Whereas Bitcoin treads water round $50,000, with some predicting a droop, one analyst on X is swimming towards the present, claiming the coin has “by no means been this bullish.” The coin is bullish regardless of cooling off from 2024 highs above $54,000.

Analyst: Bitcoin Is Bullish, Right here’s Why

The analyst Mags argues that Bitcoin is, at spot charges, defying historic patterns and exhibiting bullish alerts, particularly trying on the candlestick preparations. Particularly, Bitcoin not too long ago closed a weekly candle above the 0.618 Fibonacci stage earlier than the subsequent halving occasion. Mags stated that is the primary time within the four-year cycle.

Due to this fact, although Bitcoin costs have been shifting horizontally up to now few buying and selling days, with fears of value slumps, the event within the weekly chart is overly bullish. Additional bolstering their optimism, Mags factors to the rising demand for Bitcoin from institutional traders following the launch of spot Bitcoin exchange-traded funds (ETFs).

Wall Avenue heavyweights, together with Constancy, problem a few of these merchandise. BitMEX Analysis information shows that spot ETFs proceed to siphon increasingly more cash from circulating provide, sending them to custodians, like Coinbase Custody, for safekeeping. These cash will possible be launched within the coming years, not months.

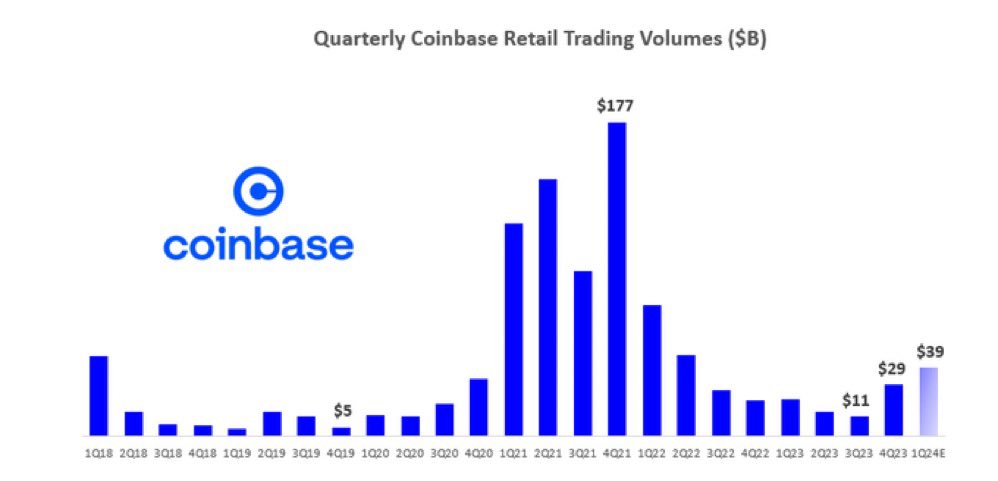

Apart from institutional curiosity, optimism for extra value beneficial properties additionally stems from the absence of retail curiosity at spot charges. Knowledge from Coinbase exhibits that not like the spike in curiosity that drove Bitcoin to $70,000, primarily behind retailers, BTC costs are up, however the dynamics are altering.

Will Retailers Take BTC To New Ranges?

Stable information reveals that retailers are largely not within the coin at spot charges, trying on the quantity retailers have been spending on the coin. By This autumn 2021, retailers buying Bitcoin through Coinbase spent roughly $177 billion. Nonetheless, this determine sharply fell all through 2022 throughout the bear market, discovering help in H2 2023.

Then, in accordance with change information shared by Will Clemente on X, retailers started loading the coin from Q3 2023. The determine has risen to round $39 billion in Q1 2024–lower than 25% of This autumn 2021 volumes.

How retailers will impression the value of Bitcoin sooner or later is but to be seen. Previously, retail worry of lacking out (FOMO) has been a essential value driver. Presently, CoinStats sentiment tracker, Concern & Greed indicator, stands at 74, at “greed” territory, down from “excessive greed” on February 22.

This discount could possibly be doable due to the faux breakout that lifted Bitcoin above $53,000. The coin has help at $50,500 however usually stays in a bullish sample.

Characteristic picture from DALLE, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site fully at your personal danger.

More NFT News

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin

Canine Memecoins Rebound as Bitcoin Reaches $98,000