As dangerous information concerning FTX’s chapter maintain showing in crypto (and mainstream) media, traders have rushed to guess in opposition to bitcoin and the crypto market, with bear positions hitting two-year highs.

In keeping with the “Digital Asset Fund Flows Weekly Report” from European cryptocurrency funding agency CoinShares, a bearish sentiment took maintain of the crypto market over the past week to such an extent that quick positions accounted for 75% of all trades available in the market.

Which means the overwhelming majority of institutional traders are betting closely on the autumn of BTC and different cryptocurrencies, similar to ETH, which registered the very best quantity of shorts ($14M).

1/ What’s the crypto market sentiment this week?

A deeply destructive one with the biggest inflows into short-investments on report.Our Head of Analysis @jbutterfill shares his newest insights.

All the info might be present in our weekly report:https://t.co/mCc3kw8twn pic.twitter.com/7Z7HMf8gi9— CoinShares 👩🚀 (@CoinSharesCo) November 21, 2022

Bitcoin (BTC) Shorts Elevated by Extra Than 10%

James Butterfill, Head of Analysis at CoinShares, mentioned that final week’s BTC quick inflows reached $18.4M, representing a rise of greater than 10% week on week.

The distinction between lengthy and quick BTC positions was $4.3M, which based on the report, exhibits that there’s nonetheless numerous uncertainty available in the market about the way forward for the BTC value.

By way of whole belongings below administration (AuM), the report discovered that the entire of BTC shorts is over $173 million, very near the report of $186 million.

The FTX Collapse Unfold Panic Amongst Traders

The CoinShares report argues that the rise briefly inflows is especially as a result of potential “fallout from the FTX collapse.” In 2022, a handful of massive gamers have died on the hand of the brutal crypto market. Celsius, 3AC, Terra, and FTX are among the most notorious examples.

All this rising concern on the a part of traders might be mirrored within the withdrawal of greater than $6 million from completely different altcoins similar to Solana, XRP, Polygon, and BNB.

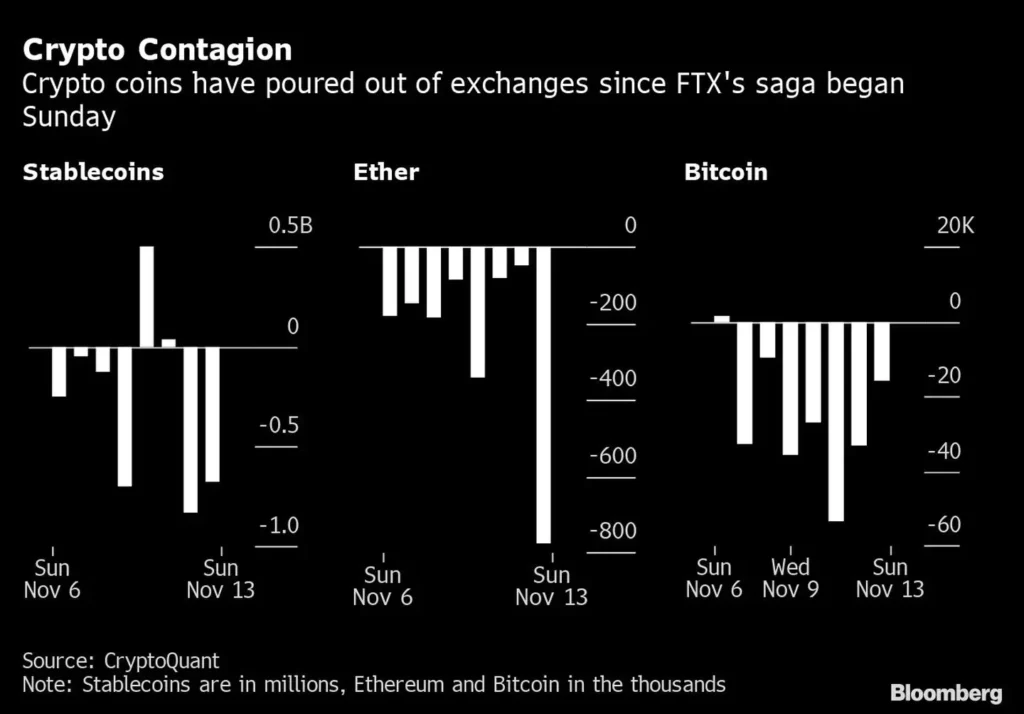

In keeping with Bloomberg, between November 6 and 13, a number of crypto funds withdrew greater than $3.7 billion in Bitcoin (BTC) and $2.5 billion in Ethereum (ETH) from numerous exchanges following the panic attributable to the FTX crash.

As well as, over $2 billion in altcoins have been withdrawn throughout the identical interval, based on experiences from CryptoQuant, a crypto analytics agency that tracks information from main crypto exchanges.

The market’s actions observe what appears to be the market’s sentiment. The Crypto Fear & Greed Index exhibits that proper now, merchants are in a state of “excessive concern,” touching 22 factors on a scale that goes from zero to 100, with zero being a theoretical stage of absolute panic the place no one is prepared to spend money on an asset and 100 is a stage of absolute greed the place no one is prepared to promote its belongings.

Binance Free $100 (Unique): Use this link to register and obtain $100 free and 10% off charges on Binance Futures first month (terms).

PrimeXBT Particular Supply: Use this link to register & enter POTATO50 code to obtain as much as $7,000 in your deposits.

More NFT News

Marathon and Hut Eight scoop up $1.6 billion price of Bitcoin throughout market dip

Osprey Funds Launches First US Publicly Quoted BNB Belief

Will Binance's BNB Attain $1000? Worth Prediction Amid Authorized Challenges in Australia