Right here’s how the present Bitcoin worth compares in opposition to the earlier cycles once they have been at comparable phases of their lifespan.

Present Bitcoin Cycle Seems To Line Up With Earlier Ones

In a brand new post on X, the group supervisor at CryptoQuant Netherlands, Maartunn, mentioned how the present cycle traces up in opposition to the final two cycles.

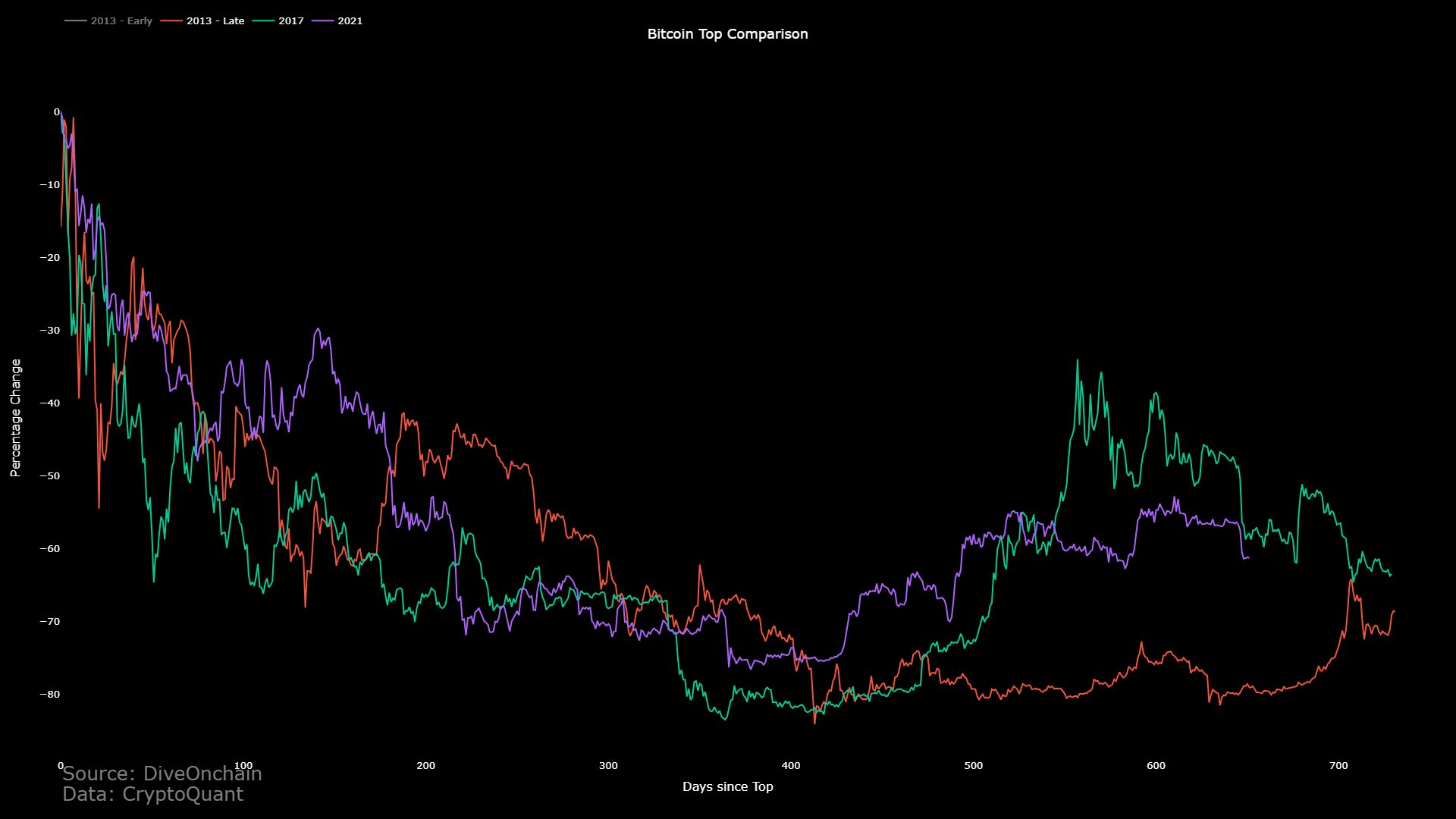

Right here’s the chart in query:

How the completely different cycles seem like when aligned in opposition to one another | Supply: @JA_Maartun on X

From the chart, it’s seen that the analyst hasn’t in contrast the whole cycles, however slightly from the factors the place every of those cycles set their respective all-time highs.

The idea of the comparability right here is the share change within the worth. For the reason that section of the cycle related to this chart is the post-ATH, bear market interval, the share change is on the unfavourable scale for every of the cycles.

A putting similarity between them instantly turns into obvious on a primary have a look at the bear market drawdown section of every of those cycles. The value motion in every of those doesn’t align completely, as every cycle had short-term fluctuations.

In a extra long-term view, nevertheless, it’s attention-grabbing that the share drawdowns throughout these cycles have even been as shut as they’ve been. The alignment turns into particularly sturdy across the time of the cyclical bottoms, with every of those cycles observing their lows not too removed from one another.

That is naturally beneath the belief that the underside seen again in November 2022 following the FTX collapse was certainly the bear-market backside for the present cycle.

Within the bear-market restoration phases of every cycle, the costs present extra of a divergence, as the present and final processes each noticed vital rallies. In distinction, the 2013 cycle noticed an prolonged section of consolidation.

Nonetheless, curiously, the present Bitcoin crash nearly exactly coincides with a pointy drawdown from the 2017 cycle, whereas the 2013 cycle, which had diverged from the opposite two, nonetheless noticed a pointy decline not too lengthy earlier than the opposite two noticed their crashes.

Following the present level, the 2013 and 2017 cycles had gone on to converge once more. If the present cycle reveals this similar conduct, extra drawdown is perhaps coming for the value.

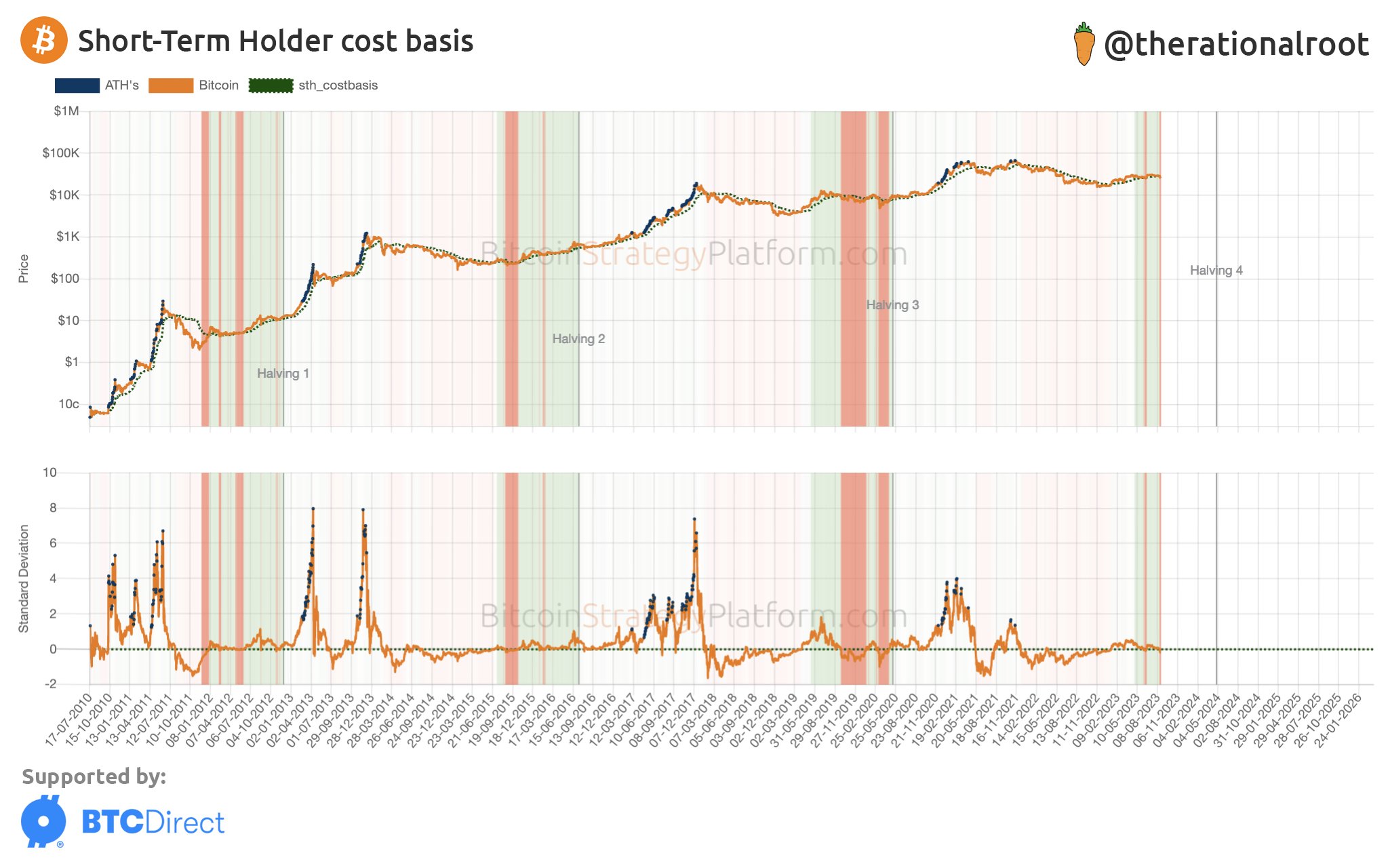

Not too long ago, Bitcoin has misplaced an important degree within the type of the short-term holder cost basis. This degree refers back to the worth at which the common short-term holder acquires cash.

One other analyst, Root, has posted a cycle comparability chart on X that shows how every of the cycles had gone by way of durations of being beneath this degree within the remaining 12 months main as much as the halving.

The sample of every of the cycles | Supply: @therationalroot on X

This is able to counsel that the present Bitcoin cycle isn’t displaying one thing out of the peculiar with the most recent crash beneath the short-term holder price foundation.

BTC Worth

On the time of writing, Bitcoin is buying and selling at round $26,400, down 7% within the final week.

BTC appears to be making an attempt to make some restoration | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, CryptoQuant.com, BitcoinStrategyPlatform.com

More NFT News

Hashrate Development Aligns With Rising Search Curiosity

SOL Worth Hits Report, Persevering with Turnaround From Crypto Winter Crash

Bitcoin Nears $100,000 As Trump Council Anticipated To Implement BTC Reserve