Essentially the most typically used cryptocurrency worldwide, Bitcoin, has had an impressive price rise over the previous few weeks, significantly elevating dealer confidence.

Associated Studying

The larger cryptocurrency market nonetheless reveals volatility even with Bitcoin’s latest rallies. Due to Ethereum ETFs, which have created circumstances good for important worth actions, the market is right now way more liquid. As Ethereum ( ETH) and Bitcoin (BTC) negotiate these tough waters, their mechanics in addition to the danger of development reversals are impacting one another.

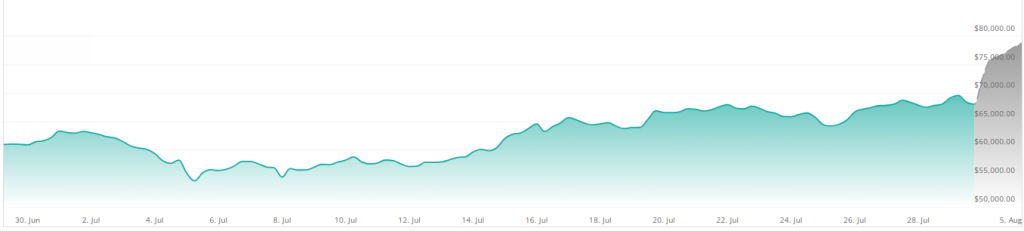

BTC up within the final month. Supply: Coingecko

In keeping with Santiment statistics, since March 2023 the proportion of optimistic to damaging feedback about Bitcoin has climbed to its highest degree. Seeing an all-time excessive inside attain as soon as extra, buyers have gotten extra hopeful about the way forward for cryptocurrencies as they keep at $66,882.

Market Dynamics: Ripple Impact Of Ethereum ETFs

Ethereum exchange-traded funds (ETFs) have significantly raised market liquidity, due to this fact affecting general stability. Not simply Ethereum but additionally unintentionally Bitcoin has been impacted by this inflow. Having a market valuation of $1.32 trillion and a 55% market domination, merchants are carefully watching how these occasions may change market dynamics.

Although it lately surged, the worth of Bitcoin has declined by 1.36% throughout the day prior to this. This fall underlines how erratic the crypto sector is. Given altering opinions and unsure circumstances, buyers discover it difficult to exactly predict short-term swings. Nonetheless, the rising hope for Bitcoin suggests a revival of digital foreign money curiosity and confidence.

$BTC could be very near the Essential 70okay Resistance and is on the Cusp of Broadening Wedge Upside Breakout.

Because the 70okay Resistance weakens with every check, a Breakout is anticipated this time.

A profitable Breakout may ship Bitcoin above 80okay in August..✍️#Crypto #Bitcion #BTC pic.twitter.com/r2n1p631xY

— Captain Faibik (@CryptoFaibik) July 29, 2024

Forecasts By Analysts: Breaking Limits, Scaling New Heights

Famend bitcoin guru Captain Faibik has given a optimistic future worth estimate for the coin. In keeping with Faibik, Bitcoin is poised to check as soon as extra the essential $70,000 resistance degree. Traditionally a significant barrier, this degree appears to be changing into less complicated with each check that comes round. Faibik says this declining resistance suggests a possible upward breakthrough proven as a broadening wedge.

A spreading wedge technical chart sample means that the worth of an asset could possibly be poised to interrupt out. A breakthrough is trying extra believable as Bitcoin approaches the $70,000 barrier degree. In keeping with Faibik, ought to Bitcoin be capable to go this impediment, by August it may be valued past $80,000. This hopeful forecast is predicated on the development of declining resistance, which usually signifies an approaching breakout and consequent worth rise.

Path Of Improvement Of Bitcoin

Bitcoin appears to be going to have a notable enhance within the following weeks. Though the worth of the alpha coin is now 31% beneath the projection for the following month, short-term indicators present a optimistic development that will trigger the worth to rise. Traders are making ready themselves for a possible resurgence because the market responds to a number of optimistic indicators and growing demand.

Associated Studying

Primarily based on CoinCheckup data, main resistance ranges may be challenged quickly; help is concentrated across the present buying and selling worth. For the anticipated climb, this projection offers a powerful foundation. Forecasts present a notable upward development as Bitcoin will enhance by 45% in the course of the subsequent three months.

Featured picture from Pexels, chart from TradingView

More NFT News

Machine Studying in Focus as Chainalysis Acquires Hexagate

Extra Than Half of Crypto Tokens, Memecoins Launched in 2024 Have been Malicious: Blockaid

Hedera Value Prediction for Right now, December 18 – InsideBitcoins