Bitcoin worth is struggling to get better above $26,200. BTC is once more shifting decrease and there may very well be a pointy decline under $25,500 within the close to time period.

- Bitcoin didn’t get better above the $26,200 and $26,500 ranges.

- The worth is buying and selling under $26,000 and the 100 hourly Easy shifting common.

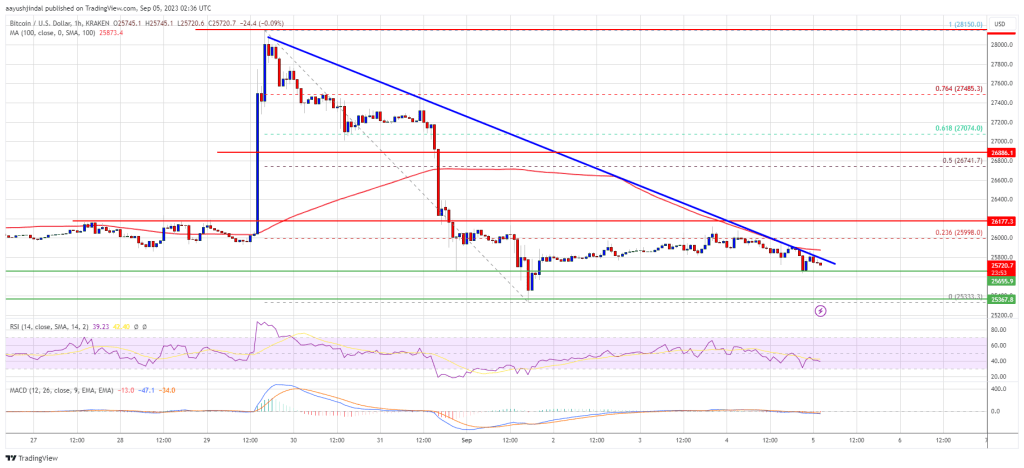

- There’s a main bearish development line forming with resistance close to $25,650 on the hourly chart of the BTC/USD pair (knowledge feed from Kraken).

- The pair might speed up decrease under the $25,500 and $25,400 ranges within the close to time period.

Bitcoin Value Resumes Slide

Bitcoin worth tried a recovery wave from the $25,350 zone. Nonetheless, BTC struggled to get better above the $26,200 pivot stage and remained in a bearish zone.

The worth is once more shifting decrease and buying and selling under the $26,000 stage. There are loads of bearish indicators rising under $26,000 and the 100 hourly Simple moving average. Apart from, there’s a main bearish development line forming with resistance close to $25,650 on the hourly chart of the BTC/USD pair.

Fast resistance on the upside is close to the $25,650 stage and the development line. The primary main resistance is close to the $26,000 stage or the 23.6% Fib retracement stage of the downward transfer from the $28,150 swing excessive to the $25,332 low.

Supply: BTCUSD on TradingView.com

The subsequent main resistance is now close to the $26,200 stage. A transparent transfer above the $26,200 stage would possibly begin a good restoration wave towards $26,500. The subsequent main resistance is close to $27,000, above which there may very well be a good enhance. Within the acknowledged case, the worth might check the $27,800 stage.

Extra Losses In BTC?

If Bitcoin fails to clear the $26,000 resistance, it might proceed to maneuver down. Fast assist on the draw back is close to the $25,350 stage.

The subsequent main assist is close to the $25,000 stage. A draw back break under the $25,000 stage would possibly ship the worth additional decrease. Within the acknowledged case, the worth might drop towards $24,500.

Technical indicators:

Hourly MACD – The MACD is now gaining tempo within the bearish zone.

Hourly RSI (Relative Energy Index) – The RSI for BTC/USD is now above the 50 stage.

Main Assist Ranges – $25,350, adopted by $25,000.

Main Resistance Ranges – $25,650, $26,000, and $26,200.

More NFT News

Chinese language Auto Supplier Dives Into Bitcoin Mining With $256M Funding

Harnessing idle GPU energy can drive a greener tech revolution

Will Dogecoin Attain $1? Crypto Volatility Returns as Bitcoin and Ethereum Slide