Be part of Our Telegram channel to remain updated on breaking information protection

Dropping under the $23ok worth degree, Bitcoin raised some issues out there a few days again. On Thursday, nevertheless, the token surged confidently above the $24ok degree and traders try to guess what pumped the value.

Bitcoin Climbs Again To $24,000 On Thursday

Bitcoin lately closed its most affluent January for the reason that yr 2013. This may be attributed to its month-to-month improve of just about 40%. The asset’s worth rose because it broke via the $17,000 mark at the beginning of the yr and reached a excessive of just about $23,000 by the top of January.

The market was poised for heightened worth volatility in the course of the US Federal Reserve’s first FOMC assembly of the yr, which resulted in a 25 foundation level hike in rates of interest. This hike is often seen as a bullish sign for risk-on belongings, contemplating the 75 basis-point hikes up to now.

Regardless of the preliminary dip, Bitcoin made a big leap, reaching its highest worth since August 2022, at $24,350 on Thursday. Whereas it has since misplaced some worth, bitcoin nonetheless maintains a powerful inexperienced presence on a every day scale and has a market cap of $456 billion, with a dominance of 42% over the complete cryptocurrency market. This spectacular efficiency has confirmed that Bitcoin continues to be a power to be reckoned with on the planet of finance.

How Has Bitcoin Been Transferring So Far

Bitcoin, the primary decentralized digital forex, was created in 2009 by the mysterious Satoshi Nakamoto. This revolutionary digital asset operates on a peer-to-peer community constructed on blockchain know-how and operates with out the necessity for a government or banks.

Solely 21 million Bitcoins will ever exist and might be made obtainable in circulation via mining, the place miners validate transactions and are rewarded with a set variety of Bitcoins. Blockchain know-how ensures a everlasting ledger, with transactions added in a chronological method, making it unimaginable to change or reverse.

Bitcoin’s success has impressed the creation of hundreds of different cryptocurrencies similar to Ethereum, Litecoin, and Ripple. Regardless of preliminary scepticism, it has turn into extensively accepted, with main corporations like Microsoft and Tesla accepting it as fee. Bitcoin could be traded on numerous cryptocurrency exchanges and its worth is topic to fixed fluctuations.

Over the last decade ending in 2021, the worth of Bitcoin skyrocketed from close to zero to its all-time excessive. The primary transaction to present Bitcoin financial worth occurred in October 2009 when a pc science scholar offered 5,050 cash for $0.0009 every. Adoption was gradual initially however picked up when exchanges like Mt. Gox started dealing with a good portion of all Bitcoin transactions.

In 2013, Bitcoin skilled vital progress with its worth growing from round $15 at the beginning of the yr to $1042 by November. Nonetheless, a security breach at Mt. Gox resulted within the change shutting down and a drop in Bitcoin’s worth to $666 by the top of the yr.

From 2015 to 2016, its worth was comparatively secure, however in 2017, elevated media consideration and investor focus led to a dramatic improve in worth, reaching $64ok by November 2021. The introduction of futures contracts on the CME additional solidified its standing as a reputable monetary asset class.

Bitcoin has come a great distance since its inception, experiencing each volatility and progress within the mainstream market. It has remodeled how folks view and use digital currencies, providing new alternatives on the planet of finance. With its decentralized nature, clear transactions, and immutability, Bitcoin is poised to form the way forward for the monetary business.

Liquidity Inflow Pumps Bitcoin’s Worth

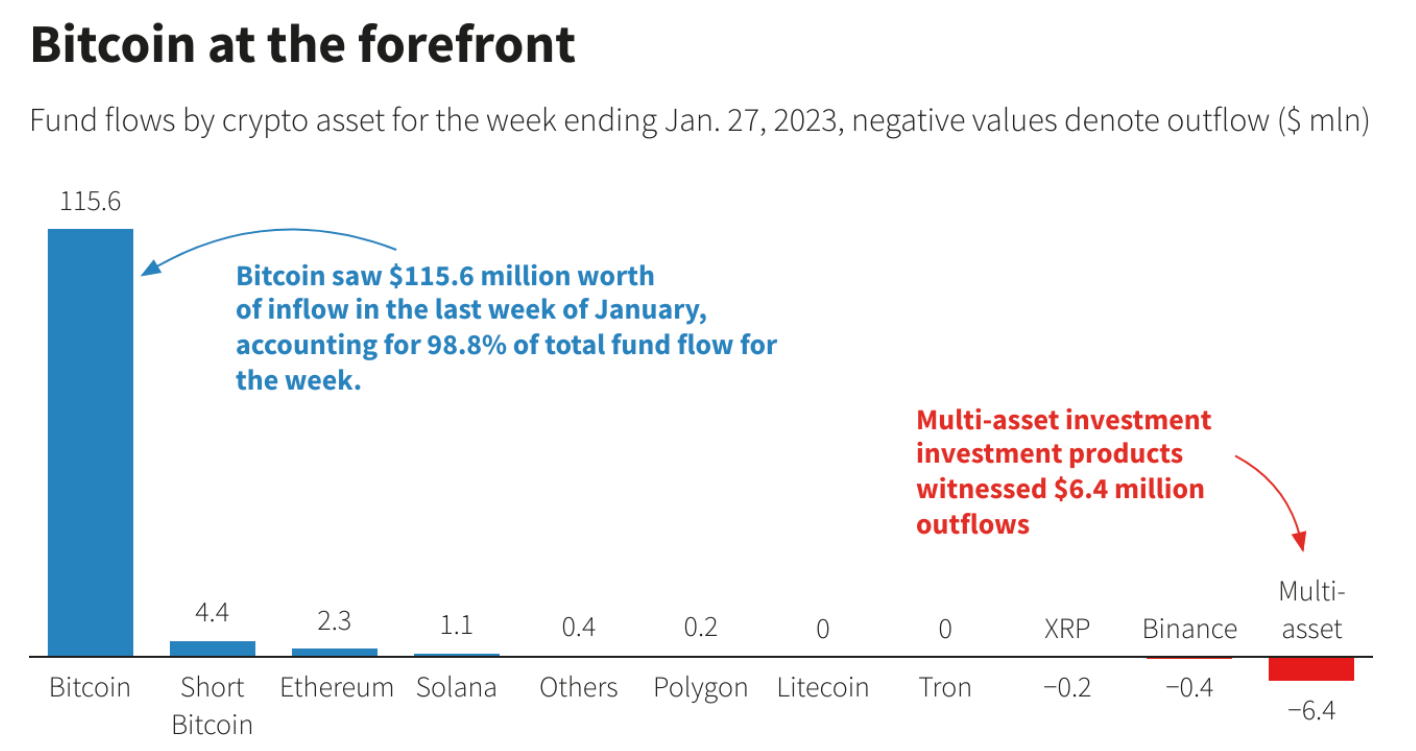

Institutional traders are displaying an elevated curiosity in Bitcoin as they see it as a invaluable asset class. The best degree of exercise in January was seen amongst US institutional traders, who have been answerable for 35% of Bitcoin’s 40% worth rise.

Main monetary corporations together with BNY Mellon and JPMorgan have expanded their choices to incorporate crypto companies and are rising their dedication to the cryptocurrency market. Based on a Goldman Sachs report, Bitcoin was the best-performing asset of 2023 in each absolute and risk-adjusted phrases.

Non-public and public corporations, similar to Tesla, are additionally investing in Bitcoin, with a survey revealing that 82% of high-net-worth people sought recommendation on crypto investments in 2022. Bitcoin miners, who’re the only producers of latest Bitcoin, have additionally skilled an enchancment in income and safety for the community because the exercise turns into extra worthwhile. The shift in market sentiment from “worry” to “greed” suggests one other progress cycle is on the horizon for the cryptocurrency market.

Elevated liquidity out there attributable to anticipation of easing of rates of interest, in addition to elevated mining income which pumped the inflow of Bitcoin in circulation was partially answerable for the token managing to bear an upsurge.

Buyers at the moment are curious as to the place the token strikes from right here because it cleared a number of targets on Thursday. Whereas the influence of the U.S. debt ceiling on Bitcoin is unsure. A possible improve in liquidity might drive the market greater, but when the debt ceiling isn’t reached, it might hurt threat belongings like Bitcoin. The timing of the debt ceiling is unclear, with estimates starting from later within the yr to sooner. The Fed’s current dovish tone could push Bitcoin in direction of $25,000 if the debt ceiling debate continues.

Altcoins That Can Probably Outcompete High Gainers

With quite a few cash making it to the top list of cryptocurrencies, a bunch of different tokens not obtainable on cryptocurrency exchanges are elevating tons of of {dollars} a day and that’s simply the beginning of it. Listed below are a couple of tokens which are definitely worth the consideration.

RobotEra is an all-new digital planetary world, much like the Sandbox metaverse. Within the recreation, contributors will turn into robots and oversee their territory and the ecosystem. TARO, the in-game forex, is taken into account a profitable metaverse coin with a present increase of over $808,000.

The metaverse platform by RobotEra will present gamers with thrilling gaming experiences and limitless alternatives by incorporating cryptocurrency and digital belongings into the gaming universe. TARO will function the forex for all transactions within the RobotEra ecosystem and is constructed on Ethereum as an ERC-20 token. The TARO presale is ongoing, and traders can purchase the token for $0.020 with USDT or ETH.

Second on the checklist is C+Charge, a challenge that transforms the EV charging panorama by introducing carbon credit to the ecosystem. In a always rising EV market, the challenge has managed to make an impression by elevating over $547ok, with every CCHG token obtainable to buy for 0.013 USDT.

The corporate will make a community of charging stations, the place customers will get rewarded with carbon credit for charging their autos. Which might then be redeemed for CCHG tokens, which could be traded on the change or staked to earn a passive earnings.

CCHG has a powerful future because it powers the complete C+Cost ecosystem, and due to this fact traders in search of a challenge with a promising future shouldn’t miss out on the CCHG presale.

Learn Extra:

Battle Out (FGHT) – Latest Transfer to Earn Challenge

- CertiK audited & CoinSniper KYC Verified

- Early Stage Presale Dwell Now

- Earn Free Crypto & Meet Health Targets

- LBank Labs Challenge

- Partnered with Transak, Block Media

- Staking Rewards & Bonuses

Be part of Our Telegram channel to remain updated on breaking information protection

More NFT News

Machine Studying in Focus as Chainalysis Acquires Hexagate

Bitcoin Traders Are Now Up $67,000 On Common – And This Is Simply The Begin

Extra Than Half of Crypto Tokens, Memecoins Launched in 2024 Have been Malicious: Blockaid