Bitcoin is recovering however nonetheless underneath immense liquidation stress when writing. As BTC faces headwinds, the zone between $70,000 and $72,000 is proving to be a powerful resistance degree that should be damaged for the wave of upper highs registered in Q1 2024 to proceed.

The world’s most precious coin is buying and selling beneath $70,000 at press time, bouncing greater from round $67,000. The first essential help degree to observe at press time is $66,000.

Nonetheless, if bears are relentless, reversing beneficial properties of earlier at this time, extra losses could possibly be on the horizon.

Will Bitcoin Drop To The STH Realized Value And Help At $62,300?

Taking to X, one analyst notes that if the continuing liquidation of lengthy positions continues, BTC may plummet to the “Quick-Time period Holder Realized Value” (STH Realized Value) of $62,300.

The dealer sees this degree as a zone of low lengthy liquidity. Accordingly, it could possibly be a restricted help the place BTC bulls may discover entry to plug losses.

The STH Realized Value is normally used to gauge sentiment. Primarily, it represents all BTC’s common buy value inside 155 days. Those that select to carry BTC throughout this time are sometimes called short-term holders or primarily speculators aiming to scalp value volatility.

Whereas the STH Realized Value serves as a sentiment indicator, the road plotted can act as help. If BTC costs proceed plunging, trending beneath the STH Realized Value, it may drive coin holders to liquidate since they’re within the crimson.

However, if costs method the STH Realized Value, merchants may select to purchase, convincing holders that they’re at near-breakeven.

The STH Realized Value is at present $62,300, however the one-to-three-month Realized Value is $66,600.

Due to this fact, if Bitcoin loses $66,000, the liquidation may speed up the dump towards the 155-day STH Realized Value.

Eyes On The FOMC Amid Excessive Inflation And Stable Employment Information In The USA

Because the crypto market stays on edge, traders are intently watching the upcoming Federal Open Market Committee (FOMC) assembly. Given the robust labor market circumstances, the central financial institution is predicted to go away rates of interest unchanged at 5.50%.

Final week, employment knowledge exceeded expectations. In keeping with the US Bureau of Labor Statistics (BLS), 272,000 new jobs have been created in June, excess of the 185,000 economists projected.

Nonetheless, stable non-farm payrolls (NFP) knowledge poured chilly water on hopes of an imminent charge lower.

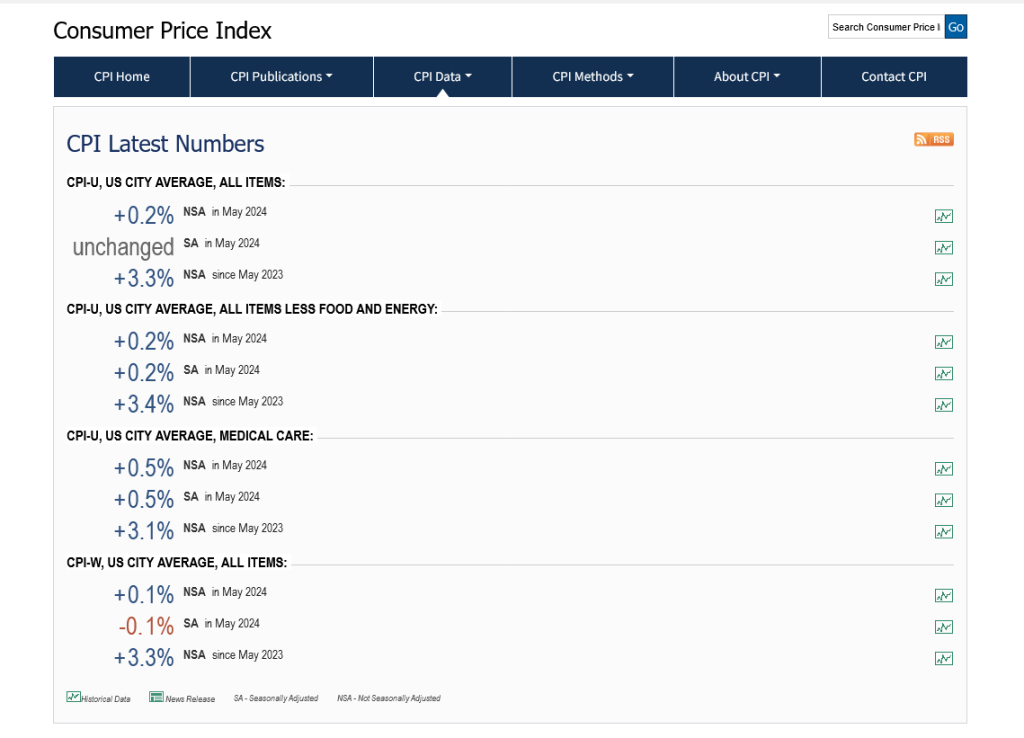

Even so, with inflation dropping to three.3% year-to-date, based on the BLS, the percentages of a charge lower is greater, an enormous increase for Bitcoin bulls.

Function picture from Canva, chart from TradingView

More NFT News

Machine Studying in Focus as Chainalysis Acquires Hexagate

Extra Than Half of Crypto Tokens, Memecoins Launched in 2024 Have been Malicious: Blockaid

Hedera Value Prediction for Right now, December 18 – InsideBitcoins