Glassnode information analyzed by CryptoSlate analysts exhibits that Asia, the U.S., and the EU have been bullish on Bitcoin (BTC) and Ethereum (ETH) since late January.

Because the regional value metrics point out, buyers from all three areas really feel extra bullish on BTC than they do on ETH. Within the meantime, year-over-year BTC provide for Asia means BTC will proceed to extend within the quick time period.

Regional costs

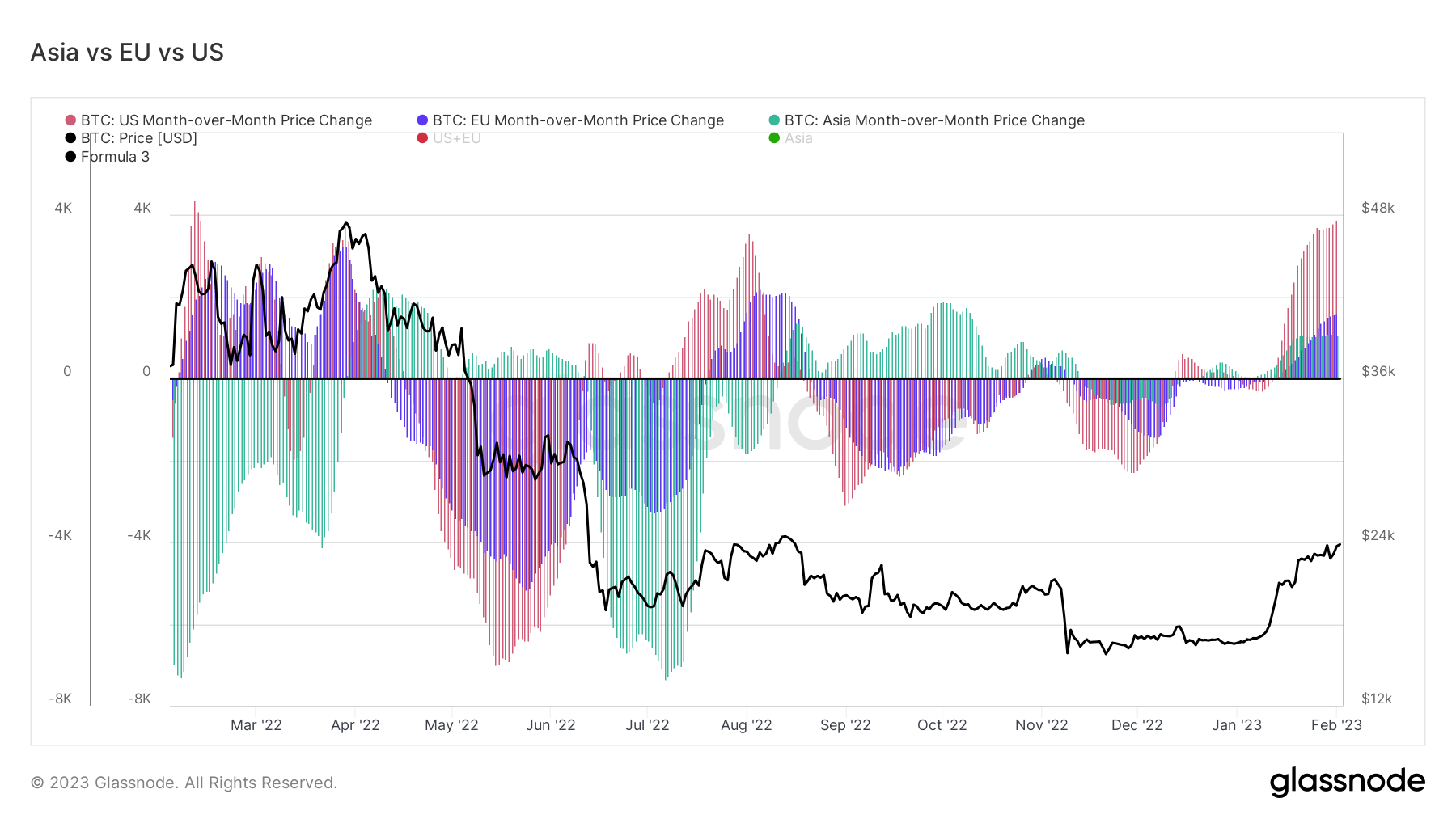

The regional value metric used on this analysis exhibits the 30-day change within the regional costs of Asia, the EU, and the U.S. The worth actions in the course of the working hours of a area should be recorded earlier than calculating the regional value metric. Then, the value for a area might be decided by calculating the cumulative sum of the value modifications recorded throughout the working hours of that area.

The chart beneath displays the regional BTC costs for all three areas because the starting of 2022. The crimson bars characterize the regional value for the U.S., whereas the blue and inexperienced ones characterize the EU and Asia, respectively.

If the metric falls beneath the zero line, this means that the area is bearish on BTC. If it locations above the road, it represents the area’s bullish sentiment.

In keeping with the chart, that every one three areas turned on the bullish aspect in late January 2023 and have been bullish since then, with the U.S. being probably the most bullish. The final time all three areas had been bullish was throughout a short while in August 2022, proper after the Luna collapse.

Ethereum

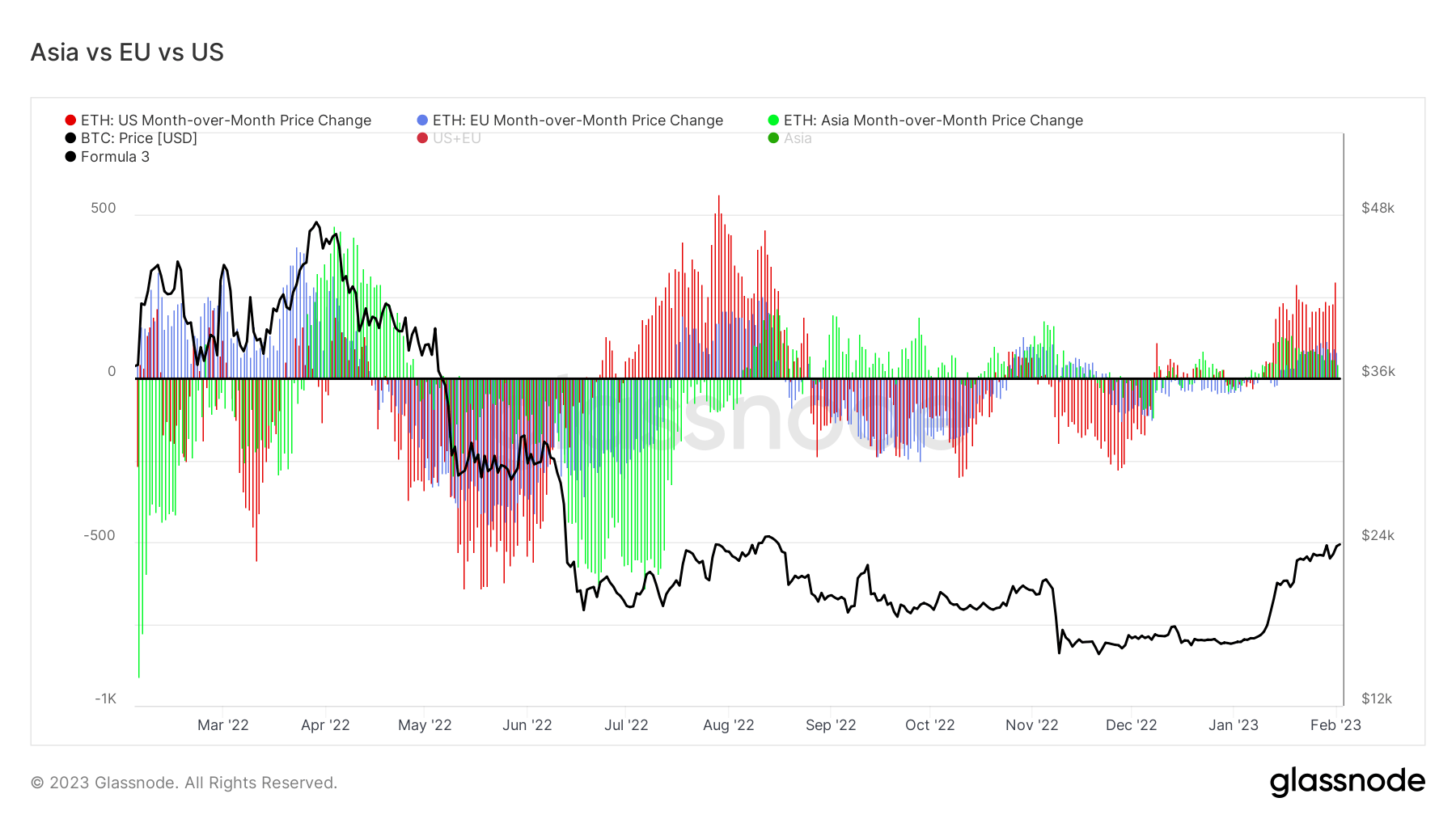

The regional ETH costs for Asia, the U.S., and the EU additionally characterize an identical bullish sentiment. The chart beneath illustrates the regional ETH costs for every area because the starting of the yr 2022. The U.S., the EU, and Asia are represented with crimson, blue, and inexperienced, respectively.

Just like the regional BTC costs, all three areas at present seem bullish on ETH, with the U.S. being probably the most bullish one. Nonetheless, not one of the areas present the identical degree of enthusiasm as they do with BTC.

12 months-over-12 months provide of Asia

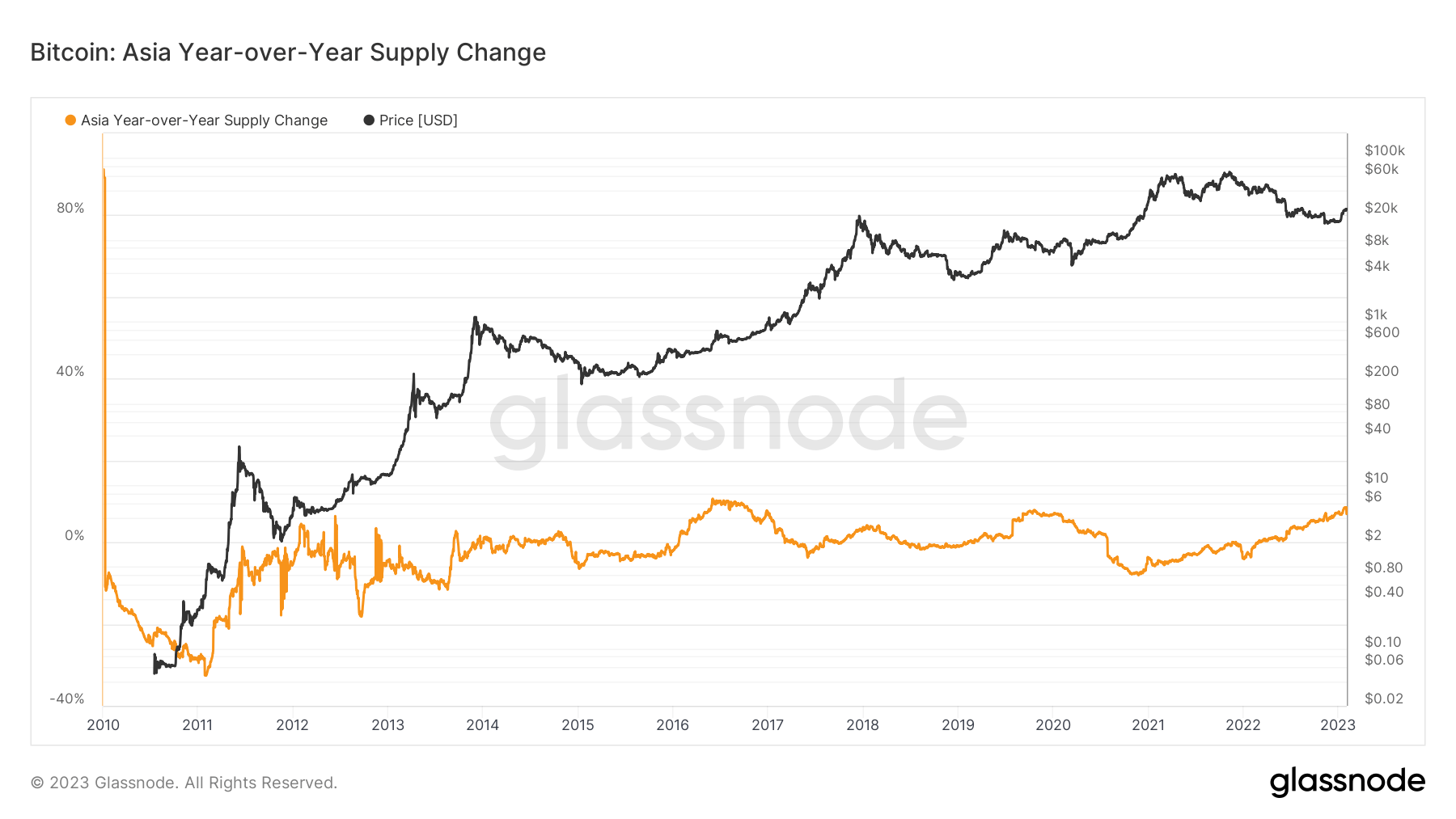

This metric supplies an estimate for the year-over-year (YoY) change available in the market share between the BTC provide held and being traded. The chart beneath exhibits the YoY provide for the Asia area because the starting of 2010.

The info exhibits that the area’s YoY provide is at present over 8.5%. This share signifies that Asia is on the highest bullish level it has ever been.

Earlier CryptoSlate research revealed that Asian buyers constructed and maintained a wise cash fame by persistently shopping for on the backside and promoting on the prime. Assuming Asiacontinuesg to behave “good,” their bullish sentiment signifies that BTC will proceed to extend, not less than within the quick time period.

More NFT News

Chinese language Auto Supplier Dives Into Bitcoin Mining With $256M Funding

Harnessing idle GPU energy can drive a greener tech revolution

Will Dogecoin Attain $1? Crypto Volatility Returns as Bitcoin and Ethereum Slide