On-chain knowledge exhibits the Bitcoin mining issue is heading in the direction of its sixth consecutive improve, which might be a brand new file for 2023.

Bitcoin Mining Problem Estimated To See Virtually 4% Rise This Weekend

The Bitcoin “difficulty” refers to a function on the blockchain that controls how arduous the miners would discover it to mine blocks proper now. The metric’s worth is measured by way of the variety of hashes that miners would want to generate earlier than the subsequent block may be discovered.

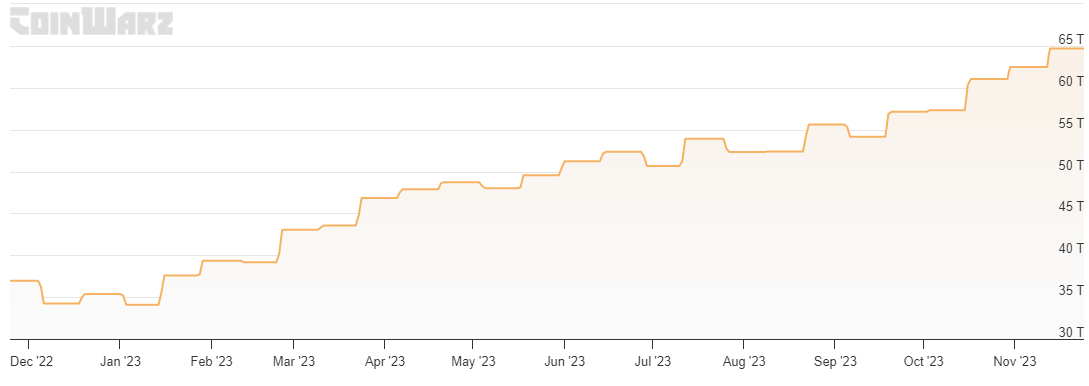

The community robotically adjusts its issue roughly each two weeks, and in response to knowledge from CoinWarz, the Bitcoin issue is ready to see one other such adjustment over the upcoming weekend.

Seems just like the metric's worth is about to go up | Supply: CoinWarz

As you may see above, the Bitcoin mining issue is estimated to extend by over 3.8% on this coming adjustment, which might take its worth to 67.14 trillion.

Now, the primary query is: what’s the rationale behind this issue improve? To know this, it’s possible you’ll first should know why the issue function exists on the community in any respect.

Every time miners clear up blocks, they get compensated by way of BTC rewards. These BTC rewards are the one option to produce extra of the cryptocurrency, so the speed at which these chain validators mine serves because the manufacturing fee for the asset.

Every time the miners improve their complete computing energy (the hashrate), they naturally develop into quicker at hashing blocks, thus claiming the BTC rewards.

Now, think about a situation the place the issue doesn’t exist. If miners continued to extend their computing energy indefinitely, they might mow by way of blocks quicker and quicker. Ultimately, the asset’s worth would tank due to inflation because the market is flooded with new tokens.

Satoshi had foreseen the problem, and in an try to unravel it, the nameless creator had made it in order that the miners would all the time mine at near a network-standard fee of 1 block per 10 minutes. The function that ensures that that is adopted is certainly, the mining issue.

The above desk exhibits that the typical Bitcoin block time is 9.63 minutes at present, which is quicker than the speed the blockchain intends to maintain. That is the rationale why the issue will go up within the subsequent adjustment; miners will probably be slowed again all the way down to the specified tempo as soon as they discover it more durable to search out blocks.

The basis explanation for the latest quicker block time lies within the explosive hashrate progress that the community has noticed not too long ago.

The 7-day hashrate has continued to rise | Supply: Blockchain.com

Between the sturdy worth progress and a spike within the transaction charges because of the Inscription hype returning and the community exercise surging, miners have been having a good time by way of their income.

So, it’s not stunning that the Bitcoin hashrate has not too long ago seen such a fast rise, as miners are doing all the things to capitalize on the worthwhile alternative.

Because the metric has been setting new all-time highs for some time now, the issue has additionally been on its approach up. The problem has seen 5 straight uplifts within the final 5 changes, matching the yearly file set within the 12 months’s first half.

The worth of the metric appears to have been going up since some time now | Supply: CoinWarz

Thus, with one other constructive adjustment over the weekend, the Bitcoin mining issue will set one other all-time excessive, breaking the 2023 file with a sixth consecutive rise.

BTC Value

Bitcoin is at present floating across the $37,800 mark because the asset gears up for one more go on the $38,000 mark.

BTC is knocking on the door of $38,000 | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CoinWarz.com, Blockchain.com

More NFT News

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin

Canine Memecoins Rebound as Bitcoin Reaches $98,000