Information reveals Bitcoin shorts have been piling up on cryptocurrency exchanges Binance and Deribit throughout the previous few days.

Bitcoin Funding Charges On Binance & Deribit Are Deep Purple Proper Now

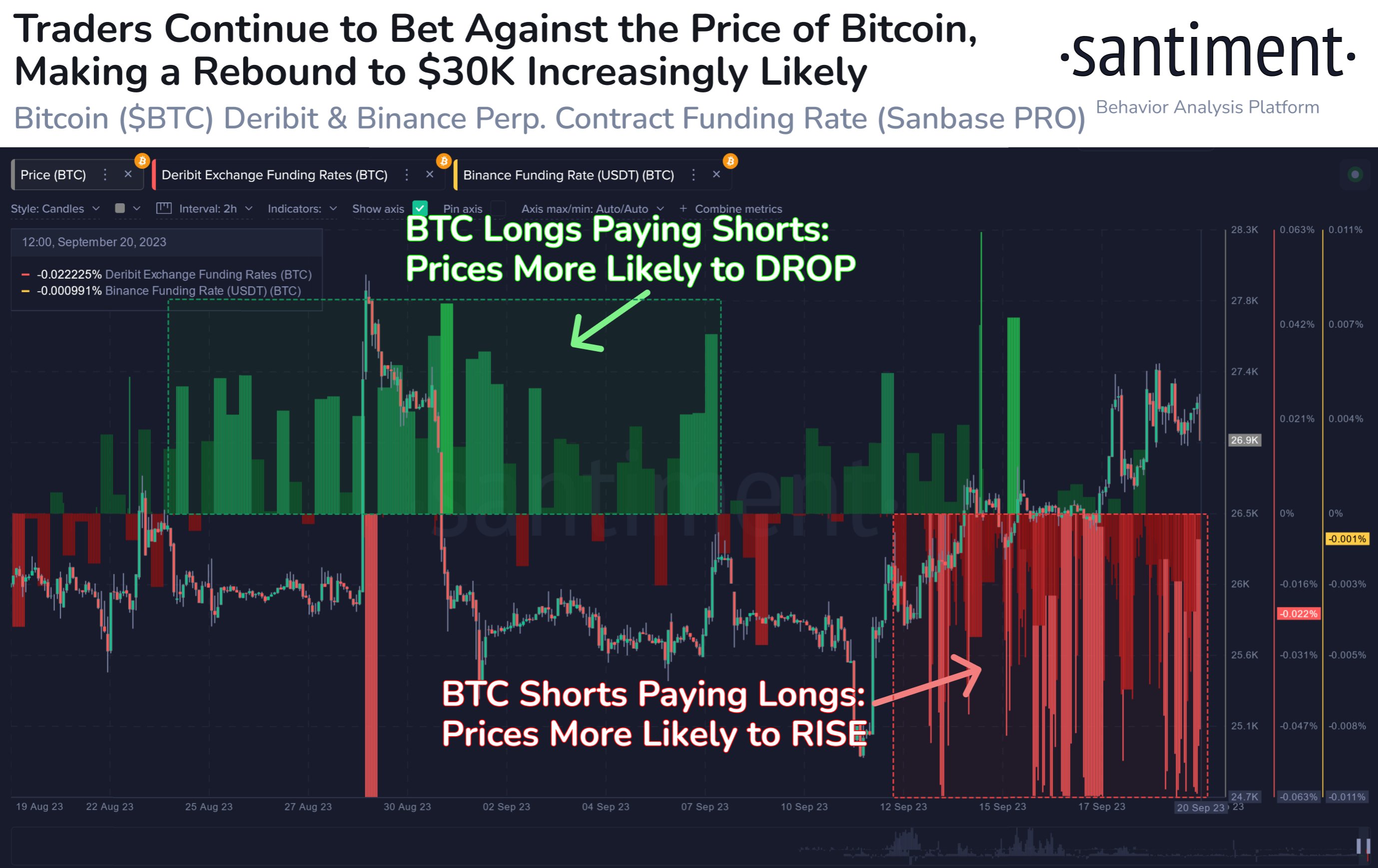

In accordance with knowledge from the analytics agency Santiment, merchants on the by-product market have continued to wager in opposition to the cryptocurrency lately. The related indicator right here is the “funding rate,” which retains observe of the periodic payment that by-product contract holders on an alternate are paying one another proper now.

When this metric has a constructive worth, it signifies that the lengthy merchants are paying a premium to the quick merchants with a purpose to maintain onto their positions. Such a development suggests that almost all sentiment on the given alternate is bullish at present.

Alternatively, the metric being below the zero mark implies the merchants on the platform maintain a bearish mentality in the intervening time, because the shorts are the dominant pressure.

Now, here’s a chart that reveals the development within the Bitcoin funding charges for Binance and Deribit over the previous month:

Appears like the worth of the metric has been fairly crimson in current days | Supply: Santiment on X

As displayed within the above graph, the Bitcoin funding fee for each of those exchanges had been principally constructive over the last third of August and the beginning third of this month, implying that almost all of the merchants had been longs.

The bets of those holders had failed, nevertheless, as the worth had seen an total downtrend on this interval. Because the rebound earlier this month, although, the sentiment has flipped out there as shorts have piled up on each of those platforms.

These quick merchants haven’t been profitable thus far, both, as the worth of the cryptocurrency has seen web progress since they’ve appeared. Traditionally, the market has really been extra more likely to go in opposition to the expectation of the bulk, so this sample could also be consistent with that.

The rationale why the asset would transfer in opposition to the bets of those contract holders is that mass liquidation occasions, known as squeezes, turn out to be extra more likely to occur the extra lopsided the sector is.

A considerable amount of lengthy liquidations can amplify crashes, whereas quick liquidations can present the gasoline for upward surges. Since Bitcoin continues to be seeing aggressive shorting, it could be a constructive signal for the cryptocurrency’s present worth rise, as a possible quick squeeze might assist it prolong additional.

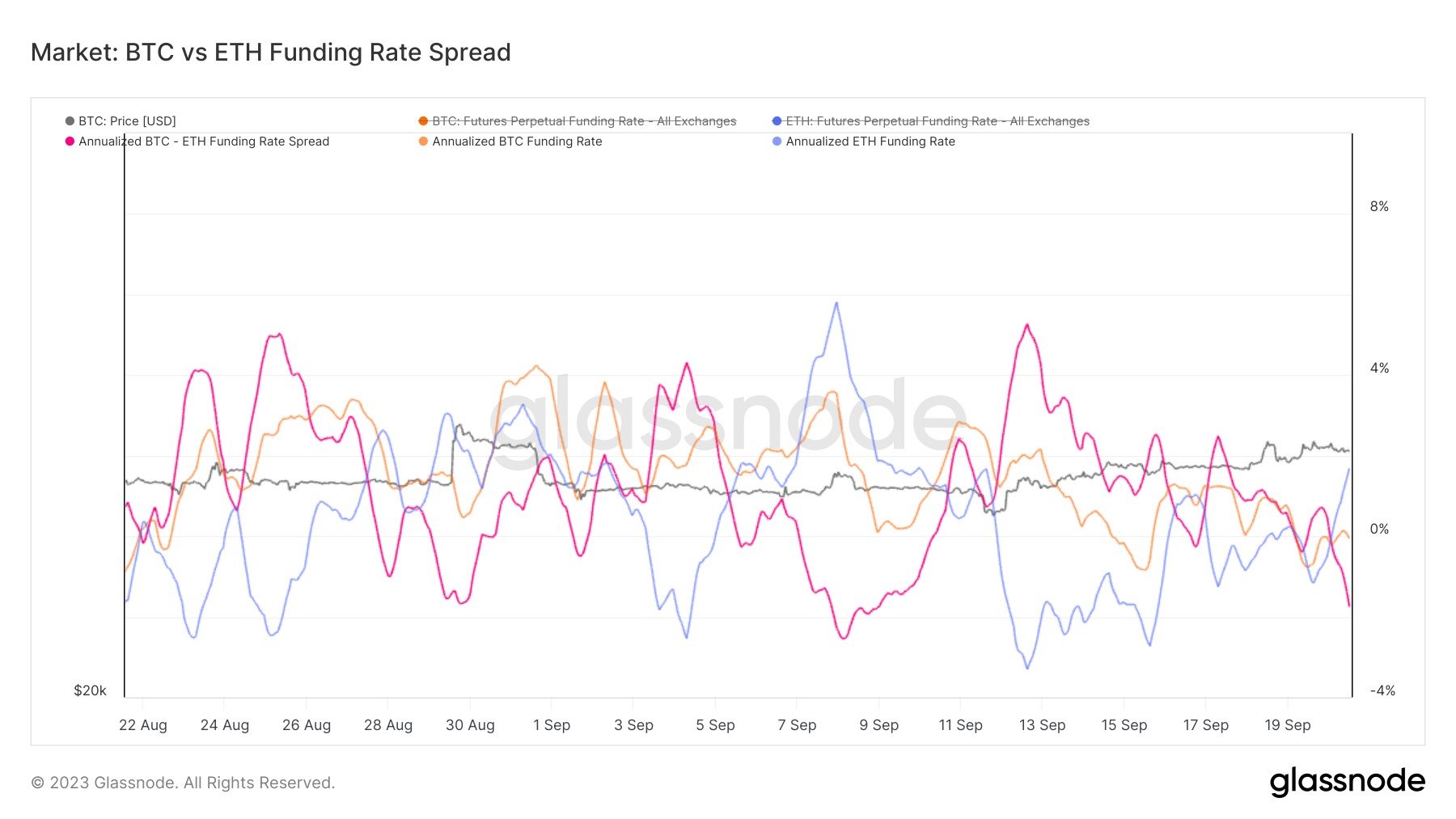

Curiously, whereas Bitcoin is being wager in opposition to proper now, Ethereum’s funding charges are constructive, as identified by analyst James V. Straten in a post on X.

The 2 metrics have diverged lately | Supply: @jimmyvs24 on X

From the graph, it’s seen that the funding charges of the highest two belongings within the sector have gone reverse methods lately. Which means whereas BTC could possibly construct an uptrend off the shorts, ETH might face the alternative impact if the longs find yourself being liquidated.

BTC Worth

Bitcoin has seen a drawdown of about 1.5% at the moment because the asset’s worth has now dropped in direction of the $26,700 stage.

BTC continues to be total up up to now week | Supply: BTCUSD on TradingView

Featured picture from Yiğit Ali Atasoy on Unsplash.com, charts from TradingView.com, Glassnode.com

More NFT News

Chinese language Auto Supplier Dives Into Bitcoin Mining With $256M Funding

Harnessing idle GPU energy can drive a greener tech revolution

Will Dogecoin Attain $1? Crypto Volatility Returns as Bitcoin and Ethereum Slide