That is an opinion editorial by Kudzai Kutukwa, a monetary inclusion advocate and Mandela Washington fellow.

“When use of sturdy cryptography turns into in style, it is tougher for the federal government to criminalize it. Subsequently, utilizing PGP is sweet for preserving democracy. If privateness is outlawed, solely outlaws may have privateness… PGP empowers individuals to take their privateness into their very own palms. There was a rising social want for it. That is why I wrote it.”

–Phil Zimmerman, “Why I Wrote PGP”

The case of Roman Sterlingov, who stands accused of operating the custodial Bitcoin mixer, “Bitcoin Fog,” is indicative of the various conditions wherein people are focused by regulation enforcement for safeguarding their monetary privateness.

As outlined in “What Bitcoin Did,” the U.S. Division of Justice relied on Chainalysis’ Reactor software program to hint the acquisition of the Bitcoin Fog area again to an tackle linked to Sterlingov’s Mt. Gox account, establishing him as its operator. Reactor was designed to tie cryptocurrency addresses with real-world identities. Regardless of the assorted irregularities current on this ongoing case, one might draw the conclusion that it sends a transparent message of “thou shalt not have monetary privateness.”

Introducing Ark

Given this rising hostility towards monetary privateness for Bitcoin transactions, there’s a urgent want for the event of superior instruments. On the not too long ago concluded Bitcoin 2023 convention, a probably game-changing software, referred to as the Ark Protocol, was launched.

Introduced throughout one of many keynote sessions on the open-source stage by developer Burak, Ark is a Layer 2 scaling answer that permits low cost, nameless and off-chain Bitcoin transactions. The protocol additionally has a minimal on-chain footprint, which additional protects person privateness whereas preserving transaction prices low. In what could be described as an “unintended invention” that occurred when Burak was making an attempt to develop a Lightning pockets, Ark is a definite protocol that would probably scale non-custodial bitcoin use.

Burak named the protocol “Ark” in reference to Noah’s Ark, which acts as a lifeboat that gives refuge from predatory blockchain surveillance corporations and custodians.

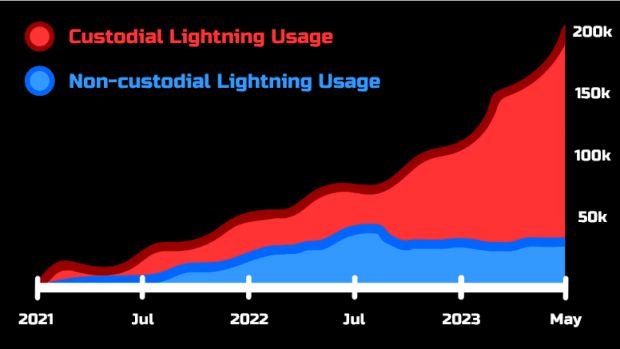

Throughout his presentation, Burak highlighted one of the regarding developments with the Lightning Community in the present day, which is that there are at present extra custodial customers of Lightning than there are non-custodial ones. That is primarily as a result of liquidity constraints on Lightning that require non-custodial customers to first obtain liquidity from another person’s node earlier than they’ll obtain funds. Custodial wallets like Pockets Of Satoshi summary this downside away from the person however on the expense of the person not being 100% in command of their funds, in addition to their monetary privateness.

An Different Layer 2 Protocol

I interviewed Burak to achieve a deeper understanding of Ark and the inspiration behind its growth. After I quizzed him on what led him to develop another Layer 2 protocol, he stated:

“I’ve all the time been a critic of Lightning primarily due to inbound liquidity points, async receiving in addition to its on-chain footprint. Inbound liquidity all the time felt like a bug to me, which made the person expertise something however nice. Along with that, it could take greater than a century to onboard your complete world inhabitants in a non-custodial style onto the Lightning Community, assuming every particular person has 4 channels that every eat a number of hundred vbytes.”

As he got down to tackle these and different points, his Lightning pockets thought finally morphed into Ark.

“Ark could be greatest outlined as trustless e-cash or a liquidity community just like the Lightning Community however with a UTXO set that lives solely off-chain and it’s neither a statechain nor a rollup,” Burak stated. “These UTXOs are referred to as ‘digital UTXOs’ or ‘vTXOs,’ which have a ‘lifespan’ of 4 weeks. The core of Ark’s nameless off-chain funds is pushed by the vTXOs.”

All through the dialog, Burak continued to emphasise his obsession with a frictionless expertise for the tip person, his view being that sending sats needs to be as straightforward as pushing a button. This is without doubt one of the explanation why Ark customers don’t must have channels or liquidity, as that is delegated to a community of untrusted intermediaries often called Ark service suppliers (ASPs). These are always-on servers that present liquidity to the community, equally to how Lightning service providers function, however with an additional benefit: ASPs are unable to hyperlink senders with receivers, which provides one other layer of privateness for customers.

That is made doable by the truth that each cost on Ark takes place inside a CoinJoin spherical which obfuscates the connection between sender and receiver. One of the best half about that is that the CoinJoin occurs solely off-chain whereas settling funds each 5 seconds, which not solely drastically reduces on-chain footprints but in addition fortifies the customers’ privateness. The anonymity set is each social gathering concerned in a transaction and, theoretically, this creates a better diploma of privateness than what’s doable on the Lightning Community. Moreover, Ark mimics on-chain person experiences in that customers have a devoted tackle for sending and receiving funds, however the distinction is that it’s a reusable tackle that doesn’t compromise the person’s privateness, made doable in a means that’s just like how silent payments work.

Commerce-Offs

Nonetheless, like some other system, Ark does have its personal trade-offs. Though it could not provide on the spot settlements as quickly as Lightning does, it gives instant accessibility to funds with out having to attend for confirmations in what Burak described as “instant availability with delayed finality.”

For distributors, Lightning continues to be the higher possibility in relation to receiving funds. Moreover, liquidity suppliers are required, however based mostly on the belief that people will likely be motivated to supply liquidity to earn yield in bitcoin, Burak additionally thinks this problem could be simply overcome in the long run. This novel proposition addresses sure shortcomings in Lightning, but additionally comes with its personal set of challenges.

The Street Forward

In abstract, the Ark protocol is a singular, second-layer scaling answer with unilateral exit functionality that permits seamless transactions with out imposing any liquidity constraints or interactivity, nor necessitating a direct connection between sender and receiver. Subsequently, recipients can simply obtain funds with out the trouble of any onboarding setup, sustaining a steady server presence or compromising their anonymity to 3rd events. Designed to be a scalable, non-custodial answer, Ark permits customers full management over their funds and offers everybody the choice to self custody their cash.

Ark is interoperable with Lightning, but in addition serves as a complement to it. Nonetheless, as a result of difficult means of self-custodial Lightning and ranging ranges of privateness for senders and receivers, together with the upcoming hazard posed by blockchain surveillance corporations, scaling options that prioritize privateness, like Ark, have develop into important. The varied makes an attempt to assault Bitcoin via malicious prosecution, like within the case of Sterlingov, and predatory laws such because the EU’s MiCA, exhibit the necessity for scalable, environment friendly, privacy-preserving instruments to be able to stop future points.

It’s in opposition to this background that I believe Ark is an attention-grabbing idea value keeping track of as growth of the protocol unfolds. In fact, with out code to evaluation in the meanwhile or a battle-tested, working prototype, it’s nonetheless a protracted highway forward. Regardless of the unexpected challenges forward, Burak is optimistic about Ark’s potential and is satisfied that it’s a breakthrough that strikes the stability between personal Bitcoin transactions and scalability, in a user-friendly method. A sentiment that I additionally share, given the important want for non-custodial, privacy-preserving instruments.

It is a visitor publish by Kudzai Kutukwa. Opinions expressed are solely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

More NFT News

SOL Worth Hits Report, Persevering with Turnaround From Crypto Winter Crash

Bitcoin Nears $100,000 As Trump Council Anticipated To Implement BTC Reserve

DOGE Worth Soars 19% As Buyers Flock To Its Rival PEPU