The talk round whether or not or not this coverage is a type of quantitative easing misses the purpose: Liquidity is the secret for world monetary markets.

The article beneath is an excerpt from a current version of Bitcoin Journal PRO, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

QE Or Not QE?

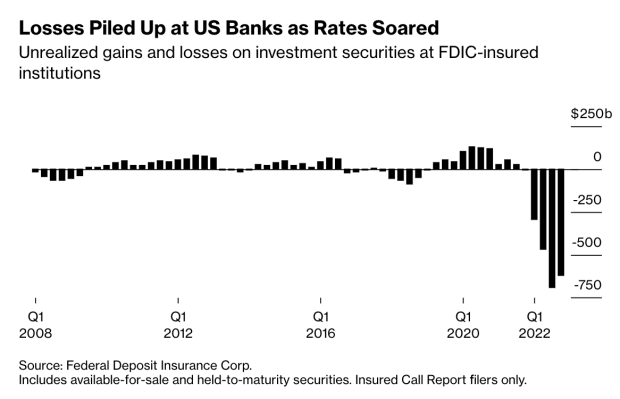

The Financial institution Time period Funding Program (BTFP) is a facility launched by the Federal Reserve to supply banks a secure supply of funding throughout instances of financial stress. The BTFP permits banks to borrow cash from the Fed at a predetermined rate of interest with the purpose of guaranteeing that banks can proceed to lend cash to households and companies. Specifically, the BTFP permits certified lenders to pledge Treasury bonds and mortgage-backed securities to the Fed at par, which permits banks to keep away from realizing present unrealized losses on their bond portfolios, regardless of the historic rise in rates of interest over the previous 18 months. Finally, this helps assist financial progress and protects banks within the course of.

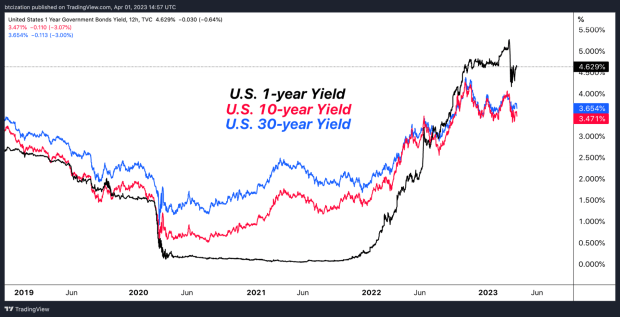

The trigger for the great quantity of unrealized losses within the banking sector, notably for regional banks, is because of the historic spike in deposits that got here on account of the COVID-induced stimulus, simply as bond yields have been at historic lows.

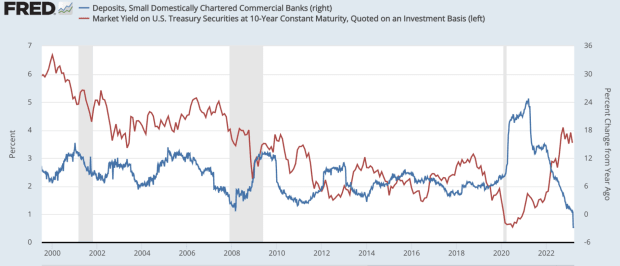

Proven beneath is the year-over-year change in small, domestically chartered industrial banks (blue), and the 10-year U.S. Treasury yield (crimson).

TLDR: Historic relative spike in deposits with short-term rates of interest at 0% and long-duration rates of interest close to their generational lows.

The explanation that these unrealized losses on the financial institution’s safety portfolios haven’t been broadly mentioned earlier is because of the opaque accounting practices within the trade that permit unrealized losses to be primarily hidden, until the banks wanted to boost money.

The BTFP permits banks to proceed to carry these belongings to maturity (at the least quickly), and permit for these establishments to borrow from the Federal Reserve with the usage of their at present underwater bonds as collateral.

The impacts of this facility — plus the current spike of borrowing on the Fed’s low cost window — has led to a hotly debated subject in monetary circles: Is the newest Fed intervention one other type of quantitative easing?

In the simplest phrases, quantitative easing (QE) is an asset swap, the place the central financial institution purchases a safety from the banking system and in return, the financial institution will get new financial institution reserves on their steadiness sheet. The supposed impact is to inject new liquidity into the monetary system whereas supporting asset costs by decreasing yields. Briefly, QE is a financial coverage device the place a central financial institution purchases a hard and fast quantity of bonds at any value.

Although the Fed has tried to speak that these new insurance policies should not steadiness sheet growth within the conventional sense, many market contributors have come to query the validity of such a declare.

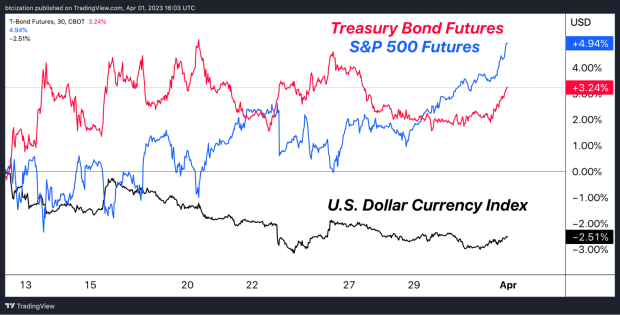

If we merely take a look at the response from numerous asset lessons for the reason that introduction of this liquidity provision and the brand new central financial institution credit score facility, we get fairly an attention-grabbing image: Treasury bonds and equities have caught a bid, the greenback has weakened and bitcoin has soared.

On the floor, the ability is solely to “present liquidity” to monetary establishments with constrained steadiness sheets (learn: mark-to-market insolvency), but when we intently study the impact of BTFP from first rules, it’s clear that the ability gives liquidity to establishments experiencing steadiness sheet constraint, whereas concurrently retaining these establishments from liquidating long-duration treasuries on the open market in a firesale.

Teachers and economists can debate the nuances and intricacies of Fed coverage motion till they’re blue within the face, however the response operate from the market is greater than clear: Stability sheet quantity go up = Purchase danger belongings.

Make no mistake about it, the complete sport is now about liquidity in world monetary markets. It didn’t was once this manner, however central financial institution largesse has created a monstrosity that is aware of nothing aside from fiscal and financial assist throughout instances of even the slightest misery. Whereas the short-to-medium time period appears unsure, market contributors and sidelined onlookers needs to be nicely conscious as to how this all ends.

Perpetual financial growth is an absolute certainty. The flowery dance performed by politicians and central bankers within the meantime is an try and make it look as if they will hold the ship afloat, however in actuality, the worldwide fiat financial system is like an irreversibly broken ship that’s already struck an iceberg.

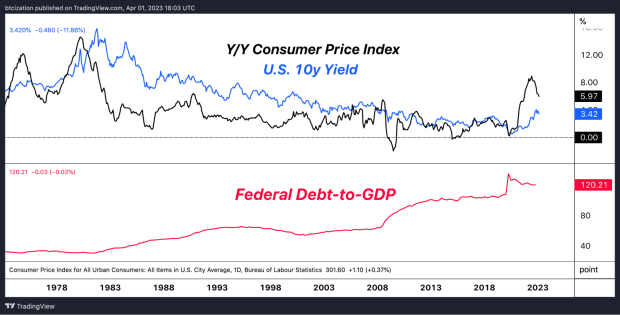

Allow us to not neglect that there is no such thing as a approach out of 120% debt-to-GDP as a sovereign with out both a large unexpected and unlikely productiveness increase, or a sustained interval of inflation above the extent of rates of interest — which might crash the financial system. Provided that the latter is very unlikely to happen in actual phrases, monetary repression, i.e., inflation above the extent of rates of interest, seems to be the trail going ahead.

Remaining Notice

For the layman, there is no such thing as a dire must get caught up within the schematics of the talk whether or not current Fed coverage is quantitative easing or not. As a substitute, the query that deserves to be requested is what would have occurred to the monetary system if the Federal Reserve didn’t conjure up $360 billion price of liquidity from skinny air over the past month? Widespread financial institution runs? Collapsing monetary establishments? Hovering bond yields that ship world markets spiraling downwards? All have been attainable and even doubtless and this highlights the rising fragility of the system.

Bitcoin gives an engineering resolution to peacefully choose out of the politically corrupted assemble colloquially referred to as fiat cash. Volatility will persist, trade fee fluctuations needs to be anticipated, however the finish sport is as clear as ever.

That concludes the excerpt from a current version of Bitcoin Journal PRO. Subscribe now to obtain PRO articles straight in your inbox.

Related Previous Articles:

- Another Fed Intervention: Lender Of Last Resort

- Banking Crisis Survival Guide

- PRO Market Keys Of The Week: Market Says Tightening Is Over

- Largest Bank Failure Since 2008 Sparks Market-Wide Fear

- A Tale of Tail Risks: The Fiat Prisoner’s Dilemma

- The Everything Bubble: Markets At A Crossroads

- Not Your Average Recession: Unwinding The Largest Financial Bubble In History

- Just How Big Is The Everything Bubble?

More NFT News

XRP Worth On Its Approach To $10 In Solely Three Months If It Follows This Sample

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin