Fast Take

- As the worldwide world is dealing with excessive inflation, central banks try to reign in inflation by lowering their stability sheets (quantitative tightening) and rising rates of interest.

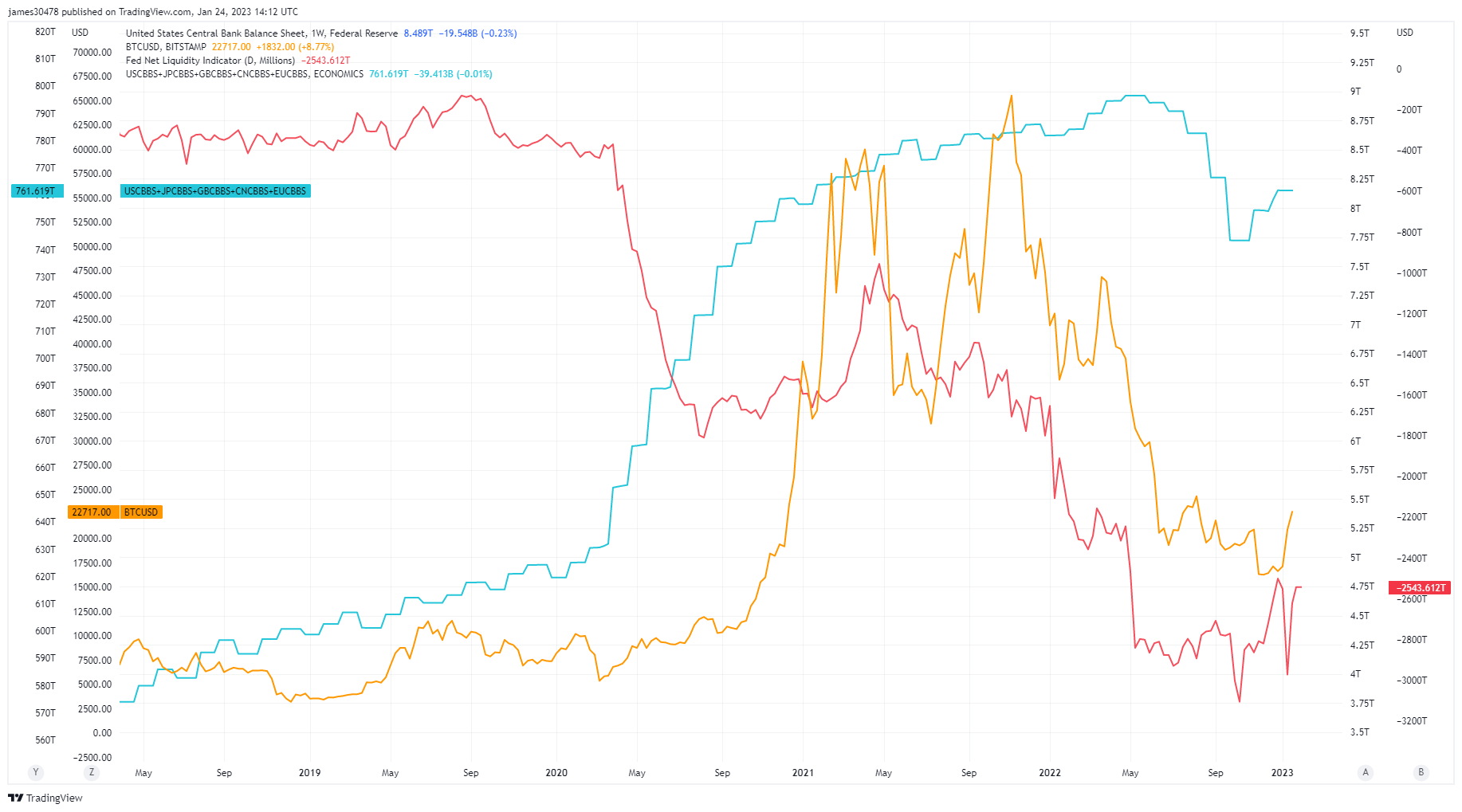

- The blue line considers the central financial institution stability sheet of the US, Japan, UK, China, and Europe, which quantities to $760T. Down from $800T again in Might 2022.

- The pink line symbolizes the online liquidity, which equals the Fed’s whole property (Treasury + Reserve Repo).

- The orange line is the worth of Bitcoin.

- Many narratives have been developed over time for Bitcoin, one being an inflation hedge and one other a liquidity hedge.

- As central banks have to extend their stability sheet because of being on a credit-based system, i.e., the necessity for perpetual development, BTC strikes on credit score growth on stability sheets, which is seen with its newest uptick in worth. These actions are vital to witness.

The put up Bitcoin is acting as a liquidity indicator for central bank balance sheets appeared first on CryptoSlate.

More NFT News

Marathon and Hut Eight scoop up $1.6 billion price of Bitcoin throughout market dip

Osprey Funds Launches First US Publicly Quoted BNB Belief

Will Binance's BNB Attain $1000? Worth Prediction Amid Authorized Challenges in Australia