PEPE, the once-promising meme coin that garnered consideration previously quarter, suffered an unexpected blow on Thursday because it succumbed to the grip of FUD (concern, uncertainty, and doubt). Regardless of making waves in latest months, PEPE’s momentum fizzled out by August, exacerbated by a wave of damaging sentiment that battered the altcoin.

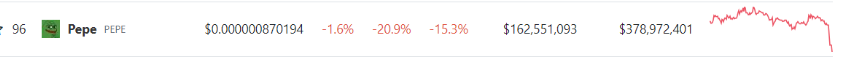

The present worth of PEPE stands at a mere $0.000000870194 in line with CoinGecko, sustaining a 21% hunch within the final 24 hours alone. Over the span of seven days, the meme coin incurred losses of 15.3%, signaling a distressing pattern for its holders.

PEPE worth motion right now. Supply: Coingecko

Multisig Pockets Modifications Gas PEPE Rug Pull Allegations

The foundation of this downturn traces again to latest alterations in PEPE’s multisig pockets, coupled with newfound token transfers that ignited a prevailing concern of a possible “rug pull” orchestrated by the mission’s builders.

On August 24, nearly $16 million worth of Pepe tokens have been transferred from the builders’ multisig pockets to numerous crypto exchanges, sending shockwaves all through the neighborhood.

1/4

1 hour in the past, the Pepe multisig pockets, modified the quantity of signatures required on their multisig from a 5/Eight to 2/8. This comes after sending $15.7 million price of $PEPE to exchanges.

A breakdown of what we all know: pic.twitter.com/bxBxp6Nzqz

— ASXN (@asxn_r) August 24, 2023

The tokens flowed out of the PEPE multisig pockets, directed in direction of addresses affiliated with notable platforms comparable to Binance, OXK, and Bybit.

What additional exacerbated issues was the transformation within the transaction approval course of inside the vault-like pockets. Beforehand requiring consensus from 5 out of eight wallets, it had inexplicably shifted to a meager two out of eight.

Any motive why the PEPE multisig pockets modified the brink to only 2/Eight signatures? Appears bizarre, this isn’t customary proper?

Additionally, appears that some has been despatched to exchanges pic.twitter.com/1DVZIOvef8

— CryptoNoddy (@Crypto_Noddy) August 24, 2023

This unprecedented maneuver marked the primary occasion wherein the mission’s essential multisig, accountable for safeguarding a good portion of the token’s provide, executed such an outward switch.

Investor Reactions And Realized Losses

Whereas the authenticity of the allegations stays unverified, traders swiftly leaped to conclusions, suspecting the event workforce of orchestrating a rip-off for private achieve. Opposite to this sentiment, closer analysis means that had foul play been supposed, the switch’s magnitude would have been considerably bigger.

PEPEUSD buying and selling at $0.000001 on the every day chart: Gemini/TradingView.com

Nonetheless, the panic-induced sell-off quickly gained traction, precipitating an abrupt nosedive in PEPE’s worth and fostering an atmosphere dominated by concern.

On a broader scale, the community skilled a surge in Realized Losses, reaching a three-month peak and registering the third-highest single-day losses for the reason that token’s inception. In the end, investor losses tallied a staggering $14 million.

The rollercoaster journey of the PEPE meme coin, from hovering highs to a precipitous fall, underscores the influence of FUD inside the risky cryptocurrency panorama.

Whereas the true intentions behind the pockets adjustments and token transfers stay shrouded in uncertainty, the incident serves as a stark reminder of the fragility inherent in meme-based tokens.

(This website’s content material shouldn’t be construed as funding recommendation. Investing entails danger. While you make investments, your capital is topic to danger).

Featured picture from Blockcast

More NFT News

VanEck maintains $180,000 Bitcoin goal as bull market beneficial properties steam

MicroStrategy Completes $3B Observe Providing to Purchase Extra Bitcoin however MSTR Dumps 16%

SEC Chair Gary Gensler to step down on Jan. 20