Within the midst of a risky cryptocurrency market, Floki Inu (FLOKI) has managed to defy expectations and change into a logo of optimism for buyers. Whereas altcoins face the challenges of a recession triggered by the Securities and Change Fee’s actions towards main cryptocurrencies within the US, the meme coin sector is fighting declining capitalization, sinking additional into uncertainty.

Nonetheless, towards all odds, FLOKI has saved its regular bearing and rise above the chaos, proudly glowing in inexperienced on at this time’s buying and selling charts.

Because the cryptocurrency world grapples with regulatory hurdles and market volatility, FLOKI stays steadfast, capturing the eye of buyers and defying the prevailing adverse market sentiment.

Floki Inu (FLOKI) Surges Amidst Meme Coin Downturn

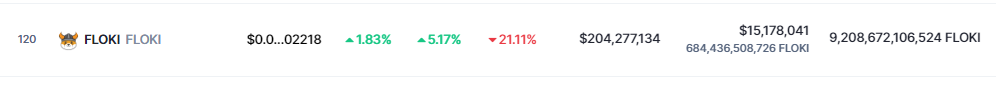

Within the midst of a current collapse in meme cash, Floki Inu (FLOKI) has skilled a noteworthy 24-hour rally of 5.17%. This surge has propelled its value on CoinMarketCap to $0.00002218. Moreover, the buying and selling quantity for FLOKI has reached a formidable $10,059,314 within the final 24 hours, catapulting it to the fifth place among the many most traded meme cash.

Supply: CoinMarketCap

In stark distinction, its opponents, together with well-liked cash similar to Dogecoin (DOGE) and Shiba Inu (SHIB), have been experiencing declines, with their market caps diminishing by 0.5% to 1%.

Amidst the present downturn in meme cash, FLOKI has emerged as a standout performer, attracting consideration and buying and selling exercise whereas its counterparts falter. This sudden surge showcases the resilience and potential of FLOKI, demonstrating its skill to rebound and generate renewed curiosity in an in any other case difficult market setting.

FLOKI in an upward trajectory. Supply: CoinMarketCap.

Crypto Market Stays Risky Amid Regulatory Uncertainty

As the brand new week started, the crypto market confirmed indicators of renewed exercise, albeit with cautious optimism as regulatory crackdowns from the earlier week continued to weigh on sentiment. The uncertainty surrounding the classification of crypto tokens added to investor jitters, additional exacerbating the market’s volatility.

The index monitoring the top 100 crypto tokens skilled a decline of 0.8%, reflecting the cautious temper prevailing amongst buyers. Newest information indicated that the full market capitalization of cryptocurrencies slipped to $1.09 trillion on Monday, underscoring the continuing challenges confronted by the market.

Bitcoin re-enters the $26Okay territory. BTCUSD chart: TradingView.com

Regulatory ambiguity has change into a major level of concern, with differing views on the classification of assorted tokens. Whereas Bitcoin (and apparently Ethereum and Litecoin) is just not by definition a safety by US regulators, SEC Chair Gary Gensler has emphasised that almost all different tokens fall below the company’s investor-protection legal guidelines.

Moreover, Gensler has pressured the significance of buying and selling platforms registering with the SEC, including one other layer of complexity to the regulatory panorama.

(This web site’s content material shouldn’t be construed as funding recommendation. Investing includes threat. Once you make investments, your capital is topic to threat).

Featured picture from BlockchainReporter

More NFT News

Osprey Funds Launches First US Publicly Quoted BNB Belief

Will Binance's BNB Attain $1000? Worth Prediction Amid Authorized Challenges in Australia

What Does Spot Buying and selling Imply in Cryptocurrency and How Is It Accomplished?