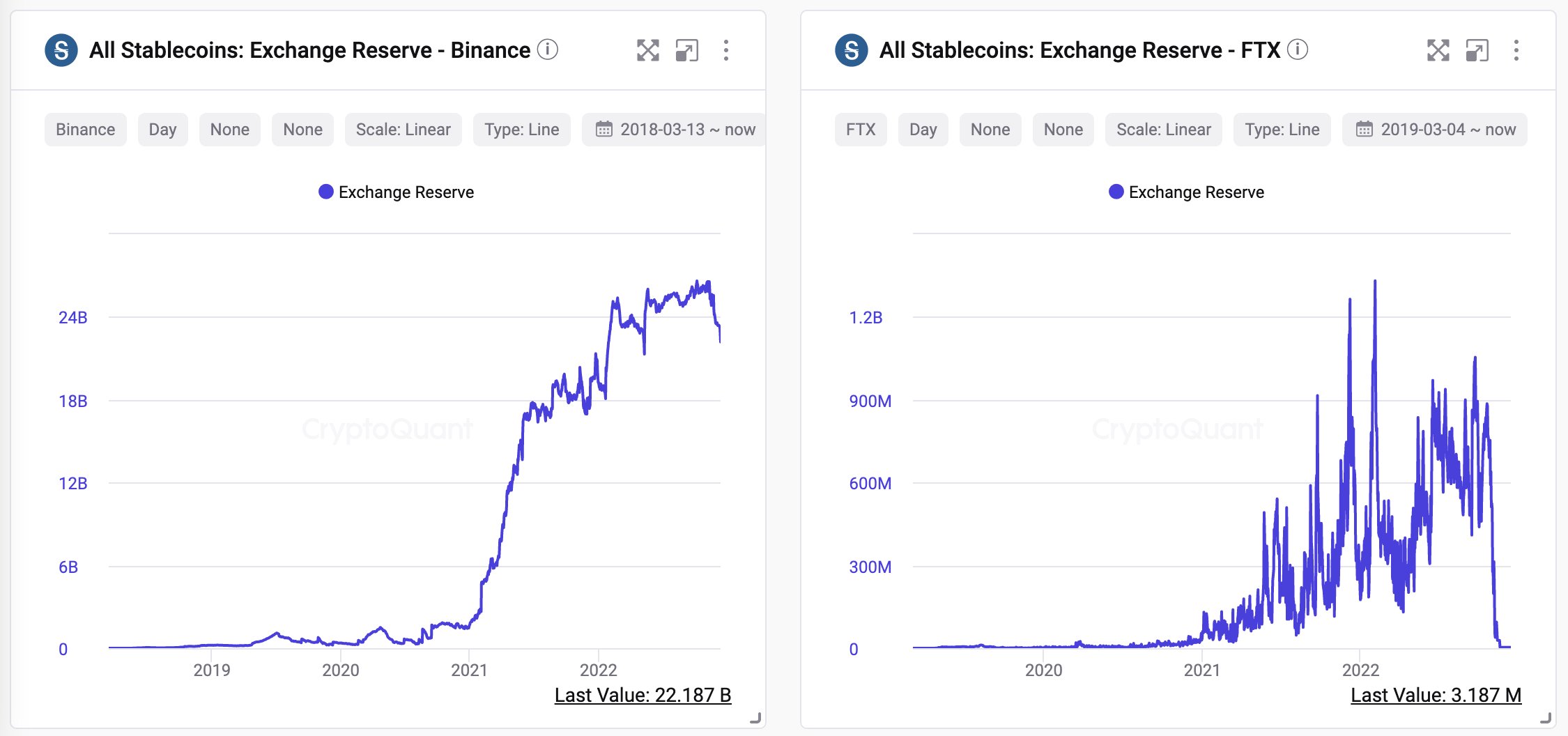

The CryptoQuant CEO additionally identified Binance’s very robust stablecoin reserves in comparison with FTX.

The FTX reserve doesn’t look natural with many in/outflows associated to non-FTX wallets, and the reserve dropped -93% already, a number of days earlier than the financial institution run.

Binance CEO Dispels Rumors Of Difficulties

CZ tweeted right now that “issues have stabilized.” Because the Binance CEO notes, yesterday’s withdrawals weren’t even the very best:

Yesterday was not the very best withdrawals we processed, not even prime 5. We processed extra throughout LUNA or FTX crashes. Now deposits are coming again in.

We noticed some withdrawals right now (internet $1.14b ish). We have now seen this earlier than. Some days we now have internet withdrawals; some days we now have internet deposits. Enterprise as typical for us.

The newest information from DefiLlama shows that Binance’s complete reserves presently stand at $60.44b, with a internet influx of -$3.92b within the final 24 hours and -$5.03b within the final seven days. For the second, it appears to be enterprise as typical for Binance.

Even when there’s a financial institution run on Binance, the change ought to have the ability to course of all orders whether it is certainly 101% lined as claimed in its PoR.

On this sense CZ additionally wrote that FUD introduced “stress take a look at”, which in flip helps to construct the credibility for exchanges that passes the take a look at. “I truly assume it’s a good suggestion to ‘stress take a look at withdrawals’ on every CEX on a rotating foundation.”

The BNB worth suffered from yesterday’s rumors and slipped to $256 at one level. At press time, the value has recovered considerably to round $276.

More NFT News

Machine Studying in Focus as Chainalysis Acquires Hexagate

Bitcoin Traders Are Now Up $67,000 On Common – And This Is Simply The Begin

Extra Than Half of Crypto Tokens, Memecoins Launched in 2024 Have been Malicious: Blockaid