An analytics agency has revealed that three altcoins have been seeing bearish bets on Binance, which can assist gasoline rebounds.

Tron, Stellar, And 1inch Have Seen Destructive Funding Charges Lately

In a brand new post on X, the on-chain analytics agency Santiment has lately mentioned the pattern within the Binance Funding Charge for a couple of totally different altcoins.

The “Funding Rate” is an indicator that retains observe of the periodic quantity of charges that the merchants on a given derivatives trade (which, within the present case, is Binance) are exchanging between one another.

When the metric has a constructive worth, it means the lengthy contract holders are paying a premium to the quick traders to carry onto their positions proper now. Such a pattern implies a bullish mentality is the dominant one available in the market.

Alternatively, the indicator underneath the zero mark means that the quick traders presently outweigh the lengthy ones, so the bulk shares a bearish sentiment.

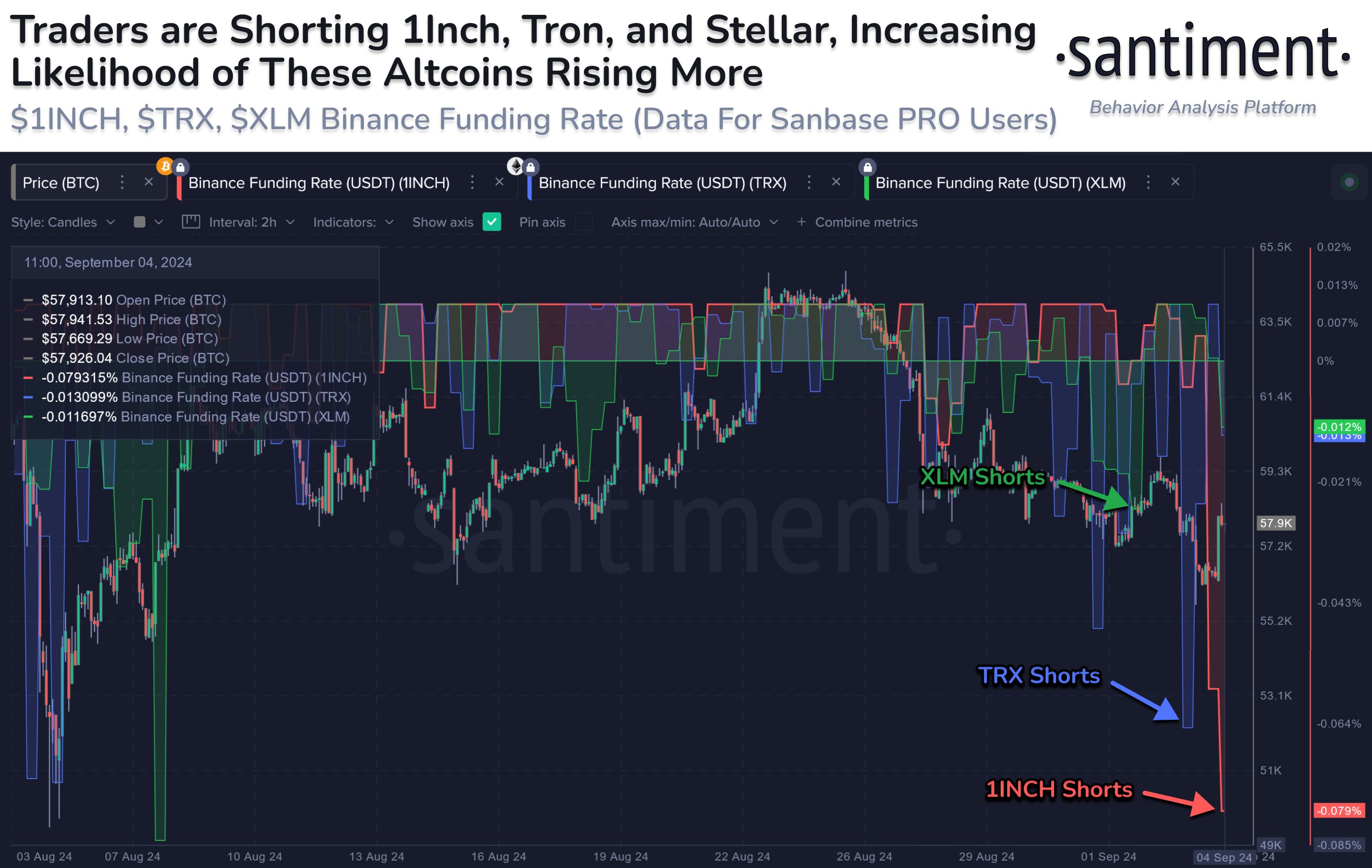

Now, here’s a chart that reveals the pattern within the Binance Funding Charge for 3 altcoins, 1inch Community (1INCH), Tron (TRX), and Stellar (XLM), over the previous month:

Appears like the worth of the metric has been crimson for all three of those cash lately | Supply: Santiment on X

The above graph reveals that the Binance Funding Charge has been unfavorable for all three of those altcoins lately, suggesting that extra merchants have been attempting to guess towards a worth rise.

1inch seems to have been having it the worst by way of this indicator, with its worth presently being a unfavorable 0.079%. Whereas the crimson values of the metric would recommend the group has been bearish, they will not be dangerous for his or her costs.

It is because a mass liquidation event is mostly the probably to have an effect on the market with probably the most positions. The chance of such liquidations shall be raised much more if the positions in the marketplace contain important leverage. As Santiment explains,

Once we see heavy bets towards an asset, liquidations can happen which act as “rocket gasoline” for the asset’s worth to rise larger. Going towards the group of doubters might pay dividends.

Thus, it stays to be seen how the costs of those altcoins will develop from right here on out, given this potential rocket gasoline brewing within the background.

TRX Worth

Tron, the most important of those three altcoins, has had a bearish week, very similar to the remainder of the cryptocurrency sector, however by way of month-to-month returns, TRX traders haven’t had a nasty time in any respect because the asset has managed to outperform the likes of Bitcoin (BTC) with its 18% surge.

The beneath chart reveals what the current efficiency of Tron has seemed like.

The value of the altcoin seems to have gone up over the previous few weeks | Supply: TRXUSD on TradingView

Featured picture from Dall-E, Santiment.web, chart from TradingView.com

More NFT News

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin

Canine Memecoins Rebound as Bitcoin Reaches $98,000