The beneath is an excerpt from a latest version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Binance: FUD Or Authentic Questions?

By far, one of many largest winners within the aftermath of the FTX collapse has appeared — on the floor — to be Binance. After solely having 7.82% market share of the bitcoin provide on exchanges in 2018, their share is now 27.50% regardless of a wider pattern of bitcoin provide leaving exchanges. The bitcoin stability on Binance now totals 595,864 BTC, which is 3.1% of excellent provide, price $10.58 billion. This bitcoin belongs to their prospects and displays a rising pattern in market share over the previous couple of years that has made Binance the biggest bitcoin and cryptocurrency trade on the earth.

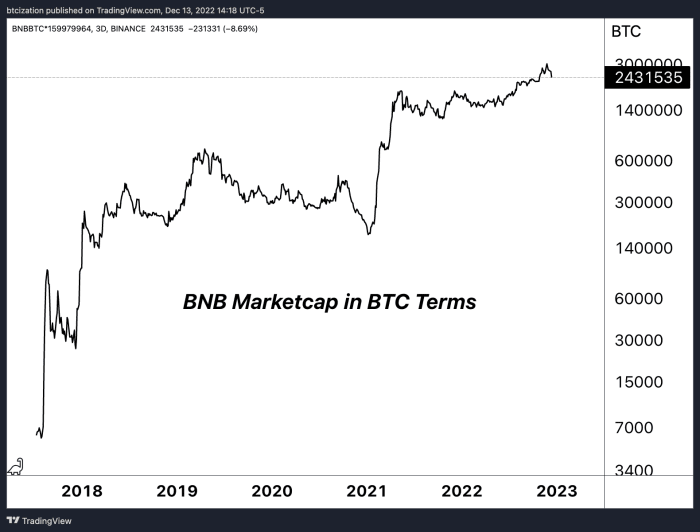

Binance now controls roughly 60% of the spot and derivatives volume in your complete market. It’s onerous to see how any trade within the house is usually a “winner” within the present market situations, however one may make the case for Binance, with the trade’s rising energy in a decimated business. On high of that, Binance’s BNB token, the native foreign money of Binance’s personal Ethereum-competing Layer 1 blockchain, continues to be one of many higher performing tokens when valued in bitcoin phrases this 12 months.

But, is that this latest “energy” every thing that it appears or is it a facade? We’ve realized during the last month that no firm is protected on this business proper now (particularly exchanges) and questions are rising round Binance’s practices, solvency, BNB token worth and the general state of their enterprise over the previous couple of weeks. Is it FUD or legit? Let’s attempt to break a few of it down, addressing the issues by an goal and skeptical lens.

Binance Flows

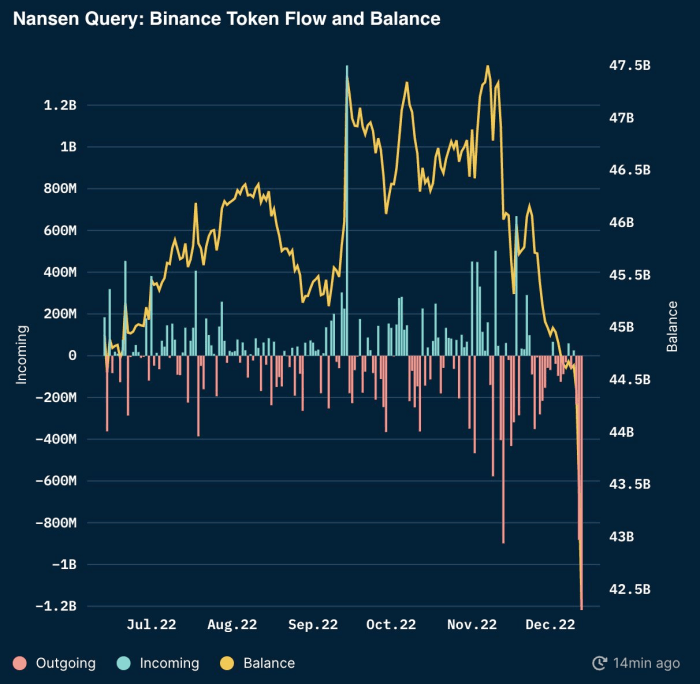

We’ve seen vital outflows from Binance throughout completely different varied tokens and bitcoin when each Nansen and Glassnode monitoring. Throughout ETH and ERC20 tokens, Binance noticed $3 billion leaving the trade in its largest single-day outflow since June. Throughout Nansen whole pockets monitoring, all Binance balances are estimated at $62.5 billion with round 50% of these balances in stablecoins throughout BUSD and USDT.

Supply: Nansen

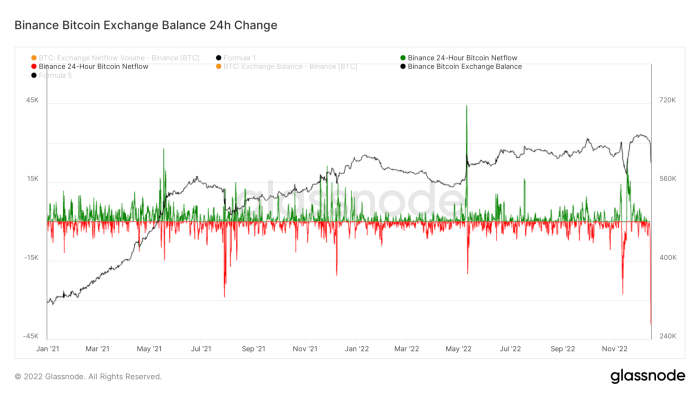

In accordance with Glassnode, the full bitcoin trade stability on Binance is down round 6-7% during the last day, after reaching a peak on December 1. Though balances stay above 500,000 bitcoin and Binance has proven a rising pattern of bitcoin balances on the platform this 12 months, it is a vital transfer for outflows in simply 24 hours. As a basic comparability, the pattern of bitcoin trade balances was a a lot completely different story for FTX, whose stability had been falling closely since June. Binance outflows during the last couple days are a bit alarming and lift questions: Is that this a one-off occasion and simply enterprise as standard or is that this the beginning of one thing extra?

Readers can track the on-chain addresses provided by Binance for free here.

The principle trigger for concern will not be whether or not Binance has any bitcoin/crypto or not. We are able to transparently see that the agency controls tens of billions price of crypto property. What isn’t precisely clear, much like FTX, is whether or not the agency has commingled customers funds or whether or not the agency has any excellent liabilities towards consumer property.

Binance CEO Changpeng Zhao (CZ) has stated that the agency has no liabilities with some other corporations, however as latest months have proven, phrases don’t imply all that a lot. Whereas we aren’t claiming that CZ is mendacity to the general public concerning the state of Binance funds, we now have no strategy to show in any other case.

CZ’s response as as to whether the corporate was going to audit liabilities towards consumer property was, “Sure, however liabilities are more durable. We do not owe any loans to anybody. You possibly can ask round.”

Sadly, “ask round” isn’t a passable sufficient reply for an ecosystem supposedly constructed across the ethos of “don’t belief, confirm.”

Whereas there isn’t a doubt that Binance is an business large within the crypto derivatives business, how do we all know the agency isn’t doing related issues as previous actors with reference to buying and selling towards purchasers utilizing consumer funds and/or proprietary information. Issues like the previous Chief Authorized Officer of Coinbase departing Binance U.S. last summer after just three months because the CEO leaves one with many questions.

So as to add to our skepticism, the value of the Binance trade token BNB is close to all-time highs in bitcoin phrases, appreciating an astounding 828% towards bitcoin within the final 785 calendar days.

The approaching weeks will probably be filled with headlines across the state of world crypto regulation in a post-FTX world. In a 48-hour interval, Reuters printed information stating that the U.S. Justice Dept is split over charging Binance, Binance withdrawals for bitcoin and combination stablecoin pairs have hit all-time highs and the BNB trade token has fallen 10% relative to bitcoin.

Out of an abundance of warning, we’ll proceed to induce readers working on any centralized trade — of which Binance is most positively included — to look into self custody options. There have been far too many situations of incompetence and/or misconduct from exchanges.

It’s not that we don’t belief CZ or Binance, it is the truth that we don’t belief anybody.

The entire level of bitcoin is we now have an asset that’s actually the legal responsibility of nobody. Confirm the possession of an open distributed community with cryptography; don’t belief permissioned IOUs. With the combination of regulatory issues concerning the international crypto derivatives business, a questionable trade token with unbelievable relative efficiency during the last two years and a shaky proof-of-reserves attestation — that was incorrectly claimed to be an audit and had business CEOs elevating eyebrows — we discover the necessity to urge our readers to judge their counterparty threat.

More NFT News

Machine Studying in Focus as Chainalysis Acquires Hexagate

Bitcoin Traders Are Now Up $67,000 On Common – And This Is Simply The Begin

Extra Than Half of Crypto Tokens, Memecoins Launched in 2024 Have been Malicious: Blockaid