Information exhibits the Bitcoin switch quantity has noticed an increase not too long ago, however nonetheless stays round 65% decrease than the 2021 all-time excessive.

Bitcoin Switch Quantity Stays Considerably Decrease Than 2021 Bull Run Ranges

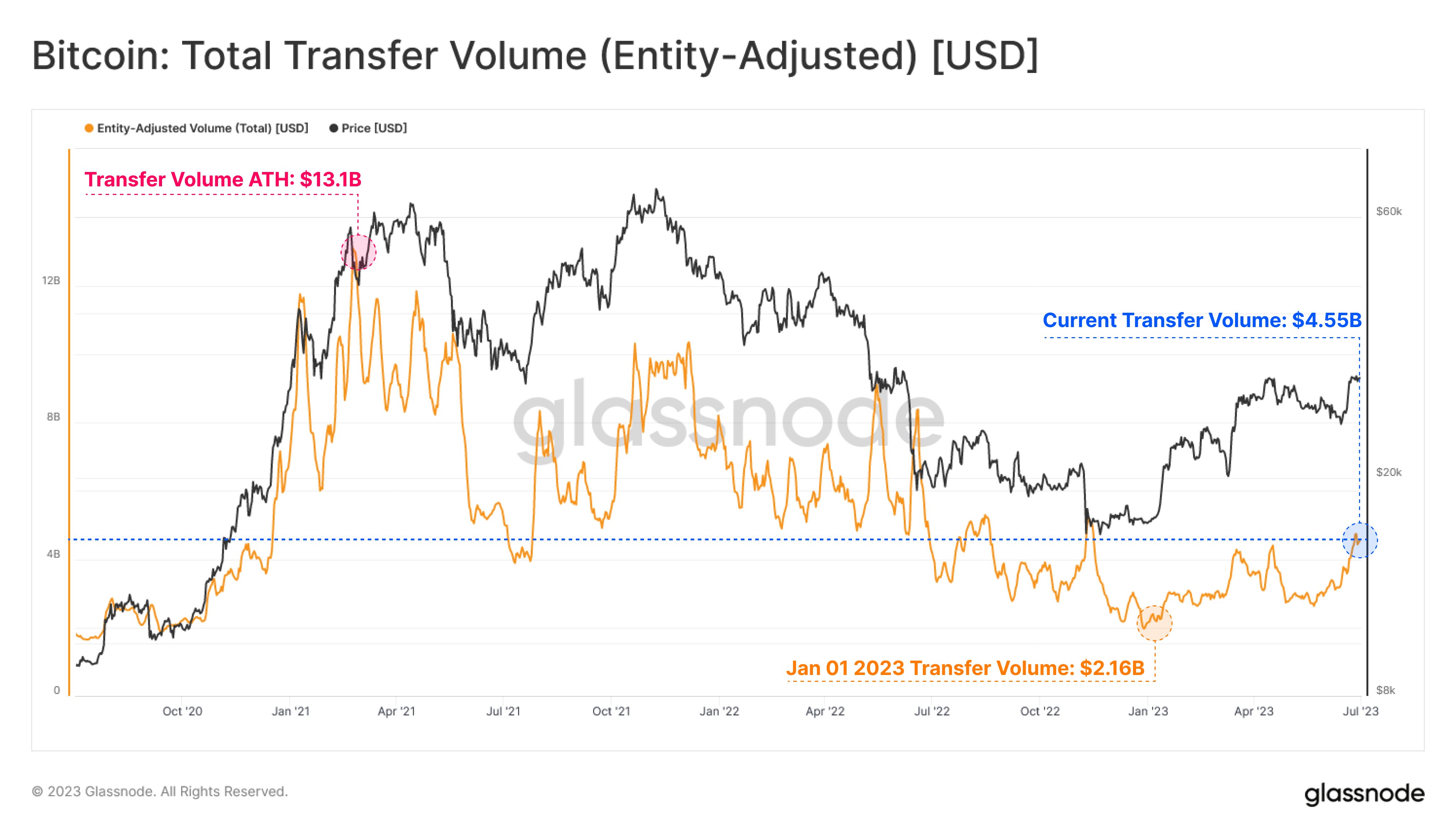

Based on information from the on-chain analytics agency Glassnode, BTC switch quantity has elevated to $4.56 billion not too long ago. The “transfer volume” here’s a measure of the each day whole quantity of Bitcoin (in USD) that’s getting concerned in transactions on the community.

When the worth of this indicator is excessive, it signifies that the traders are shifting round numerous cash on the community proper now. Such a pattern is usually an indication that the merchants are lively available in the market at present.

However, low values of the metric generally is a signal that blockchain exercise is low in the mean time. This type of pattern could counsel that there isn’t a lot curiosity within the cryptocurrency amongst common traders.

Now, here’s a chart that exhibits the pattern within the Bitcoin switch quantity over the previous few years:

The worth of the metric appears to have been going up in current days | Supply: Glassnode on Twitter

The model of the Bitcoin switch quantity getting used right here is the “entity-adjusted” one, that means that the indicator is simply accounting for the transactions going down between completely different entities, moderately than completely different particular person wallets.

An “entity” is a single handle or a group of addresses that belongs to the identical investor. Since a holder shifting cash from one pockets of theirs to a different isn’t related to the market in any respect, it is sensible to exclude such transfers from the amount information.

As displayed within the above graph, the entity-adjusted Bitcoin switch quantity has been going up not too long ago. This improve within the indicator has come because the rally above the $30,000 level has taken place.

Typically, sharp worth actions like rallies can appeal to plenty of consideration to the community, as traders discover such worth strikes thrilling. This curiosity naturally results in extra transactions occurring on the community, which might result in the switch quantity registering an uptick.

Such worth strikes are additionally in flip solely sustainable with the backing of such exercise, as these strikes require numerous merchants to supply gasoline for them. Thus, if a rally fails to draw any sizeable consideration (or if curiosity dies down partway by way of), then the value surge can run out of steam.

As the present rally has been in a position to carry eyes to the blockchain, it’s a constructive signal for its sustainability. From the chart, nonetheless, it’s seen that whereas the present switch quantity of 4.65 billion is considerably greater than the two.16 billion determine from the beginning of the 12 months, it’s nonetheless fairly a bit decrease than the norm through the 2021 bull market.

At its all-time excessive, the entity-adjusted Bitcoin switch quantity had a worth of 13.1 billion, which means that the present worth of the indicator remains to be 65% decrease.

BTC Value

On the time of writing, Bitcoin is buying and selling round $30,600, up 1% within the final week.

BTC has been buying and selling sideways in the previous few days | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Glassnode.com

More NFT News

XRP Worth On Its Approach To $10 In Solely Three Months If It Follows This Sample

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin