The situations of the cryptocurrency market have modified drastically; in response to an evaluation by QCP Capital, the choices market in its present state makes the crypto trade appear like a serious disaster, such because the shutdown of crypto alternate FTX after submitting for chapter, by no means occurred.

Buying and selling desk QCP Capital published observations on the crypto trade, revealing some key factors to think about for the approaching months.

The Crypto Market Comes Again To Life

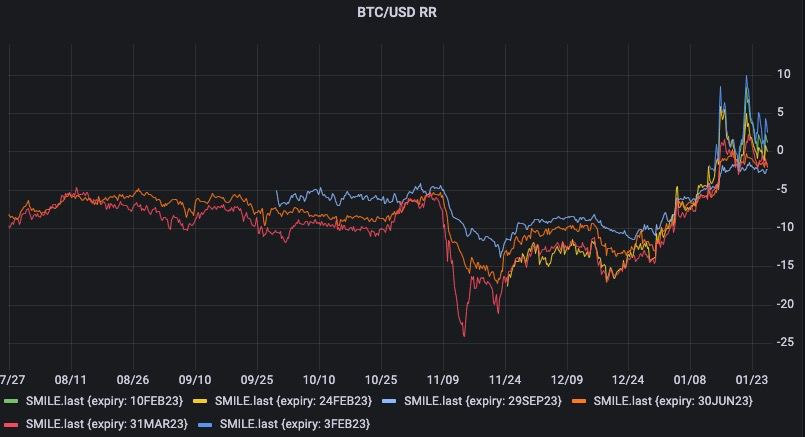

QCP’s evaluation factors out that Bitcoin (BTC) threat reversals have been buying and selling in optimistic territory over the previous week, which tells us that calls (buys) have been costlier than places (sells) since 2021 throughout a number of tenors.

That is uncommon for the sector as BTC sometimes has a persistent put skew, primarily on account of miner/treasury hedging exercise. The chart beneath depicts this market conduct and the bullish sentiment impacting the choices sector.

Put skew drives the value of places greater and calls decrease. This distinction in pricing between choices is known as skew and, below regular circumstances, places commerce with greater volatility than calls exactly as a result of traders are hedging a few of their bullish positions.

For the buying and selling desk, because of this the sentiment within the cryptocurrency market has shifted from bearish to bullish, a fruits of what has been taking place within the macro market and the slight restoration within the economic system.

Bulls Would possibly Get Their Hearts Damaged On Valentines Day

Ethereum’s (ETH) implied volatility (IV), which represents the anticipated volatility of a inventory or forex over the choice’s life, has fallen, indicating complacency because the market costs out fears of a value collapse, in response to the evaluation.

The passion out there might be measured by the quantity of “worry of lacking out” (FOMO) that has set in, with many chasing costs and the highest by shopping for excessive delta calls and going lengthy within the spot market over the previous week.

With the upcoming “Huge Unhealthy” Federal Open Market Committee (FOMC) assembly, the buying and selling desk expects the market to be extra cautious and conservative.

Based on QCP, the next doubtlessly problematic date might be February 14th, when the next CPI report will happen, which may doubtlessly “break the center of the bulls.”

For QCP, this is identical state of affairs the market skilled in December. Equally, the value could expertise a topside breakout characterised by a extremely sharp and violent motion.

Bitcoin is at present buying and selling at $23,200 and appears to be paving the way in which for the conquest of recent ranges. It has gained 0.7% within the final 24 hours and 10.3% within the final seven days. Bitcoin is making an attempt to interrupt the following impediment represented by the $24,400 stage.

Ethereum is buying and selling at $1600, up 0.3% within the final 24 hours, with sideways value motion. The subsequent resistance wall is at $1,691, a zone the bulls haven’t visited since September 2022. Ethereum has gained 3.8% within the final seven days.

Cowl picture from Unsplash, charts from Tradingview.

More NFT News

VanEck maintains $180,000 Bitcoin goal as bull market beneficial properties steam

MicroStrategy Completes $3B Observe Providing to Purchase Extra Bitcoin however MSTR Dumps 16%

SEC Chair Gary Gensler to step down on Jan. 20