In a current surge of on-line dialogue, famend crypto analyst and entrepreneur Willy Woo has made headlines together with his optimistic prediction for Bitcoin’s future on Elon Musk’s social media platform, X.

Woo means that Bitcoin, already gaining traction amongst conventional monetary circles as an rising asset class, might see exponential development.

He argued that if Bitcoin continues to be perceived on the scale of main asset lessons, historically valued within the tens of trillions of {dollars}, it might probably improve in worth tenfold within the coming years.

Associated Studying

Present Market Dynamics and Predictions

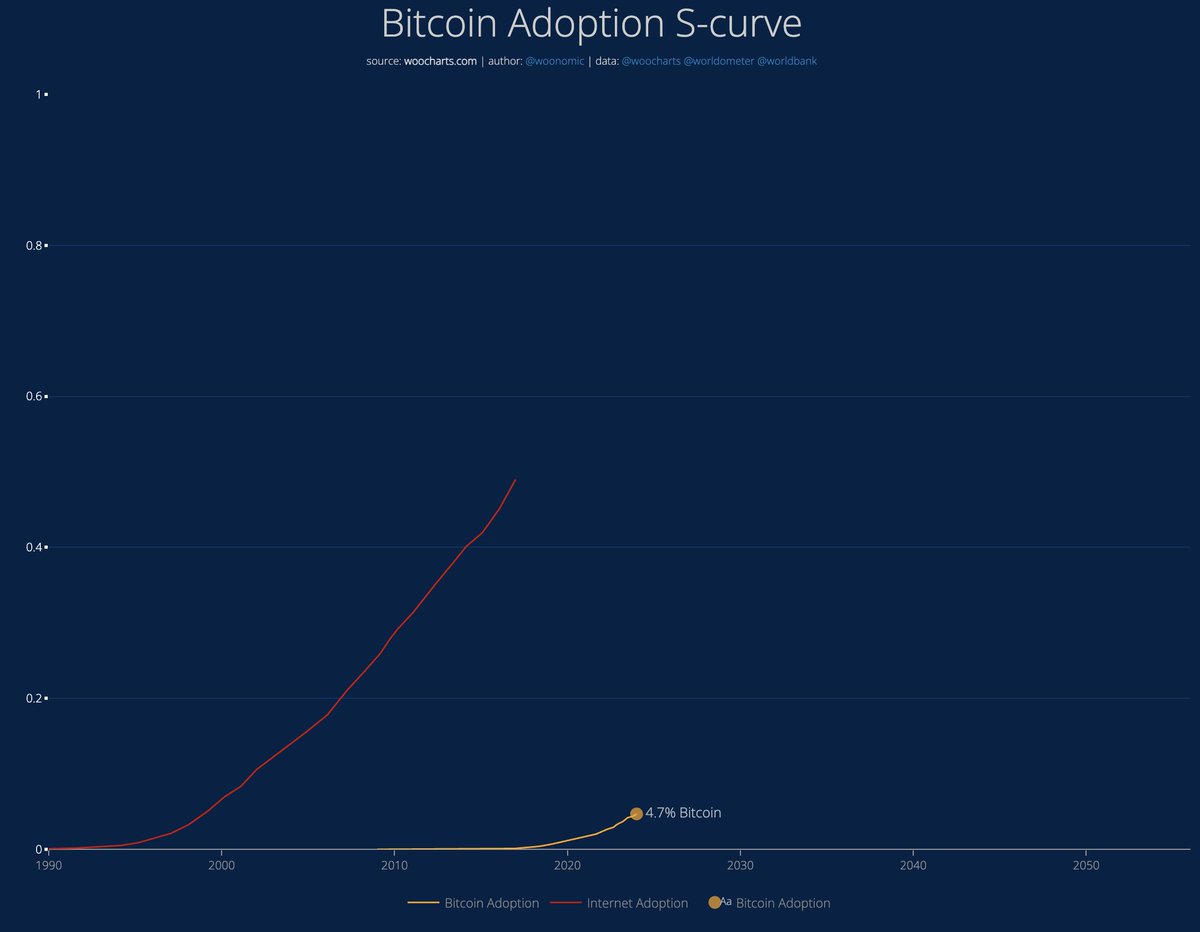

Woo’s perception comes at a essential time for Bitcoin, which at the moment faces fluctuating market conditions. Regardless of the downturn, he initiatives that Bitcoin might rival the US greenback and emerge as a worldwide reserve asset by the 2030s, aligning with a projected 25-40% international adoption price.

His stance is rooted within the rising recognition of Bitcoin on Wall Road, highlighting a significant shift in how conventional monetary markets are starting to view digital currencies.

Everybody asking “when?”

I’d say after we into the vary of 25-40% world adoption.

I.e. 2030s pic.twitter.com/Sdsw5PNrZM

— Willy Woo (@woonomic) June 25, 2024

Regardless of Woo’s long-term optimism, Bitcoin’s fast trajectory remains challenged, with current information indicating a decline. Over the previous week, Bitcoin has seen a discount of 5.3% in worth, with a slight 0.1% drop within the final 24 hours, stabilizing at a market value of $61,486.

Keith Alan, Co-founder of TeamBlacknox, stays cautiously optimistic, noting that whereas Bitcoin might retest its lows, the broader development might stay “intact” if month-to-month closures keep between $56.5k and $61.8k.

Gauging Bitcoin Potential Rebound and Future Progress

Including to the discourse, CryptoQuant analyst Gustavo Faria highlighted indicators that Bitcoin might need reached an area backside. The evaluation identified a discount in open curiosity within the futures market and a drop in funding charges for perpetual contracts, suggesting a stability restoration between patrons and sellers.

This equilibrium is essential for sustaining a wholesome market construction with out extreme optimism that sometimes results in sharp corrections.

Indicators of a Native Backside?

After a 15% correction, #Bitcoin reveals potential indicators of an area backside. Open curiosity has declined, funding charges are close to zero, suggesting a extra balanced market. Essential U.S. financial information incoming. Is the tide turning? – By Gustavo Faria

Full put up… pic.twitter.com/nRCDVawmFa

— CryptoQuant.com (@cryptoquant_com) June 26, 2024

The continuing dialogue round Bitcoin’s future additionally considers broader financial indicators similar to upcoming US macroeconomic information, together with GDP, preliminary jobless claims, and inflation information. These elements are poised to affect market sentiment considerably within the close to time period.

Moreover, Bitcoin’s positioning on the Bitcoin Rainbow Chart, which at the moment signifies a “Purchase” zone, and historic value cycles following Halving occasions counsel additional potential for development.

Associated Studying

Analysts anticipate that these technological and market cycles might propel Bitcoin’s price to as high as $260,000 by round September-October 2025.

Featured picture created with DALL-E, Chart from TradingView

More NFT News

XRP Worth On Its Approach To $10 In Solely Three Months If It Follows This Sample

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin