A version of this article was originally published here.

In any new and creating house, there may be sure to be a variety of noise. New options each compete for a brand new market in opposition to current monopolies — which presently personal the market, and in opposition to different applied sciences making an attempt to displace them.

Arduous To Perceive

That is very true in these breakthrough improvements/discoveries that change our world and pressure us to make use of a brand new lens to know it. Prior biases make us much less more likely to examine the brand new improvements on a primary ideas foundation. Information is a legacy of our current fashions — not these new ones. New ones must be intuited to foretell what is going to occur as a substitute of forecasted utilizing historic knowledge. We simplify the fashions in our brains to avoid wasting time and in consequence, most individuals fall into the lure of predicting their future conduct by trying again at their previous.

It’s the identical purpose that when utilizing a Blackberry cellphone when the iPhone was launched, we couldn’t predict how our minds would change — and our minds altering due to new worth created, would change an business. We transfer immediately when given one thing of larger worth, and it’s inconceivable to foretell that transfer earlier than we’ve “seen” it.

It’s the identical purpose why Kodak was destroyed by the very digital digicam that Kodak created, and Blockbuster didn’t see the specter of Netflix till it was too late.

And it’s the identical purpose why all monopolies fail when misunderstanding the worth creation delivered to society by a brand new know-how. Know-how adoption is most frequently backside up versus prime down. Why? Just because the individuals furthest away from monopoly energy have probably the most to achieve, and the individuals closest to the monopoly have probably the most to lose.

Add to this that there are at all times far bigger numbers of individuals farther away from the monopoly than near it, and it turns into simple to see how briskly one thing that creates extra worth for these individuals can take maintain and get stronger — rendering a monopoly impotent in combating it.

Be aware: This framework is essential to think about no matter whether or not the monopoly is inside an business, or whether or not it applies to cash itself.

Tougher To Perceive

It’s even more durable to know basic goal applied sciences like synthetic intelligence that have an effect on all industries or predict their charge of progress. As a result of these basic goal applied sciences apply to most worth creation over time, we are able to simply underestimate the corresponding influence on each enterprise and, in flip, our lives. For instance, pretending {that a} slender or basic synthetic intelligence received’t negatively influence our job in the future is one thing we need to imagine, which ensures narratives that assist that line of considering are in style — even when unfaithful.

Hardest To Perceive

However the improvements which are hardest of all to know are open, decentralized, protocol-level applied sciences. These protocols create worth within the type of a brand new basis that emerges slowly and methodically. Protocols are inbuilt layers, which implies we are able to’t usually see what is feasible on the following layer till it’s already constructed. The bottom layer know-how protocol (Layer 1) that allowed computer systems to be networked collectively is named the transmission management protocol, and the web protocol (TCP-IP) and was developed by the Protection Superior Analysis Initiatives Company (DARPA) in the late 1960s. It wasn’t till 1989 that Tim Berners-Lee invented the hypertext switch protocol (HTTP) on Layer 4, which might hyperlink these computer systems and webpages and would type the world large internet.

Which is why if you happen to tried to elucidate the TCP-IP open protocol layer that allowed beforehand remoted computer systems to speak to one another and even HTTP to somebody within the early 1990s, or tried to inform them that in the future that very same know-how (largely unchanged) would give rise to the iPhone, Google, Zoom, Amazon, and the whole lot else we take with no consideration in the present day, their eyes would roll over in disbelief.

We expertise worth by services and products that give us worth as a substitute of making an attempt to know the intricate particulars of the plumbing that provides rise to these services and products.

I’m going to aim to make use of a framework for contemplating how this is applicable to Bitcoin, and the predictable rise of altcoins, decentralized finance (DeFi) Web3, Metaverse and all the blockchain house.

However earlier than we go there, we should begin at a better degree as a result of the higher-level abstraction results and amplifies the whole lot else.

We should begin at cash. We should begin there for a similar purpose said above.

Specifically:

- We expertise worth by services and products that give us worth, as a substitute of making an attempt to know the intricate particulars of the plumbing that provides rise to these services and products, and

- Cash is the muse layer that provides rise to the whole lot else.

Subsequently, when cash breaks down, standing your floor when the bottom offers manner will present little in the best way of security.

Cash Is Simply Data

This may be arduous to see as a result of it can be crucial info, however we don’t need extra items of paper (or the digital items it represents). We need the sensation we get from having these items of paper and what it might purchase us. No matter whether or not that “purchase” is a sense of security, a legacy within the type of giving to your youngsters, a trip, standing, a house or freedom. Cash is simply the data (a ledger) that permits us to measure what now we have, and what it is going to take (in our personal minds) to realize our desired end result. Worry, greed and the human need to need extra comes on prime of that ledger and comparability to different individuals.

It makes logical sense then, that one, if cash is simply info and two, cash is being manipulated by central banks at an unprecedented charge to keep away from a credit score collapse of the system, then misinformation should be rising all through the system. (A second order by-product of that misinformation is that belief should be declining all through the system.)

However that’s the unlucky system we stay in, and it has vastly detrimental penalties. As a result of we measure a system from inside the system, for a lot of the inhabitants, it will make the reality nearly inconceivable to see. Equally, each firm, group and political occasion are made up of comparable individuals measuring the system from the system, whereas each member of our society writ giant every believes that they will see by this misinformation higher than others.

(Caveat emptor: Though I do my private finest to go deeper on points to know each side and the place I may be mistaken, this contains me, and the phrases on this web page.)

By consequence, it’s fully logical to see conspiracy theories, confusion, polarization, in-group, out-group bias and social chaos reign.

That misinformation within the type of cash wouldn’t simply create polarization. As a result of cash connects worth between individuals and nations, it will drive an amazing misallocation of capital and assets as particular person actors within the system all made the system worse with their actions to make sufficient cash to flee the system. Chasing ever greater returns, it wouldn’t solely be most people. Even pension plans, which want sure development returns to remain solvent to pay liabilities within the type of retirement advantages would seek for greater “actual” returns — all of them, and us too, trying to find methods to unravel a development drawback to flee the very system creating the issue.

In a world that appeared like this, it will be simple to fall right into a lure of pyramid and get-rich-quick schemes to flee. Actually, the very construction of manipulating cash (info) and corresponding incentive construction would guarantee a market grew to abuse it — each in crypto and the general market. Everybody measuring and making an attempt to create worth from this technique would unknowingly contribute to larger insecurity. Nobody can be exempt. All, trying to find a better return to flee the prevailing debasement of currencies, crowded into markets that in flip, harm others.

With this one, misinformation as a backdrop, and two, a brand new protocol layer know-how rising, (do not forget that open protocols present probably the most worth to society and are the toughest to know) it will be terribly troublesome to see why Bitcoin alone stands out as a breakthrough know-how and the place it’s heading. By extension, it will be comparatively simple on this atmosphere for ill-informed or unhealthy actors to conflate Bitcoin with crypto, Web3, DeFi, blockchains, Metaverse and different naming conventions to achieve a bonus for his or her providing. A public market that one, believed these have been comparable and watching a meteoritic rise in Bitcoin during the last 13 years (whereas they have been concurrently dropping buying energy in their very own currencies) and two, lacked the time to do deep analysis, can be simple targets for copycats, fraudsters and even well-intentioned actors who may be misinformed, selling the following massive factor.

This might act to amplify the cycles of highs and lows in Bitcoin and obfuscate its true nature. Firstly, by bringing extra leverage, hypothecation and rehypothecation into the general house by leveraging bitcoin (which has no counterparty danger) as a pristine bearer asset and amplifying the value of bitcoin on the best way up. And secondly, as every of the altcoins and DeFii schemes tied to them, then fell attributable to that very same leverage, creating “financial institution runs” that will amplify bitcoin’s fall in worth (in USD phrases) because the pristine bearer asset (BTC) was offered right into a failing market to cowl losses.

Because the vastly greater market of cash broke down, (the world balance sheet is roughly 4 orders of magnitude bigger than bitcoin market cap in the present day) and the Federal Reserve and different central banks eased or tightened in fiat phrases, it will solely amplify all the course of described right here and create further confusion.

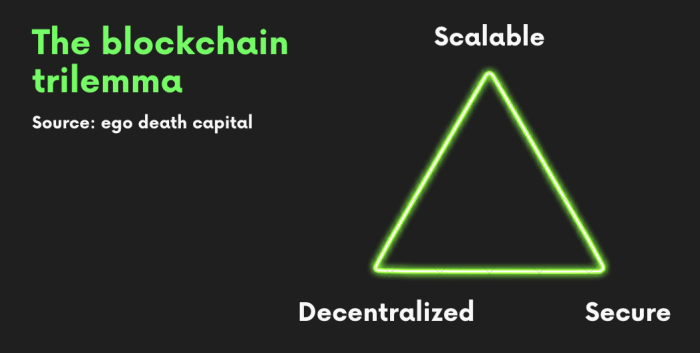

With that as a backdrop, I’ll present a easy framework to elucidate why Bitcoin is the ultimate in its design so others can use that framework to resolve for themselves. My hope is that by understanding the mandatory commerce offs required within the design of any blockchain, a basic public, and/or coverage makers can extra precisely perceive the commerce offs and see the sign by the noise. In doing so, I’ll additionally present why the rise of competing blockchains and altcoins are predictable, the benefits and downsides of them and why, for my part, every will fail in the long run.

Decentralization, Safety, Scalability

Bitcoin (on Layer 1) solved decentralization and safety. By no means in historical past has society had decentralization and safety collectively. 13 years after its discovery/invention by the pseudonymous Satoshi Nakamoto and regardless of the quantity of nation state, financial problem, or concern, uncertainty and doubt (FUD) thrown at it, it stays decentralized and fully safe. This can be a greater deal than it appears at first look. As a result of society all through time may by no means depend on decentralization and safety collectively, it wanted to depend on belief in establishments and the rule of legislation (to maintain these establishments in test) for cover, the Magna Carta, Declaration Of Independence and lots of different such frameworks over time enshrining rights to residents from unchecked energy over them by their rulers. The issue is that over an extended time horizon, cash surpasses legal guidelines, so legal guidelines alone can not remedy belief. Legal guidelines change over time guaranteeing these with entry to cash both re-write the legal guidelines or prevail in courtroom. A mirrored image of the world we stay in exhibits this unlucky fact, i.e., the place cash is most damaged, rule of legislation breaks down!

The rule of legislation would not shield residents from the manipulation of cash. It protects these closest to the manipulation.

Bitcoin stays decentralized and safe due to its design. Two crucial design components led to this end result: One, a restricted block dimension and two, utilizing vitality to safe the community by proof of labor. (Further components of design related to those two design components stay crucial to the safety and decentralization of the community. For the reader who needs to go deeper, these shall be explored later on this submit with hyperlinks to some nice thought leaders and content material.) You will need to keep in mind, Bitcoin is open supply which implies it’s open to everybody (to audit or use freely), managed by nobody and freely out there for anybody to alter by a fork to attempt to design otherwise that creates extra worth for customers.

By designing in such a manner, Bitcoin during the last 13 years turned a wonderful retailer of worth, but additionally remained largely unviable for use as a forex or broader know-how stack attributable to its lack of transaction pace at 5 to seven transactions per second (on the primary layer). The transaction pace wasn’t the one limitation. By conserving block dimension small to make sure continued decentralization, Bitcoin left a gap for competing blockchains/altcoins to do extra on Layer 1. Enterprise capital, entrepreneurs and builders raced into this ecosystem as a result of one, inventing a brand new coin that would compete with bitcoin would obtain huge short-term earnings for its founders and enterprise capital backers, and two, with a bigger block dimension and extra permissive blockchain, extra may very well be carried out. These competing blockchains would give rise to sensible contracts, non-fungible tokens (NFTs) and “decentralized” finance.

It will be simple to point out Bitcoin as previous know-how, as a substitute of a protocol layer to an viewers searching for scalability and different use circumstances. That very same alternative although, both transaction pace or offering extra functionality by sensible contracts on Layer 1, required these blockchains to sacrifice both decentralization or safety, to realize their goals.

You will note from an extended historical past of competing blockchains that they all both change into centralized (by a council or small variety of individuals/nodes who make selections for everybody) or change into susceptible to hacks/outages as they scale.

Bitcoin stands alone in decentralization and safety.

Why? As a result of there may be merely no manner across the two-of-three alternative for a blockchain on Layer 1.

The logical conclusion although, is that if one sacrifices safety for scalability, the blockchain fails as a result of it’s insecure, or If one sacrifices decentralization for scalability, a blockchain should finally change into ineffective for financial causes. And whilst you might argue that standpoint from an ecosystem that appears to offer worth for a window of time, the financial commerce offs of operating a blockchain that’s centralized guarantee it might’t work in the long run. Acknowledged merely, if centralization is a requirement of the design, a database is a a lot less expensive resolution — by way of economics and vitality utilization. That financial purpose alone negates any long-term profit (aside from preliminary holders of tokens) of a centralized blockchain for the members of the system as a result of somebody must pay for it.

Which ensures that every one initiatives constructed on prime of those different blockchains (Web3, Metaverse, NFTs, and so on.) whatever the intent of the founders of those initiatives, should undergo the identical destiny because the underlying blockchain.

Constructing on prime of quicksand shouldn’t be long-term technique.

Some fast inquiries to carry readability:

- How may decentralized finance happen on a centrally-controlled blockchain?

- How would Web3’s promise be any totally different than in the present day’s monopoly energy in know-how if it was constructed on a base layer that was extra pricey, and managed by only a few?

- What’s the long-term worth of a digital copy (NFT) of one thing related to a blockchain that fails?

- If a decrease value (by Layers 2 and three) and decentralized different existed that enabled gaming and digital actuality firms to manage their very own future reasonably than danger their future on a centrally-controlled blockchain, what would these entrepreneurs select? Wouldn’t or not it’s extra probably that this new protocol, as a substitute of a centrally-controlled one, varieties the muse of the “metaverse”?

All of the whereas, entrepreneurs constructing to these blockchains, most people and regulators

could also be unaware of the long-term nature of the vulnerability. Worse nonetheless, capital, and huge holders of the varied altcoins schemes may change into keen or unwilling members in a perverse incentive scheme the place they get wealthy or get out simply in time, on the unknowing public’s expense. Charlie Munger’s famous quote “present me an incentive and I’ll present you the end result” applies properly right here. If invested capital (by enterprise capitalists) and time (by an entrepreneur or staff) has gone into designing one in every of these blockchains or constructing an organization on prime of 1, human nature tells us that it’s a lot simpler to obfuscate the reality to promote to a better bidder earlier than it collapses than to confess a mistaken technique.

As at all times, comply with the cash.

The road turns into significantly skewed by exchanges who provide these cash to an unknowing public. By providing a large number of securities (altcoins, 20,000 and counting) that every one finally undergo an identical destiny, they create huge wealth at society’s expense, making transaction charges on the best way out and in, each time somebody trades any one in every of these 20,000-plus cash. It’s a really low-risk enterprise enabled by a extremely prone public. That very same wealth is then used to advocate/foyer governments for favorable insurance policies to permit them to function. Seeing alternatives for funding and jobs from the biggest exchanges, whereas believing that bitcoin and altcoins are comparable in nature, ensures coverage makers are simply swayed. A lot of this provides to the general public and media being fully misinformed about Bitcoin and proof of labor.

Why? As a result of conflating Bitcoin, blockchains and altcoins is essential to working earnings.

A Deeper Dive On The Three Sides Of The Pyramid

1. Safety

By means of proof of labor, Bitcoin gives miners a option to compete to unravel cryptographic hash puzzles to confirm new transactions on the blockchain. Miners buy the newest {hardware}, to compete for Bitcoin within the type of block rewards. The reward follows a halving schedule the place the reward for fixing the hash puzzle is programmatically lowered each 210,000 blocks. Beginning in 2009 at 50 bitcoin per verified new transaction on the blockchain (roughly as soon as each 10 minutes) to 25 bitcoin in 2013, to 12.5 in 2016, to six.25 BTC in the present day, and to be lowered by half each 210,000 blocks till the yr 2140. Within the pure competitors that arises within the free market with different financial actors making an attempt to “win” bitcoin, an incentive is created the place miners win bitcoin by securing the community. As a result of the first prices of mining are one, the {hardware} (required to unravel the cryptographic hash puzzles) and two, the intensive vitality prices to run the {hardware}, miners are incentivized by competitors to achieve benefit over different miners which provides hash charge to the community (hash charge is the full computational energy securing the community).

Nakamoto developed a novel option to shield the community and benefit from sport concept because the community ebbed and flowed with the newest {hardware} enhancements permitting sooner computing, and new nodes being added or faraway from the community. Referred to as the issue adjustment, the community routinely adjusts the issue each 2,016 blocks, primarily based on the time it took to mine the final 2,016 blocks, to maintain the common time for locating the following block at 10 minutes. This takes benefit of greed and concern in a free market of financial actors working in their very own finest pursuits for achieve, to always stability and shield the community. As extra compute energy is added to the community, the issue adjustment routinely makes it more durable to search out the following 2,016 blocks and conversely, as compute energy is eliminated, the issue routinely adjusts to make it simpler to search out the following 2,016 blocks. This course of creates extra and fewer worthwhile mining operations which benefit from the free market. For instance, when China instituted a ban on all bitcoin mining in Could 2021, Bitcoin hash charge fell over a two-month period from roughly 185 million terahashes per second to 58 million terahashes per second. Each two weeks, the issue adjusted downwards to maintain the typical block time at 10 minutes. With fewer miners competing for rewards, and a glut of newly-available mining gear hitting the market, creating downwards pricing stress on the gear, mining turned far more worthwhile. In flip, many U.S. firms rushed in to fill the void (and the financial alternative) that China created. A “gold rush” for mining ensued. As extra financial actors rushed in to benefit from simple earnings, and the issue adjustment clocked greater, earnings rationalized as soon as once more.

And so, no matter a nation state assault, or a growth bust cycle pushed by greed and concern, the

community, globally, is at all times protected by the issue adjustment in making a pure incentive to win a bigger share of an financial prize. As extra market entrances race in to benefit from the upper revenue alternative created by a neater issue charge, they add further safety to the community — in flip taking the issue charge greater and their earnings decrease. (Bitcoin hash charge is presently 212 million terahashes)

Moreover, the method of paying for extra gear which is then obsoleted over time as new gear turns into superior, is expensive. This has the impact of supporting new entrants/concepts available in the market. In different phrases, its very nature reduces the monopolistic tendencies of a market to consolidate round just a few giant miners and worth others out.

The growth and bust cycles of bitcoin mining needs to be checked out because the free market competitors for a bonus in a wonderfully clear market with every rational actor, in their very own minds looking for a bonus (which ends up in vitality innovation, see beneath). All of the whereas, securing the community as a byproduct of this pure competitors.

Power (As A Half Of Safety)

Whereas many individuals falsely imagine that Bitcoin and the best way it makes use of proof of labor to validate blocks is unhealthy for the planet due to the vitality used to safe the community, the reality is that Bitcoin is the solely factor that I’ve discovered that may enable a transition to a system of planetary alignment and abundance. As I’ve typically said: Abundance in cash creates shortage in every single place else, and shortage in cash creates abundance.

On the highest degree, it is because our present financial system for the planet is incongruent with the place know-how is taking us and life on a finite planet.

As defined in “The Price Of Tomorrow: Why Deflation Is Key To An Abundant Future” and in “The Greatest Game.”

A battle must be resolved at a system degree:

- Exponentially growing effectivity pushed by technological progress requires a forex that permits for deflation (bitcoin). We get extra for much less work.

- The present fiat financial system requires inflation and consequently, it wants manipulation to stay viable. We get much less for extra work.

As a result of the prevailing system is credit score primarily based, it can not enable ongoing deflation with out full collapse (as a result of the credit score can be worn out and the credit score is the system). Society would by no means vote to have its whole way of life collapse. Which suggests a paradox exists the place society will at all times finally insist on manipulated “development” for concern of the results of collapse, and that manipulated development is the first supply of the issues that society is coping with — together with environmental injury.

Finally, it is because as a substitute of permitting costs to fall (and society to achieve time and freedom) with growing productiveness, it presupposes that we are able to “develop” endlessly. And the expansion itself presupposes that cash might be created out of skinny air to realize it. This “development” for extra jobs to have the ability to pay the payments, to pay for greater costs, that are manipulated greater within the first place retains society on a hamster wheel unable to see that it’s the system itself with its embedded development obligation to service unpayable debt that’s chargeable for all of the ache. It will get worse — from the prevailing system each innovation reducing worth or saving time sooner or later have to be offset with extra manipulation of forex to maintain the prevailing financial scheme going. Power itself offers instance. It isn’t like there hasn’t been an abundance of know-how deployed into the exploration, manufacturing, transportation and growth of recent vitality sources. Once you notice that the first purpose (growing demand is essential, too) vitality costs have risen in opposition to new vitality coming on-line and effectivity good points of current vitality sources, is that they have to rise to assist the prevailing credit score system, you additionally notice there isn’t a manner out from the system.

Past the environmental drawback being unsolvable from the prevailing system, Bitcoin offers a path to a Kardashev type 1 planet the place we harness all of the vitality that may attain earth from the solar.

It does so as a result of it offers a constructive financial incentive in a transition to considerable vitality. From the attitude of provide and demand, Bitcoin’s excessive vitality value to safe the community is a function as a result of an financial incentive is created that’s each pure and constructive to construct out vitality abundance. Power is the primary driver of profitability in Bitcoin mining, which means that low-cost vitality is required for earnings. A bitcoin miner can not stay worthwhile by paying for vitality at charges {that a} retail buyer will, so it doesn’t compete with that vitality.

As a substitute, it unleashes the identical free market conduct in vitality manufacturing and utilization. Specifically trying to find decrease value or stranded vitality. By doing so, it offers a flooring worth for vitality and a option to allocate capital to investments that will in any other case not be made. These new vitality investments, together with renewables, enable areas that have been as soon as minimize off from the world attributable to an absence of dependable vitality to construct wealth and vitality independence. The fixed competitors to search out decrease prices in vitality and/or to make use of the warmth supplied from Bitcoin mining for different business makes use of similar to heating greenhouses or business buildings unleashes a wave of entrepreneurial expertise onto the problem of vitality utilization. All by the use of free market competitors to make sure a dependable abundance of vitality and utilization.

It needs to be apparent to most observers by now that vitality is extra essential in our lives than the quantity of printed paper notes or digital representations of these notes. Printing extra paper or digital items solely creates further vitality shortage. Power supersedes {dollars} as a result of with out vitality, there isn’t a economic system.

Bitcoin’s tie to vitality for safety and its corresponding constructive impact on actual development and vitality abundance is then maybe its most under-appreciated function (and one which the mainstream press has fully backwards).

This excerpt from Gigi (@dergigi) offers a novel manner of understanding how vitality protects the community:

“Something that does not have any actual value—value that’s instantly apparent and might be verified by anybody at a look—might be trivially solid or just made up. Within the phrases of Hugo Nguyen: ‘By attaching vitality to a block, we give it ‘type’, permitting it to have actual weight & penalties within the bodily world.’

“If we take away this vitality, for example by shifting from miners to signers, we reintroduce trusted third events into the equation, which removes the tie to bodily actuality that makes the previous self-evident.

“It’s this vitality, this weight, that protects the general public ledger. By bringing this unlikely info into existence, miners create a clear force-field round previous transactions, securing everybody’s worth within the course of—together with their very own—with none use of personal info.

“It’s this vitality, this weight, that protects the general public ledger. By bringing this unlikely info into existence, miners create a clear force-field round previous transactions, securing everybody’s worth within the course of—together with their very own—with none use of personal info.

“Right here comes the half that’s tough to know: the worth that’s protected shouldn’t be solely worth within the financial sense, however the very ethical worth of the integrity of the system. By extending the trustworthy chain with probably the most work, miners select to behave actually, defending the very guidelines that everybody agrees to. In flip, they’re rewarded monetarily by the collective that’s the community.”

2. Decentralization

There are two main design selections that result in the continuing decentralization of Bitcoin:

1. First is the character of proof of labor in fixing the Byzantine generals problem. Importantly, it’s a discovery that can’t be solved once more. It may be copied which units up its personal challenges, or it may be modified to attempt to remedy it in a special method. However, due to basic relativity, altering it can not remedy the issue with out introducing an oracle and centralization. Let’s dive into every of those:

a. A replica by necessity isn’t the longest chain as a result of it should begin later than Bitcoin which has probably the most proof of labor defending its historical past. The longest blockchain, by definition, is the one with probably the most belief. Subsequently, a duplicate can not have the identical safety or belief. Which begs the query, what utility would the brand new copy of Bitcoin present that wouldn’t be higher achieved by using probably the most trusted and safe chain? Or how would a brand new chain with out utility achieve sufficient traction to compete with Bitcoin, whereas on the identical time Bitcoin was exponentially growing its safety and hash charge due to its belief?

b. There isn’t any such factor as common time. Einstein’s concept of basic relativity says the best way we expertise time is from our standpoint. Time is relative to us — the place we’re. Relying on orbits, this “time” distinction from our standpoint on earth to Mars is between 4 minutes and 24 minutes. This identical time distinction happens on earth as properly however in such small intervals that we don’t discover it in our day by day lives. The truth that we don’t discover them, doesn’t change the truth that these small time variations exist. When laptop techniques are trying to find cryptographic keys to show they discovered the following block and received the prize, these small variations in time between totally different areas change into critically essential. Two Bitcoin miners on totally different sides of the world may remedy the cryptography at precisely the identical “time” due to these small variations and each be right. It isn’t simply theoretical, it has occurred quite a few instances on the Bitcoin protocol and the best way it’s solved is, once more, the longest chain, or most belief wins. For a interval of 10 minutes then, or till the following block is mined, these two chains can each be legitimate till the following block is mined and the nodes affirm the longest chain. Miners select which block they imagine is legitimate and as 51% of them select the legitimate block, the opposite miners transfer to the longest chain. It’s a waste of vitality and assets to mine on prime of an orphaned block. Once more, the longest chain is the one with probably the most belief.

Due to this discovery that ties vitality and proof of labor collectively, there exists just one different option to remedy the time drawback. This includes introducing a “trusted” agent or oracle that defines the “guidelines” after which chooses which transactions are legitimate (what transaction got here first). However as soon as an oracle is launched to unravel the issue, belief is positioned within the oracle, the principles can change and decentralization is misplaced.

Bitcoin, by proof of labor, is the one option to remedy the issue. As Neil Degrasse Tyson points out, “After the legal guidelines of physics, the whole lot else is an opinion.”

2. The second design alternative that retains Bitcoin decentralized is the dimensions of the block. Sacrificing further block dimension on Layer 1 of Bitcoin meant a decrease variety of transactions per 10 minute block and/or much less room for sensible contracts within the underlying code. By conserving the block dimension small, the tens of 1000’s of full node operators world wide are the true rule enforcers of the community. (Tomer Strolight offers an amazing firsthand account of this energy within the arms of the node operators here.)

Subsequently, whereas miners compete as financial actors to safe the community, they’re held in test by nodes (open to anybody to simply arrange and run) who affirm the transactions. These full nodes every have a complete historical past of the blockchain and make sure every of its transactions. As a result of block dimension is stored small, it implies that these nodes are very economical to run in {hardware} and vitality prices, which in flip results in extra nodes or members validating the system (decentralization).

By including further info or house to the blockchain on Layer 1, the fee in vitality and compute energy to safe the community explodes, and in flip results in solely probably the most highly effective or rich having sufficient cash to run nodes, which in flip controls the choices, i.e., centralization. The Blocksize Wars beginning in 2015 to 2019 have been fought over this key subject with lots of the strongest Bitcoin proponents on the time favoring a rule change that will carry extra performance to Layer 1, however in flip would give them extra management within the type of centralization. Bitcoin arduous forked over this battle with new code representing the brand new guidelines. In contrast to delicate forks that are agreed to by the miners and nodes and are backwards appropriate, arduous forks create a brand new chain. For instance, if you happen to owned bitcoin previous to August 1, 2017, and a tough fork to Bitcoin Money occured, you’d personal cash in each chains. You possibly can then elect to promote one in every of them in favor of the opposite or maintain each. Beneath is a snapshot of what the market determines as worth in each cash:

Market capitalization of Bitcoin as of August 6, 2022: $443 billion

Market capitalization of Bitcoin Money as of August 6, 2022: $2.7 billion

The worth discrepancy of the fork demonstrates once more that whereas anybody can change the principles to supply a special coin, the longest chain with probably the most proof of labor has probably the most belief, and is valued greater by market members in consequence. Decentralization is a giant a part of this belief.

3. Scalability

As strengthened all through this text, the design selections that led to decentralization and safety which itself wasn’t potential earlier than Bitcoin, additionally led to design selections that lacked scalability. It’s right here that a lot of the battle and confusion in blockchains originate. From a human nature perspective, it’s simple to see that there can be conflicts, some customers that wished to construct extra by way of scaling or differentiation on prime of Bitcoin and felt blocked by its sluggish and methodical consensus of nodes defending the ecosystem. They then determined to create their very own blockchains with differentiation and tried to persuade others that the brand new blockchains have been higher ultimately. Whereas many have been/are full fraudsters trying to make a fast buck on the again of ignorance, some might not have even been conscious of the long-term implications of their design selections in creating blockchains that should fail — both attributable to one, centralization and lack of financial incentives, or two, safety vulnerabilities. And as soon as created, there was no manner out however to confess failure, or to maintain altering whereas promising to unravel the paradox sooner or later sooner or later.

A Totally different Means To Scale

Protocols scale in layers. Scaling Bitcoin in layers offers a option to retain safety and decentralization of Layer 1, but additionally achieve scalability within the second or third layers as a substitute of sacrificing the primary, just like the layers that type the constructing blocks of the web and in the end the merchandise that you just use day-after-day. Every of the totally different protocols function solely at that layer. This abstraction ensures that every layer is self-contained, solely needing to know easy methods to interface with the layer above and beneath it, which simplifies design and suppleness with out sacrificing what one other layer offers. This short YouTube video offers overview of the community protocol layers of the TCP-IP layered mannequin.

Due to the misunderstanding that protocols scale in layers, and the general noise available in the market, improvements like Lightning that enable Bitcoin to scale can be largely dismissed by an viewers that noticed Bitcoin as slow-moving, previous know-how, uncompromising in its safety and decentralization.

This would offer an uneven alternative for the nations, entrepreneurs, capital and public who took time to know what was taking place within the ecosystem versus those that dismissed it.

I imagine that we’re at that inflection level the place applied sciences similar to Lightning, Fedimint, Taro and others will usher in a wave of innovation within the house. I additionally imagine though it’s nonetheless in its infancy, Bitcoin and the protocol are unstoppable.

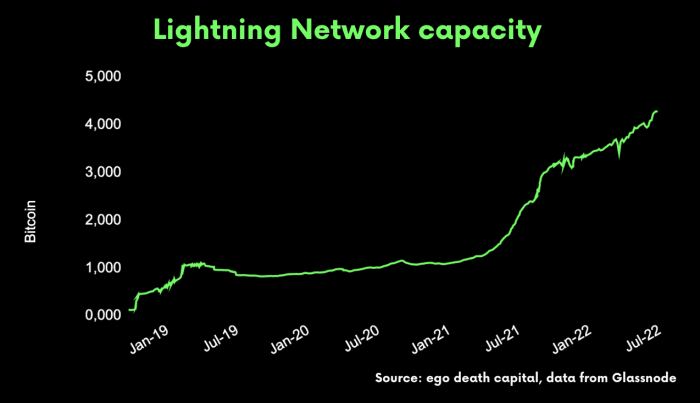

Beneath is a chart of Lightning adoption since inception:

From Lyn Alden’s current masterpiece on The Lightning Network:

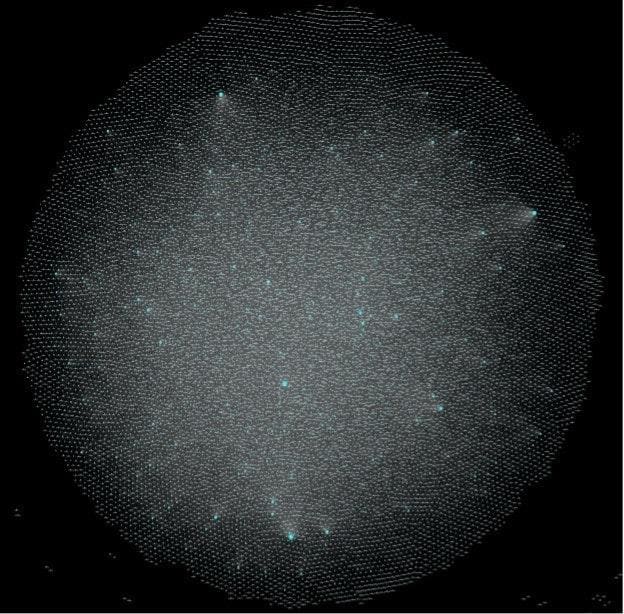

“Think about a worldwide system with a large variety of interconnected nodes. Anybody can enter the community with a brand new node and begin creating channels. Alternatively, many custodial companies additionally offers their account-holders entry to the community by their nodes and channels.

“Right here’s a visualization of the general public Lightning community in the meanwhile. It’s a rising community of interconnected nodes related by fee channels, with these greater dots representing significantly well-connected nodes:”

It’s early, and never the whole lot will work out as deliberate, however every success scaling in layers reinforces and brings extra expertise and capital to the ecosystem. A few of these items of the puzzle (like Lightning, Taro and Fedimint) will work collectively in methods not but fully understood — accelerating adoption, all of them will construct upon a Layer 1 basis that’s rock strong. In doing so, lots of the long-term “use circumstances” of other cash will disappear and one after the other, they may fail.

The Bitcoin protocol, scaling in layers, will present a base layer that merges a brand new peer-to-peer web and cash natively inside it. This may type a totally safe, open to anybody, integral basis for know-how extra broadly. Just like the daybreak of the web, however this time decentralized and safe, guaranteeing with its design a hopeful path for humanity the place the pure abundance gained by know-how is broadly distributed to society as a substitute of being consolidated within the arms of some. Regulators in sure nations may attempt to sluggish or cease it, however in doing so, they’d be making a grave mistake, analogous to shutting down the web from their residents and blocking the innovation that got here with it. It wouldn’t cease the innovation however would as a substitute make sure that the innovation, and worth derived from that innovation moved to different nations. Over time, individuals will notice that as a substitute of pricing bitcoin “from the system” that they stay in in the present day, bitcoin will worth the whole lot in that system.

There shall be unimaginable successes, failures, and learnings. Most significantly although, there shall be enduring worth to society that comes on prime of a strong basis that’s incorruptible by a small group of individuals — decentralized and safe by its design. That emergent system, launched to the world by Nakamoto in 2009, modifications the whole lot.

Some main thinkers in house and their work:

Troy Cross and Kyn Urso

This can be a visitor submit by Jeff Sales space. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

More NFT News

Machine Studying in Focus as Chainalysis Acquires Hexagate

Bitcoin Traders Are Now Up $67,000 On Common – And This Is Simply The Begin

Extra Than Half of Crypto Tokens, Memecoins Launched in 2024 Have been Malicious: Blockaid