Bitcoin gained by over 10% previously week because it reclaimed the $60,000 price mark on Friday. Following an initially adverse efficiency in September, this current value rise by the crypto market chief has elicited a lot constructive sentiments from buyers. Nonetheless, a Cryptoquant analyst with the username CRYPTOHELL studies that this bullish momentum is being challenged by reverse forces driving the BTC market to a crossroads.

Bitcoin Market Forces At A Standstill – What Subsequent?

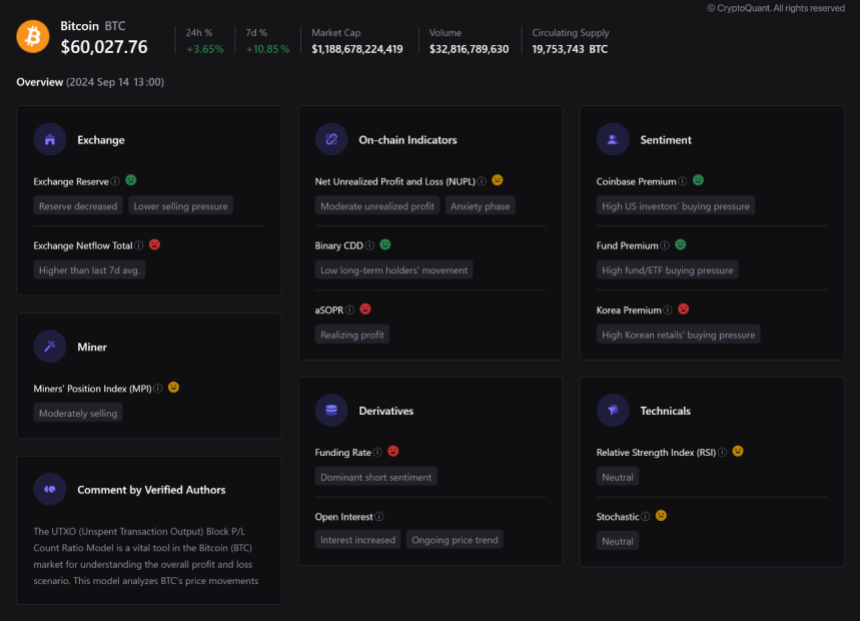

In a Quicktake post on Saturday, CRYPTOHELL said that the present Bitcoin market presents each optimistic and cautionary indicators.

On the constructive entrance, the crypto analyst notes that there was a lower in BTC exchange reserves which hints at a diminished promoting strain, with buyers opting to take care of their holdings in anticipation of a future value achieve. This bullish sentiment is additional strengthened by a robust demand from US-based buyers as evidently seen within the demand for the Bitcoin spot ETFs and indicated in metrics such because the Coinbase Premium Index.

Alternatively, CRYPTOHELL states there are market developments that will require buyers to use some warning.

Firstly, the analyst highlights that there’s a higher-than-average trade netflows of Bitcoin over the past 7 days, which can point out the presence of some vital promoting strain. Moreover, the Adjusted Spent Output Revenue Ratio (aSOPR), a key metric for assessing market sentiment exhibits that there’s a modest stage of revenue realization by buyers which signifies a promoting strain on Bitcoin.

As well as, this bearish sentiment is bolstered by the adverse funding charges within the derivatives market which signifies that many merchants are taking leveraged quick positions in anticipation of a value drop.

The presence of those bullish and bearish components concurrently has pushed the BTC market into “an anxiousness section” the place most buyers are unsure in regards to the digital asset. Nonetheless, long-term buyers are nonetheless largely dormant which is a giant constructive for the bullish forces.

In conclusion, CRYPTOHELL states the Bitcoin market is at a “determination level”, and with technical indicators additionally presenting a impartial place, future value actions might be doubtlessly influenced by vital adjustments in market sentiment and vital information presumably by way of adoption, regulation, and so forth.

BTC Leverage Ratio Hits New Yearly Excessive

In different information, crypto analyst Ali Martinez has reported that the entire estimated leverage ratio of Bitcoin throughout exchanges has attained a brand new yearly excessive. This growth largely means Bitcoin merchants are taking extra dangers as they open extra positions with borrowed funds. Whereas leveraging typically can result in amplified achieve, it additionally presents the dangers of serious losses which might induce large-scale liquidations. Thus, there’s a want for elevated warning within the BTC market.

On the time of writing, Bitcoin trades at $60,220 with a 0.23% decline within the final day. Notably, Bitcoin’s buying and selling quantity is down by 51.83% and valued at $15.74 billion.

Associated Studying: Bitcoin Price Recovery Hinges On This Key Market Indicator, Reveals Analyst

More NFT News

Machine Studying in Focus as Chainalysis Acquires Hexagate

Extra Than Half of Crypto Tokens, Memecoins Launched in 2024 Have been Malicious: Blockaid

Hedera Value Prediction for Right now, December 18 – InsideBitcoins