Information exhibits the Bitcoin drop under the $27,000 degree has made most buyers fearful for the primary time this month.

Bitcoin Worry & Greed Index Is Pointing At “Worry” Proper Now

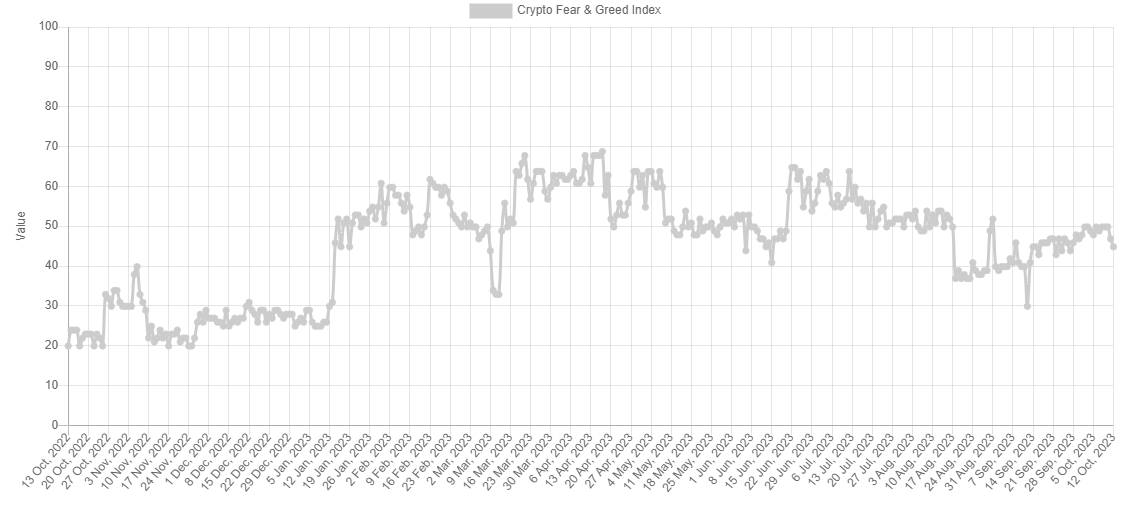

The “fear and greed index” is an indicator that tells us in regards to the basic sentiment amongst buyers within the Bitcoin and broader cryptocurrency market. Alternative created the metric, and in line with the web site, it’s primarily based on these components: volatility, buying and selling quantity, social media sentiment, market cap dominance, and Google Traits knowledge.

The indicator makes use of a numeric scale from zero to hundred to characterize the sentiment. When the index has a price better than 54, it signifies that the common investor is grasping proper now, whereas it being beneath 46 implies a fearful mentality is dominant.

The area between these two thresholds naturally signifies a impartial sentiment among the many holders. Till in the present day, the sector had been caught inside this area for the reason that final couple of days of September, because the buyers had been cut up in regards to the trajectory of Bitcoin.

The chart under exhibits that the market sentiment has worsened with the most recent drop within the cryptocurrency’s value under the $27,000 degree.

It seems like the worth of the metric has registered some decline in latest days | Supply: Alternative

After this newest drop in sentiment, the concern and greed index has hit a price of 45, that means that investor sentiment has simply entered the concern area.

The worth of the metric appears to be 45 proper now | Supply: Alternative

Traditionally, the market has tended to maneuver in a manner that’s reverse to what nearly all of the buyers imagine. The probability of such a opposite transfer occurring will increase as this imbalance within the sentiment rises.

Whereas the holders are leaning in the direction of one facet (concern), the imbalance is small, because the concern and greed index is barely contained in the territory. As such, the chance of a rebound could be fairly excessive proper now (at the very least primarily based on the sentiment).

In addition to the core sentiments mentioned earlier than, there are additionally two particular zones, referred to as “extreme fear” (at or under values of 25) and “excessive greed” (at or above values of 75).

These areas are the place the cryptocurrency has usually circled up to now. Naturally, bottoms have occurred within the former zone, whereas tops have fashioned within the latter space.

If the Bitcoin concern and greed index continues declining within the coming days and reaches values close to the intense concern area, a bounce may develop into an actual risk.

For now, one signal pointing to the possibilities of a rebound could also be that the big buyers have been shopping for not too long ago, as an analyst on X pointed out.

The BTC sharks have elevated their holdings not too long ago | Supply: @ali_charts on X

For the reason that begin of October, Bitcoin buyers holding between 100 and 1,000 cash have bought a mixed 20,000 BTC value round $533.6 million on the present trade fee.

BTC Worth

On the time of writing, Bitcoin is buying and selling at round $26,700, down virtually 5% up to now week.

BTC has skilled some downtrend not too long ago | Supply: BTCUSD on TradingView

Featured picture from Bastian Riccardi on Unsplash.com, charts from TradingView.com, Santiment.internet

More NFT News

XRP Worth On Its Approach To $10 In Solely Three Months If It Follows This Sample

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin