The value of Bitcoin put in one other optimistic efficiency during the last seven days, trying to finish the month and begin October on a good stronger footing. Persevering with its resurgence over the previous few weeks, the premier cryptocurrency climbed as excessive as $66,000 on Friday, September 27th.

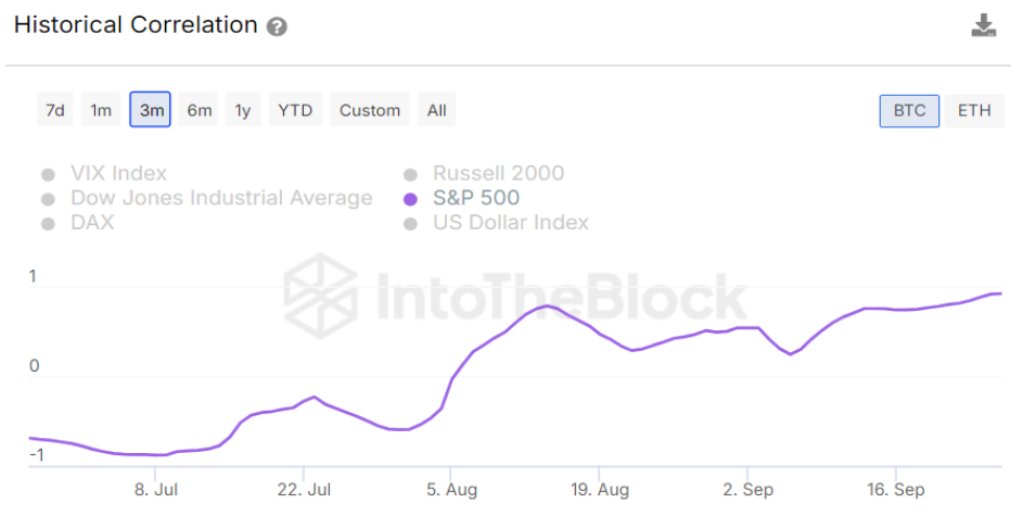

Latest knowledge reveals that there may be a rising correlation between the efficiency of the US inventory market and the worth of the world’s largest cryptocurrency. The query right here is — how might this affect the behavior of investors?

How Did Bitcoin And S&P 500 Carry out In September?

In a current put up on the X platform, crypto intelligence agency IntoTheBlock revealed the correlation between the Bitcoin worth and the S&P 500, one of the crucial widespread inventory market indices, has reached its highest level in additional than two years. For readability, the S&P 500 index tracks the efficiency of 500 of the biggest exchange-listed firms in america.

The Bitcoin worth registered a surprisingly optimistic efficiency in September, a month identified to be traditionally bearish for the flagship cryptocurrency. In keeping with knowledge from CoinGecko, the worth of BTC is up by greater than 11% previously month.

Supply: IntoTheBlock/X

In the meantime, the S&P 500 index has undergone a fast and powerful restoration, printing a brand new all-time excessive after an preliminary hunch at the start of the month. Knowledge from TradingView reveals that the index is up nearly 4% in September.

The connection between the inventory market and the cryptocurrency market has at all times been intriguing, as traders look to reap the benefits of alternatives both market provides. Nonetheless, a powerful correlation between these two asset courses is deemed to slim the diversification alternatives they provide to traders.

As of this writing, Bitcoin worth stands round $66,024, reflecting a mere 1.1% improve previously 24 hours. In the meantime, the S&P 500 Index continues to hover round 5.8K, with a 0.4% rise previously day.

World Liquidity Surges By $1.426 Trillion In A Week

Fashionable crypto pundit Ali Martinez took to the X platform to share that there was a notable surge within the quantity of capital within the world monetary markets. Knowledge supplied by Martinez reveals that world liquidity jumped by $1.426 trillion previously week.

World liquidity surged by $1.426 trillion this week, hitting $131.6 trillion. #Bitcoin and different threat property are gaining, although this liquidity increase might roll over into October. pic.twitter.com/PtFDjkR7wU

— Ali (@ali_charts) September 27, 2024

Bitcoin and different threat property have been the key beneficiaries of the rising world liquidity, as their values have gained as a result of elevated capital inflow. Martinez additionally famous that this liquidity increase might roll over into October.

The value of BTC breaks above $66,000 on the day by day timeframe | Supply: BTCUSDT chart from TradingView

Featured picture from iStock, chart from TradingView

More NFT News

Machine Studying in Focus as Chainalysis Acquires Hexagate

Extra Than Half of Crypto Tokens, Memecoins Launched in 2024 Have been Malicious: Blockaid

Hedera Value Prediction for Right now, December 18 – InsideBitcoins